Lien Individual For The Future

Description

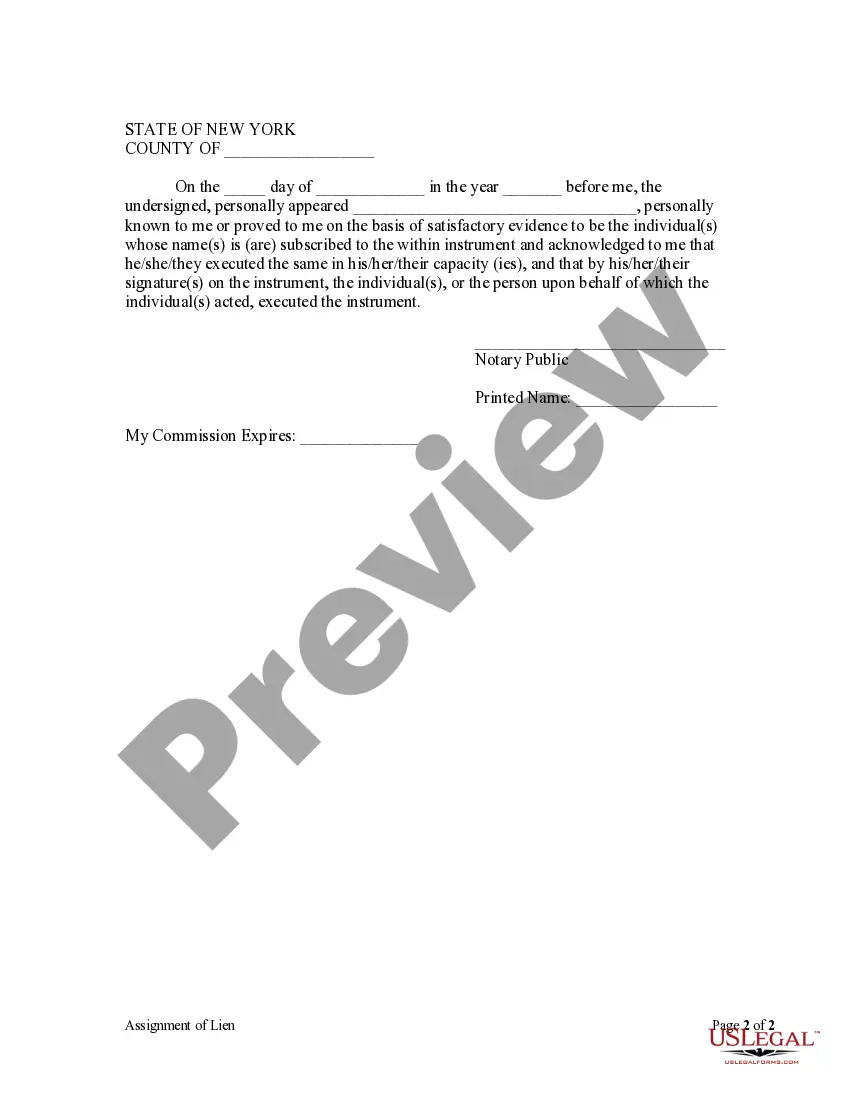

How to fill out New York Assignment Of Lien By Individual?

- If you're a returning user, simply log in to your account. Verify your subscription status and download the lien individual form directly from your library.

- For first-time users, start by exploring the Preview mode to read the description of the lien individual form. Confirm it aligns with your needs and local jurisdiction.

- If the current form doesn't meet your requirements, utilize the Search tab to find the appropriate lien individual form that best fits your situation.

- Purchase the selected document by clicking on the Buy Now button. Choose your desired subscription plan and register for an account to access the extensive resources.

- Complete your transaction by providing your payment information via credit card or through PayPal.

- Download the lien individual form to your device for completion, and you can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms is designed to empower both individuals and attorneys to efficiently create and manage legal documents. With over 85,000 forms at your fingertips, Precision is guaranteed with expert guidance.

Get started today and ensure your legal needs are met effortlessly!

Form popularity

FAQ

The three main types of liens include consensual liens, judgment liens, and statutory liens. Consensual liens arise from agreements, judgment liens result from court actions, and statutory liens are created by law. Each type has different implications for you as a property owner. For comprehensive resources on these liens and strategies to deal with them, check out US Legal Forms.

A lien can have both positive and negative implications depending on your perspective. While it can secure funds for creditors, it may also restrict your ability to sell or refinance the affected property. Understanding the full impact of a lien is crucial for your financial health. Consulting legal solutions like US Legal Forms can help clarify your position and options regarding liens.

When someone puts a lien on your property, they are asserting a legal right to hold your property until a debt is resolved. This action aims to ensure that creditors can reclaim owed amounts. It's essential to communicate with creditors to resolve any disputes to prevent potential asset forfeiture. Explore resources on US Legal Forms to learn more about managing liens.

A lien can negatively impact your credit score. When a lien is placed against you, it becomes part of your public record, which lenders may consider when evaluating your creditworthiness. A lower credit score can affect your ability to secure loans or favorable interest rates in the future. It is wise to monitor your credit regularly to understand how a lien may influence your financial options.

