3 Days Notice Form For Tenant

Description

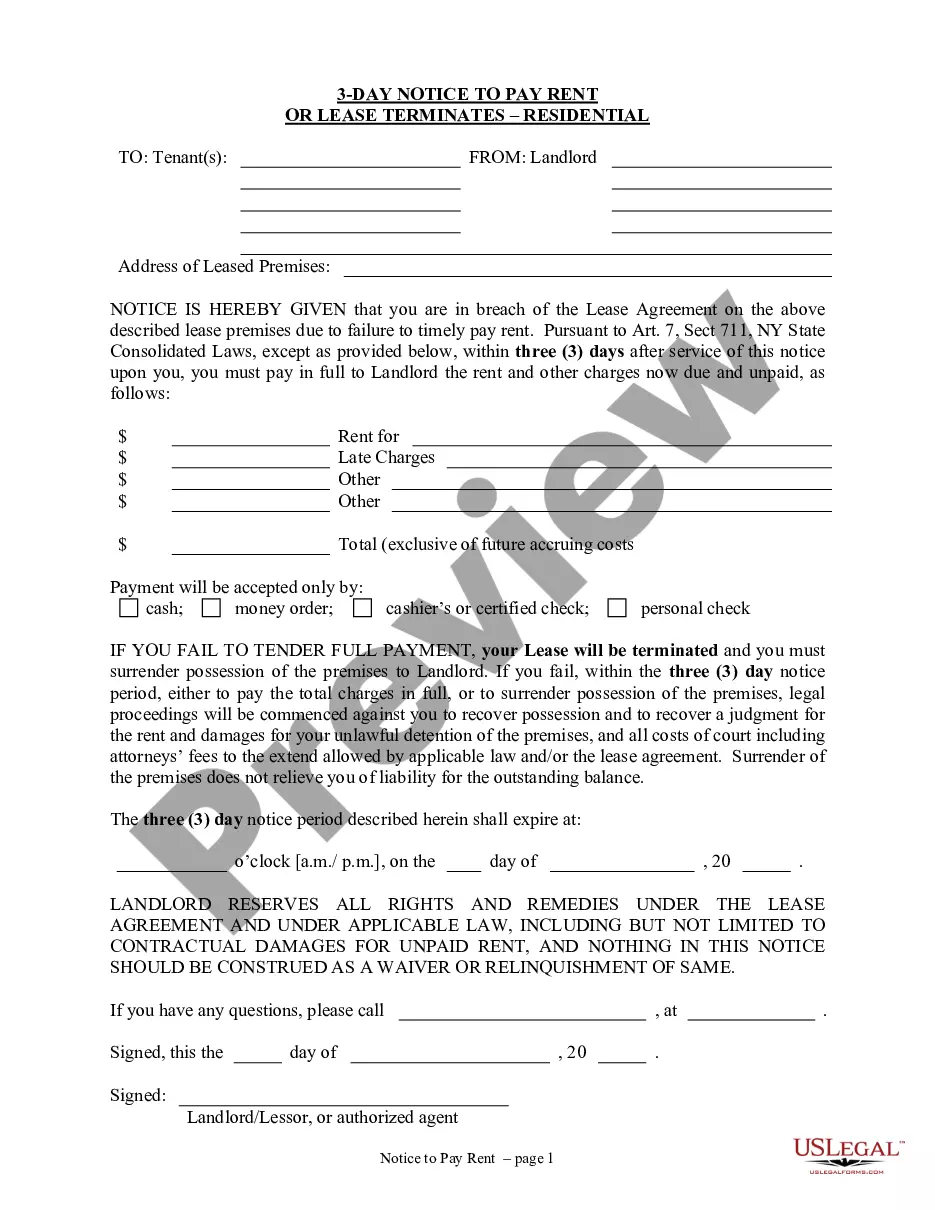

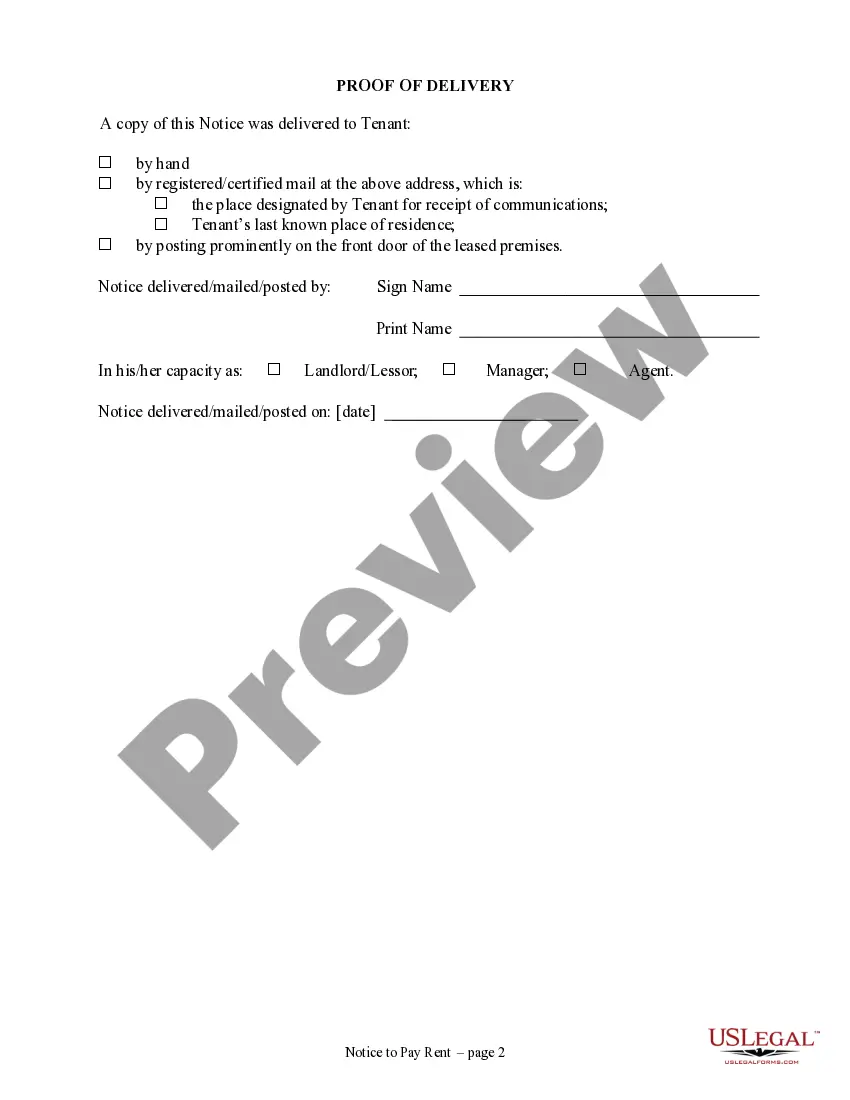

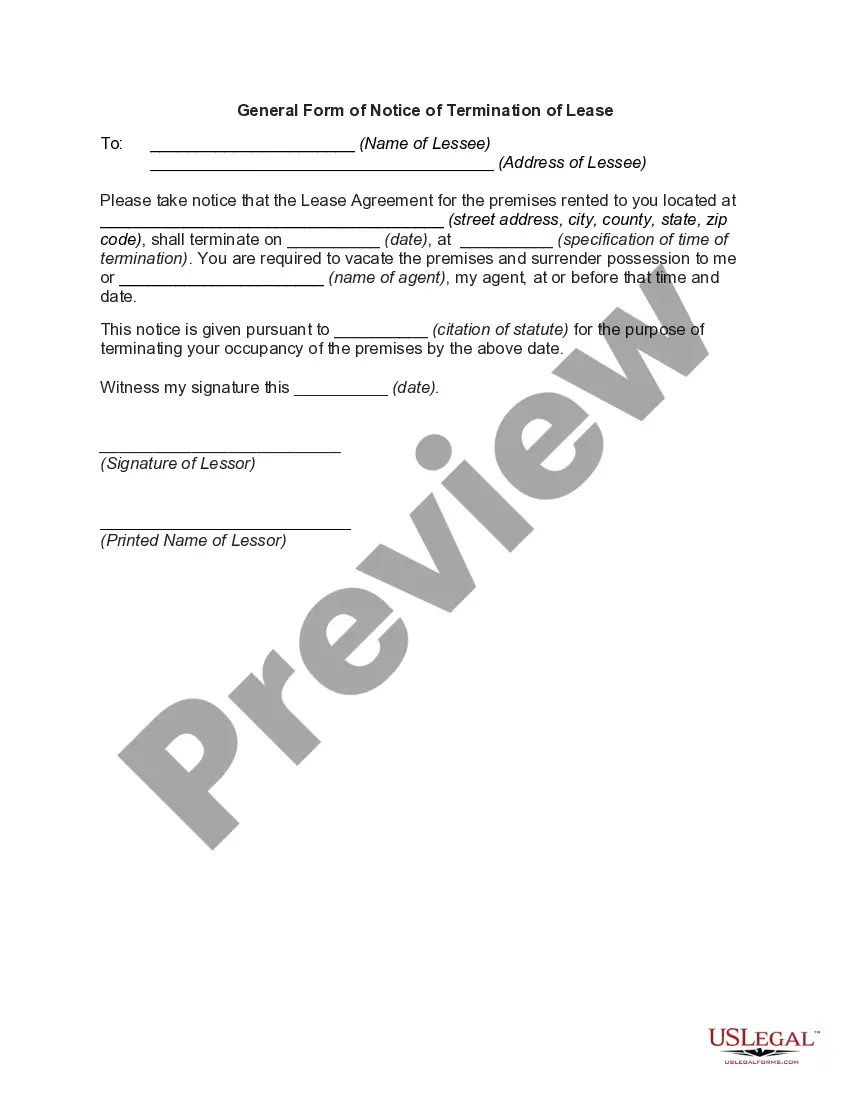

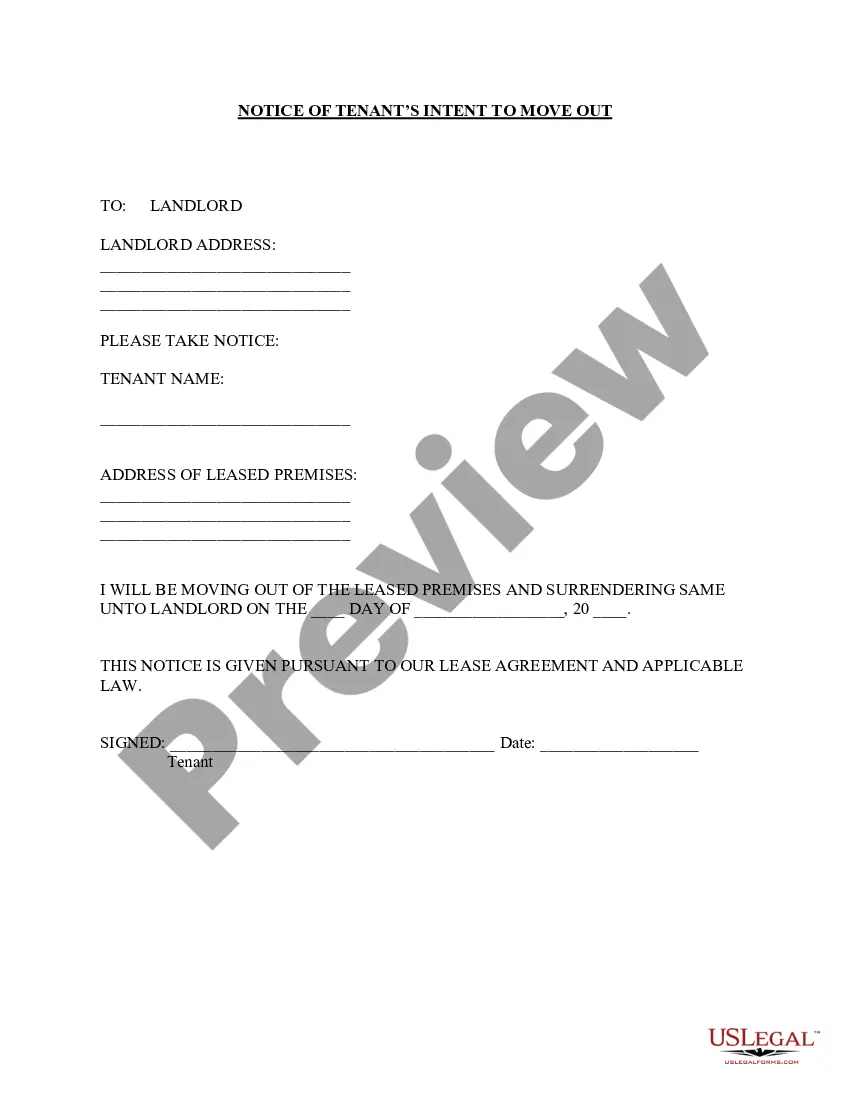

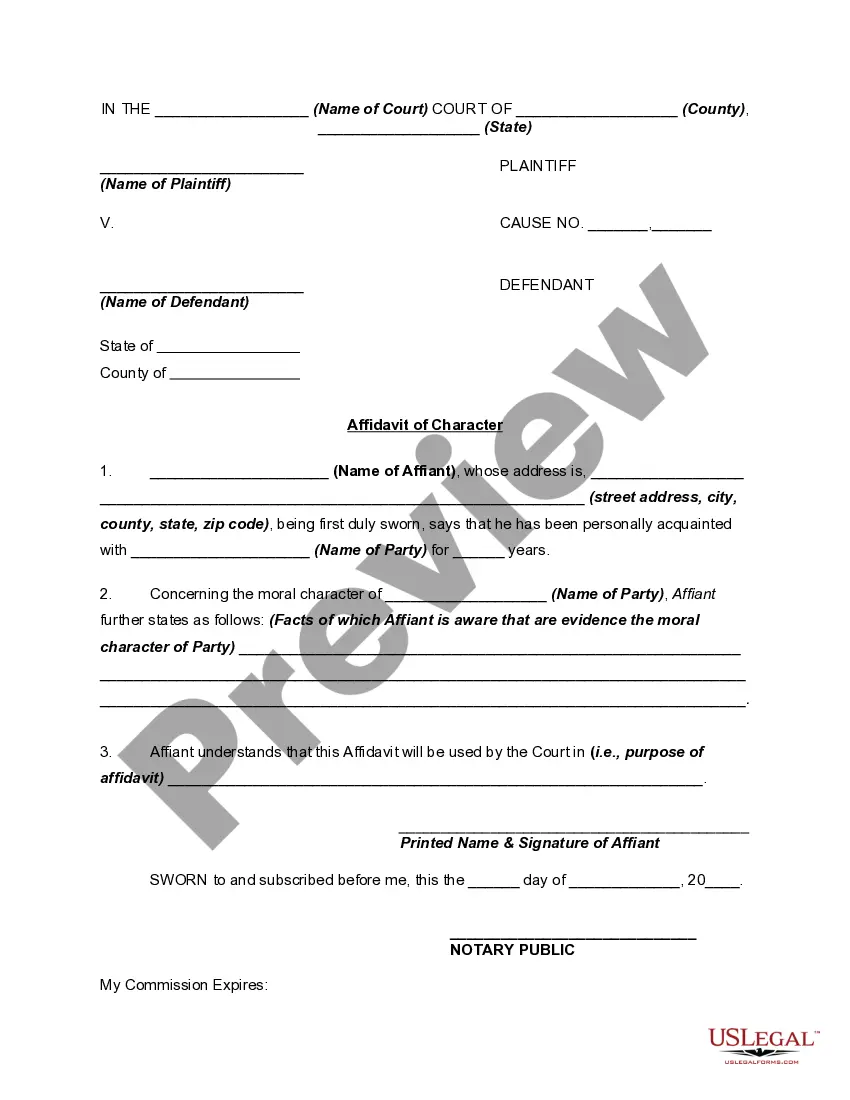

How to fill out New York 3 Days Notice To Pay Rent Or Lease Terminates For Residential Property From Landlord To Tenant?

Acquiring legal document examples that comply with federal and state regulations is essential, and the internet presents a variety of choices.

However, why waste time searching for the appropriate 3 Days Notice Form For Tenant template online when the US Legal Forms virtual library has already compiled such documents in one location.

US Legal Forms is the largest digital legal library, boasting over 85,000 fillable templates created by attorneys for every business and personal scenario.

