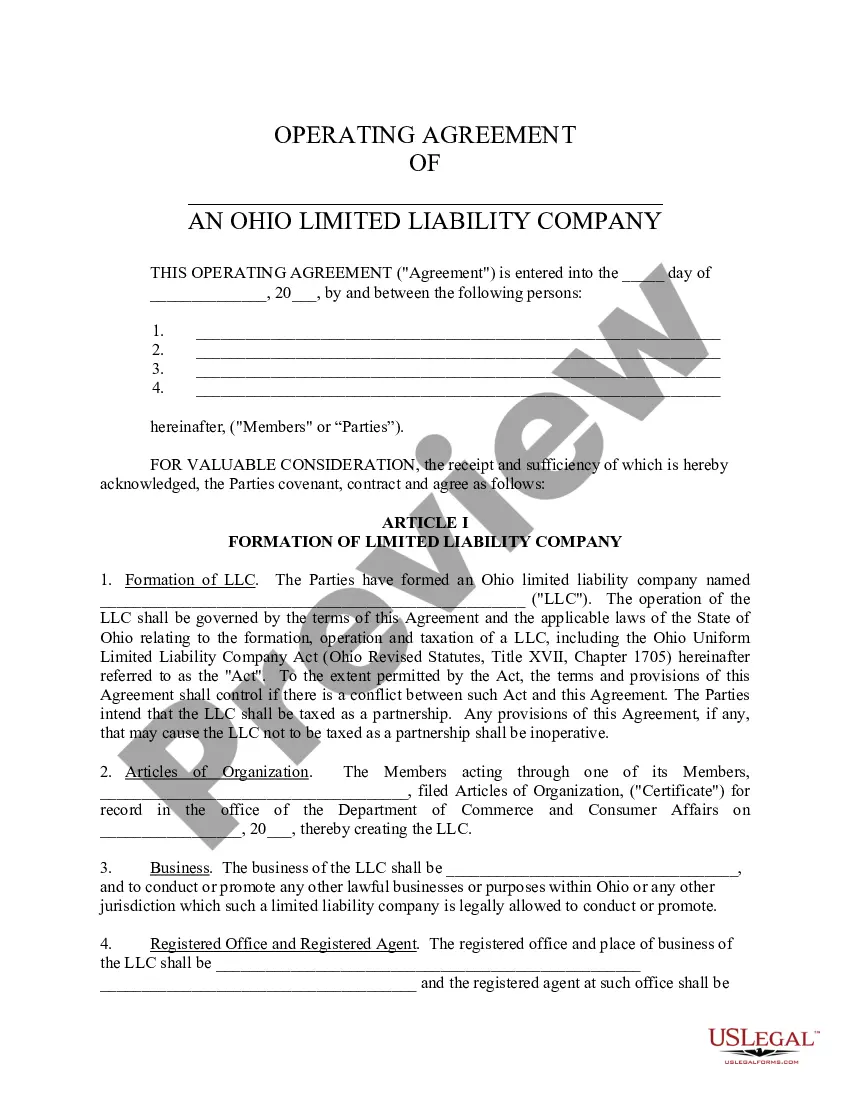

Ohio Llc Operating Agreement With Profits Interest

Description

How to fill out Ohio Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Completing legal paperwork requires careful attention, starting with choosing the right form template. For example, when you pick a wrong edition of a Ohio Llc Operating Agreement With Profits Interest, it will be turned down when you submit it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you need to obtain a Ohio Llc Operating Agreement With Profits Interest template, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Look through the form’s description to ensure it matches your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to locate the Ohio Llc Operating Agreement With Profits Interest sample you require.

- Download the template if it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the account registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Pick the document format you want and download the Ohio Llc Operating Agreement With Profits Interest.

- When it is saved, you can fill out the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time searching for the right sample across the web. Use the library’s straightforward navigation to find the correct template for any situation.

