Visitation may be granted if grandparent has an interest in welfare of child and visitation would be in child's best interest. Also if the grandparent adult child's who was one of the child's parents is deceased, or if child's parents were never married to each other visitation may be granted., Title 31, Section 3109.051 (O.R.C. ?§ 3109.051, 3109.11).

Grandparents Rights In The State Of Ohio Withholding Tables

Description

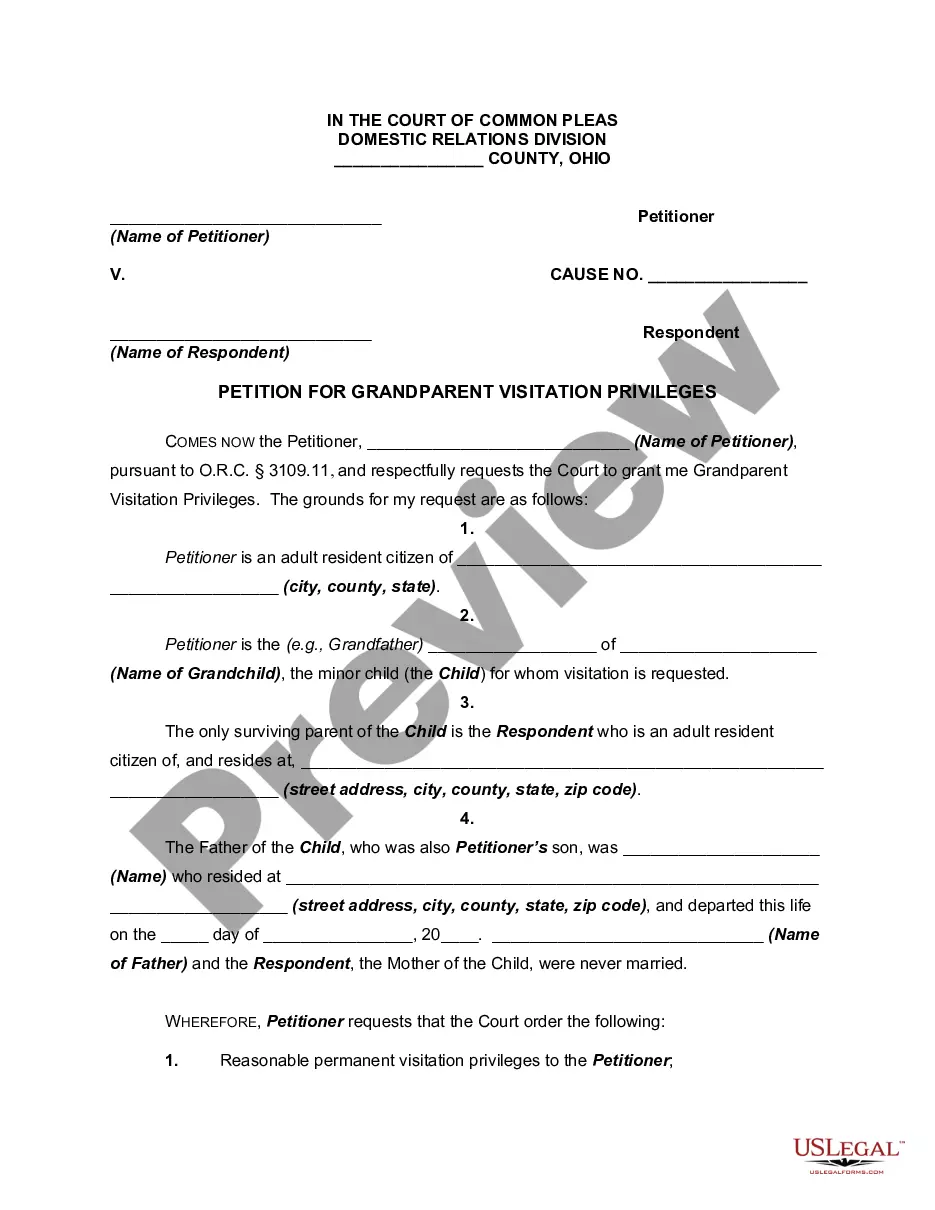

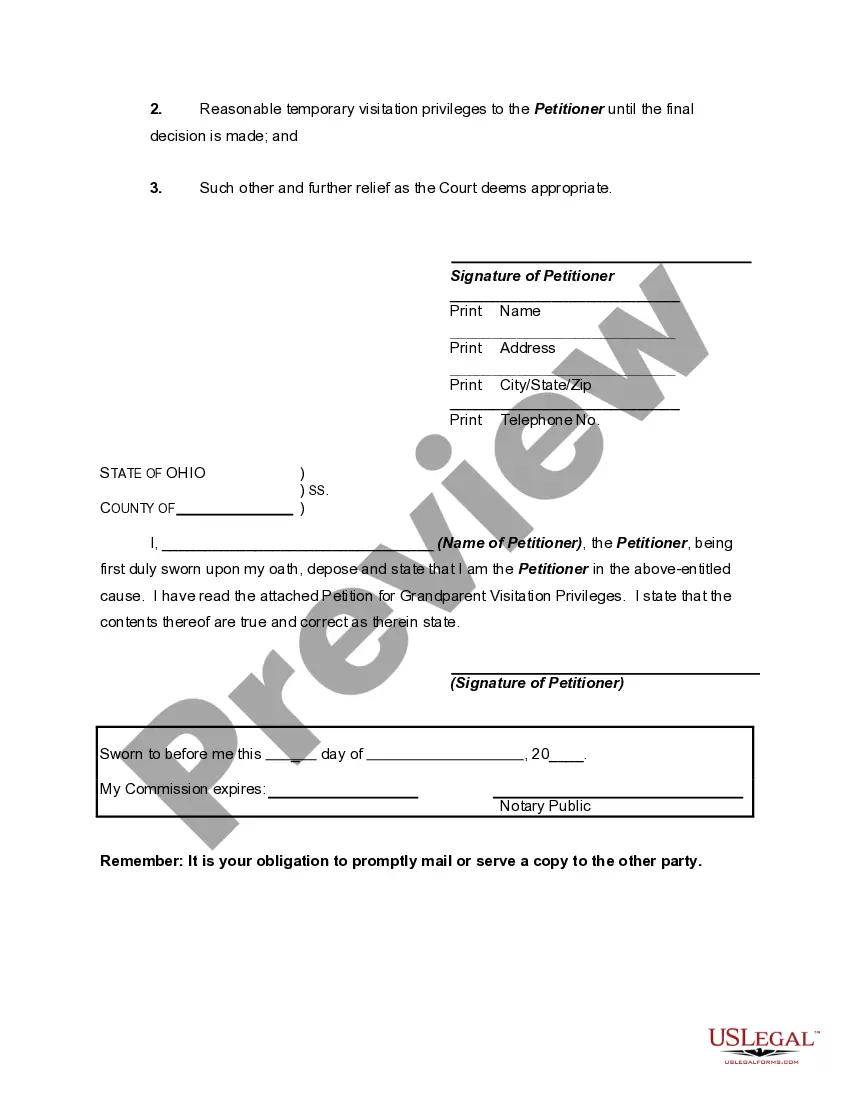

How to fill out Ohio Petition By Grandparents For Visitation Rights With Minor Grandchild Following The Death Of Son?

Getting a go-to place to access the most current and appropriate legal templates is half the struggle of working with bureaucracy. Choosing the right legal papers requirements precision and attention to detail, which is the reason it is vital to take samples of Grandparents Rights In The State Of Ohio Withholding Tables only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the details regarding the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to complete your Grandparents Rights In The State Of Ohio Withholding Tables:

- Use the library navigation or search field to find your template.

- View the form’s information to ascertain if it matches the requirements of your state and area.

- View the form preview, if available, to ensure the template is the one you are searching for.

- Go back to the search and look for the correct template if the Grandparents Rights In The State Of Ohio Withholding Tables does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Grandparents Rights In The State Of Ohio Withholding Tables.

- Once you have the form on your gadget, you can modify it using the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal paperwork. Discover the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Withholding Account Number If you cannot locate this document or account number, please call the Ohio Department of Taxation at (888) 405-4039 to request it. Visit the Ohio Business Gateway and click ?Create an Account?. The online registration process can take 1-2 days.

Every employer maintaining an office or transacting business within the state of Ohio and making payment of any compensation to an employee, whether a resident or nonresident, must withhold Ohio income tax.

Hear this out loud PauseSummary. Ohio employers must withhold state income tax from the pay of employees who are Ohio residents. For employees who are Ohio residents but work in another state, the employer must withhold for the other state's taxes, unless the other state does not require withholding.

Ohio state income tax brackets depend on taxable income and residency status. The state has five tax rates: 0%, 2.76%, 3.22%, 3.68% and 3.99%. $0 to $26,050. None.