Ohio Transfer On Death Deed Statute

Description

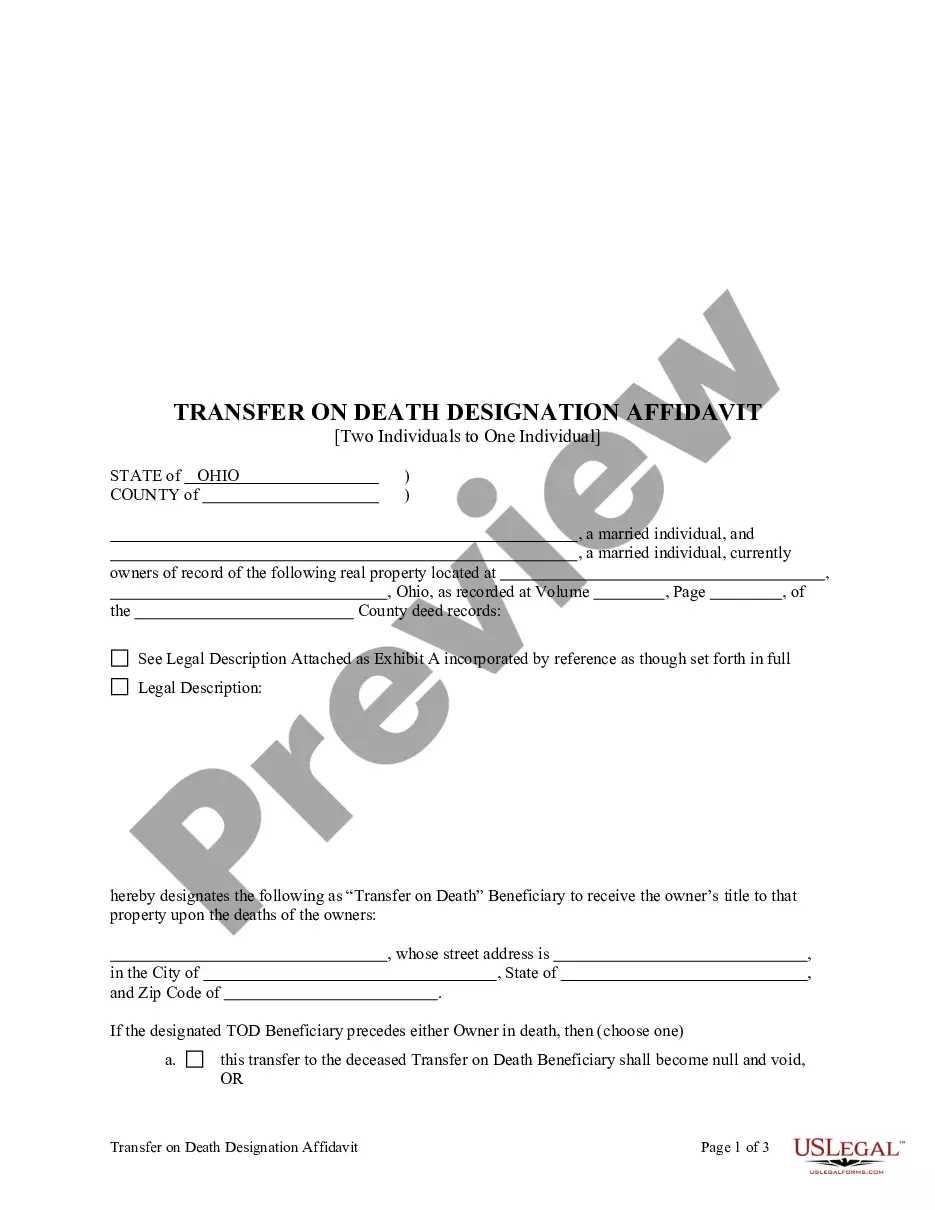

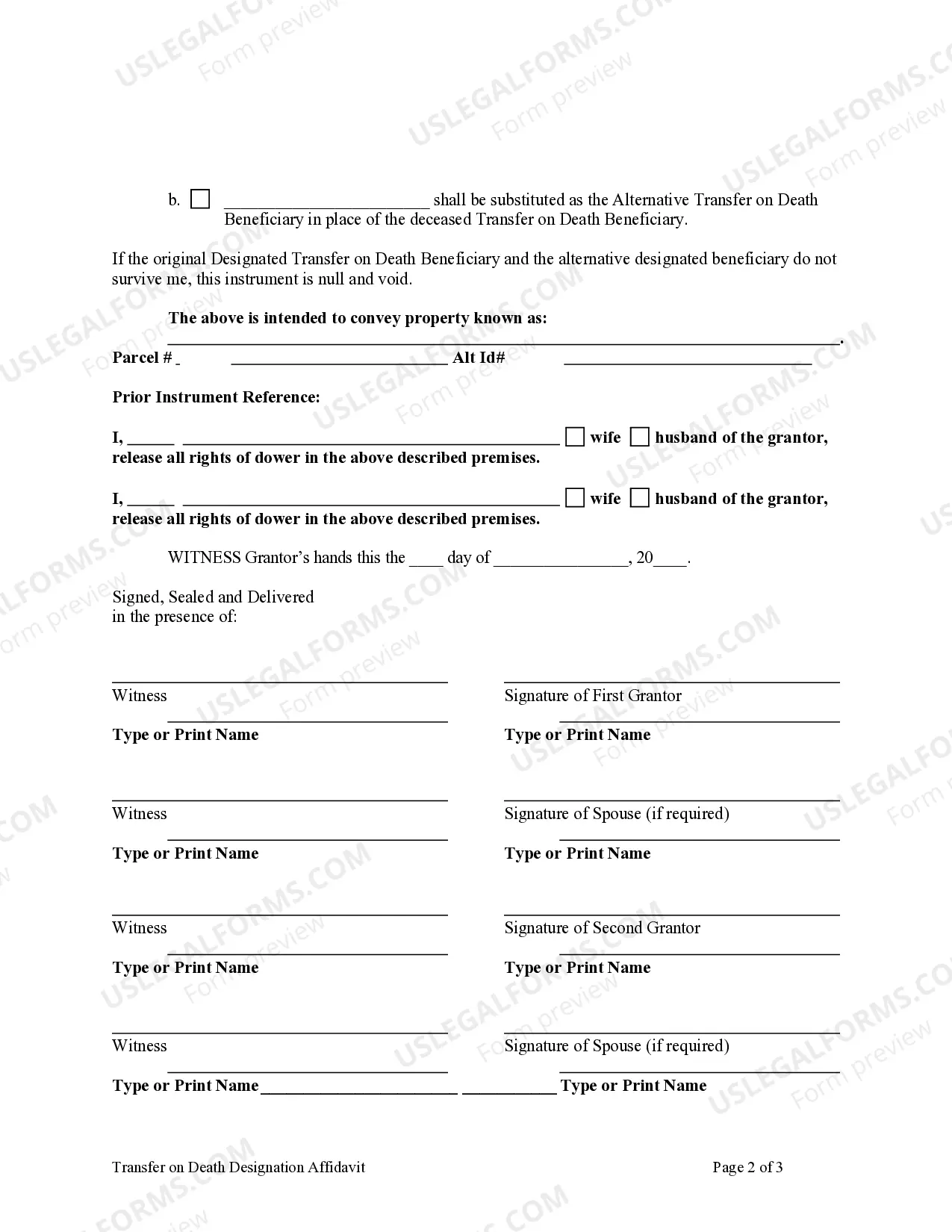

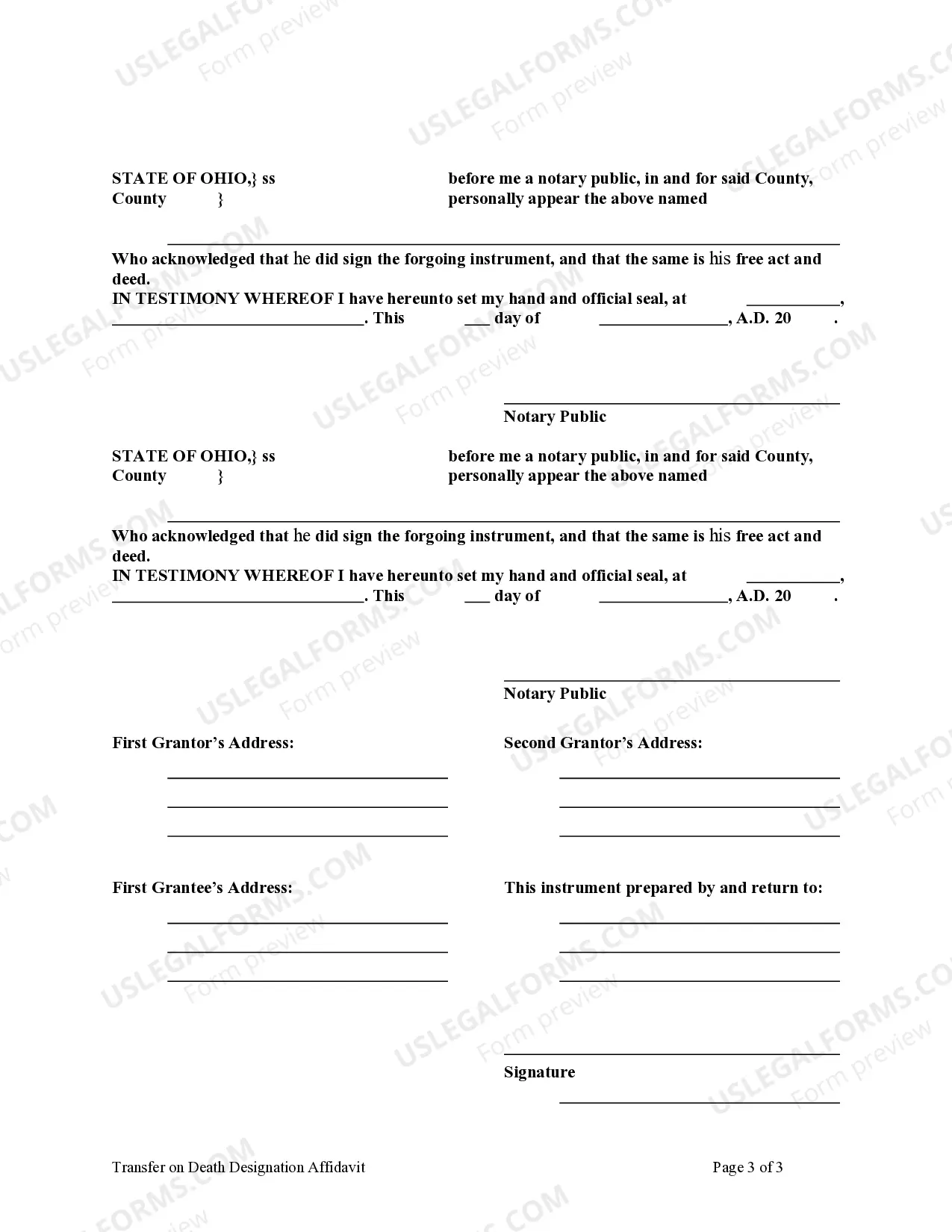

