Transfer Death Designation For The Future

Description

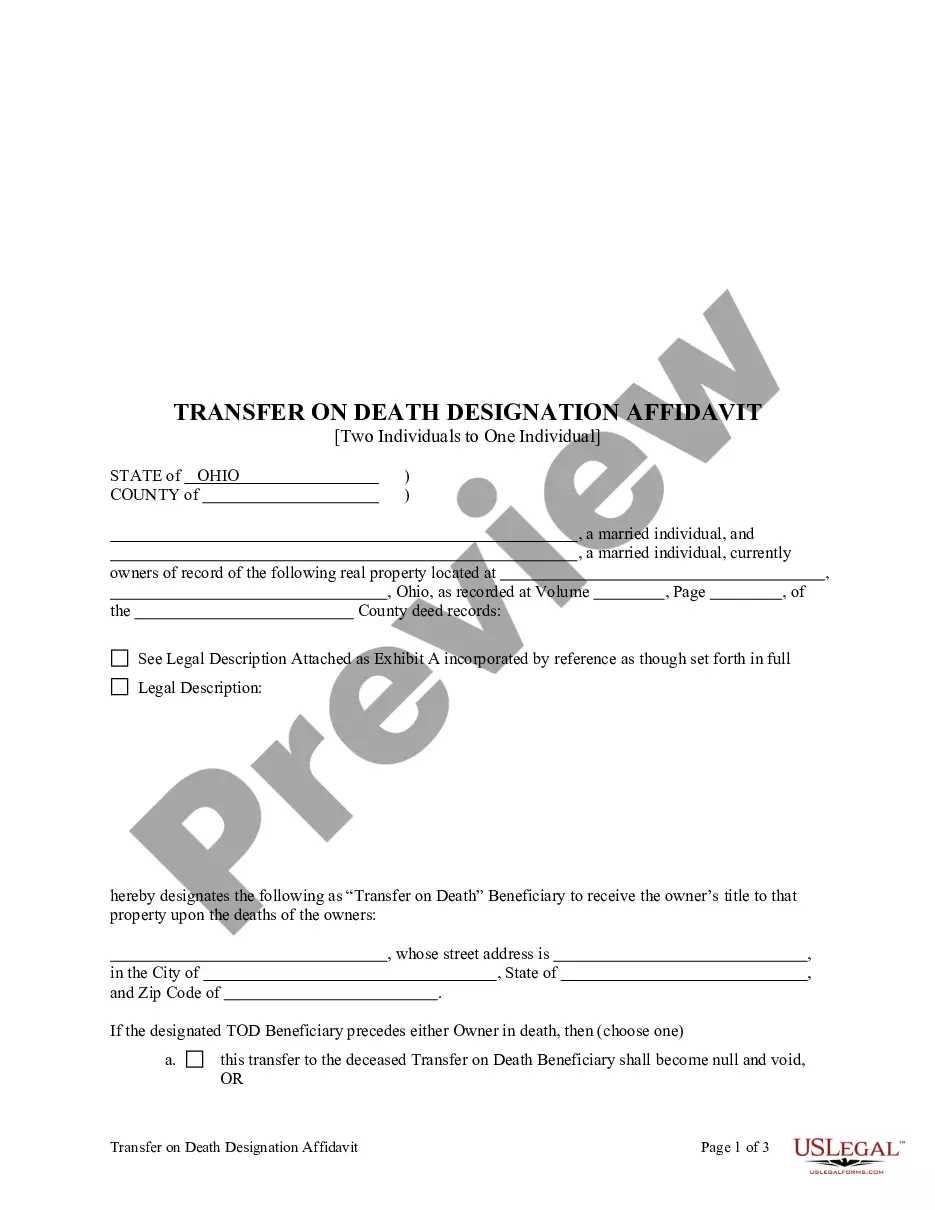

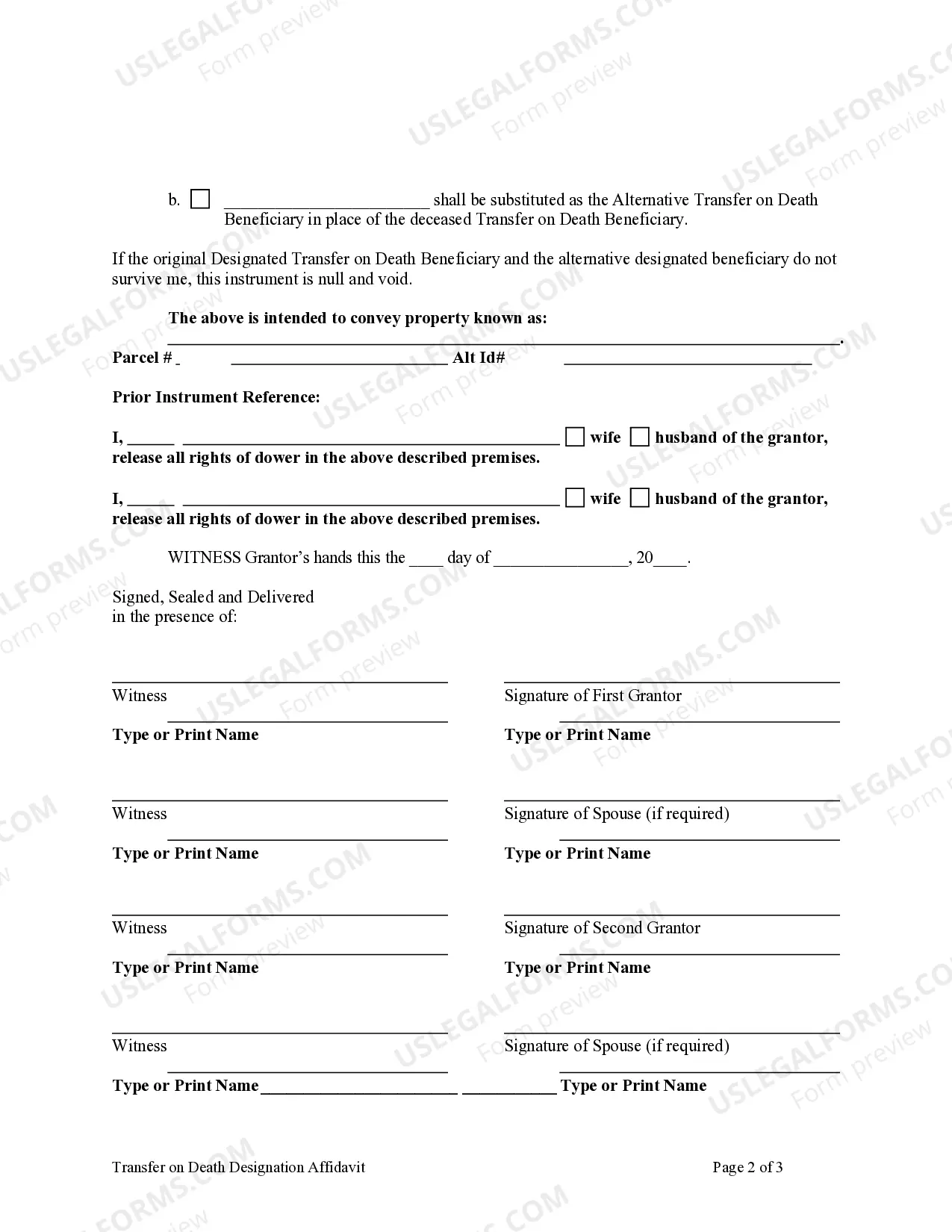

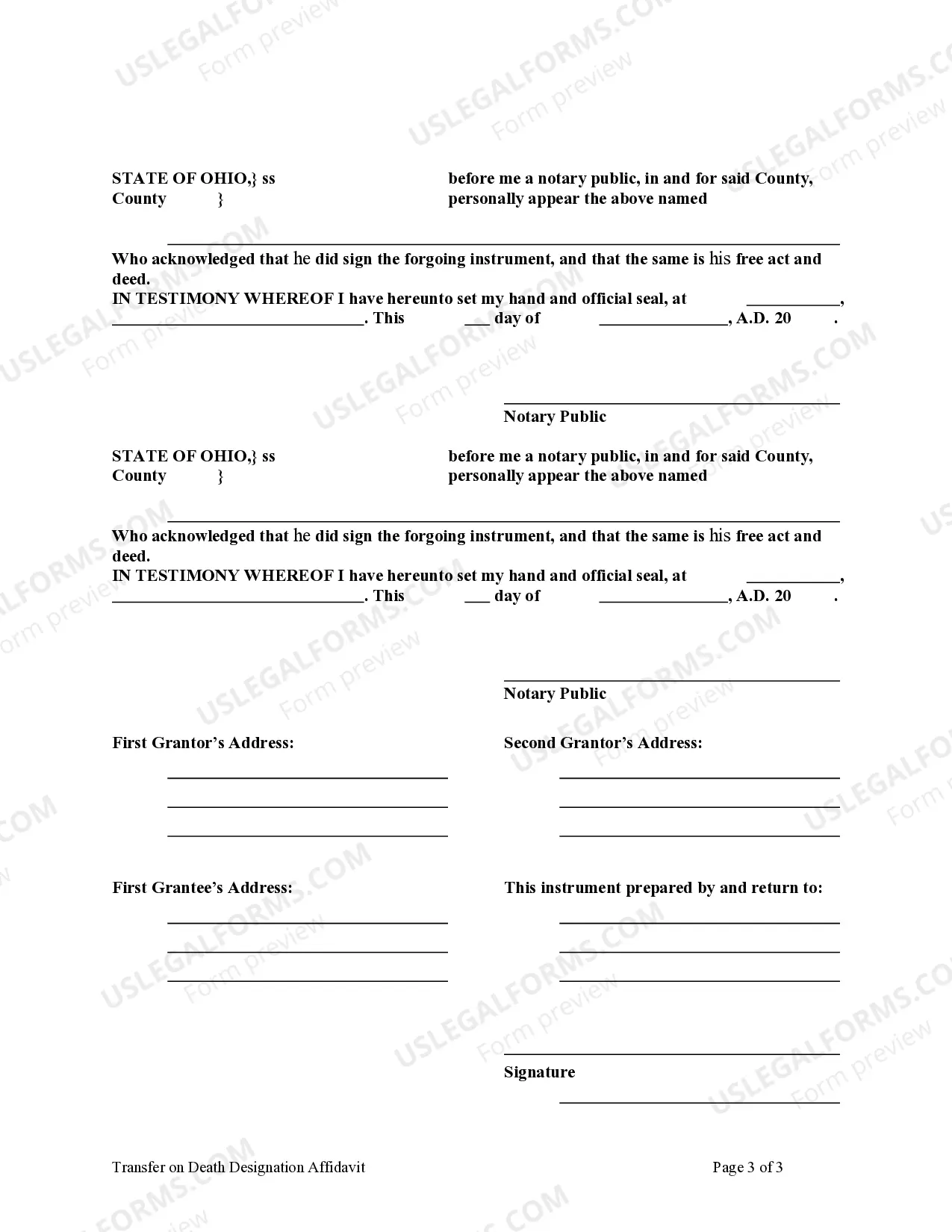

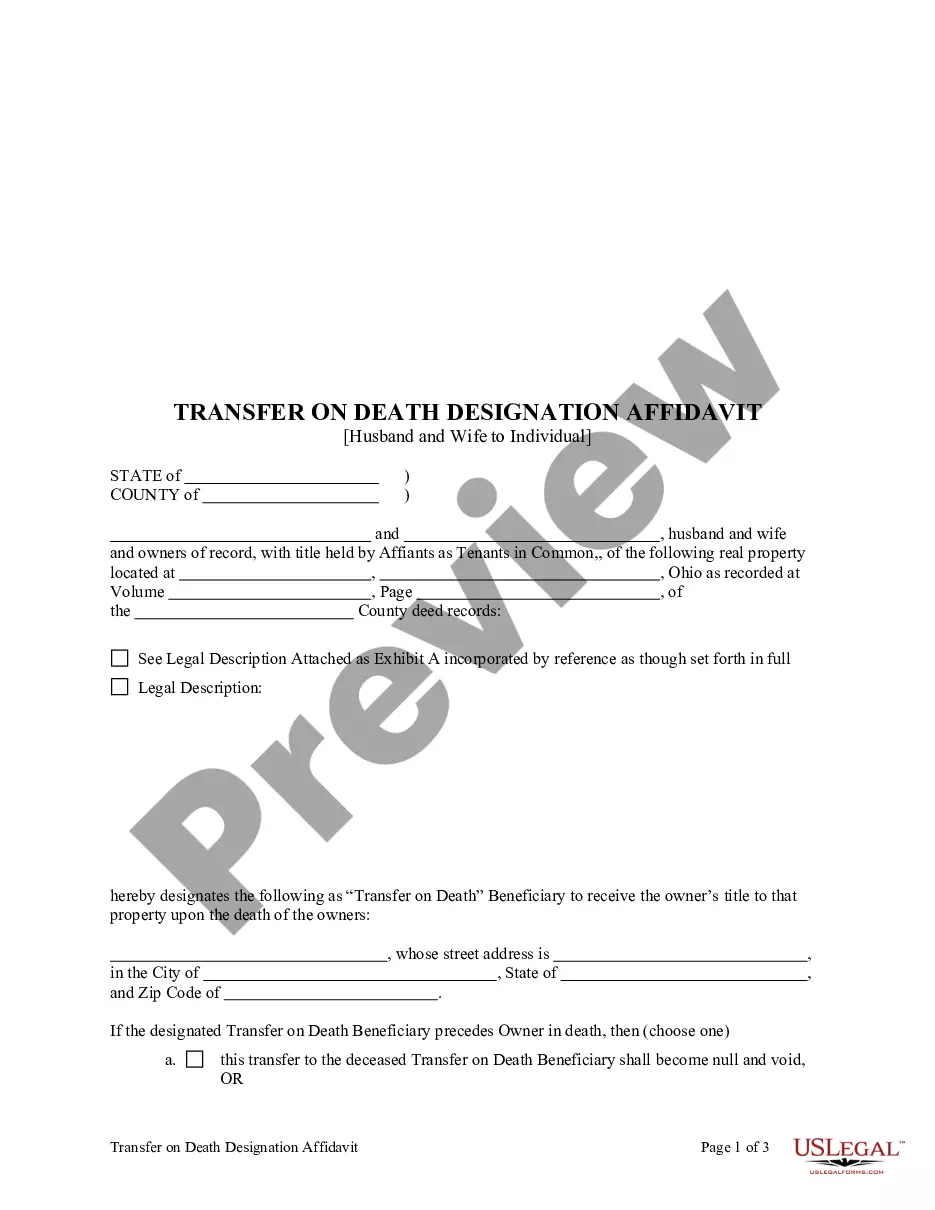

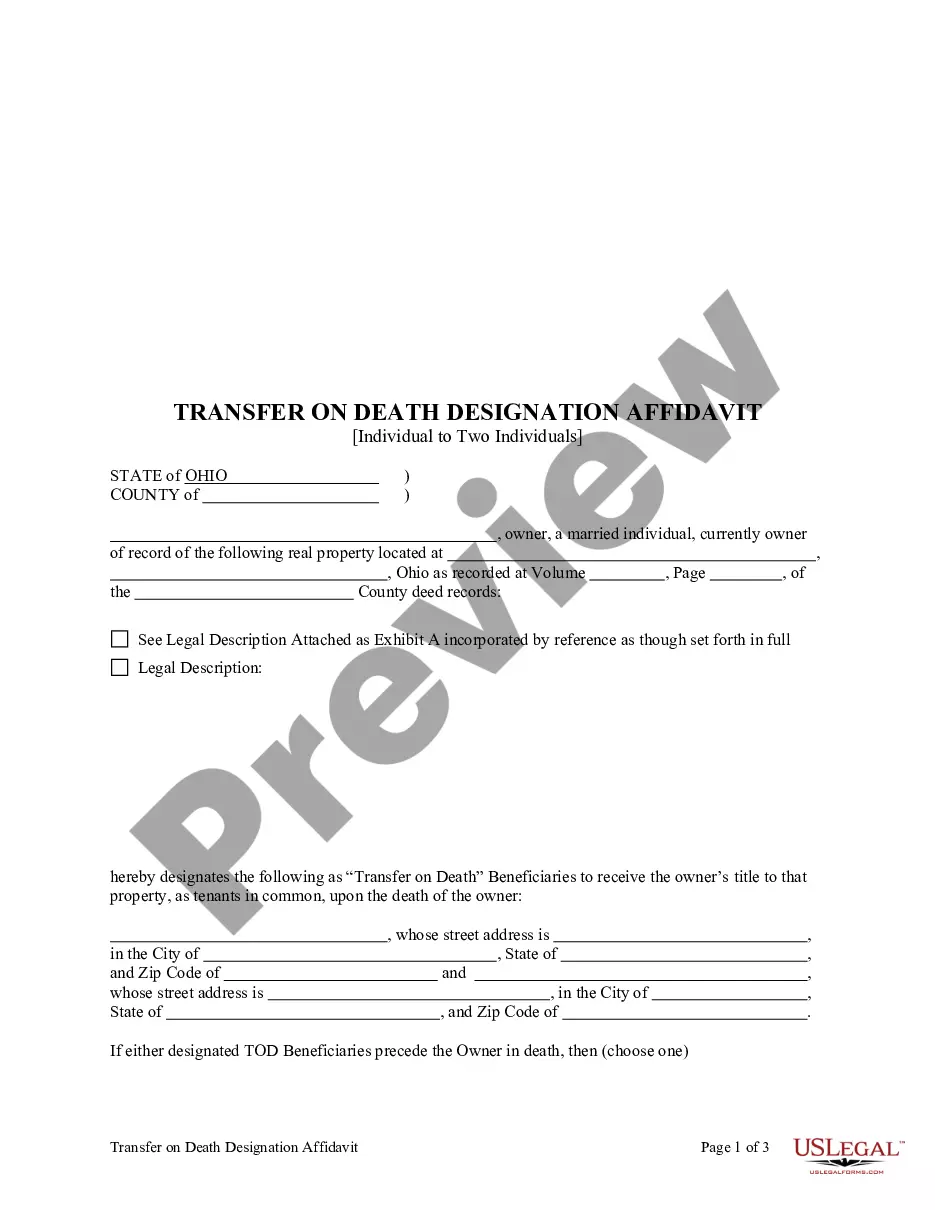

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

- If you are a returning user, log in to your account, verify your subscription status, and download the necessary form by clicking the Download button.

- For first-time users, start by browsing the preview mode and form descriptions to select the appropriate document that aligns with your local jurisdiction.

- If you find any discrepancies or need a different template, utilize the Search tab to locate the correct form.

- Purchase your document by clicking the Buy Now button and selecting your preferred subscription plan. You must register for an account to gain access to our extensive library.

- Complete your purchase by entering your credit card information or opting for PayPal for payment.

