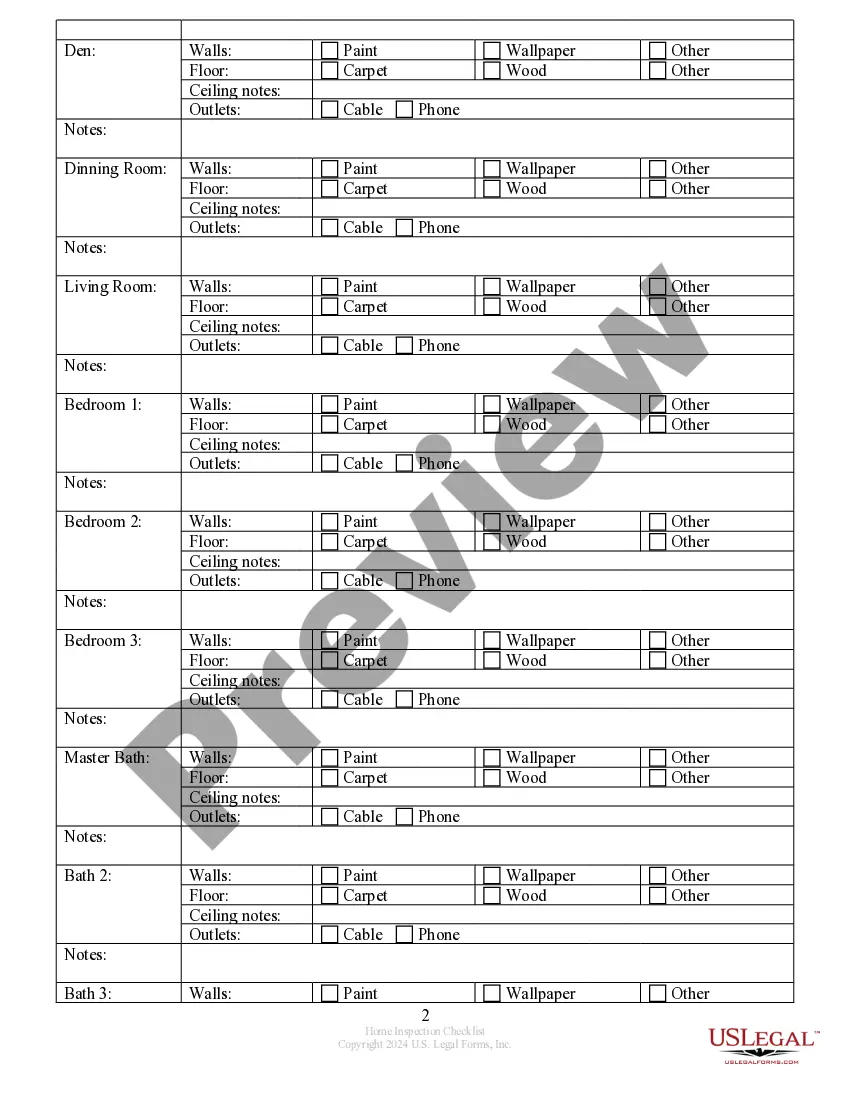

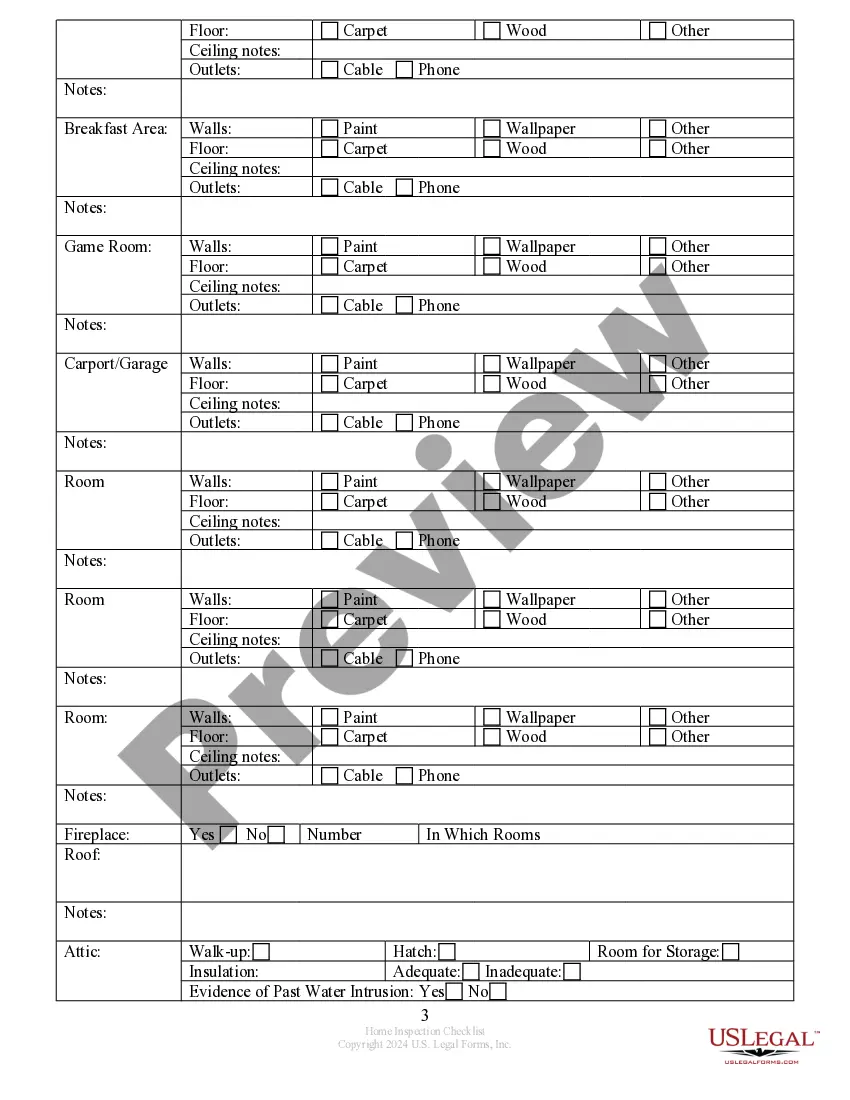

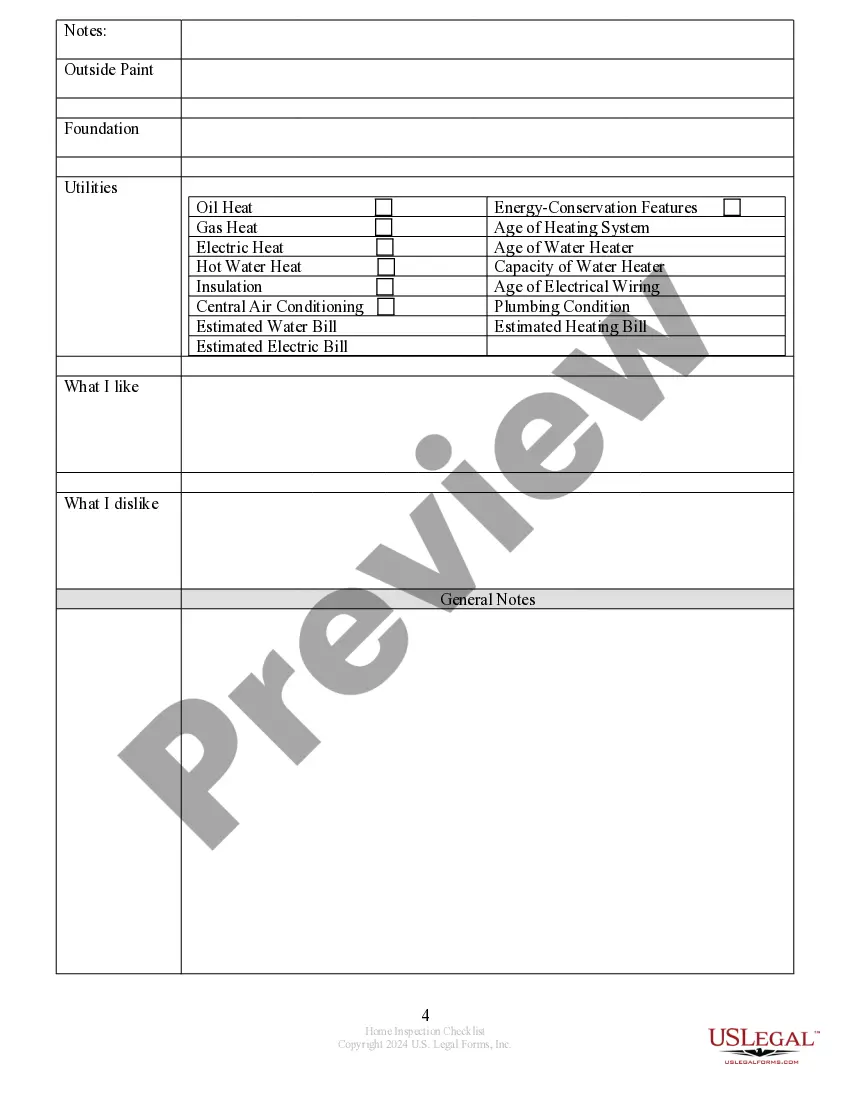

Ny Checklist With Dates

Description

How to fill out New York Buyer's Home Inspection Checklist?

Creating legal documents from the ground up can frequently be somewhat daunting. Certain situations may entail hours of investigation and substantial expenses.

If you’re looking for a simpler and more cost-effective method of generating Ny Checklist With Dates or any other paperwork without unnecessary obstacles, US Legal Forms is always available to assist you.

Our online library of more than 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can immediately access state- and county-compliant documents meticulously prepared for you by our legal experts.

Utilize our website whenever you require reliable and trustworthy services through which you can swiftly find and download the Ny Checklist With Dates. If you’re already familiar with our services and have previously established an account with us, simply Log In to your account, choose the document and download it, or re-download it at any time later in the My documents section.

Ensure that the template you select adheres to the requirements of your state and county. Choose the appropriate subscription plan to obtain the Ny Checklist With Dates. Download the file, then complete, sign, and print it out. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make document completion a straightforward and efficient process!

- Not registered yet? No worries.

- It takes minimal time to sign up and explore the library.

- However, before diving straight into downloading Ny Checklist With Dates, consider these suggestions.

- Review the form preview and descriptions to confirm that you have located the document you need.

Form popularity

FAQ

Overview of the 14-Day Withholding Threshold Section 671(a)(1) of the New York Tax Law provides that every employer maintaining an office or transacting business within New York and making payment of any wages subject to New York State personal income tax is required to deduct and withhold tax from those wages.

Filing Schedule C You will use the federal Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), for this purpose. The form will help you list your income, expenses, cost of goods sold, and other expenses and will determine your business' profit or loss.

Annual filing The annual return, Form ST-101, New York State and Local Annual Sales and Use Tax Return, covers the period March 1 through February 28/29. Since sales tax returns are generally due within 20 days after the end of the reporting period, annual returns are due by March 20 each year.

If you make $65,000 a year living in the region of New York, USA, you will be taxed $15,560. That means that your net pay will be $49,440 per year, or $4,120 per month.

If a nonresident employee was not initially expected to work more than 14 days in New York State during the calendar year, but does in fact work more than 14 days in New York, the employer is required to withhold on all New York State wages paid after the 14th day.