Ohio Land Contract Form

Description

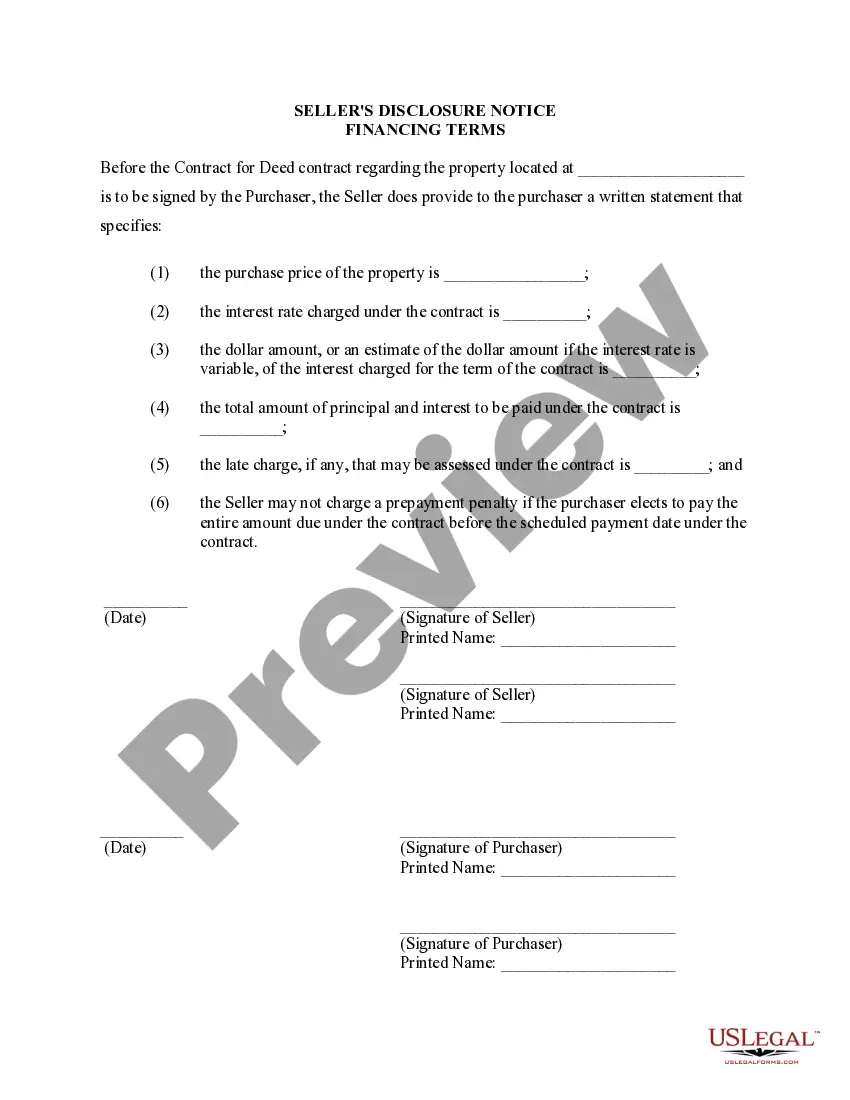

How to fill out Ohio Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Navigating through the red tape of official documents and templates can be challenging, particularly when one does not engage in such tasks professionally.

Even selecting the appropriate template for the Ohio Land Contract Form will consume time, as it must be legitimate and accurate to the very last digit.

However, you will need to invest significantly less time locating a suitable template if it originates from a trustworthy source.

Obtain the correct form with just a few straightforward steps: Enter the document title in the search bar, select the appropriate Ohio Land Contract Form from the results, review the sample description or view its preview. If the template meets your requirements, click Buy Now. Next, select your subscription plan, use your email to create a password to register an account at US Legal Forms, choose your payment method by credit card or PayPal, and save the document file on your device in your preferred format. US Legal Forms will save you time and effort in determining whether the document you found online is suitable for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of searching for the appropriate forms online.

- US Legal Forms is a singular location where one can find the latest examples of documents, verify their application, and download these examples to complete them.

- It is a collection with over 85K documents applicable in various fields of work.

- When searching for an Ohio Land Contract Form, you won’t need to doubt its legitimacy as all the documents are validated.

- Creating an account with US Legal Forms will ensure you have all the necessary examples readily available.

- You can store them in your history or add them to the My documents section.

- You can access your saved documents from any device by clicking Log In on the library site.

- If you have yet to create an account, you can always start a new search for the template you require.

Form popularity

FAQ

How does a land contract work?Identify a land contract home.Negotiate the terms of the land-purchase agreement.Arrange an inspection.Sign the land contract.Move into the home.Record the land contract.Begin making installment payments.Pay off the loan.20-Feb-2020

Requirements can vary from state to state, but when executed in Ohio, land contracts must include specific details, such as the following:Personal information.Specific dates.Full description of the property.Total sale price, down payment, and payment schedule.Interest rate.Frequency of statements.More items...

The advantages of a land contract to the buyer are that it provides an ownership interest in the real estate, which helps to quickly build equity in the property and good credit history. A major disadvantage is that the buyer is almost always responsible for structural and mechanical repairs to the house.

There's also something called a wrap-around land contract. Essentially, the buyer and seller agree to a seller-financed land contract, but the seller keeps paying on their existing mortgage, pocketing the difference between their mortgage payment and what they are paid on a monthly basis by the buyer.

The most significant disadvantage of a land contract is the amount of risk both parties take on.