Transfer Death Tod For Trust

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

- Log into your US Legal Forms account. If you're a returning user, access your account and verify that your subscription is active.

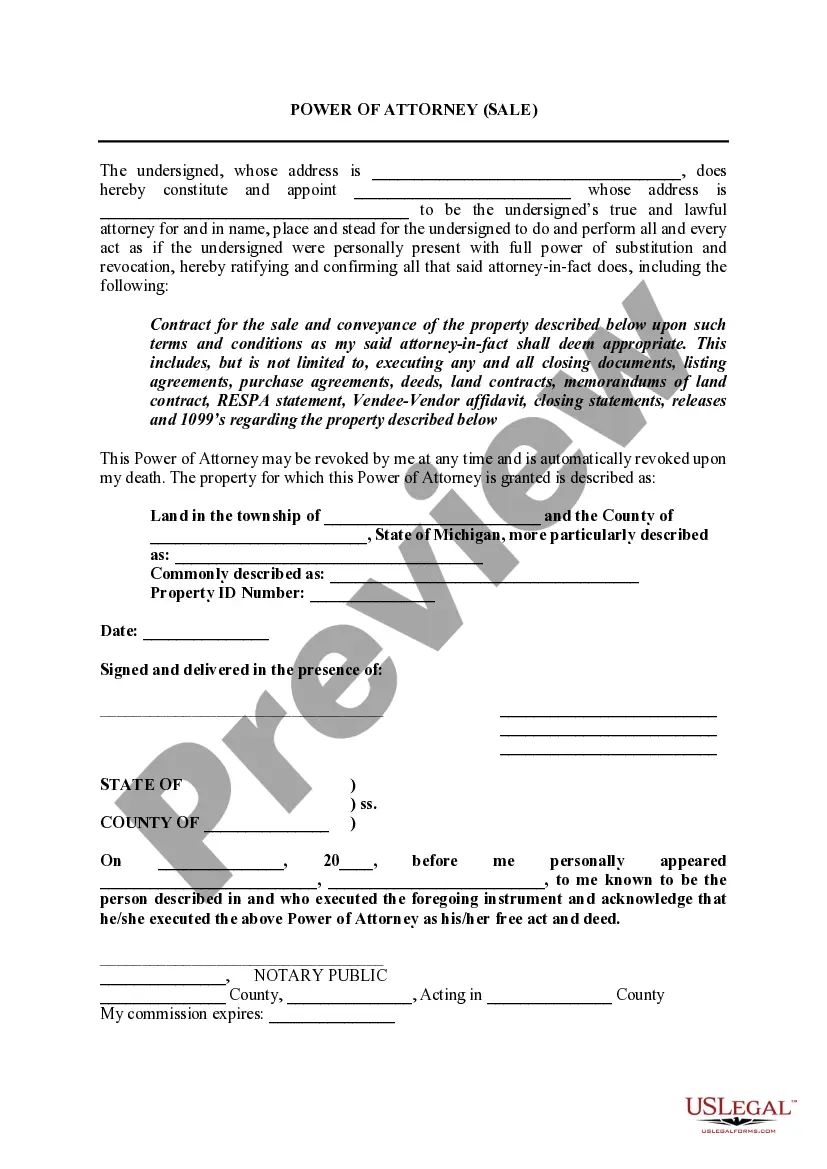

- Search for the specific Transfer Death TOD form. Use the Preview mode to check its description and confirm it aligns with your jurisdiction’s requirements.

- If you need additional forms, utilize the Search tab at the top to locate any additional templates necessary.

- Select and purchase the form. Click the 'Buy Now' button and choose an appropriate subscription plan, if this is your first time accessing our service.

- Complete the payment process. Provide your credit card details or opt for your PayPal account to finalize the purchase.

- Download the completed document. Save it onto your device and access it anytime through the 'My Forms' section of your account.

By following these straightforward steps, you can efficiently manage your legal documentation with confidence.

Start your journey today with US Legal Forms and ensure your estate planning is seamless. Need help? Reach out to our premium experts for personalized assistance!

Form popularity

FAQ

Several states in the U.S. permit the use of a transfer on death (TOD) deed for the transfer of property to a trust. States such as California, Arizona, and Nevada have laws that facilitate this process, making it easier for individuals to manage their assets. By choosing to transfer death TOD for trust, you can avoid probate and ensure a smooth transition of ownership. To get complete and accurate information tailored to your situation, consider using the UsLegalForms platform, which provides resources and forms tailored to your needs.

Setting up a Transfer on Death (TOD) account is a straightforward process. You typically need to complete a beneficiary designation form provided by your financial institution or use a service like US Legal Forms for guidance. Indicate your choice of beneficiary, ensuring their information is accurate. After submission, keep track of the documentation, making sure everything aligns with your overall estate planning strategy.

You do not necessarily need a lawyer to create a Transfer on Death (TOD) designation, but it is advisable to seek legal advice. A qualified attorney can ensure that you correctly complete the necessary forms and comply with state regulations. Furthermore, a lawyer can help you integrate your TOD with your overall estate plan, which might include trusts and other legal documents.

In Texas, the rules for a Transfer on Death (TOD) are straightforward and user-friendly. You can designate beneficiaries for real estate and certain financial accounts using a simple form. Your TOD will need to be filed with the appropriate entity and recorded if it involves real property. It's essential to be specific about your wishes to ensure a smooth transfer of assets upon your death.

While it’s not required to hire a lawyer for a Transfer on Death (TOD) designation, doing so can be beneficial. A lawyer can help you understand the implications of transferring assets, ensuring that the TOD meets your state's legal requirements. Additionally, they can help you coordinate your TOD with other estate planning tools, like trusts or wills, ensuring a smoothly executed transfer in line with your wishes.

A Transfer on Death (TOD) designation is not the same as a will, but it offers benefits in specific situations. With a TOD, assets transfer automatically to your chosen beneficiary upon your death, avoiding probate. This process is typically quicker and can be easier for your loved ones. However, a will provides more comprehensive estate planning benefits, including guardianship for minor children.

Yes, assets transferred through a TOD can be subject to inheritance taxes depending on various factors, including the state you reside in. While a transfer on death avoids probate, it does not dissolve tax obligations. Therefore, educating yourself about potential tax consequences is essential when establishing a transfer death tod for trust. Consulting with professionals can help ensure you understand your liabilities.

No, a transfer on death (TOD) arrangement does not inherently avoid inheritance tax. When you pass away, the value of your TOD assets may still be subject to estate taxes based on your local laws. It’s crucial to plan thoughtfully and consider consulting with a financial advisor or utilizing services like USLegalForms to navigate the specifics regarding taxes with your transfer death tod for trust.

Generally, a transfer on death deed does not avoid inheritance taxes, as these taxes depend on the value of the estate passed to beneficiaries. While a TOD deed allows for the direct transfer of property, state laws regarding inheritance taxes still apply. This makes it essential to consult with a tax professional to understand the implications of using a transfer death tod for trust.

While a transfer on death option provides significant benefits, there are downsides to consider. For instance, TOD accounts do not provide protection from creditors or may not accommodate complex family situations well. Furthermore, if your beneficiaries are minors or lack financial expertise, a trust might be a preferable option. It's important to evaluate your needs when deciding between a TOD and transfer death tod for trust.