New York Extension For Individuals

Description

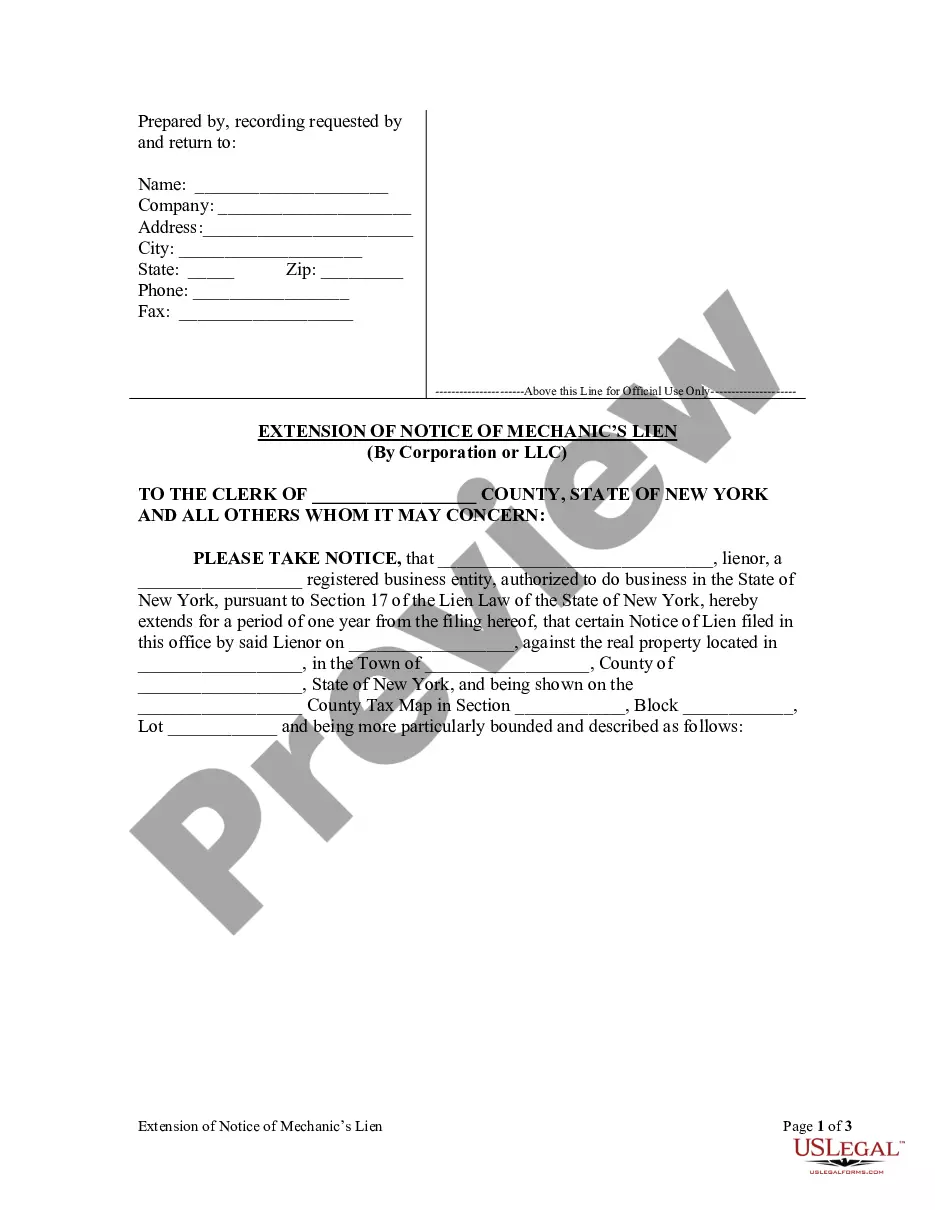

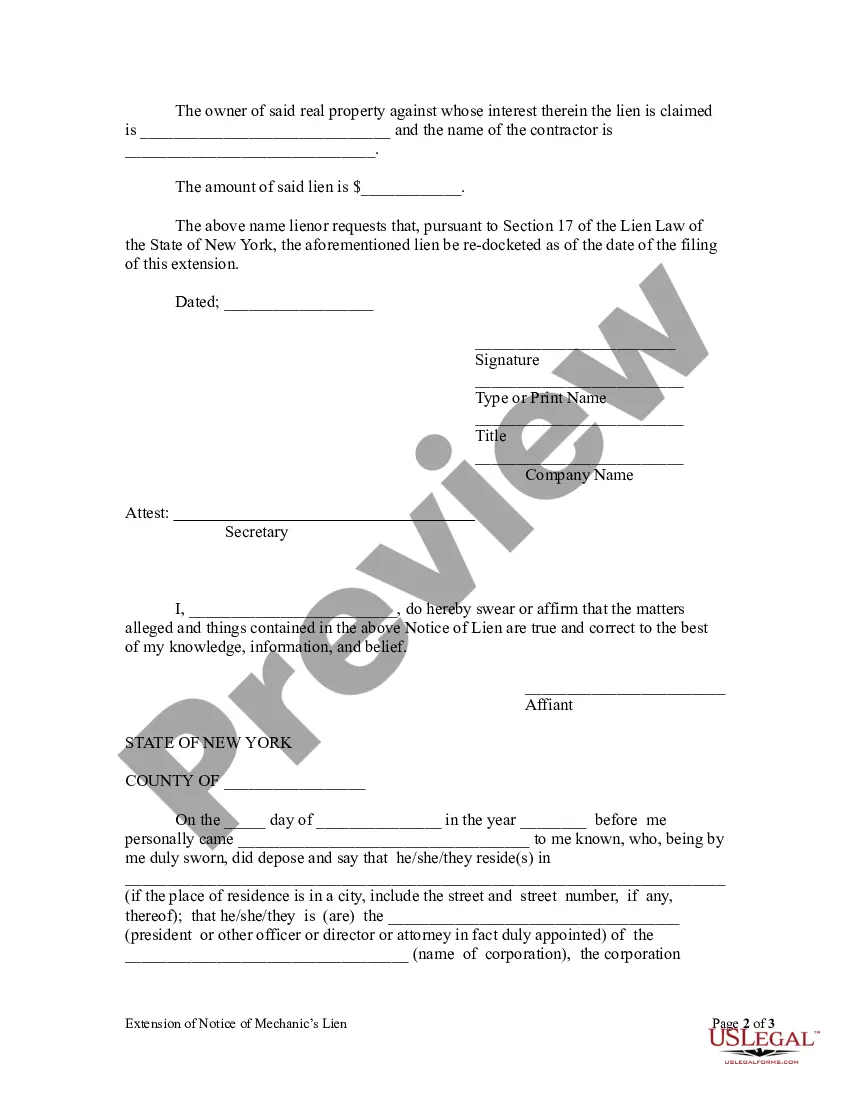

How to fill out New York Extension Of Notice Of Mechanic's Lien - Corporation?

It’s clear that you cannot become a legal authority instantly, nor can you quickly learn how to draft New York Extension For Individuals without a specialized background.

Formulating legal documents is a lengthy task that necessitates specific training and abilities. So why not entrust the preparation of the New York Extension For Individuals to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal corporate communication.

If you need any other form, restart your search.

Create a free account and select a subscription plan to acquire the form. Click Buy now. Once the transaction is complete, you can access the New York Extension For Individuals, fill it out, print it, and send or mail it to the intended recipients or organizations.

- We understand the significance of compliance and adherence to federal and local regulations.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how to start on our website and obtain the document you need in just minutes.

- Find the document you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to determine if New York Extension For Individuals is what you’re looking for.

Form popularity

FAQ

Yes, an individual can file for an extension in New York to extend the deadline for their income tax return. This process provides the necessary time to organize your documents and ensure accurate filing. However, keep in mind that filing an extension does not delay the payment of any taxes due. Utilizing US Legal Forms can help you navigate the steps and complete your New York extension for individuals efficiently.

Yes, New York accepts federal extensions for individuals, but you must still file a New York extension form, such as IT-370, to ensure your state taxes are accounted for. The federal extension gives you additional time to file your federal tax return, but it does not extend your state tax return automatically. To avoid penalties, always remember to submit your New York extension for individuals, even if you've filed federally.

