My Trust Meaning

Description

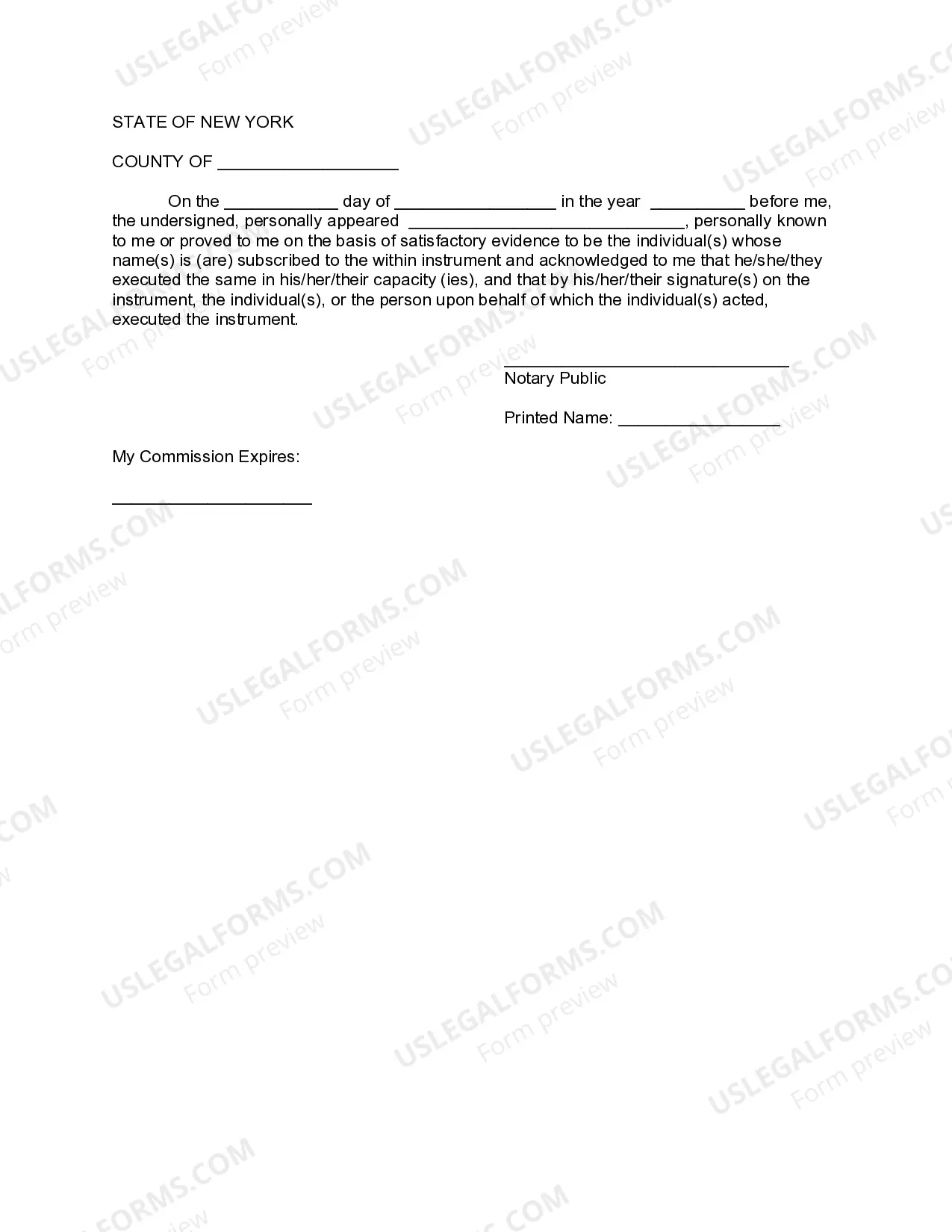

How to fill out New York Amendment To Living Trust?