- Download the form onto your device and save it for easy access. You can revisit it anytime from the My Forms section of your account.

In conclusion, US Legal Forms empowers individuals and attorneys with a robust collection of legal templates designed to simplify the process of transferring death designations and other legal documents.

Start your journey towards peace of mind today and explore the vast resources available at US Legal Forms!

Form popularity

FAQ

TOD accounts can lead to unforeseen issues, such as beneficiary disputes or lack of control over the asset during your lifetime. Moreover, if you fail to retitle assets or update beneficiaries, it might cause confusion or unintended outcomes. Coordinating with estate planning tools and platforms like uslegalforms can help you develop a clear strategy that incorporates a transfer death designation for the future and minimizes potential problems.

While transfer on death (TOD) offers benefits like avoiding probate, there are drawbacks to consider. For instance, if a beneficiary is unable or unwilling to accept the asset, it may complicate matters. Additionally, creditors may be able to claim against these assets before they transfer to the beneficiaries. Understanding these limitations is essential for effective estate planning using a transfer death designation for the future.

Yes, a beneficiary deed does indeed override a will. When you record a beneficiary deed, it conveys your property to your designated beneficiary outside of the probate process. This will streamline the distribution of your assets and solidify the transfer death designation for the future, providing peace of mind for both you and your loved ones.

While a Payable on Death (POD) account is useful for transferring balance easily, it can also lead to potential complications. If you have multiple beneficiaries, issues might arise regarding equal distribution. Additionally, unlike a TOD deed, a POD account does not necessarily allow you to dictate how the funds are used, which may affect your overall transfer death designation for the future.