Filling out the NYS withholding form requires you to provide personal information such as your name, address, and Social Security number. You will also need to indicate your filing status and the number of allowances you wish to claim. Ensure that you review your entries to avoid any mistakes, as accurate information will help you manage your taxes effectively. For assistance, US Legal Forms offers guides and templates that can help streamline this process.

The number of allowances you claim on Form 2104 depends on your personal tax situation. Generally, more allowances mean less tax withheld from your paycheck, but it may also result in a tax bill when you file your return. Consider your income, dependents, and deductions to determine the right number for you. If you're uncertain, consulting resources on New York extensions for individuals can help clarify your options.

To file an extension for your personal taxes in New York, you need to complete Form IT-370. This form allows you to request an automatic extension for up to six months. You can file it online or send it by mail to the New York State Department of Taxation and Finance. Using platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance.

October 15 serves as the final deadline for filing your tax return if you have successfully obtained a New York extension for individuals. This date is crucial, as it marks the end of the extended filing period. Ensure that you submit your completed return by this date to avoid penalties and interest. If you need assistance navigating this timeline, platforms like USLegalForms can offer valuable resources to help you stay on track.

Yes, you can file for a New York extension for individuals on your own. The process typically involves completing the required forms and submitting them by the original tax deadline. However, if you prefer to ensure accuracy and compliance, using a platform like USLegalForms can streamline the process and provide step-by-step instructions. By choosing this option, you can focus on gathering your tax documents while they handle the technical details.

The December 15 extension is generally available for individuals who have filed for a New York extension for individuals and need more time to finalize their tax returns. This extension can apply to certain circumstances, such as when a taxpayer is waiting on necessary documentation or facing special situations. Always check your eligibility based on your specific tax situation. Platforms like USLegalForms provide guidance and resources to help you understand your qualifications.