Form popularity

FAQ

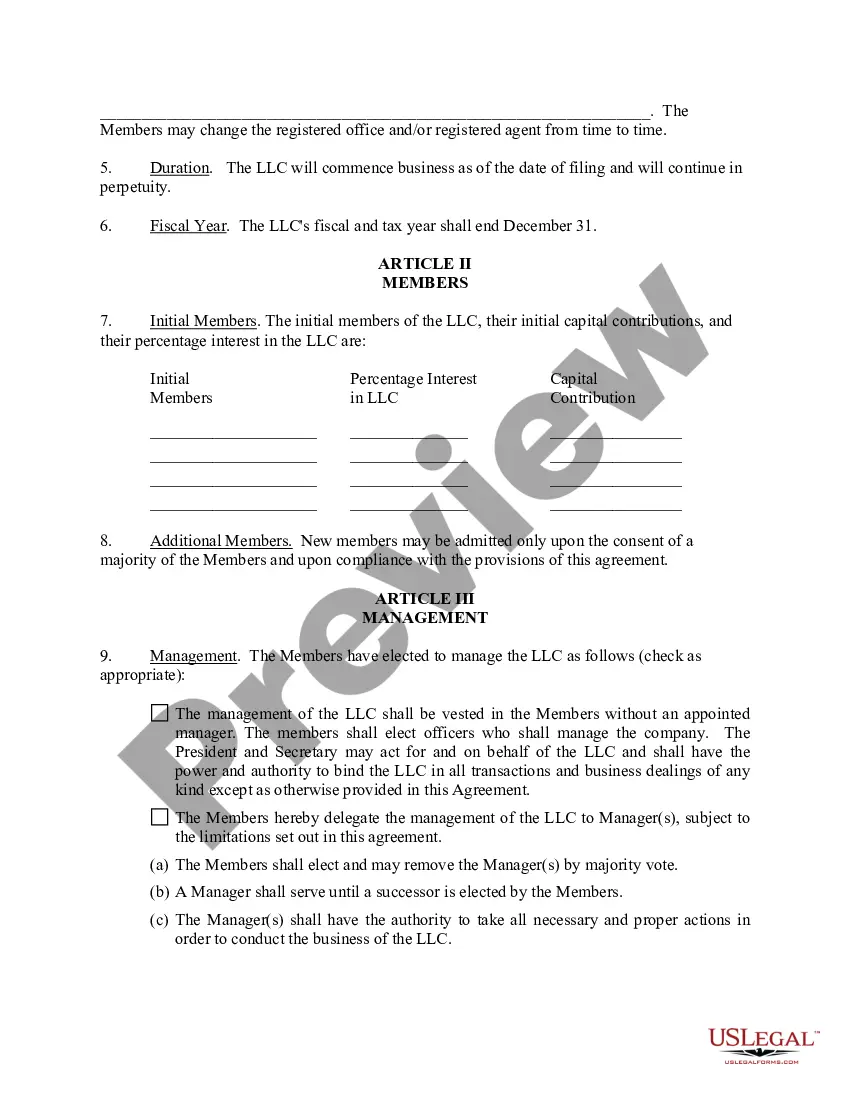

How to Transfer Ohio LLC Ownership Step 1: Review Your Ohio LLC Operating Agreement. Many states do not need to file the operating agreement. ... Step 2: Amend the Ohio Articles of Organization. ... Step 3: Spread the News. ... Step 4: Obtain a New EIN (optional)

Below is a breakdown of the process of forming an LLC in Ohio. Find a Business Idea. Create a Business Plan. Choose a Name for Your Ohio LLC. Appoint a Statutory Agent. File Articles of Organization. Receive Your LLC Certificate. Draft an LLC Operating Agreement. Obtain an EIN.

Yes, even Single-Member LLCs need an Operating Agreement. It's best to have a written Operating Agreement, even if you are the sole Member of your Ohio LLC (a Single-Member LLC). If you go to court, an Operating Agreement helps prove that your Single-Member LLC is being run as a separate legal entity.

Domestic Limited Liability Company Filing Forms Form NameFeeFile Certificate of Amendment or Restatement Online at Ohio Business Central Download Certificate of Amendment or Restatement (PDF)$50.00File Certificate of Correction Online at Ohio Business Central Download Certificate of Correction (PDF)$50.007 more rows

To be your own LLC Registered Agent, you need to have an address in Ohio. (Note: The address of a Registered Agent is the Registered Office. The Registered Office address and the name of the Registered Agent will go on your LLC paperwork.) The Registered Agent can be a person or a company.