Yes, it is possible for someone to place a lien on your property without your immediate knowledge. This often occurs when a creditor seeks to secure a debt or obligation. However, being proactive and using services like UsLegalForms can help you stay informed and manage any potential liens, which is essential for planning a lien individual for the future.

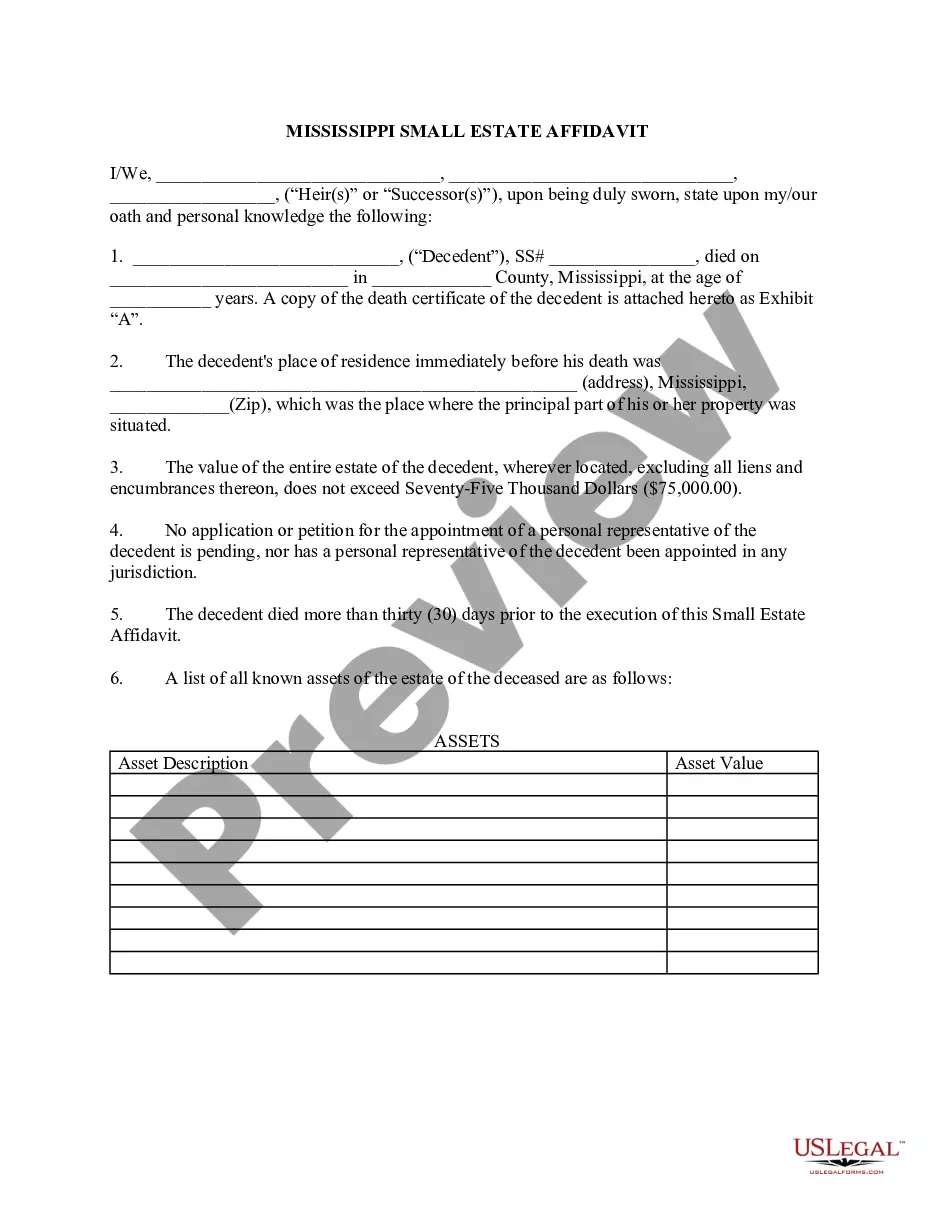

To fill out a lien affidavit, carefully input critical details, such as the property address, the lien amount, and the names of the involved parties. Be precise and thorough to avoid any legal issues that could arise from inaccuracies. Following the guidelines provided by your local authorities will ensure that your lien affidavit serves its purpose effectively in establishing a lien individual for the future.

A lien affidavit is a formal declaration that verifies the existence and details of a lien against a property. It serves as proof for the lien holder and sets a legal foundation for asserting their claim. Understanding this document is vital when considering your financial future and planning for a lien individual for the future.

Filling out a conditional waiver of a lien requires you to include the project details, along with the contributing parties' names. Provide information about the payment conditions that must be met for the waiver to take effect. Make sure to review the document carefully before signing it, as it plays a crucial role in securing a lien individual for the future.

Writing a letter of intent for a lien involves clearly stating your intentions regarding the lien. Start by addressing the lien holder and include pertinent details such as the lien's specifics and your intent to settle or negotiate. Ensure your tone remains professional and concise, as this establishes a good foundation for future discussions about a lien individual for the future.

To complete a lien release, first gather all necessary documentation related to the lien. Fill out the lien release form accurately, specifying details such as the original debtor and lien holder. Once everything is in order, submit the completed form to the local government office to officially release the lien. This ensures the lien does not hinder your property, paving the way for a lien individual for the future.