The Child Support Worksheet is used to calculate the child support obligations of both parents. In addition, this form displays and explains how the Court derives the amount from the calculation and formula.

Ohio Child Support Worksheet With Answers

Description

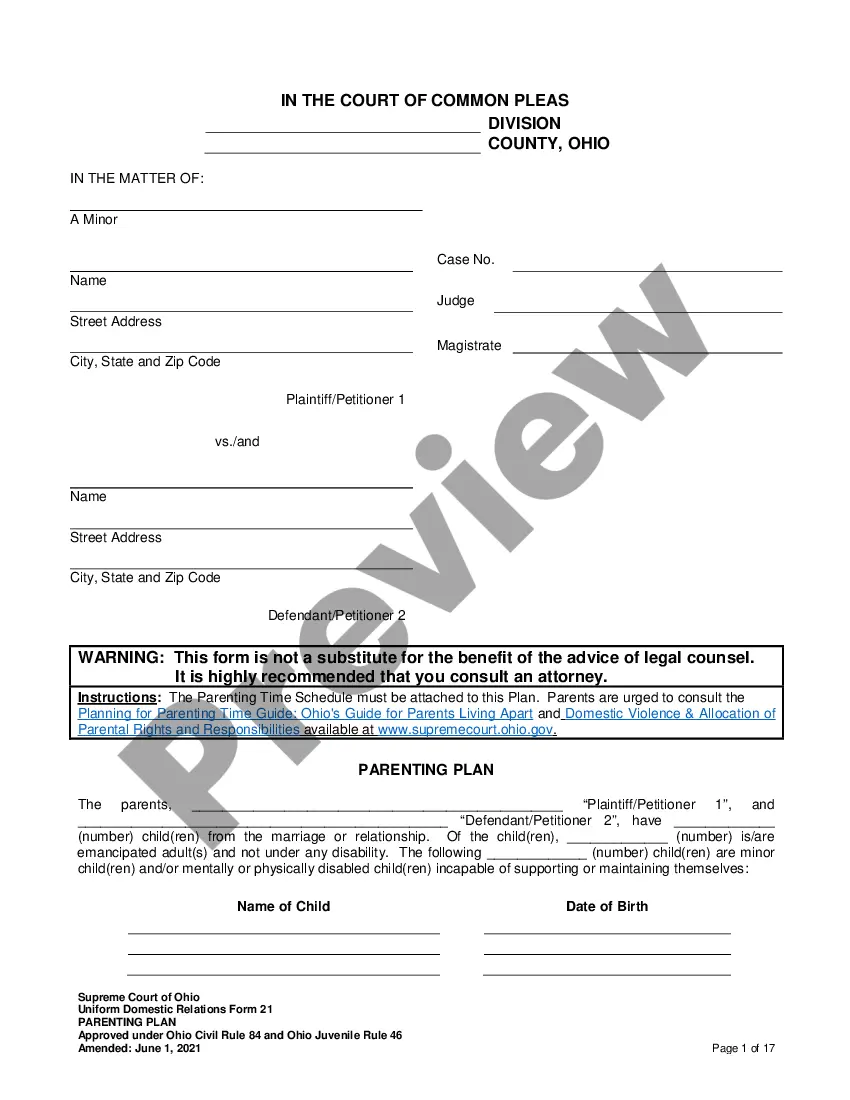

How to fill out Ohio Child Support Worksheet For Parenting?

It’s well known that you cannot quickly become a legal authority, nor can you rapidly learn to draft the Ohio Child Support Worksheet With Answers without possessing a unique set of abilities. Composing legal documents is a lengthy endeavor that demands specific education and expertise. Therefore, why not entrust the development of the Ohio Child Support Worksheet With Answers to the experts.

With US Legal Forms, which boasts one of the largest legal template collections, you can find everything from court documents to templates for internal business communication. We recognize the significance of staying compliant with federal and state regulations. That’s why all forms on our site are location-specific and current.

Let’s begin with our platform and obtain the document you need in just a few moments.

You can regain access to your documents from the My documents section at any time. If you already have an account, you can simply Log In, and locate and download the template from the same section.

Regardless of your forms’ purpose—be it financial, legal, or personal—our platform is equipped to assist you. Try US Legal Forms today!

- Locate the document you require utilizing the search feature at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain if the Ohio Child Support Worksheet With Answers is what you are looking for.

- If a different template is needed, restart your search.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once the payment has processed, you can access the Ohio Child Support Worksheet With Answers, complete it, print it, and deliver it by mail to the necessary parties or organizations.

Form popularity

FAQ

A Texas standard residential lease agreement is a document used by a landlord renting property to a tenant for monthly payment under typical conditions. Before signing, the tenant will undergo a credit verification by completing a rental application.

There are five essential elements of a valid lease: offer, acceptance, mutual assent, execution and delivery, and consideration. In addition, the Texas Property Code imposes certain default requirements on landlords and tenants if a lease does not make its own provisions.

There are five essential elements of a valid lease: offer, acceptance, mutual assent, execution and delivery, and consideration. In addition, the Texas Property Code imposes certain default requirements on landlords and tenants if a lease does not make its own provisions.

All Texas rental agreements should include many details about how the rental arrangement will work. Typically, a lease includes: The names of all parties to the agreement. Details about the property being rented.

Regardless of the structure, the lease term must be clearly stated. Rent details (Amount, due date, late fees): The rental agreement should clearly specify the rent amount, when it's due, and how it should be paid.

Do Lease Agreements Need to Be Notarized in Texas? No, Texas Lease Agreements do not need to be notarized. They just need to be signed by the Tenant and Landlord.

Jain says, "The rent agreement must contain a clause that the tenant will not sublet, assign or otherwise part with the possession of the premises to any third party and that he will not use the property for any purpose contrary to law."