New York Foreign Llc Application For Authority

Description

How to fill out New York Foreign Llc Application For Authority?

Individuals typically connect legal documentation with something intricate that only an expert can handle.

In a way, this is accurate, as preparing the New York Foreign LLC Application for Authority requires a profound knowledge of relevant criteria, encompassing state and county regulations.

However, with US Legal Forms, the process has become simpler: pre-designed legal templates for various life and business scenarios tailored to state legislation are gathered in a single online repository and are presently accessible to all.

Establish an account or Log In to proceed to the payment interface. Pay for your subscription using PayPal or a credit card. Select the format for your template and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they remain stored in your account. You can access them whenever required via the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and application area, so searching for the New York Foreign LLC Application for Authority or any specific template only requires a few minutes.

- Existing users with a valid subscription should Log Into their account and click Download to retrieve the form.

- New users of the service must first establish an account and subscribe before they can download any documents.

- Follow this step-by-step process to obtain the New York Foreign LLC Application for Authority.

- Examine the page content carefully to ensure it meets your requirements.

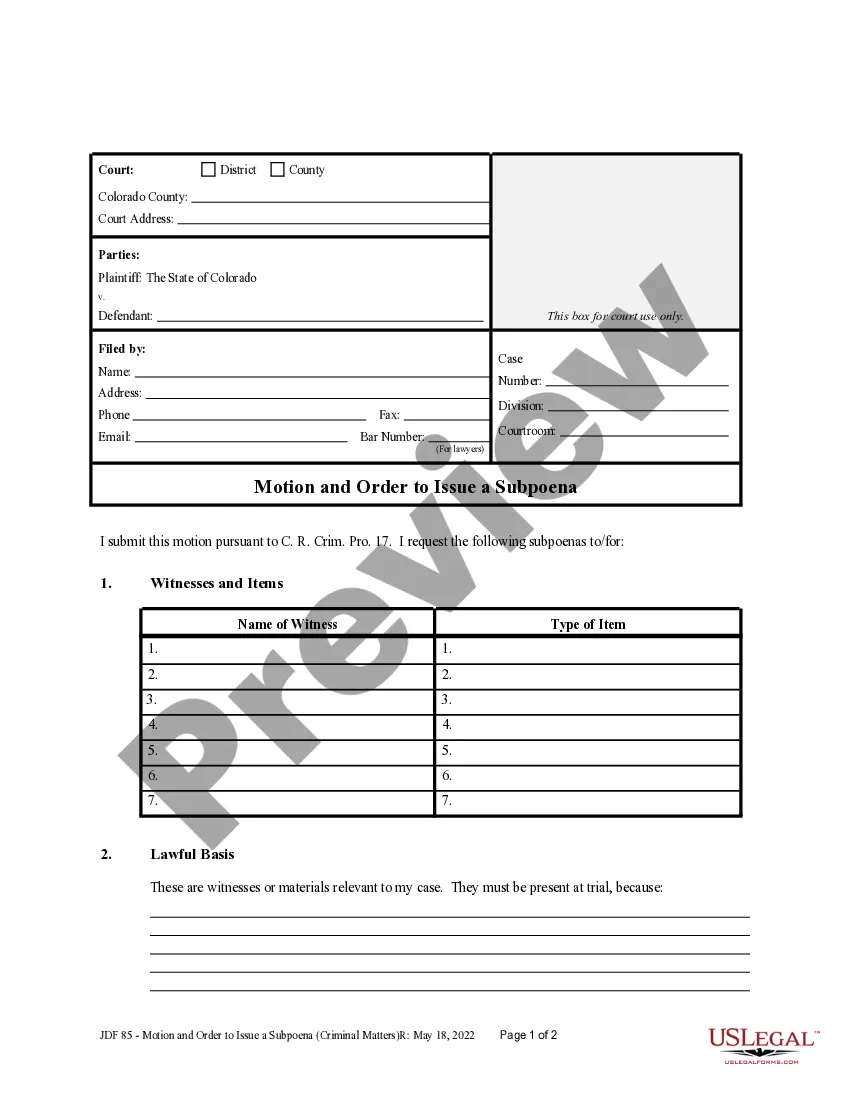

- Review the form description or check it through the Preview feature.

- If the previous example does not fit your needs, search for another sample using the Search bar above.

- Once you identify the correct New York Foreign LLC Application for Authority, click Buy Now.

- Choose a pricing plan that aligns with your requirements and budget.

Form popularity

FAQ

To form a Professional Limited Liability Company (PLLC) in New York, start by filing the New York foreign LLC application for authority. This process requires you to choose a unique name for your PLLC, which must include 'PLLC' at the end. You will then need to submit your application along with the required documents and fees. Using US Legal Forms simplifies this process, offering step-by-step guidance to ensure you meet all legal requirements efficiently.

For foreign LLCs operating in New York, publication involves posting a notice in two newspapers for six consecutive weeks. This requirement reinforces your LLC’s presence in New York and is a key step following your New York foreign LLC application for authority. Ensure to keep all publication affidavits, as these documents may need to be submitted to the Department of State to confirm compliance.

Failing to publish your LLC in New York can lead to your company facing certain legal consequences, such as potential fines or inability to defend itself in court. The state requires that foreign LLCs publish a notice of their formation in designated newspapers to maintain compliance. Without fulfilling this requirement, your New York foreign LLC application for authority may become invalid, making it essential to meet publication deadlines.

To obtain a certificate of authority in New York, start by submitting the New York foreign LLC application for authority to the New York Department of State. You'll need to provide pertinent information about your LLC, including its formation details and registered agent. Once your application is processed and approved, you will receive your certificate, enabling you to operate legally in New York.

Yes, if you want to operate your foreign business in New York, you must complete the New York foreign LLC application for authority. This application ensures compliance with state laws and allows your business to legally conduct operations in New York. Not registering may result in legal issues and lost opportunities. You can streamline this process by using the services provided by USLegalforms, which simplifies the application and ensures you meet all necessary requirements.

In New York, a registered agent for an LLC must be a resident of the state or a business entity authorized to conduct business in New York. The registered agent is crucial for receiving important legal documents and notices. If you are unsure who to choose, US Legal Forms provides resources to help you navigate this requirement effectively.

Yes, if you plan to conduct business in New York, you need to register your out-of-state business. This means you will need to file a New York foreign LLC application for authority to operate there legally. Registering not only ensures compliance but also protects your business interests in the state.

Yes, an LLC can own property in another country, but it varies based on local laws. Each country has different regulations regarding foreign ownership, so it's important to conduct thorough research. If you also wish to manage properties in New York, consider submitting a New York foreign LLC application for authority.

Absolutely, a foreign LLC can own property in New York. To facilitate this, the foreign LLC must first file a New York foreign LLC application for authority. This process ensures that your business complies with local regulations and safeguards your rights as a property owner.

Yes, foreigners can indeed own property in New York. There are no restrictions on foreign ownership, allowing individuals to buy real estate in the state. If you are considering investment options, a New York foreign LLC application for authority may streamline your transaction process and protect your interests.