Living Trust 101

Description

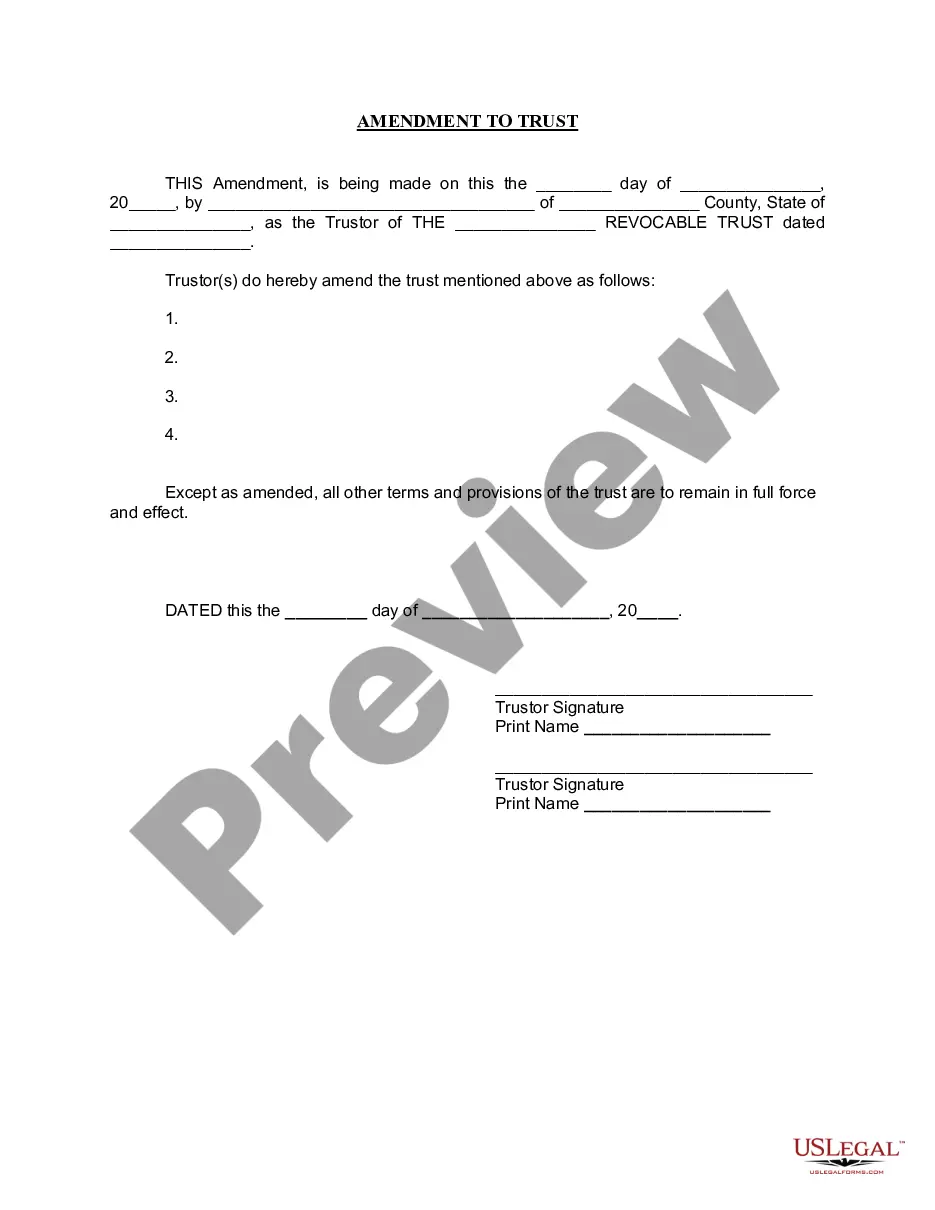

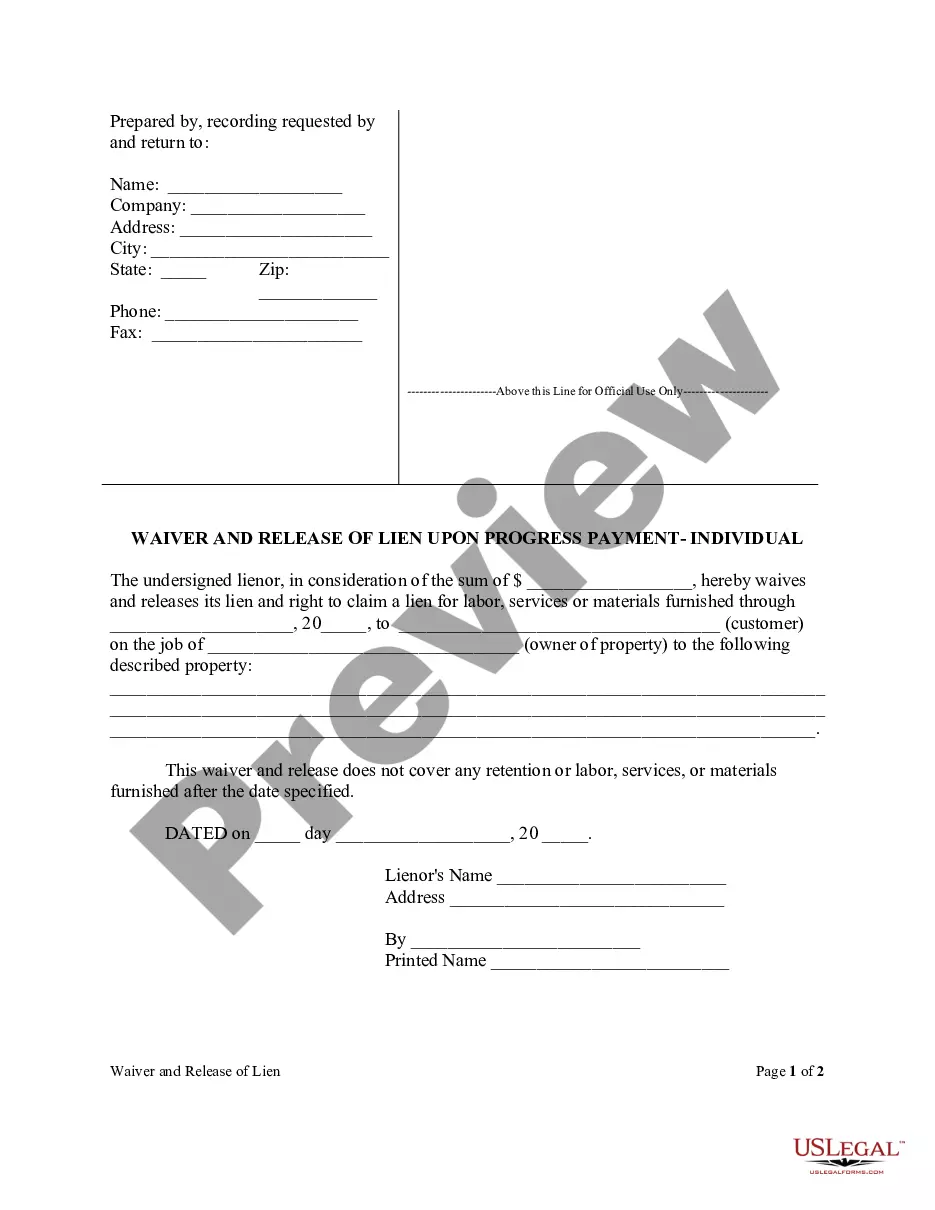

How to fill out New York Amendment To Living Trust?

- Start by checking the Preview mode and reading the form description to ensure you select the correct living trust template that fulfills your local legal requirements.

