Assumed Name Certificate New York For Llc

Description

How to fill out New York Certificate Of Assumed Name?

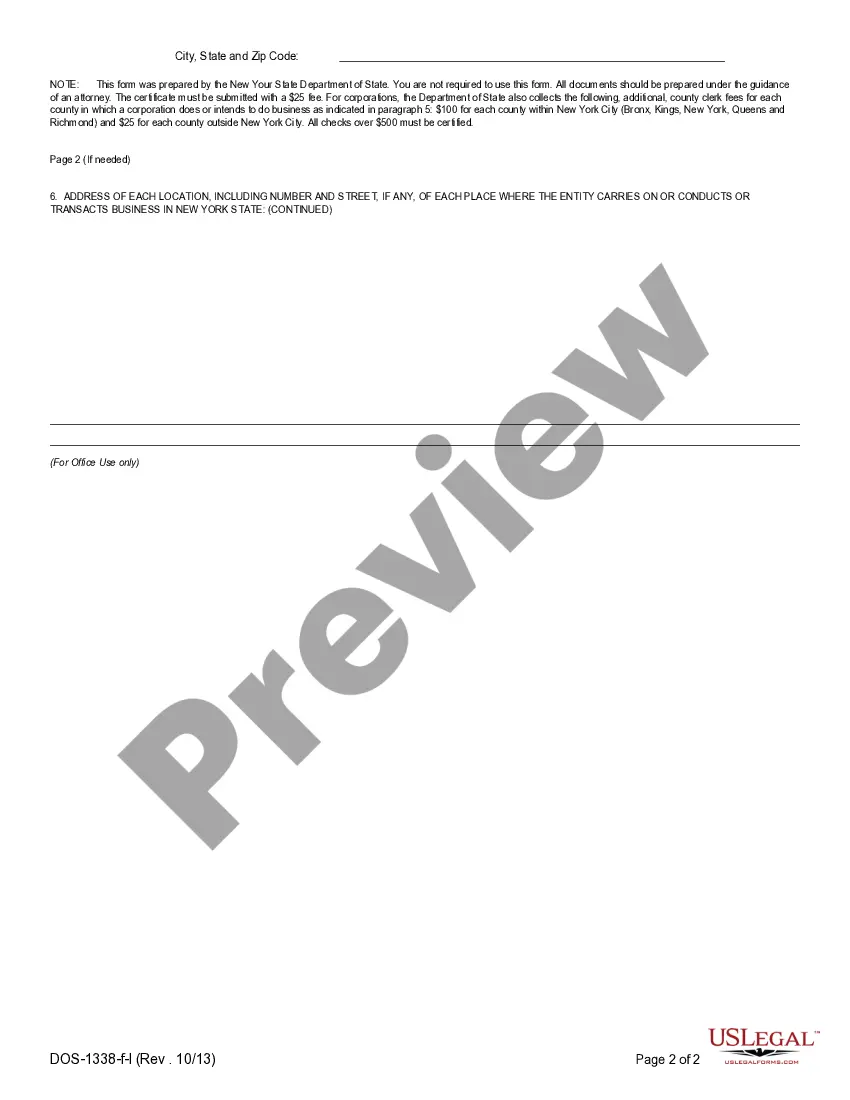

Whether for business purposes or for personal matters, everybody has to deal with legal situations sooner or later in their life. Filling out legal documents requires careful attention, beginning from choosing the appropriate form sample. For instance, when you pick a wrong version of a Assumed Name Certificate New York For Llc, it will be rejected when you send it. It is therefore crucial to get a reliable source of legal documents like US Legal Forms.

If you have to get a Assumed Name Certificate New York For Llc sample, follow these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it suits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong document, go back to the search function to find the Assumed Name Certificate New York For Llc sample you require.

- Download the template if it matches your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Assumed Name Certificate New York For Llc.

- When it is saved, you can fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the web. Use the library’s simple navigation to get the right template for any situation.

Form popularity

FAQ

LLCs, LLPs, corporations and foreign entities: Previously incorporated businesses must register their DBA through the New York Department of State by filing a Certificate of Assumed Name form. LLCs and LLPs get charged a $25 fee. Corporations must pay the state $25 for every non-NYC county.

Filing a DBA in NY for Sole Proprietors and General Partnerships. Sole proprietors and partnerships are required to file their NYS DBA with the County Clerk where their business is located. Estates and real estate investment companies are also required to file with the county.

If your business operates under a business other than its legal name, you must receive a Certificate of Assumed Name from your county clerk. This certificate is often called a "business certificate." County clerks are separate for all five boroughs of New York City.

Trade names for sole proprietorships and general partnerships must be filed with the county clerk in the county in which the business is located. For limited liability companies, corporations, and limited partnerships, DBA filings must be submitted to the New York Department of State.

This certificate is also called the "doing business as (DBA) certificate." Businesses must file the certificate with the New York State Department of State (NYSDOS). Without this certificate, a business must operate under its legal name, and use its legal name everywhere.