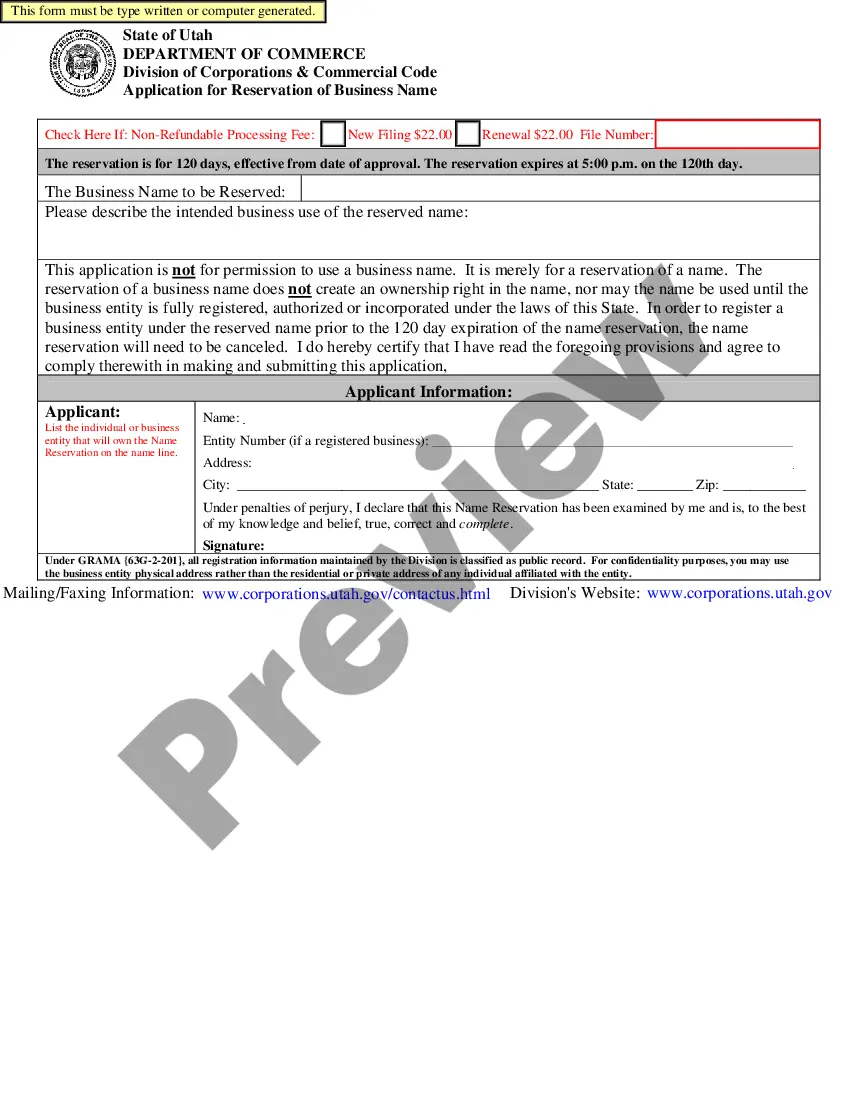

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of working with bureaucracy. Finding the right legal files calls for precision and attention to detail, which is the reason it is important to take samples of My Trust Meaning only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the details concerning the document’s use and relevance for the situation and in your state or county.

Consider the following steps to complete your My Trust Meaning:

- Utilize the library navigation or search field to find your sample.

- Open the form’s description to see if it suits the requirements of your state and county.

- Open the form preview, if available, to make sure the template is definitely the one you are interested in.

- Return to the search and look for the right document if the My Trust Meaning does not fit your requirements.

- If you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Pick the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Pick the document format for downloading My Trust Meaning.

- When you have the form on your gadget, you can alter it with the editor or print it and finish it manually.

Get rid of the inconvenience that comes with your legal paperwork. Discover the extensive US Legal Forms collection to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Hear this out loud PauseA simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Hear this out loud PauseThe most common example of when a declaration of trust is used is the situation where an adult son or daughter borrows money for a deposit on a first house from his or her parents. The parents may have a mortgage already, and the terms of that mortgage prevent them from borrowing under another.

A trust is a legal contract that ensures your assets are managed ing to your wishes during and after your lifetime. Among the many benefits trusts offer are potential tax benefits and the ability to set parameters for how and when your assets will be used and distributed.

How to Fund a Trust: Bank Accounts and Other Financial Accounts Contact your bank to see what's required to transfer your accounts to the Trust. Your bank will provide any necessary forms. Complete, sign and return forms to your bank. ... Have the bank change the title to the Trustee of the Trust.

Hear this out loud PauseA trust is a fiduciary1 relationship in which one party (the Grantor) gives a second party2 (the Trustee) the right to hold title to property or assets for the benefit of a third party (the Beneficiary). The trustee, in turn, explains the terms and conditions of the trust to the beneficiary.