Custodia Hijo Withholding Tax

Description

How to fill out New York General Power Of Attorney For Care And Custody Of Child Or Children?

Legal documents handling can be perplexing, even for seasoned professionals.

When searching for a Custodia Hijo Withholding Tax and lacking the opportunity to invest time in locating the proper and updated version, the procedures can be daunting.

Tap into a resource library of articles, guidelines, and manuals relevant to your circumstances and requirements.

Save time and effort hunting for the documents you need, and make use of US Legal Forms’ sophisticated search and Review tool to retrieve Custodia Hijo Withholding Tax and obtain it.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your everyday document management into a straightforward and user-friendly procedure today.

- If you possess a membership, Log In to your US Legal Forms account, locate the form, and obtain it.

- Check out the My documents section to review the documents you have previously saved and to organize your folders as you see fit.

- If it’s your first visit to US Legal Forms, create a free account and gain unlimited access to all the benefits of the catalog.

- Here are the steps to follow after finding the form you need.

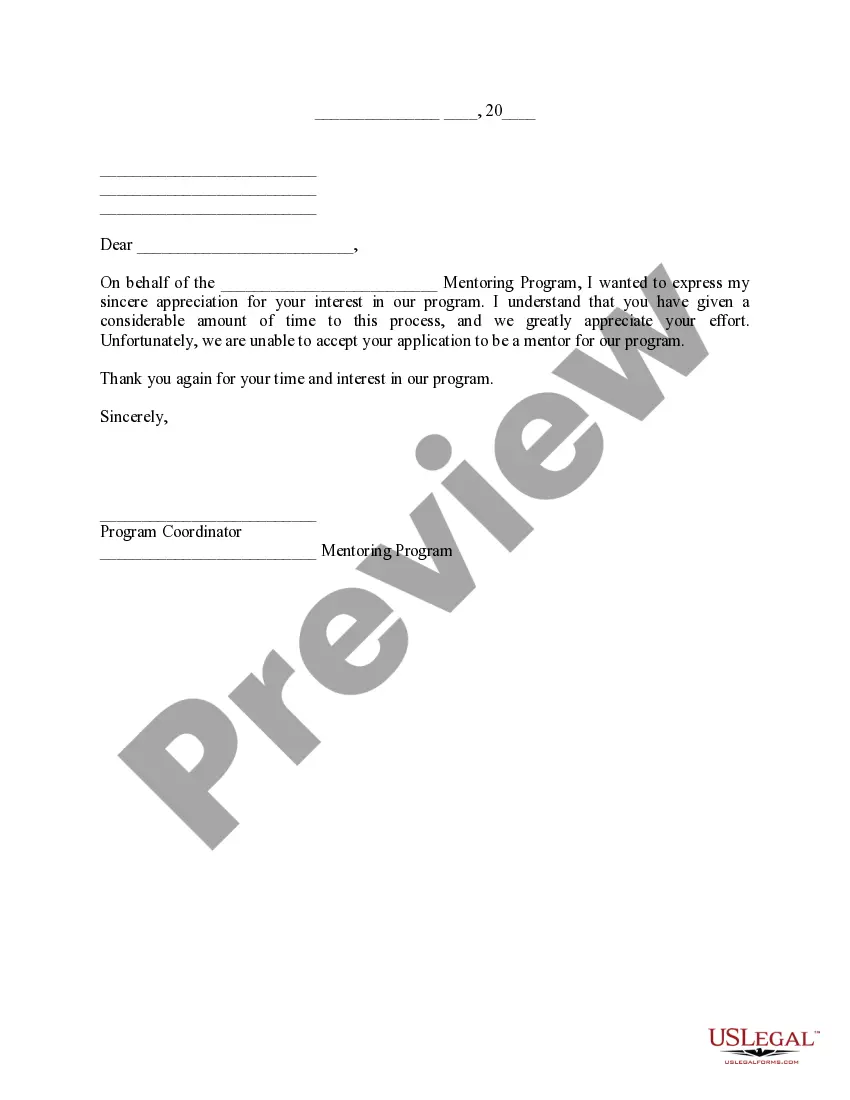

- Ensure this is the correct form by previewing it and examining its description.

- Access state- or region-specific legal and business documents.

- US Legal Forms addresses any requirements you may have, from personal to corporate paperwork, all in one spot.

- Make use of cutting-edge tools to fill out and manage your Custodia Hijo Withholding Tax.

Form popularity

FAQ

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. The form can be used for current or future tax years. Additionally, custodial parents can use tax Form 8332 to revoke the release of this same right.

The child beneficiary technically owns the custodial account ? not the custodian. It's the beneficiary's Social Security number that is attached to the account. Thus, the child is the one who technically needs to pay taxes.

If you do not file a joint return with your child's other parent, then only one of you can claim the child as a dependent. When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

The custodial parent signs a Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent or a substantially similar statement, and. The noncustodial parent attaches the Form 8332 or a similar statement to his or her return.

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.