Account Transfer Trust For Your Account

Description

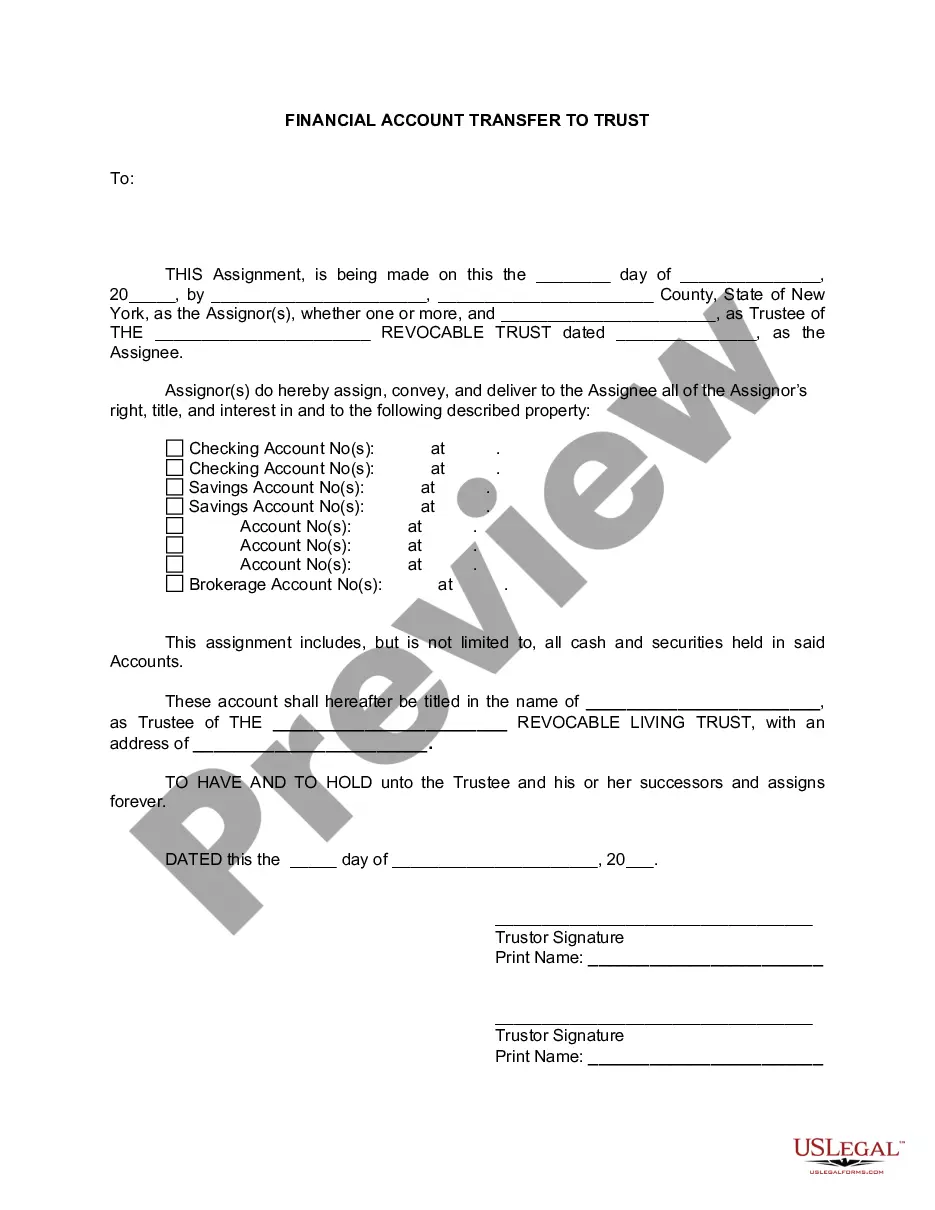

How to fill out New York Financial Account Transfer To Living Trust?

- If you're already a registered user, log into your account and make sure your subscription is active. Download the necessary form template by clicking the Download button.