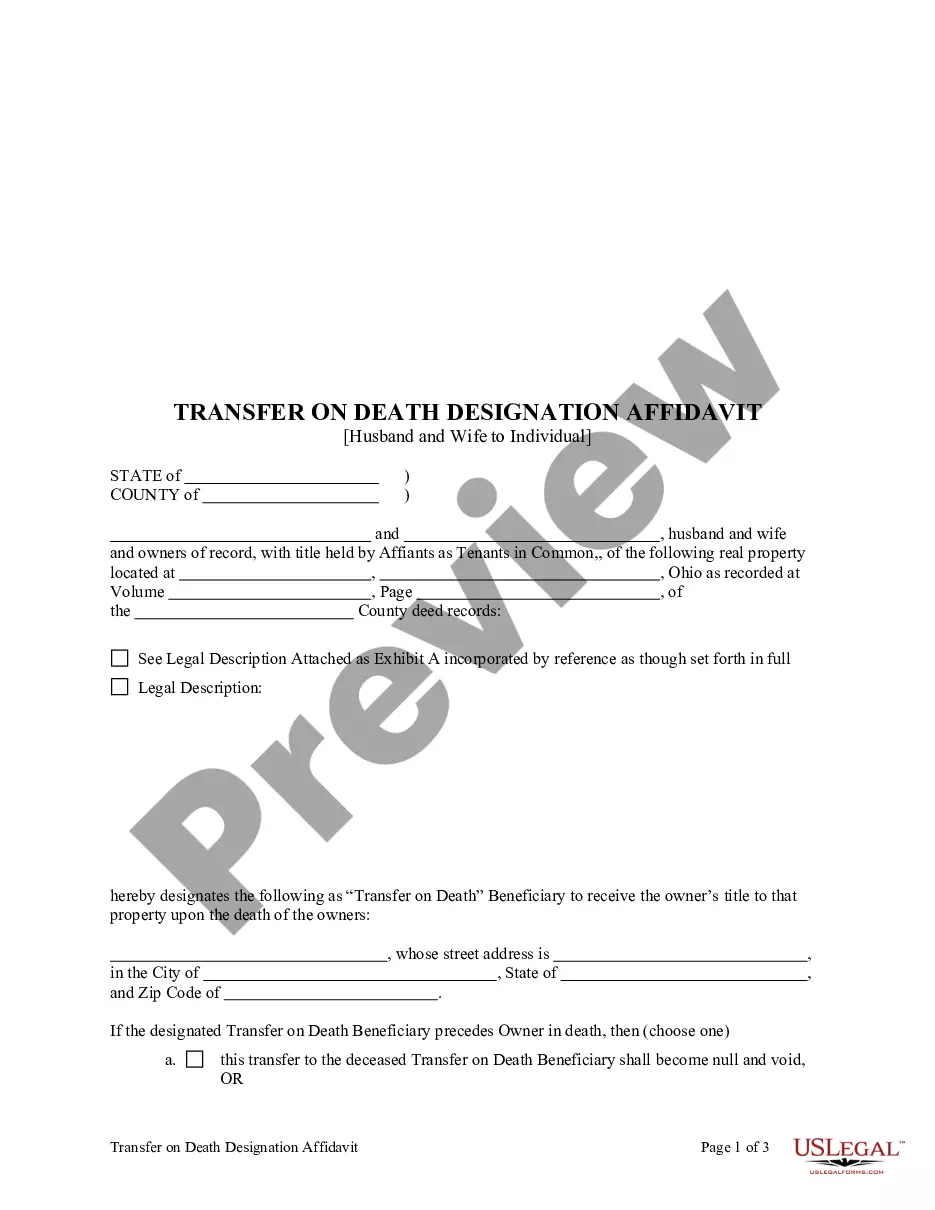

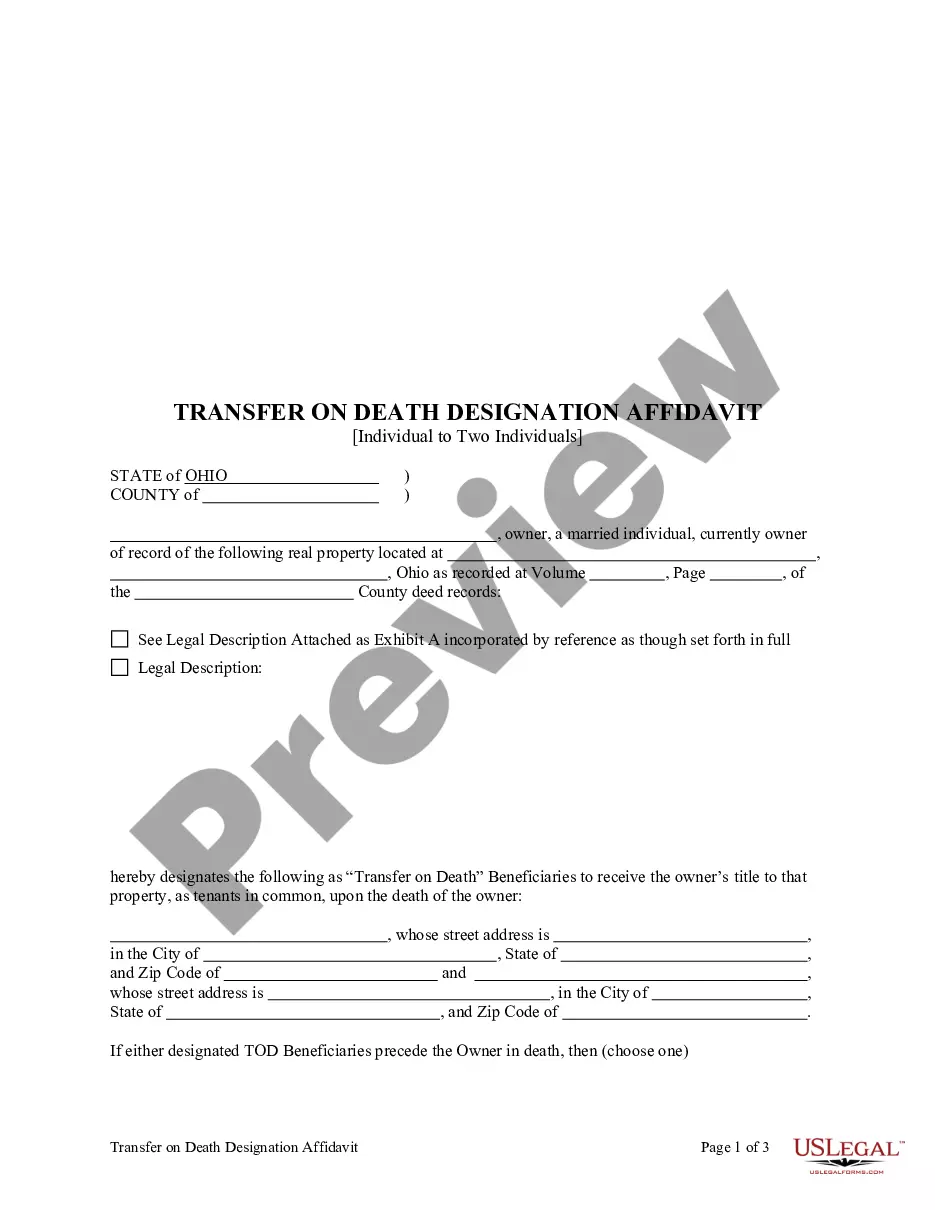

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

Locating a reliable source for the most up-to-date and pertinent legal templates is a significant part of managing red tape.

Ensuring the accuracy of legal document requirements demands precision and carefulness, which is why it is essential to obtain samples of the Ohio Transfer On Death Deed Statute exclusively from reputable providers, such as US Legal Forms. An incorrect template could squander your time and delay the circumstances you are facing. With US Legal Forms, you have minimal concerns. You can access and review all the information concerning the document's application and relevance for your situation and in your local area.

