Transfer Death Individual Form Texas

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

Legal documentation management can be daunting, even for seasoned professionals.

When searching for a Transfer Death Individual Form Texas and lacking the opportunity to invest time locating the proper and updated edition, the processes can become burdensome.

Tap into a repository of articles, guides, and resources pertinent to your situation and needs.

Save time and effort searching for the documents you require, and take advantage of US Legal Forms’ sophisticated search and Preview function to locate Transfer Death Individual Form Texas and obtain it.

Leverage the US Legal Forms online collection, backed by 25 years of experience and trustworthiness. Streamline your daily document management into a straightforward and user-friendly process today.

- If you possess a subscription, sign in to your US Legal Forms account, search for the document, and acquire it.

- Check the My documents tab to review the documents you've previously downloaded and manage your folders as desired.

- If you're new to US Legal Forms, create an account and gain unlimited access to all the features of the library.

- Here are the actions to follow after downloading your desired form.

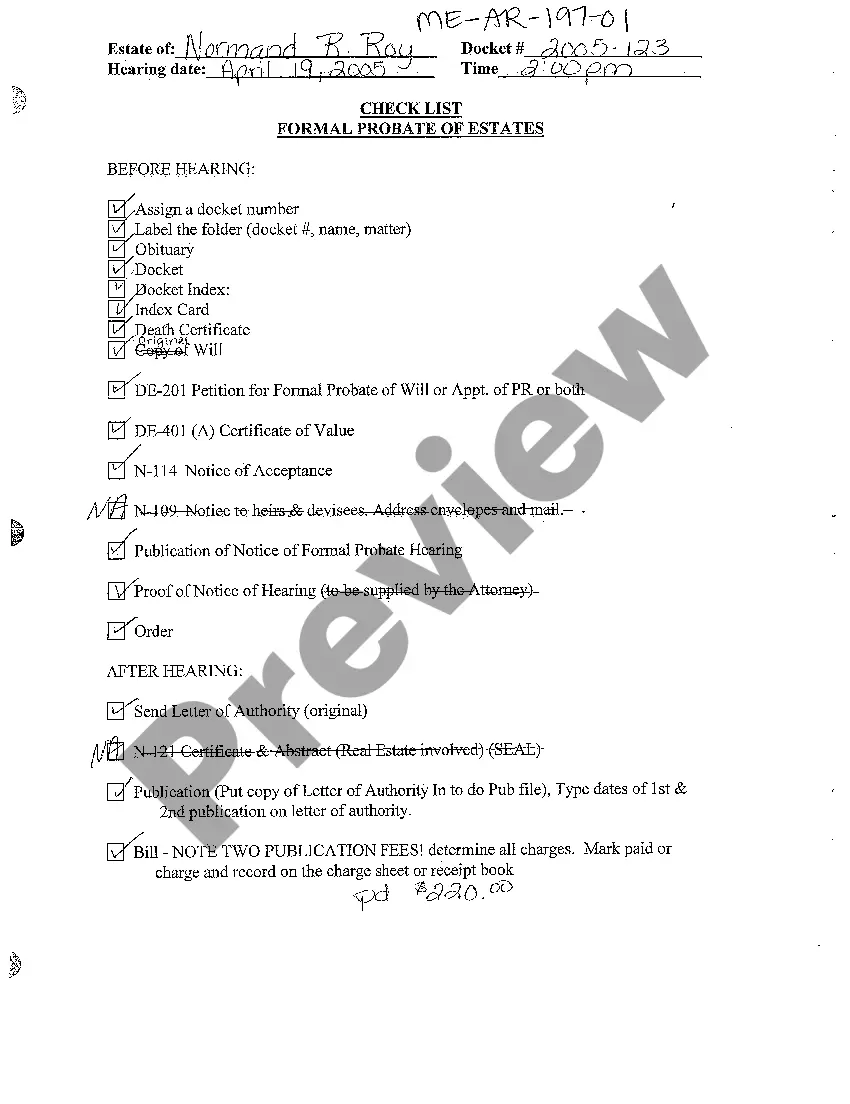

- Verify it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms satisfies all your requirements, ranging from personal to corporate papers, in one place.

- Utilize advanced tools to complete and manage your Transfer Death Individual Form Texas.

Form popularity

FAQ

An Affidavit of Heirship. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased. Once it is signed notarized, the Affidavit of Heirship is ready to be recorded in the deeds records in the county where the property is located.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

You can use a Transfer on Death Deed to give your home to someone after you die. Although you make it before you die, it is not a will. Usually, a willed property must go through probate court before it goes to your heirs.

You do not need a TOD deed. Your spouse will automatically own the entire property at your death, and vice versa. You and your spouse can make a TOD deed together, but it would not have any effect until both you and your spouse have died.

The Transfer on Death Deed takes effect upon your death, so the property never becomes part of your estate. When you die, your property interest passes to the person you named in the Transfer on Death Deed (the ?beneficiary?) without any probate action.