- For first-time users, begin by browsing our extensive library. Review templates in Preview mode to ensure they meet your specific jurisdiction requirements.

- If you need a different template, utilize the Search tab to find precisely what you need. If satisfactory, proceed to the next step.

- Purchase the document by clicking the Buy Now button and select your preferred subscription plan. You'll need to create an account to access our vast resources.

- Complete your payment by entering your credit card information or utilizing your PayPal account for your subscription.

- Finally, download your chosen form to your device, allowing you to complete it as necessary. You can always find it again in the My Forms section.

US Legal Forms stands out with a robust collection of over 85,000 fillable and editable legal documents, surpassing competitors in quantity and value. Users also benefit from access to premium experts who can assist in crafting accurate and legally sound documents.

Effortlessly manage your legal needs with US Legal Forms today. Start your account transfer process and ensure your documents are prepared correctly by accessing our user-friendly library now!

Form popularity

FAQ

Yes, you can set up a trust fund by yourself, especially with the right tools and resources at your disposal. You will need to draft a trust document that outlines the terms and conditions of the trust. While creating an account transfer trust for your account can be straightforward, legal complexities may arise. Utilizing services from uslegalforms can simplify this process, ensuring that you have the necessary forms and guidance.

Including your checking account in your trust can offer significant benefits, such as avoiding probate and ensuring a smooth transfer of assets upon your death. This action can also help manage your finances and protect your account from claims. However, circumstances vary, so consider discussing your options with a financial advisor to see if an account transfer trust for your account makes sense for you. Our platform can guide you through the necessary steps.

Filling out a trust fund involves specifying the details in a trust document. Start by providing the trust's name and the names of the trustees, then include the beneficiaries and the assets you intend to transfer. It is essential to ensure that all documents align with your intentions for an account transfer trust for your account. You can simplify this process with the resources available on uslegalforms.

The 5 year rule for trusts refers to the period that certain contributions to a trust may impact taxes or eligibility for government benefits. Specifically, any gifts made to an account transfer trust for your account within five years can affect Medicaid eligibility. Understanding how this rule applies to your trust is crucial for better financial planning and to avoid unexpected tax consequences. Consulting a professional can help to navigate these regulations effectively.

Transfers between trusts may have tax implications depending on the circumstances and the types of trusts involved. Generally, an account transfer trust for your account does not result in immediate tax consequences, but it is essential to consult with a tax professional. They can help clarify any potential liabilities and ensure that all regulations are followed correctly. Staying informed will help you make smarter choices regarding your trusts.

One of the biggest mistakes parents often make when establishing a trust fund is failing to clearly define their goals. Without a well-thought-out plan, an account transfer trust for your account can become cumbersome and ineffective. Parents should ensure they consider their wishes for distributions and future management of the trust. It is crucial to involve legal experts to avoid potential pitfalls.

To transfer your bank account to a trust, begin by gathering the required documents, including your trust document. Next, reach out to your bank and ask for their procedures for transferring accounts into a trust. Completing the necessary paperwork is essential for a successful transfer. With an account transfer trust for your account, you ensure that your assets are well-managed in accordance with your estate planning objectives.

Transferring your bank account to your trust is a straightforward process. Start by contacting your bank to inquire about their specific requirements for the transfer. Typically, you'll need to provide a copy of your trust document and complete necessary forms. Utilizing an account transfer trust for your account makes this transition smoother and ensures your assets are managed per your wishes.

Not all accounts are suitable for inclusion in a trust. For instance, retirement accounts like IRAs or 401(k)s typically should not be placed in a trust due to tax implications. Additionally, certain types of accounts may not transfer easily, potentially complicating your estate planning. It's important to consult with an expert to evaluate which accounts would benefit from an account transfer trust for your account.

Yes, you can make your trust the beneficiary of your checking account. This arrangement allows the assets in your account to seamlessly pass to your trust upon your passing, avoiding probate. By establishing an account transfer trust for your account, you can ensure that your trust controls any funds left in the account according to your wishes. This method simplifies the process and provides clarity on asset distribution.