Living Trust Property With A Title

Description

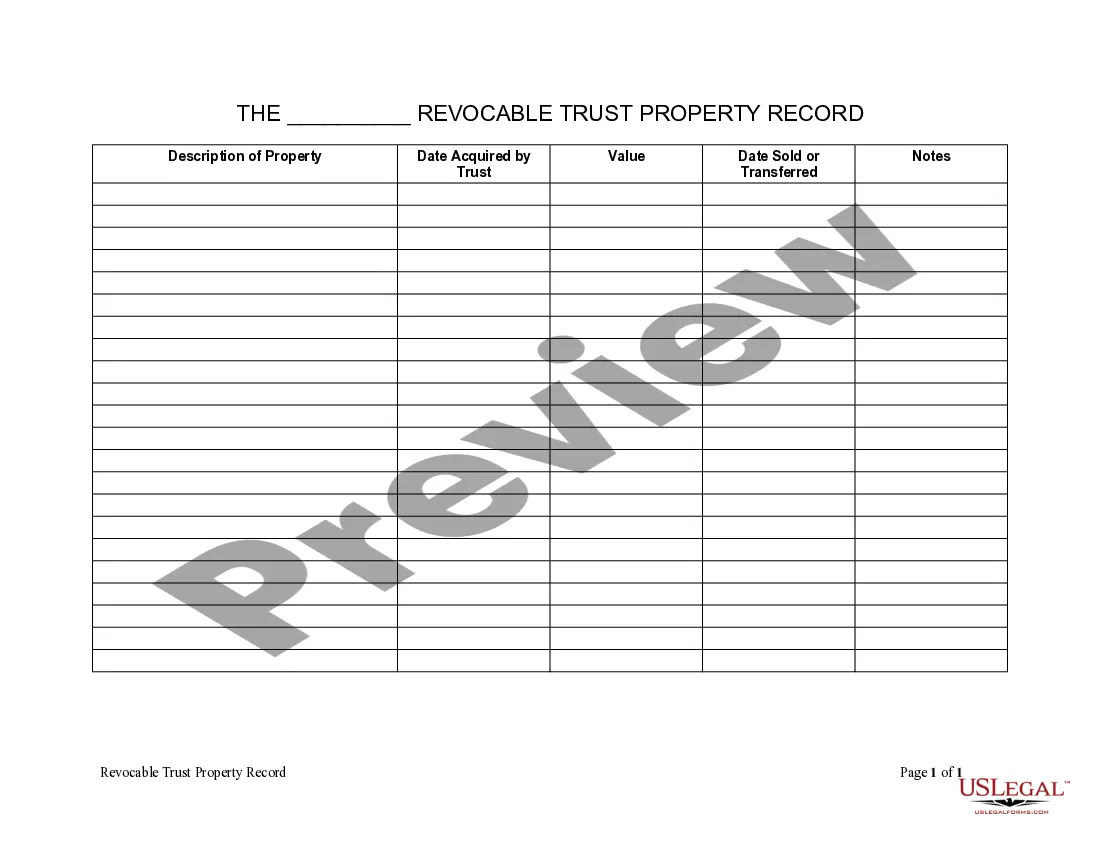

How to fill out New York Living Trust Property Record?

- If you are an existing user, log in to your account and download the necessary form you need by clicking the Download button.

- Confirm the validity of your subscription. If it's expired, renew based on your chosen payment plan.

- For first-time users, begin by exploring the Preview mode and form descriptions to find the exact template meeting your jurisdiction's requirements.

- Should you need different templates, utilize the Search tab to find suitable options that align with your needs.

- Once you identify the right document, proceed to purchase. Click on the Buy Now button and select your subscription plan. Account registration is required for access.

- Complete your transaction by providing your credit card or PayPal details for payment.

- Finally, download your form and save it. You can always return to the My Forms section of your profile to access it again.

In conclusion, US Legal Forms provides a robust and user-friendly platform for acquiring legal documents, ensuring you have the resources you need for establishing your living trust. Their extensive collection and expert assistance empower you to create legally sound documents effortlessly.

Visit US Legal Forms today to start securing your assets with confidence!

Form popularity

FAQ

When land is held in trust, it means that a trustee oversees the property for the benefit of designated beneficiaries. This arrangement can help protect the land from taxation or claims during probate. By using living trust property with a title for your land, you ensure long-term management and security, making it a favorable choice for many.

A title held in trust signifies that the ownership of that property is not with an individual but with the trust itself. This means the trustee can take actions regarding the property on behalf of the beneficiaries. By managing living trust property with a title, you ensure that your assets are handled according to your wishes and can provide peace of mind for you and your family.

When something is held in trust, it means that a third party—known as a trustee—holds and manages the property for the benefit of another party, known as the beneficiary. This setup provides a layer of protection and ensures that the property is managed according to the specific wishes of the trust creator. Therefore, living trust property with a title becomes a strategic method to control how your assets are handled.

When a title is held in a trust, it means that the ownership of property, such as real estate, is transferred to a trust instead of individual ownership. This arrangement allows a trustee to manage the asset for the benefit of the beneficiaries named in the trust. The living trust property with a title helps safeguard assets from probate and can offer tax benefits.

The best way to leave a house to your children often involves establishing a living trust property with a title. This option avoids the lengthy probate process and ensures that your wishes are met efficiently. Additionally, working with a platform like US Legal Forms can simplify the creation of your trust, giving you peace of mind regarding your estate planning.

Putting a property in a trust might limit access to certain tax benefits or create complexities during the life of the trust. While a living trust property with a title provides advantages like avoiding probate, it also requires proper management and record-keeping. Understanding these factors can help you decide if a living trust is right for you.

Deciding between gifting a house or placing it in a trust depends on your financial goals. A living trust property with a title allows for smoother transitions, avoiding probate, while gifting might have immediate tax implications. Think about your long-term intentions and consult with a professional to explore the benefits of using a living trust.

A family trust, while beneficial, may present disadvantages such as complicated tax implications. Depending on the structure, a living trust property with a title could lead to higher tax liabilities for beneficiaries. Additionally, if the trust is not managed carefully, it can create conflict within the family over asset distribution or decision-making. Seeking guidance from US Legal Forms can help navigate these challenges effectively.

One significant mistake parents often make is failing to fund their trust adequately. A living trust property with a title doesn't work effectively unless assets are transferred into it. Leaving assets outside the trust can result in them going through probate, which defeats the purpose of establishing the trust. Ensuring all assets are placed within the trust is crucial for optimal functionality.

While a trust can provide many benefits, one downfall is the need for ongoing management. A living trust property with a title requires regular updates to reflect changes in assets or beneficiaries. Additionally, if not funded properly, the trust may not fulfill its intended purpose, leading to complications in asset management and distribution.