Account Transfer Trust For You

Description

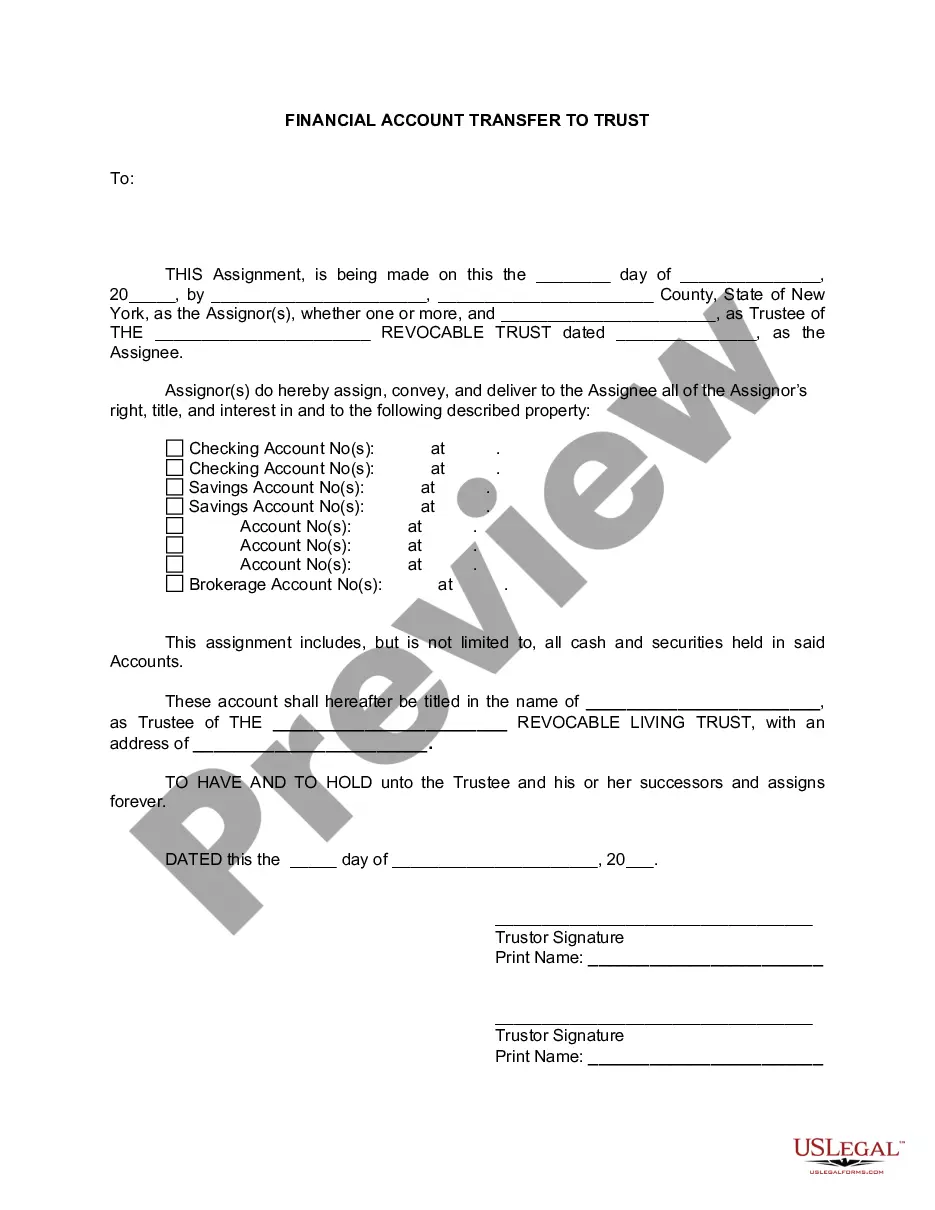

How to fill out New York Financial Account Transfer To Living Trust?