One of the primary disadvantages of a TOD deed is that it lacks flexibility once established. If you change your mind about your designated beneficiary or the property itself, you will need to execute a new TOD deed. This rigidity can complicate future estate planning, making it essential to consider your transfer death designation for the future carefully.

A transfer-on-death (TOD) designation applies specifically to real property, allowing you to transfer that property automatically upon your death. In contrast, a beneficiary designation typically relates to accounts, such as life insurance or retirement accounts, where you name beneficiaries to receive assets directly. Each method serves to simplify your estate planning and provides options for a reliable transfer death designation for the future.

Absolutely, a TOD designation will override the terms of your will. When you create a TOD designation for specific assets, those assets bypass the probate process entirely and go directly to your chosen beneficiary. By doing this, you ensure a smooth transition of your assets, establishing a clear transfer death designation for the future.

Yes, a transfer on death (TOD) deed does supersede a will. When you designate a property with a TOD deed, that designation takes priority over any provisions in your will. This means the asset will directly transfer to the designated beneficiary upon your death, ensuring a straightforward transfer death designation for the future.

Yes, one of the key benefits of a transfer death designation for the future like a TOD account is that it typically avoids probate. This means that upon the owner's death, the assets can be transferred directly to the beneficiaries without the delays and costs associated with probate court. This feature makes TOD accounts appealing for those seeking a smoother transition of their assets.

A notable downside of a transfer on death (TOD) deed is that it does not provide protections against creditors or legal claims. As such, estate owners should remain aware that their heirs may still face financial obligations linked to the estate. Additionally, if a beneficiary predeceases the owner without a contingent beneficiary specified, the TOD deed may lead to unintended complications.