- If you need a different form, utilize the Search tab at the top to find the right document. Confirm its suitability before proceeding.

- To purchase the document, click the Buy Now button and select your desired subscription plan. Registration for an account is necessary to unlock resource access.

- Complete your transaction by entering your credit card information or choosing PayPal for the subscription payment.

- Once purchased, download your living trust form and save it on your device. You can also access it anytime from the My Forms section in your profile.

In conclusion, creating a living trust is a vital step in managing your estate effectively. US Legal Forms empowers users to streamline this process with their extensive library and support from legal experts, ensuring you complete your documents accurately and efficiently.

Start your estate planning journey today with US Legal Forms and unlock the peace of mind you deserve.

Form popularity

FAQ

Filling out a living trust is a straightforward process that involves several important steps. First, you need to gather and organize your assets, including bank accounts, real estate, and personal property. Then, using the information you've collected, you can complete the living trust document, specifying who will benefit from your assets after your passing. For a smooth and confident experience, consider using US Legal Forms to access templates and guidance through Living Trust 101.

The best way to set up a living trust involves first assessing your assets and goals for estate planning. You can choose to consult an attorney or use a platform like U.S. Legal Forms for user-friendly templates and guidance. It’s crucial to transfer assets into the trust properly, ensuring they are managed according to your wishes. This approach will secure your family’s future as you explore living trust 101.

The best person to set up a trust is typically an experienced estate planning attorney. They have the knowledge to navigate complex laws and ensure your trust meets your specific needs. However, if you have a simple situation, you might consider using a reliable online service, like U.S. Legal Forms, which guides you through creating a trust with ease. Seeking professional guidance is wise as you delve into living trust 101.

One potential downside of a living trust is that it may require ongoing management. Unlike a will, which activates upon death, a living trust remains active during your lifetime and needs updates as your assets change. Additionally, establishing a living trust might involve initial setup costs, which can be higher than simply drafting a will. It’s essential to weigh these factors as you explore living trust 101.

One downside of placing assets in a trust is the potential loss of control over those assets. Once assets are transferred into a trust, the grantor may have limited ability to make changes without legal assistance. This can create frustration, especially if circumstances change unexpectedly. Exploring Living Trust 101 sheds light on these concerns, guiding families in making informed decisions about asset management.

A significant downfall of having a trust is the complexity it introduces into estate planning. Some individuals may struggle with understanding the necessary legal requirements and obligations. Moreover, if not updated regularly, a trust can become obsolete as family dynamics change. Therefore, familiarizing yourself with Living Trust 101 helps in navigating these challenges and maintaining a functional trust that evolves with your family.

While family trusts offer many advantages, one disadvantage might be the initial setup and ongoing maintenance costs. Creating a trust can involve legal fees, and if not adequately managed, it may require further expenses down the line. Additionally, some may feel restricted by the terms of the trust. Understanding Living Trust 101 enables families to weigh these factors against the long-term benefits of trust arrangements.

Putting assets in a trust can provide significant benefits, like avoiding probate and offering greater control over asset distribution. For many families, creating a trust is a proactive way to manage assets and protect the family’s financial future. It's advisable to discuss this option with your parents to assess their specific needs. Living Trust 101 can offer valuable insights into how trust structures work and whether they suit your family’s financial goals.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining their wishes. Parents sometimes assume that family members will know their intentions without proper documentation. This can lead to disputes and confusion among beneficiaries. Understanding Living Trust 101 is essential to avoid these pitfalls and ensure that your intentions are clearly communicated.

While placing your house in a trust offers benefits, it also has potential disadvantages. One concern is that transferring property into a trust may incur tax implications, such as transfer taxes. Additionally, depending on the type of trust, you may lose some control over the property during your lifetime. Gaining insight into these disadvantages is crucial in Living Trust 101, ensuring you make informed decisions. At US Legal Forms, we provide resources and support to help you navigate these complexities.