New York Incorporate For Rent

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

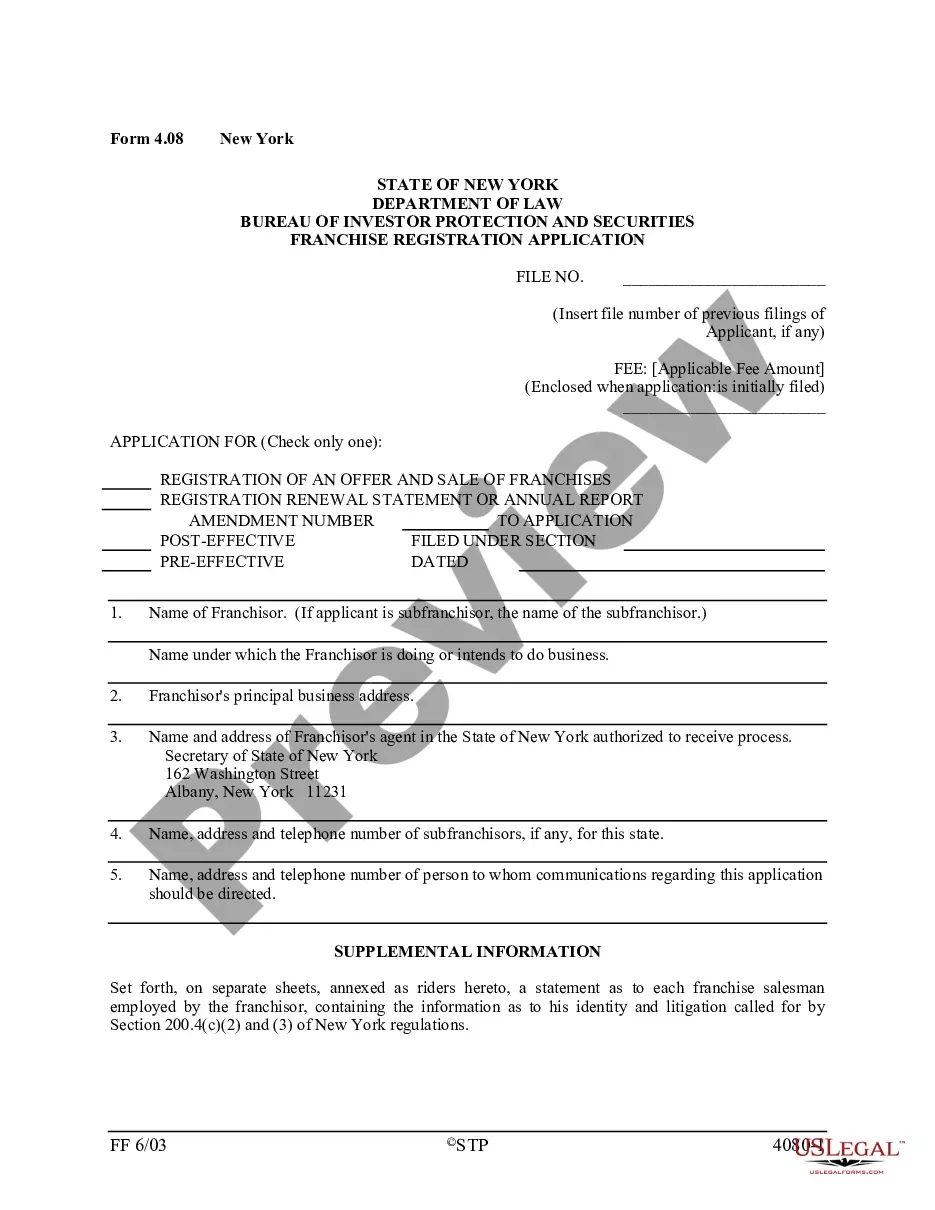

It’s no secret that you can’t become a legal expert immediately, nor can you learn how to quickly prepare New York Incorporate For Rent without having a specialized background. Creating legal forms is a long venture requiring a specific training and skills. So why not leave the preparation of the New York Incorporate For Rent to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and obtain the form you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