Once you have the form saved on your device, you can modify it using the editor or print it out and complete it by hand. Alleviate the stress associated with your legal documents. Explore the extensive US Legal Forms catalog to find legal templates, evaluate their suitability for your situation, and download them instantly.

- Utilize the library directory or search functionality to find your template.

- Review the form's description to verify its compatibility with the regulations of your state and locality.

- Preview the form, if available, to confirm that it matches what you are looking for.

- Return to the search to locate the appropriate template if the Ohio Transfer On Death Deed Statute does not meet your requirements.

- When you are confident about the form's applicability, download it.

- If you have registered, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to obtain the template.

- Select the pricing plan that best fits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your purchase by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading the Ohio Transfer On Death Deed Statute.

Form popularity

FAQ

Yes, a transfer on death deed allows assets to bypass probate in Ohio. By designating beneficiaries, properties can transfer directly upon the owner’s death, following the guidelines set in the Ohio transfer on death deed statute. This streamlines the distribution process for heirs, reduces associated costs, and prevents delays typically present in probate proceedings. This makes it an attractive option for many property owners.

Negatives of a transfer on death (TOD) deed may include the inability to control the property once the owner passes away, as heirs will receive the deed automatically. Additionally, if the owner fails to update the beneficiary designation or record the deed correctly, unintended consequences can arise. Understanding these potential hurdles helps ensure a smoother transition for beneficiaries following the Ohio transfer on death deed statute.

The disadvantages of a transfer on death deed can include limited creditor protection and the possibility that the deed can inadvertently create complications among heirs. If the property owner later changes their mind about a beneficiary or needs to sell the property, it can lead to confusion or disputes. Being aware of these aspects is crucial in making informed decisions, in accordance with the Ohio transfer on death deed statute.

A transfer on death deed in Ohio does not inherently avoid inheritance tax. The tax liability may still apply based on the overall estate's value and the beneficiaries' relationship to the decedent. However, utilizing a TOD deed can streamline the transfer process and potentially reduce administrative costs. It's advisable to consult with a tax professional to understand implications thoroughly.

While a transfer on death deed can simplify property transfer, it may have drawbacks. For instance, it does not provide protection against creditors or claims against the estate. Additionally, property passed through a TOD deed might not account for family dynamics or unexpected changes in beneficiaries. Understanding the potential risks can guide you in considering the Ohio transfer on death deed statute effectively.

To file a transfer on death title in Ohio, you must complete a specific form designating the beneficiary. It is vital to ensure that the form meets the requirements outlined in the Ohio transfer on death deed statute. After filling out the form, you should record it with the county recorder’s office where the property resides. Proper filing secures the beneficiary's rights without going through probate.

Determining whether a transfer on death (TOD) deed or a beneficiary designation is better depends on individual circumstances. A TOD deed allows property to pass directly to a designated beneficiary outside of probate, simplifying the process. Beneficiary designations, such as for bank accounts or life insurance, serve a similar purpose but focus on non-real estate assets. Both options align with the Ohio transfer on death deed statute, offering advantageous solutions.

To transfer a house deed after death in Ohio, the first step is to review the decedent’s estate planning documents. If a transfer on death deed exists, you can record it at the county recorder's office. This process allows for a straightforward transfer without the need for probate. By following the Ohio transfer on death deed statute, heirs can receive the property directly.

You have no strict deadline to transfer property after death in Ohio, but acting sooner is generally better. Utilizing the Ohio transfer on death deed statute can significantly streamline this process. Quick action minimizes potential legal complications and ensures that your loved one’s wishes are respected. Delays might complicate matters, so timely transfer is advisable.

In Ohio, a house can technically remain in a deceased person's name for an unlimited duration under specific circumstances. However, using the Ohio transfer on death deed statute offers a proactive solution. This deed allows for a seamless transfer of ownership to the designated beneficiary. For clarity and ease, it is best to execute this transfer shortly after the death.