Transfer On Death Designation Without Will

Description

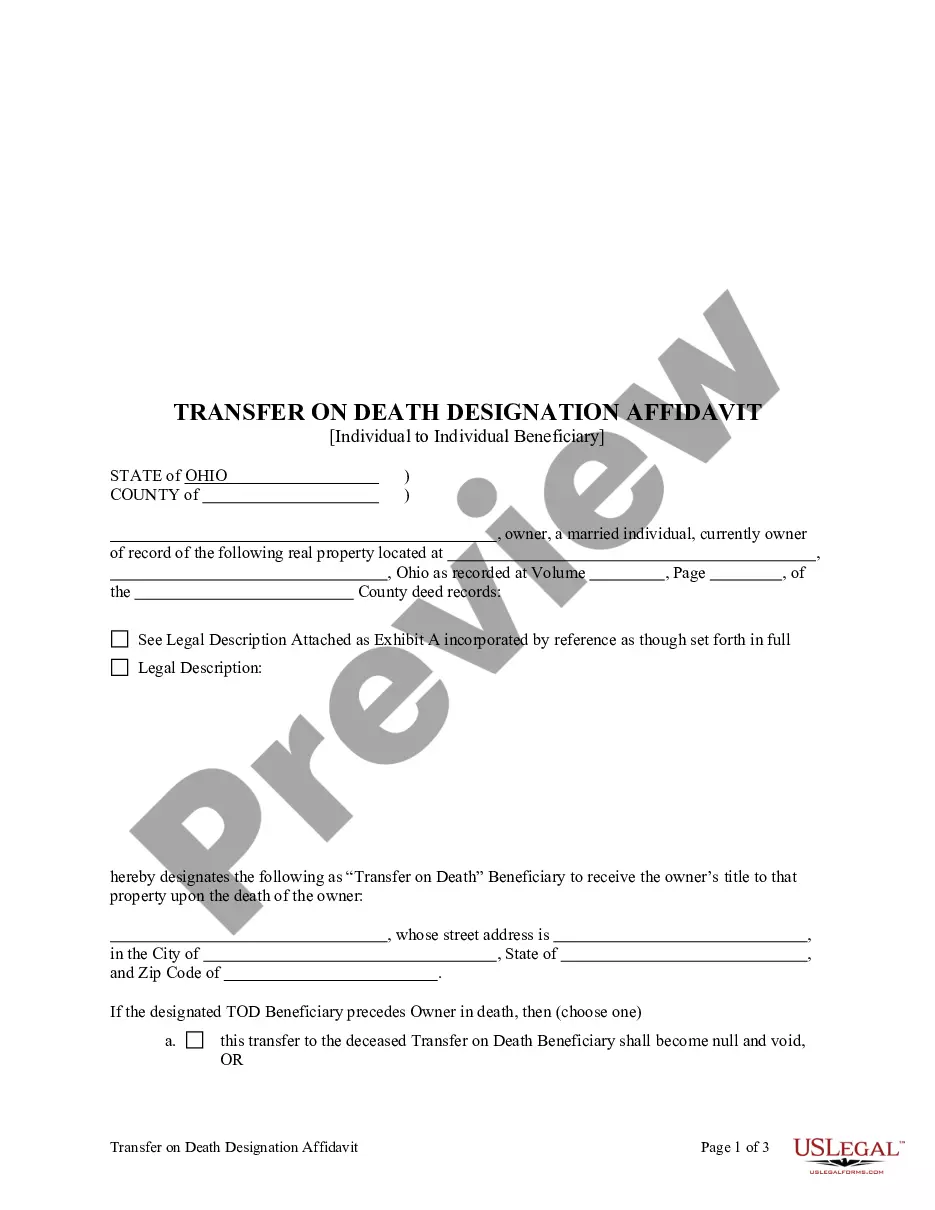

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To A Trust?

Engaging with legal paperwork and processes can be a lengthy addition to your whole day.

Transfer On Death Designation Without Will and similar forms usually require that you search for them and comprehend the most effective way to fill them out accurately.

Thus, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms readily available will be beneficial.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you in completing your documents with ease.

Is this your first time using US Legal Forms? Register and create your account in a matter of minutes to gain access to the form directory and Transfer On Death Designation Without Will. Then, follow the instructions below to fill out your form: Ensure you have located the correct form using the Preview feature and reviewing the form details. Click Buy Now when ready, and choose the monthly subscription option that suits your requirements. Click Download, then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting clients in managing their legal documents. Find the form you need today and streamline any process effortlessly.

- Browse the array of pertinent paperwork accessible to you with just one click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a premium service that allows you to prepare any form in minutes without additional or concealed fees.

- Simply Log In to your account, find Transfer On Death Designation Without Will, and download it instantly from the My documents tab.

- You can also access previously stored forms.

Form popularity

FAQ

Yes, a transfer-on-death designation without will effectively avoids probate. When you designate a beneficiary, the property transfers directly upon your death, bypassing the probate process entirely. This can save time and reduce costs for your loved ones, making it a practical choice for efficient estate planning.

In most cases, you do not need a solicitor to transfer ownership of property after death if you have a transfer on death designation without will in place. This designation allows property to pass directly to the named beneficiary, avoiding lengthy legal processes. Nevertheless, if complications arise or if you seek guidance, a solicitor can help simplify the process and clarify any uncertainties.

You do not necessarily need a lawyer to file a transfer-on-death deed. Many individuals successfully complete the process on their own, especially with clear instructions. However, consulting a legal professional can provide peace of mind, ensuring that your transfer on death designation without will complies with state laws and meets your specific needs.