- If you have previously used US Legal Forms, log into your account and select the Download button for your desired form. Ensure your subscription is active; if necessary, renew as per your payment plan.

- For first-time users, begin by exploring the Preview mode to assess if the chosen form fits your needs and aligns with local jurisdictional requirements.

- Should you need an alternative template, utilize the Search feature at the top to locate the correct document. If it meets your criteria, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Creating an account is required for full access.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to finalize the subscription.

- Download your form and save it on your device. You can access it anytime from the My Forms section in your profile.

After completing these steps, you'll have instant access to essential legal documents designed for ease and accuracy. US Legal Forms not only simplifies document creation but also connects you with premium experts for additional guidance.

Ready to manage your legal forms effortlessly? Start using US Legal Forms today and ensure that your legal needs are met with confidence and clarity.

Form popularity

FAQ

Yes, a trust can indeed be rolled into another trust under certain conditions. This process usually requires formal legal action to ensure that all assets and responsibilities are appropriately transitioned. Consulting with a legal expert is advisable to navigate the complexities of a trust merger. Thankfully, US Legal Forms offers resources to assist you in successfully managing an account transfer trust for you.

Yes, you can transfer assets from one trust to another, a process often referred to as trust-to-trust transfer. This may involve revoking the original trust and transferring its contents into a new trust. It's essential to follow legal procedures to ensure everything is properly documented. The US Legal Forms platform can guide you through the necessary steps to make this process seamless.

Transferring ownership of a trust typically requires a formal process outlined in the trust document. Usually, the current trustee must prepare and execute an assignment of trust property. It’s important to ensure that the new trustee understands their responsibilities going forward. If you’re unsure, seeking help from US Legal Forms can provide you with the right templates and legal support for an account transfer trust for you.

Filing taxes on behalf of a trust involves completing IRS Form 1041, which is the income tax return for estates and trusts. You'll need to report the income, deductions, and distributions made from the trust. Depending on the trust type, you may also need to provide beneficiaries with a Schedule K-1 detailing their share of the income. The US Legal Forms platform can assist you in finding the right forms and instructions for your specific trust situation.

Yes, you can transfer a trust to another person, but it involves specific legal steps. You will typically need to consult with an attorney to ensure the transfer meets all legal requirements. The process may also require the new trustee to accept their role once the trust is transferred. Using the US Legal Forms platform can simplify this process by providing the necessary documents and guidance.

To transfer your bank account to a trust, start by contacting your bank to obtain the necessary forms and instructions. You will need to provide information about your trust and possibly have the trust documents handy. Using the guidance from UsLegalForms can simplify this entire process, helping you create an account transfer trust for you efficiently and correctly.

One downside of putting assets in a trust is the potential lack of liquidity and access depending on the trust structure. For example, some trusts may restrict withdrawals or require complex procedures to access funds. However, an account transfer trust for you can be structured to minimize these issues, allowing for beneficial management of your assets. Always discuss your options with a professional to ensure it meets your family's needs.

A revocable bank account is often the best option for a trust because it allows flexibility and ease of access for the trustee. This type of account can be managed without significant restrictions, which is crucial for effective administration. When setting up your account transfer trust for you, consider seeking services from UsLegalForms to identify the most suitable account options for your specific needs.

Certain accounts, such as retirement accounts and health savings accounts, are typically not funded into a trust due to tax implications or beneficiary designations. It's important to understand which assets your trust should hold versus those that should remain outside the trust. By consulting resources like UsLegalForms, you can learn about the appropriate account transfer trust for you. This ensures your estate planning is effective and compliant.

The main downfall of having a trust is the initial setup costs and ongoing management responsibilities it entails. Creating a trust can involve legal fees and paperwork, which can be a burden for some families. However, the benefits of an account transfer trust for you often outweigh these concerns, particularly regarding asset protection and efficient distribution. Ultimately, it's about finding what works best for you.