Living Trust For Property

Description

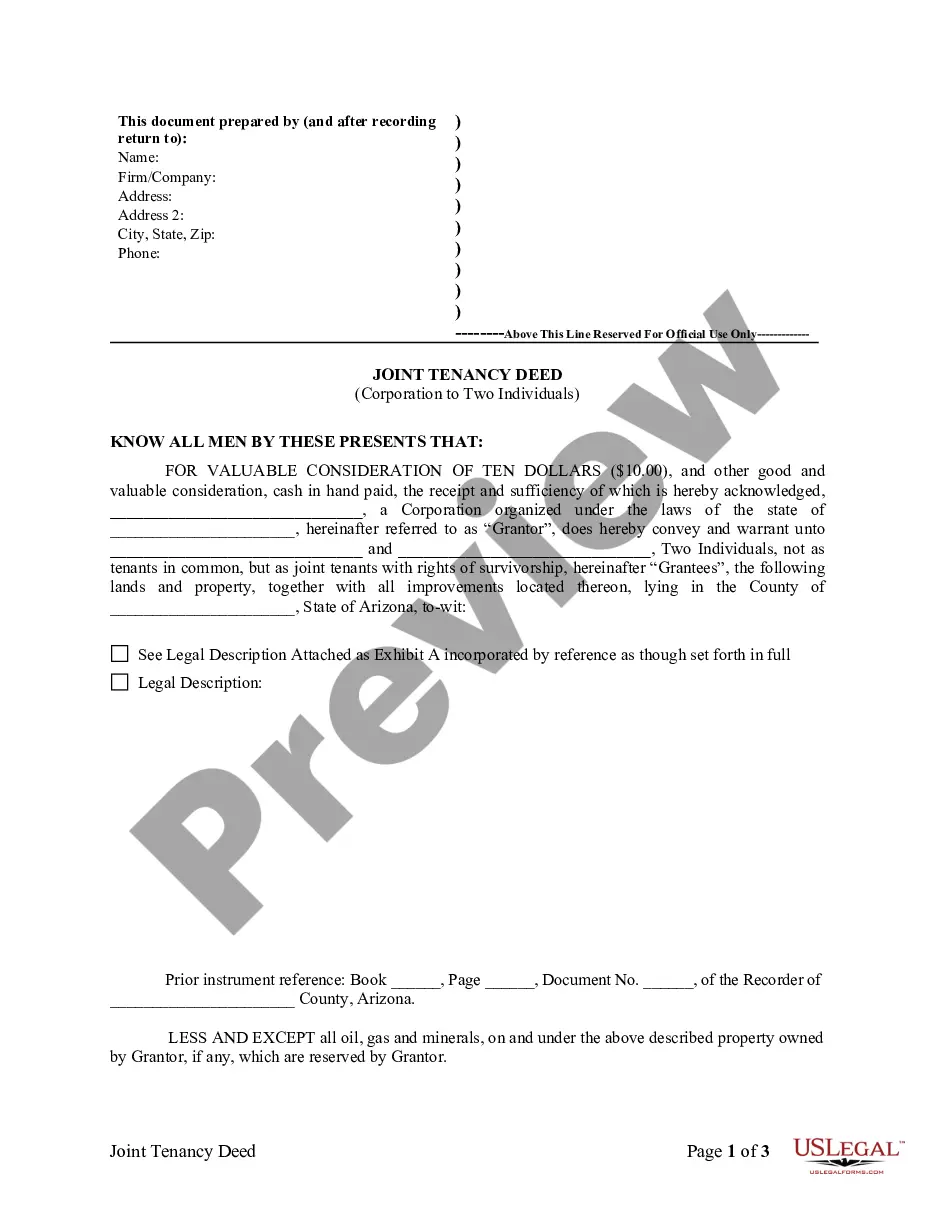

How to fill out New York Living Trust Property Record?

- If you’re an existing user, log in to your account and verify your subscription status. If necessary, renew it to access the forms you need.

- For first-time users, begin by previewing the available living trust forms. Ensure the selected form meets your needs and is compliant with your local jurisdiction.

- If you need to refine your search, utilize the Search tab to find the exact form that matches your requirements.

- Purchase the document by clicking on the Buy Now button and choosing your subscription plan, after creating an account for library access.

- Complete your payment using a credit card or PayPal to finalize your purchase.

- Download your living trust form to your device. You can find it later anytime in the My Forms section.

With US Legal Forms, you gain access to a vast collection of over 85,000 legal forms. Their platform not only offers robust and editable forms but also provides support from premium experts to ensure that your documents are completed accurately and efficiently.

Start your journey to secure your property today! Sign up or log in to US Legal Forms and take the first step towards establishing your living trust.

Form popularity

FAQ

The downside of a living trust often includes the complexity of managing the trust properly. For instance, if you fail to transfer all your property into the living trust for property, some assets may still go through probate. Furthermore, while living trusts can help avoid probate, they do not provide tax benefits. Understanding these aspects can help you make informed decisions about your estate planning.