A transfer on death designation without will allows your assets to pass directly to your beneficiaries upon your death, thereby avoiding the probate process. This means that your loved ones can access the assets more quickly and without the costs associated with probate. By using a TOD designation, you simplify the transfer of your property and ensure that your wishes are honored. With US Legal Forms, you can easily create a TOD designation to protect your assets and streamline the transfer process.

You do not necessarily need a lawyer to file a transfer on death deed, as many individuals successfully handle this process on their own. However, consulting a legal expert can provide peace of mind and ensure that you complete the transfer on death designation without will correctly. Platforms like US Legal Forms offer user-friendly resources and guidance to help you navigate the process with confidence. Ultimately, your comfort level and understanding of the required steps will dictate whether legal assistance is necessary.

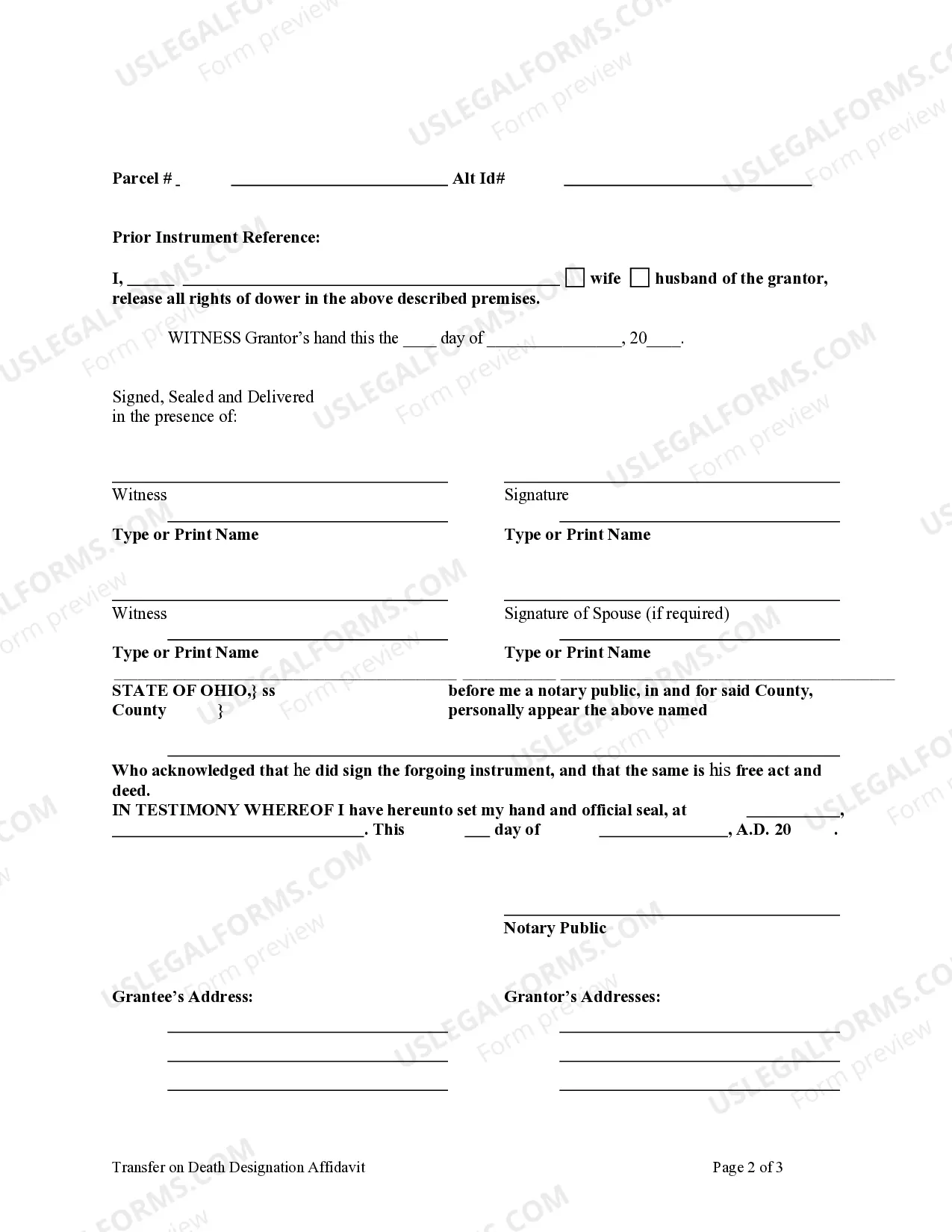

To fill out a transfer on death deed form, start by entering your name and address as the current property owner. Next, clearly identify the property by including its legal description. Then, name the beneficiary who will receive the property upon your passing. Finally, sign the form in front of a notary public to ensure its validity, allowing for a smooth transfer on death designation without will.

To get a transfer on a death certificate, you typically need to request an official copy of the death certificate from the vital records office in the state where the death occurred. This document is essential for executing a transfer on death designation without will. You may also need this certificate for other legal proceedings related to the deceased's estate. For more details, visit the US Legal Forms platform for helpful forms and instructions.

Transferring a deed from a deceased person can be accomplished through a transfer on death designation without will. First, you must gather important documents, including the death certificate and the original deed. Then, file the necessary forms with your local government office to officially transfer the property to the designated beneficiaries. For step-by-step guidance, check out the resources provided by US Legal Forms.

Yes, Tennessee does allow a transfer-on-death deed, which is a form of transfer on death designation without will. This deed enables property owners to designate beneficiaries who will inherit the property upon their death without going through probate. To ensure compliance and proper execution, you might want to explore resources available on the US Legal Forms platform.

To transfer a deed after death without a will, you can utilize a transfer on death designation without will. This process involves filing a transfer on death deed with your local recorder's office. The deed must be properly executed and recorded before the property owner's death. If you need assistance, consider using the US Legal Forms platform for guidance and templates.