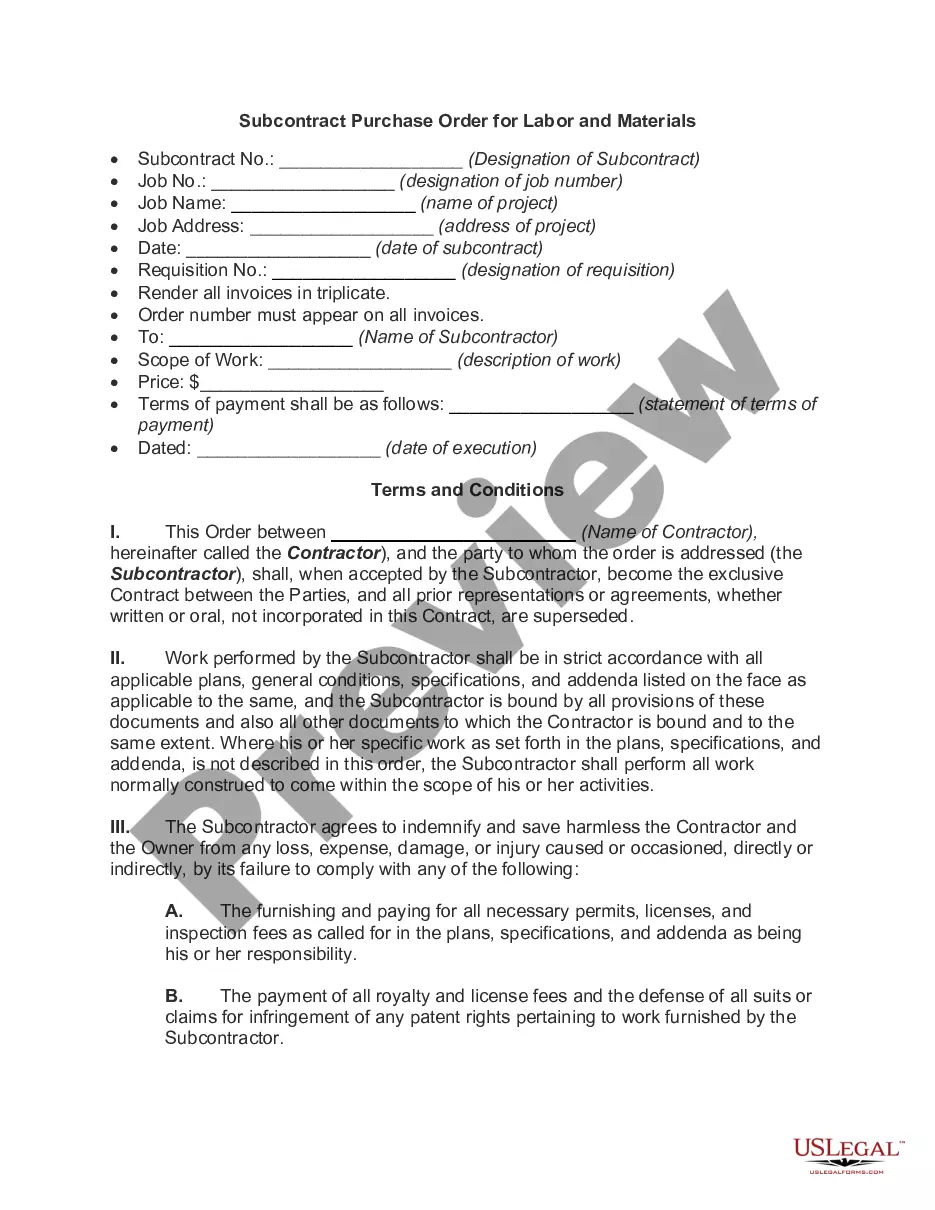

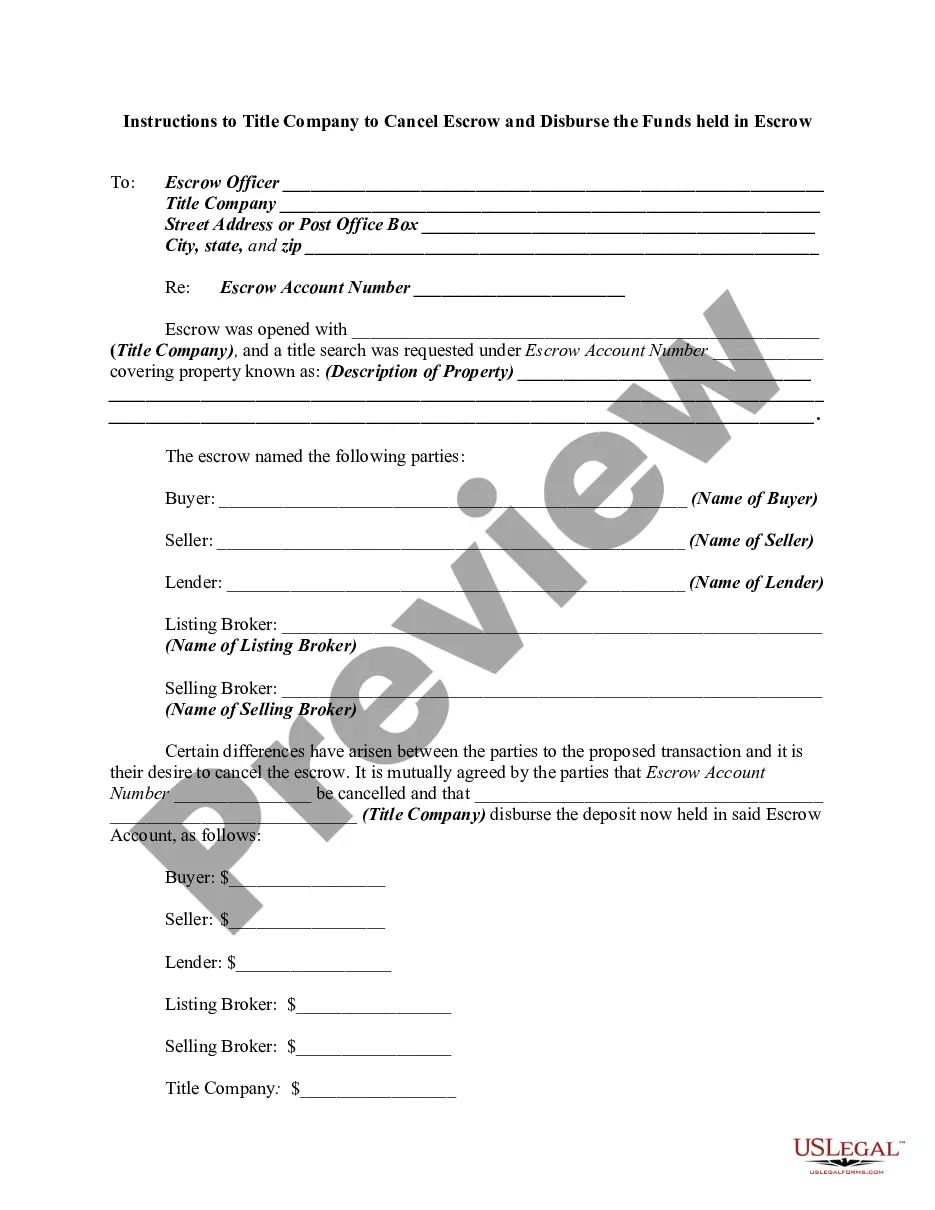

- Preview it (if this option provided) and read the supporting description to determine whether New York Incorporate For Rent is what you’re looking for.

- Begin your search over if you need a different template.

- Register for a free account and choose a subscription option to buy the form.

- Pick Buy now. As soon as the payment is complete, you can download the New York Incorporate For Rent, fill it out, print it, and send or mail it to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

The Commercial Rent Tax (CRT) applies to tenants who occupy or use a property in Manhattan, south of 96th Street for any trade, business, profession, or commercial activity, if the annual gross rent paid is at least $250,000. You are required to file a tax return if your annual gross rent paid is more than $200,000.

You should make New York State adjustments due to decoupling from the IRC using Form IT-558 only if: ? you are a partnership and are a partner in one or more partnerships and you received Forms IT-204-CP and IT-204-IP from those partnerships and an amount was reported to you in the Partner's share of New York ...

No, there are no circumstances where you can deduct rent payments on your tax return. Rent is the amount of money you pay for the use of property that is not your own. Deducting rent on taxes is not permitted by the IRS.

Annual rent received/receivable. House tax, or municipal tax paid. Name of the tenant and PAN of the tenant. Interest paid/payable on housing loan on the property. Pre-construction period interest. Address of the property and details of co-owners if any.

Paperwork and public records If the IRS learns an investor has a license, they could then see if rental income is being reported on the investor's tax return. Form 1098 is the mortgage interest statement received each year used to report interest payments made by an investor.