Examine the template using the Preview option or through the text outline to ensure it meets your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts stay informed about legal updates, ensuring you can always trust that your documents are current and compliant when obtaining a 3 Days Notice Form For Tenant from our platform.

- Getting a 3 Days Notice Form For Tenant is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in your desired format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

A creditor may sue a person to collect on a bounced check. Hawaii law allows the Court to award the creditor three (3) times the face value of the check or $100, whichever is more, but not more than $500 over the check value, plus attorney's fees, costs, and interest.

A bad check is one that can't be negotiated because it's drawn on a nonexistent account or on an account that holds insufficient funds to cover its amount. A bad check is also known as a hot check and writing one is illegal.

Bad Checks: Signs to Look for The check lacks perforations. The check number is either missing or does not change. The check number is low (like 101 up to 400) on personal checks or (like 1001 up to 1500) on busi- ness checks. (90% of bad checks are written on accounts less than one year old.)

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.

How safe are paper checks? Banks use security measures like watermarks and gradient backgrounds to prevent checks from being reproduced by fraudsters, and to help financial institutions and businesses validate them easily.

Accept Only Cashier's Checks A cashier's check offers the greatest protection to the recipient as they can't be reversed. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is responsible for paying the amount. The same goes for a wire transfer to your company's bank account.

How to Prevent Check Fraud Order checks from a reputable source. ... Fill out check properly. ... Safeguard checks and account information. ... Segregate duties. ... Reconcile accounts promptly. ... Use a positive pay service.

If you can, try to cash the check at the issuer's bank so that if it bounces again, you won't get hit with another NSF charge by your bank. Send a ?bad check? demand letter: If you're having trouble getting a response from the check issuer, send them a bad check demand letter.