Account Transfer Trust With The Client

Description

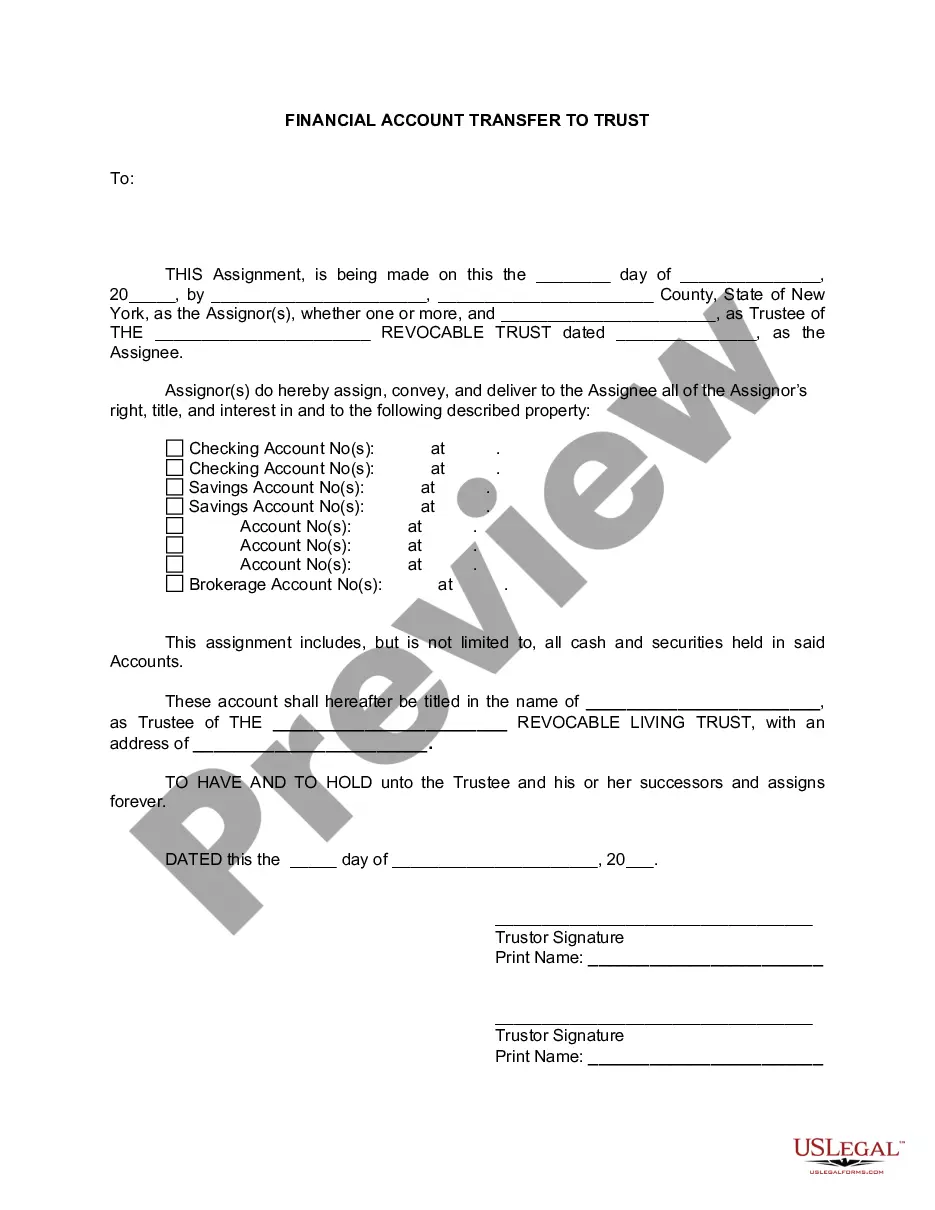

How to fill out New York Financial Account Transfer To Living Trust?

- Log in to your US Legal Forms account. If you're an existing user, access your account directly. Make sure your subscription is current; if needed, renew it based on your payment plan.

- If you are new to US Legal Forms, begin by searching for the relevant form. Preview any legal document to ensure it meets your specific requirements and complies with your local laws.

- Use the search functionality to locate the exact template you need if there are any discrepancies in your initial search.

- Select the form and click 'Buy Now.' Choose the subscription plan that best suits your needs; registration is needed to unlock access to the entire library.

- Finish your purchase by entering your payment details. You can use either a credit card or PayPal account for this transaction.

- Download your document directly to your device. You can always access it later from the 'My Forms' section of your profile.

In conclusion, utilizing US Legal Forms for your account transfer trust with the client not only streamlines the process but also guarantees that all documents are legally robust and compliant. By following these steps, you can efficiently manage your legal needs with confidence.

Ready to get started? Visit US Legal Forms today and take advantage of their extensive library to make your legal processes effortless.

Form popularity

FAQ

Yes, you can set up a trust fund by yourself; however, mistakes can be costly. Establishing an account transfer trust with the client often involves complex legal language and requirements. Therefore, while it's possible to do it independently, seeking assistance from a reliable platform like US Legal Forms can provide you with the necessary tools and information to ensure everything is done correctly. Taking this path helps protect your interests and those of your beneficiaries.

Filling out a trust fund requires careful attention to detail to create an effective account transfer trust with the client. You'll need to provide essential information, such as the names of grantors and beneficiaries, the terms of the trust, and any specific instructions for asset management. It's important to review the document thoroughly to avoid errors. Utilizing US Legal Forms can simplify this process, offering templates that guide you step by step.

