Ohio Tod Affidavit Form

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Husband And Wife To Individual?

When you need to file the Ohio Tod Affidavit Form that adheres to your local state's statutes and requirements, there can be numerous options to select from.

There's no requirement to analyze every form to ensure it satisfies all the legal stipulations if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in obtaining a reusable and current template on any subject.

Browse through the suggested page and verify it for alignment with your criteria.

- US Legal Forms is the most extensive online catalog containing a collection of over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are authenticated to conform to each state's statutes and regulations.

- Consequently, when downloading the Ohio Tod Affidavit Form from our platform, you can be confident that you possess a valid and current document.

- Acquiring the necessary sample from our platform is quite simple.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the Ohio Tod Affidavit Form at any moment.

- If it's your initial experience with our website, please follow the instructions below.

Form popularity

FAQ

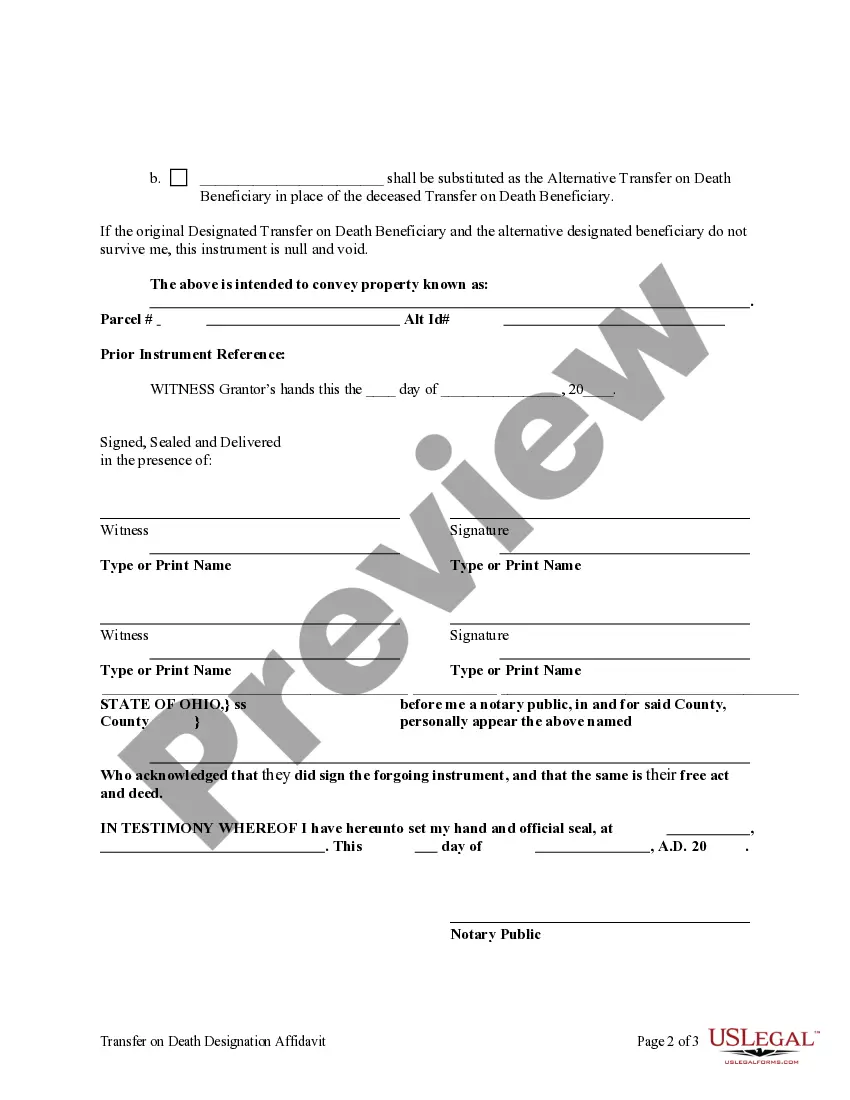

How to create a Transfer on Death for your homeChoose your recipients. You can choose one or more people to become owner of any home or land that you own.Find a copy of your deed.Complete the TOD for real estate form.Take the form to a notary .Submit the form at your County Recorder's Office.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit. What is a TOD Designation Affidavit?

In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death. Before setting-up a transfer on death account, you should review the tax implications of these accounts.

You don't have to have will to transfer your car after you die. A Transfer on Death (TOD) is a legal document that can transfer your car without a will. This means that your car will not have to go through the probate court. Going through the probate court can cost your loved ones time and money after you are gone.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.