Problems With Transfer On Death Deeds In Ohio

Description

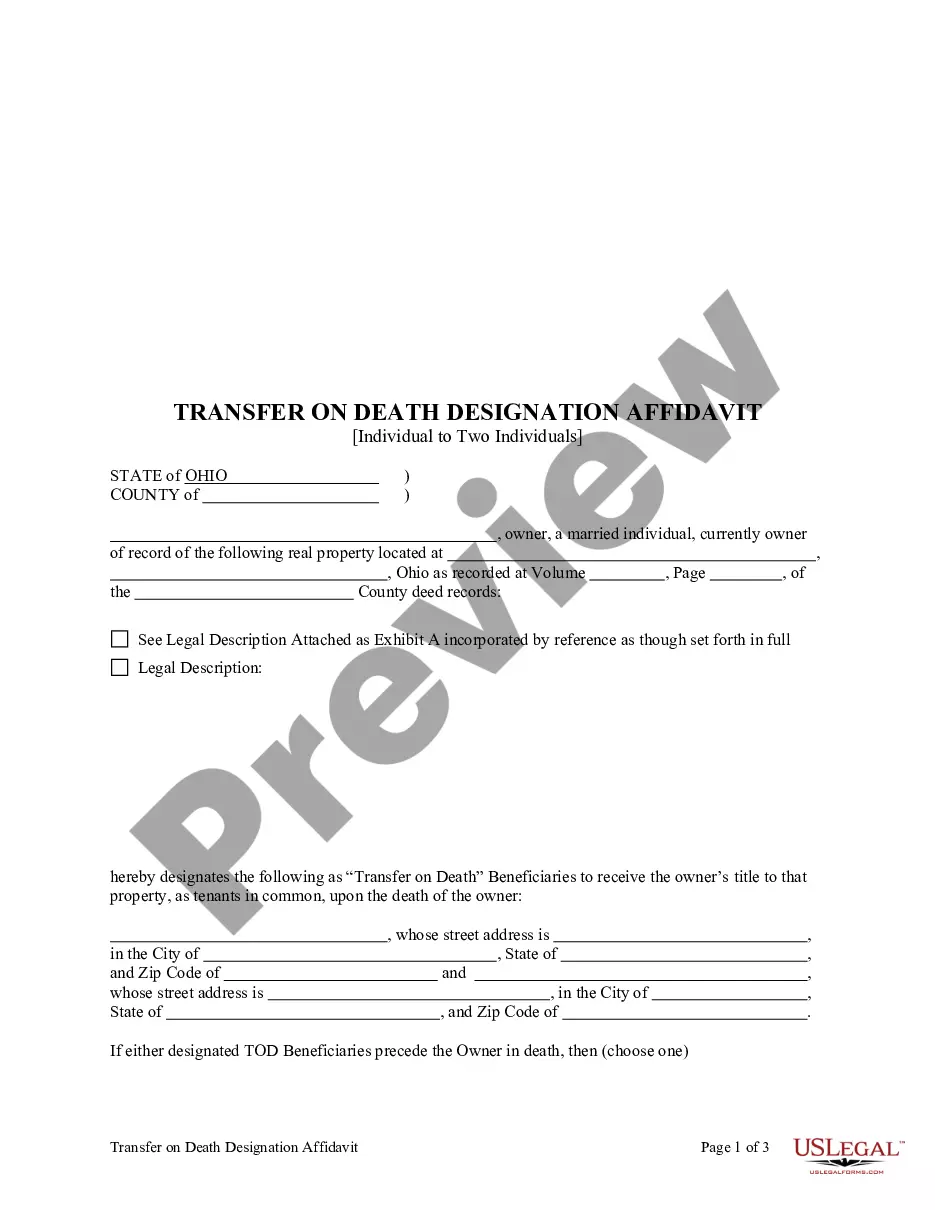

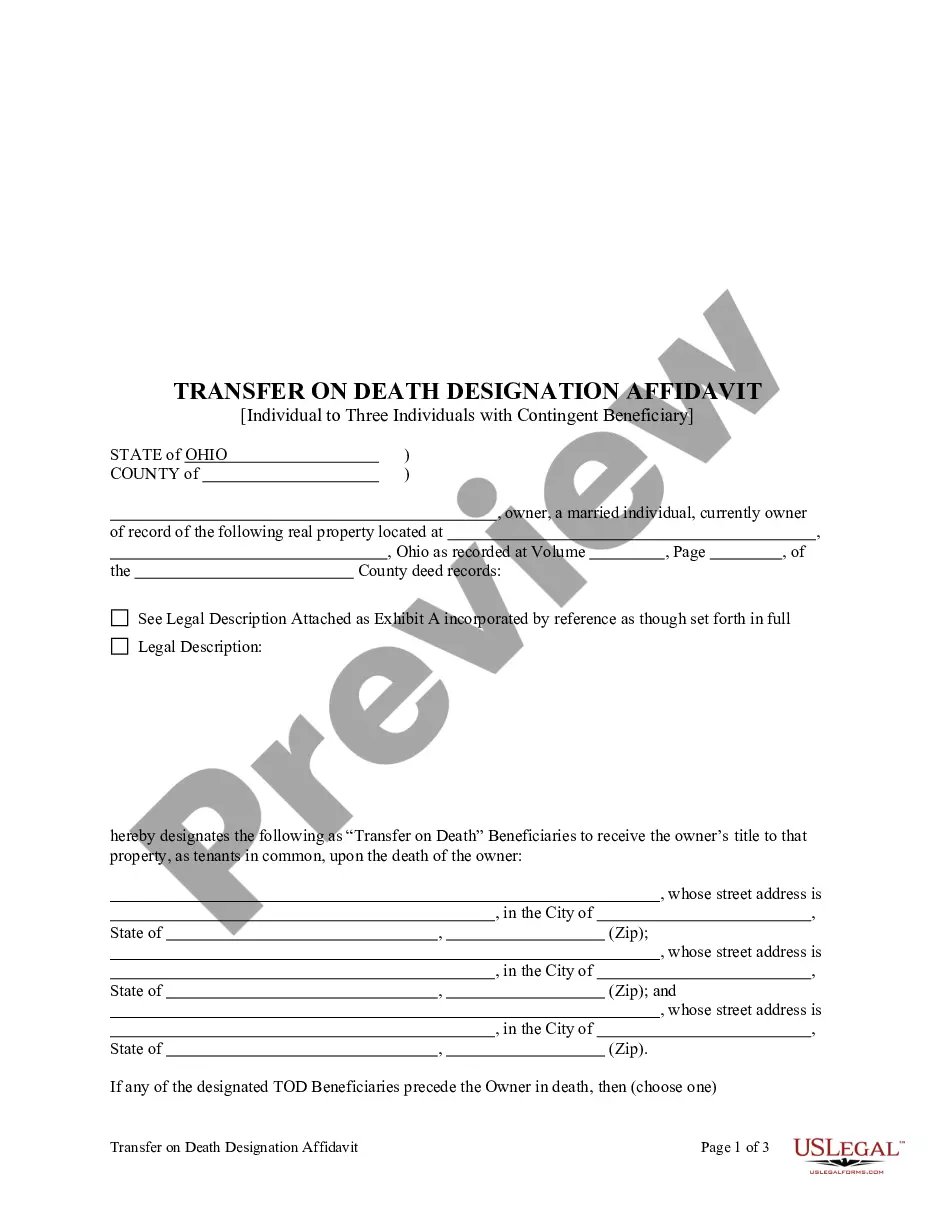

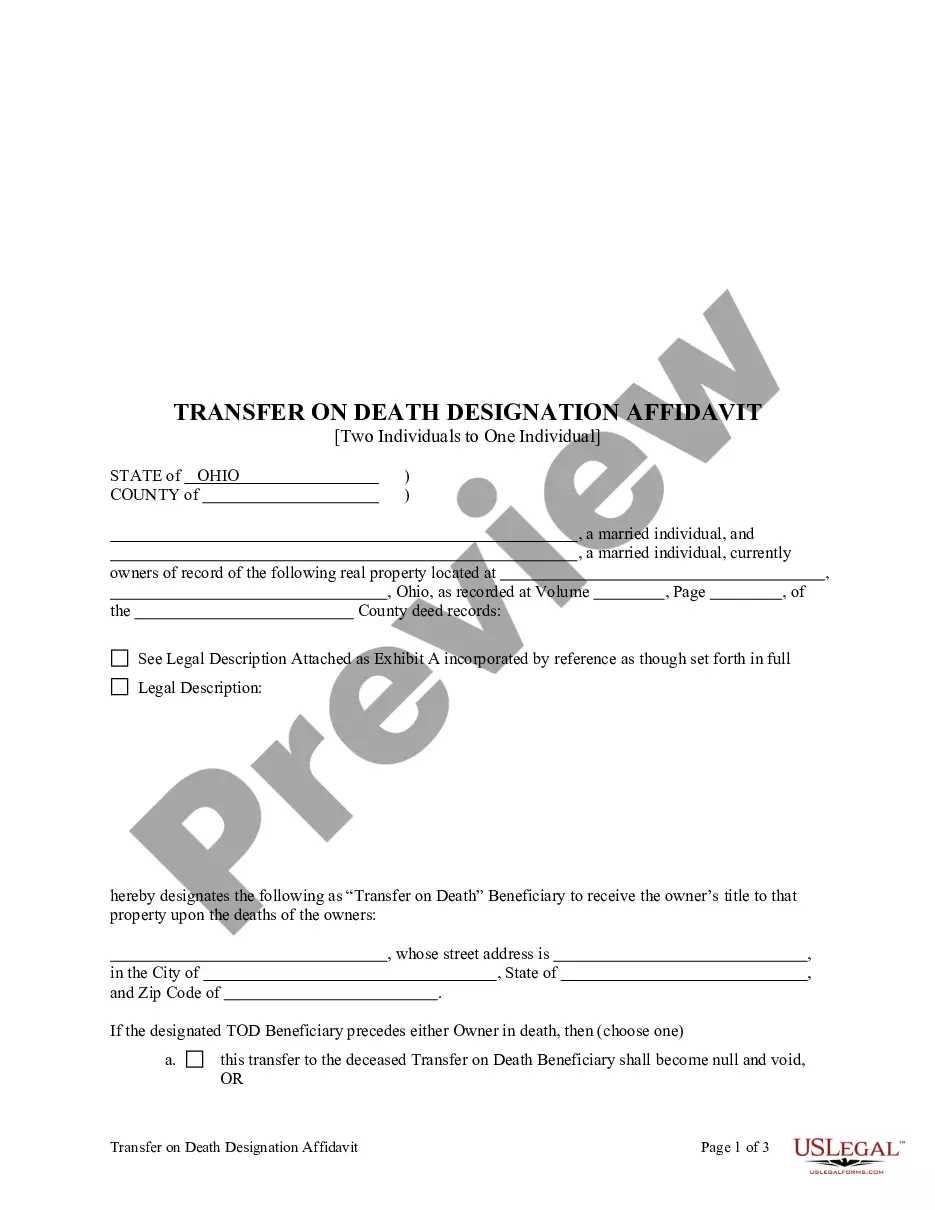

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Two Individuals With Contingent Beneficiary?

It’s well known that you cannot become a legal authority instantly, nor can you quickly acquire the ability to compose Problems With Transfer On Death Deeds In Ohio without possessing a specific set of expertise. Crafting legal documents is an extensive process that demands specialized education and expertise.