Putting your house in a living trust for property can have some disadvantages. First, there may be upfront costs involved in creating the trust, including legal fees. Additionally, once in a trust, you might need to adjust your insurance policies and property taxes. It's also essential to keep the trust updated if any changes occur in ownership or property value.

Property is often owned by a trust to provide a clear structure for asset management and distribution. This arrangement can help protect your assets from creditors and ensure that your wishes are honored after your death. Using a living trust for property facilitates smooth transitions, making it a preferred choice for many estate planners.

While a living trust has numerous benefits, it also comes with certain disadvantages. These can include the expenses associated with creating and managing the trust, as well as potential tax implications. Thus, it is important to weigh these factors when deciding if a living trust for property fits your personal situation.

Many individuals place their property in a living trust to simplify the transfer of assets to their beneficiaries after passing. This approach helps avoid the lengthy probate process, which can be both time-consuming and costly. Additionally, a living trust for property allows for greater control over how and when your assets are distributed.

A common mistake parents make when establishing a trust fund is failing to be specific about asset distribution. Ambiguity can lead to confusion and disputes among heirs. It is crucial to clearly outline how and when assets will be distributed in your living trust for property. This clarity can prevent misunderstandings and ensure that your wishes are honored.

One downside of a living trust for property is that it may require ongoing management and maintenance. Unlike a will, a living trust does not simply distribute assets upon death; you must keep it updated with your changing circumstances. Additionally, setting up a living trust can have upfront costs that some might find discouraging. However, the benefits often outweigh these concerns.

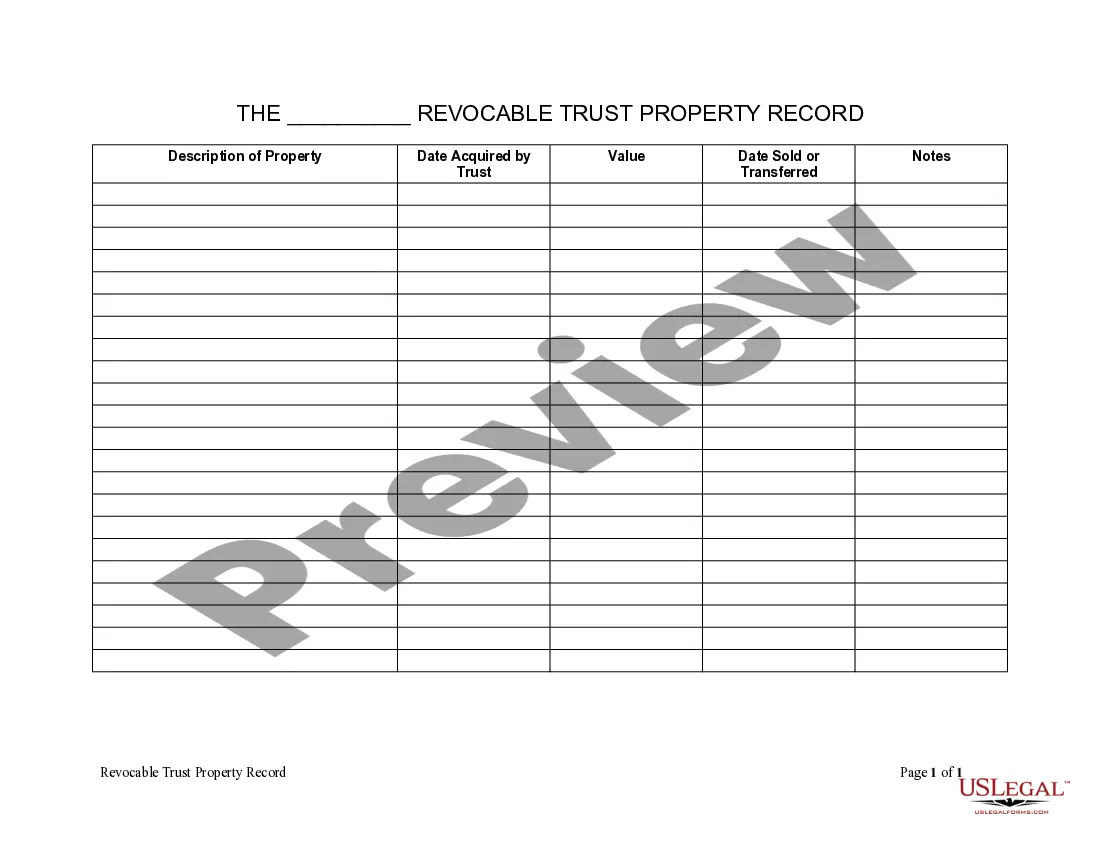

Filling out a living trust for property involves several key steps. First, you need to gather important documents regarding your property, such as deeds and titles. Then, use a reliable platform like US Legal Forms to create your trust document, ensuring you customize it for your specific needs. Finally, remember to sign the trust and properly fund it by transferring ownership of your assets.