One common mistake parents make when establishing an account transfer trust with the client is failing to clearly define the trust's purpose. Without clear objectives and guidelines, funds may not be used as intended. Communication with all involved parties is crucial, as confusion can lead to disputes or mismanagement. Using platforms like US Legal Forms can help streamline the process and ensure all legal requirements are met.

Transferring funds to a trust account typically requires you to first have an established trust set up. Once your trust account is active, you can request a fund transfer from your bank or financial institution. This might involve filling out a transfer form or providing necessary identification. Leveraging the account transfer trust with the client can streamline this procedure effectively.

Yes, placing bank accounts in a trust can be a beneficial move for many people. It offers help with estate planning, as assets in a trust avoid probate and can be distributed to beneficiaries more quickly. However, it is important to weigh the pros and cons and consider your personal financial situation. The account transfer trust with the client can guide you through this valuable decision.

Moving accounts into a trust involves a series of steps, starting with identifying the accounts you want to transfer. You will then need to create or use an existing trust document. After that, contact your financial institutions for their specific requirements, which might include forms and documentation of the trust. Utilizing the account transfer trust with the client can make this process clear and efficient.

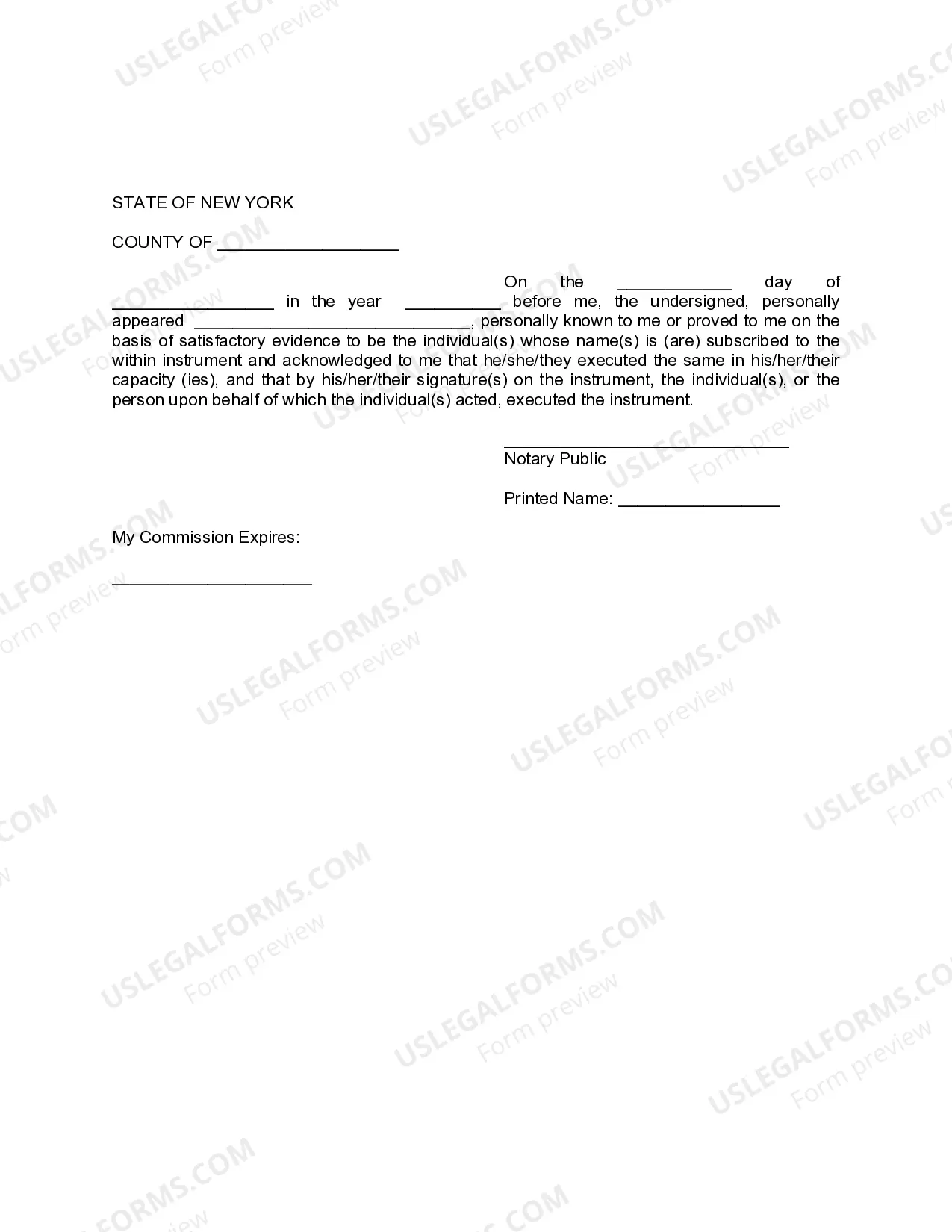

To transfer accounts to a trust, begin by gathering all necessary documentation for the accounts and the trust itself. Next, contact the financial institution managing the accounts to inquire about their specific transfer processes. They may require certain forms to be filled out or notarized. By using the account transfer trust with the client, you ensure a smooth and organized transition.

To transfer to trust, start by ensuring you have established a trust agreement. You will need to gather all necessary documents related to the assets you wish to transfer, such as real estate deeds, bank account information, and investment details. Next, you will officially change the ownership of these assets to the trust, which may involve signing transfer forms and filing them with relevant authorities. Finally, it’s beneficial to involve a legal professional or use a platform like US Legal Forms to guide you through the account transfer trust with the client, ensuring everything is done correctly and efficiently.