So why not entrust the formulation of the Problems With Transfer On Death Deeds In Ohio to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can find anything from court documents to templates for internal business communication. We recognize the significance of adhering to federal and local regulations. Therefore, on our platform, all forms are locality-specific and current.

You can regain entry to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same tab.

Regardless of the nature of your paperwork—be it financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Begin by discovering the form you require using the search bar at the top of the webpage.

- Examine it (if this option is available) and review the accompanying description to see if Problems With Transfer On Death Deeds In Ohio is what you’re looking for.

- If you need a different template, restart your search.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once the payment is processed, you can access the Problems With Transfer On Death Deeds In Ohio, fill it out, print it, and deliver it or mail it to the necessary individuals or organizations.

Form popularity

FAQ

In Ohio, several items are exempt from probate, including joint tenancy properties and assets held in a transfer on death deed. These exemptions can simplify the distribution of your estate, allowing beneficiaries to receive their inheritance more quickly. However, to avoid problems with transfer on death deeds in Ohio, it’s essential to outline your assets clearly in your estate plan. Consider using resources from US Legal Forms to list your assets appropriately.

Problems with Tod accounts can arise from misinterpretation of the deed's terms, conflicts among beneficiaries, and issues with property title. It’s crucial to ensure that the TOD account aligns with your estate planning goals. Without proper documentation and clear instructions, disputes can significantly delay the transfer process. Using US Legal Forms can assist you in setting up a clear and effective TOD account.

A transfer on death deed, often referred to as TOD, allows for the direct transfer of property to heirs, thereby avoiding probate. However, the effectiveness of TOD may depend on how you set it up and whether any disputes arise after your death. Addressing problems with transfer on death deeds in Ohio is vital to ensure your wishes are carried out smoothly. Using US Legal Forms can help you secure the proper documents to avoid these issues.

Yes, a transfer on death deed generally allows property to pass directly to beneficiaries without going through probate. However, you may encounter problems with transfer on death deeds in Ohio if the deed is not properly executed or if there are disputes among heirs. It’s important to ensure that all legal requirements are met to prevent complications. Consulting resources from US Legal Forms can provide you with the right forms and guidance.

A house can remain in a deceased person's name in Ohio until an estate settlement occurs or the property is transferred through a transfer on death deed. However, practical considerations mean that it's best to address this promptly to avoid issues. Delays can complicate ownership and maintenance responsibilities. Familiarizing yourself with the problems with transfer on death deeds in Ohio can help in understanding timeframes!

Contesting a transfer on death deed in Ohio usually requires demonstrating that the deed is invalid or that there was undue influence. This can involve gathering evidence and potentially going to court. It is crucial to fully understand the specific legal grounds for contesting a deed. Problems with transfer on death deeds in Ohio can arise, and having legal guidance can streamline the contesting process.

While transfer on death deeds provide benefits, they also have drawbacks. One major issue includes potential disputes among heirs or beneficiaries, especially if the deed isn't clear or has errors. Additionally, creditors may still pursue debts from the estate. Being aware of these problems with transfer on death deeds in Ohio can help in planning effectively.

In Ohio, there is no specific time limit for transferring property after someone dies when using a transfer on death deed. However, it is wise to complete the transfer as soon as possible. Delays can complicate matters and potentially lead to issues. Addressing the problems with transfer on death deeds in Ohio timely can help avoid later complications.

Yes, property can often be transferred without probate in Ohio, especially if there is a valid transfer on death deed in place. This deed allows the assets to go directly to the designated beneficiaries. However, issues may surface regarding the correctness of the deed and the proper transfer procedure. Understanding the problems with transfer on death deeds in Ohio will help clarify the process.

Transferring property after a parent dies in Ohio can be straightforward when using a transfer on death deed. This deed allows the property to pass directly to beneficiaries without going through probate. It’s vital to ensure that all paperwork was completed correctly before the passing. Problems with transfer on death deeds in Ohio can arise if the proper procedures weren't followed.