Home Buyer Checklist For Closing

Description

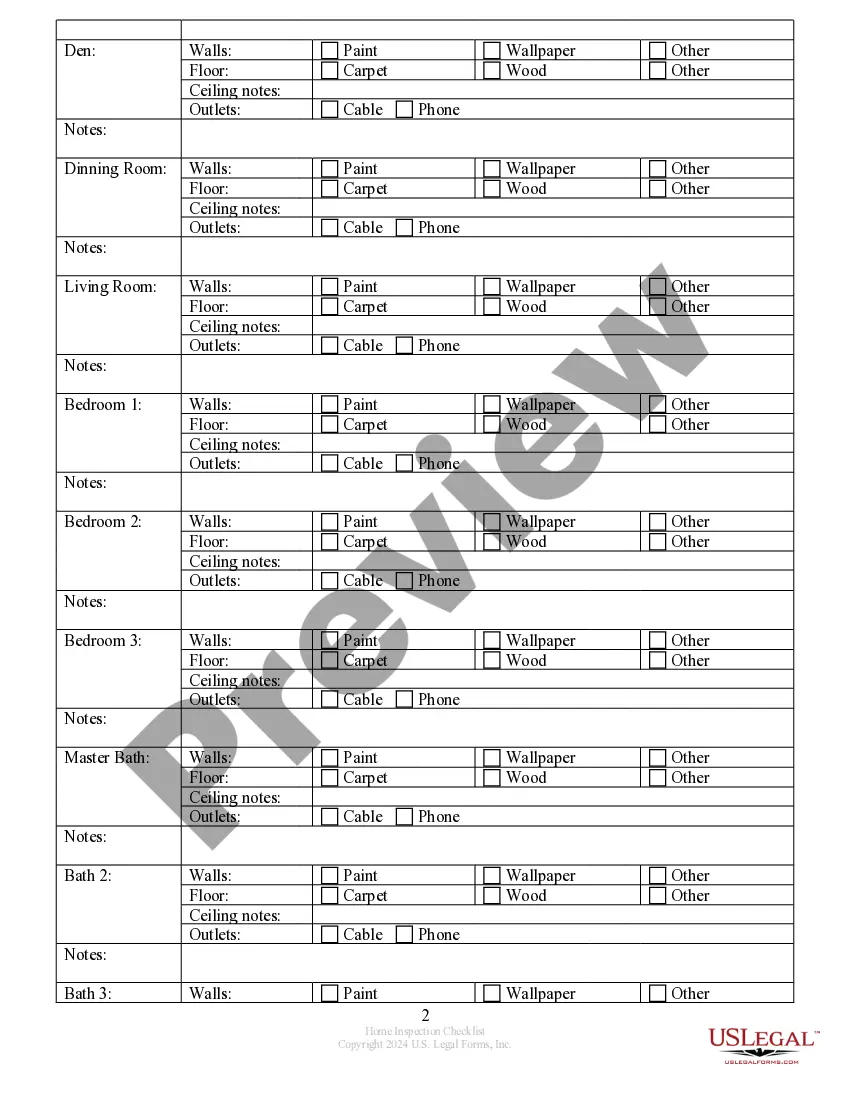

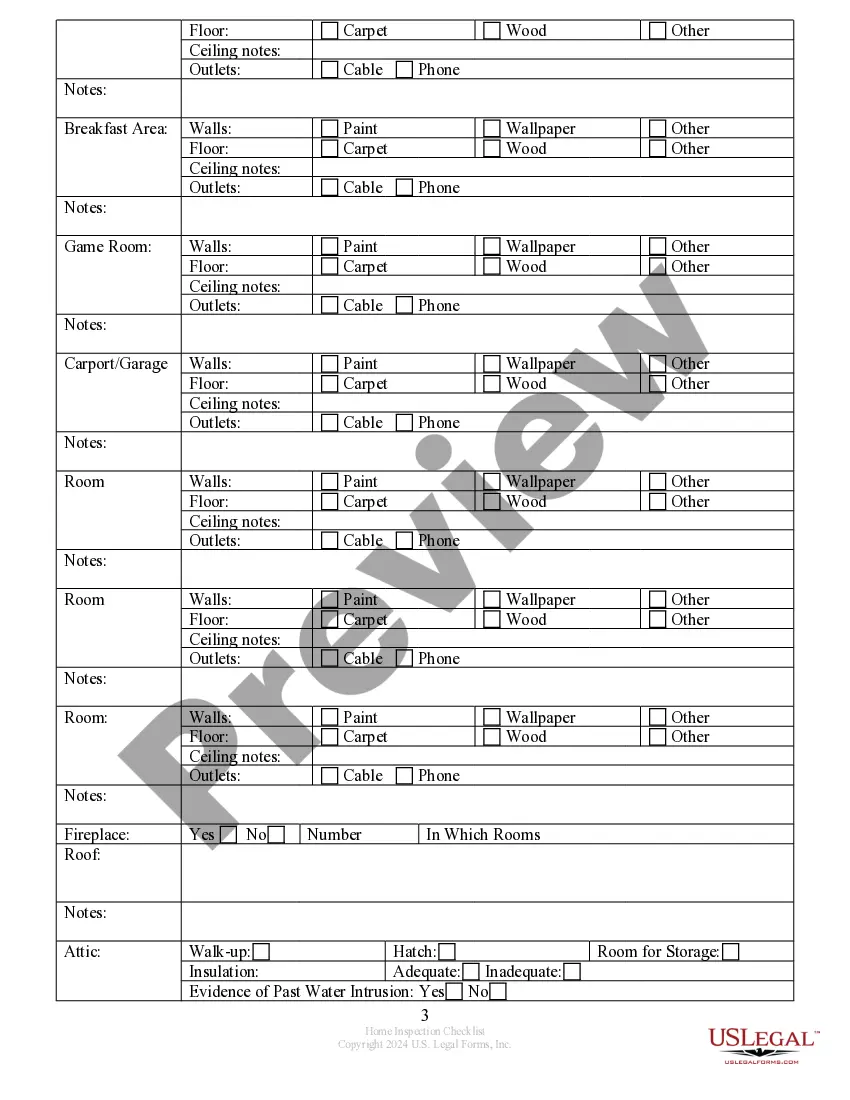

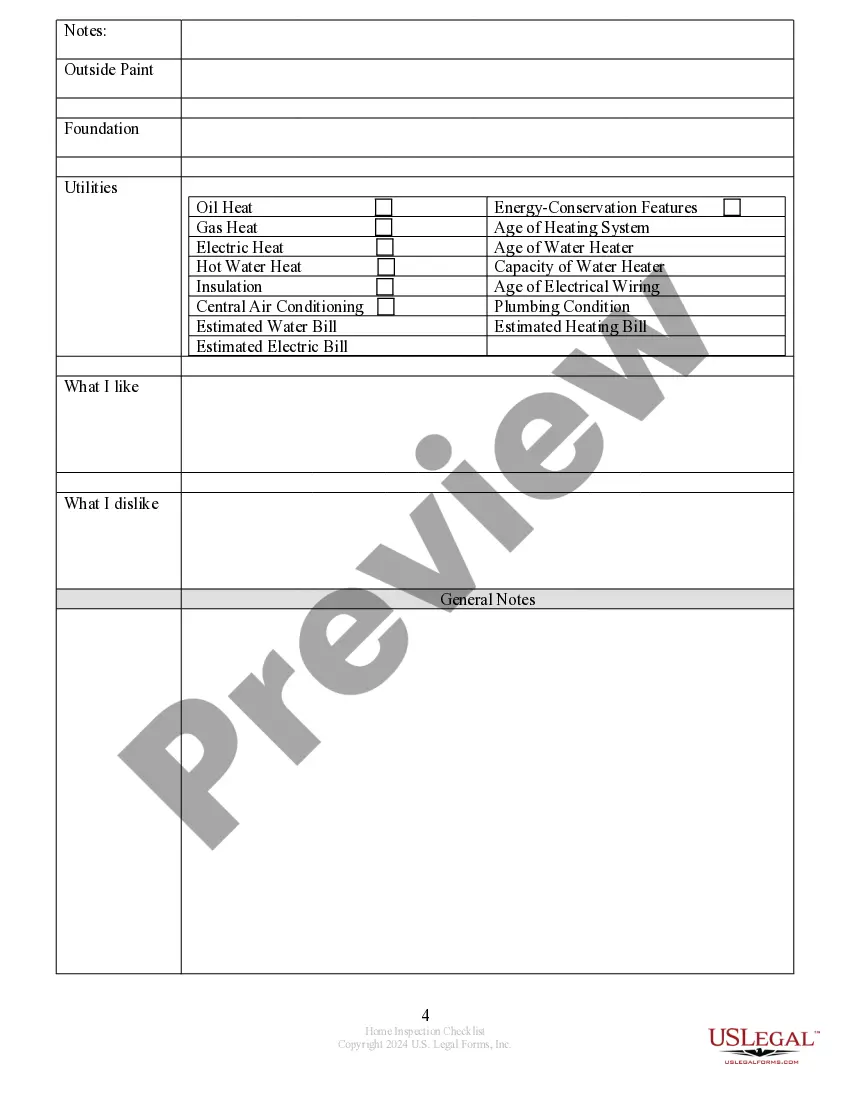

How to fill out New York Buyer's Home Inspection Checklist?

What is the most trustworthy platform for acquiring the Home Buyer Checklist For Closing and other current versions of legal documents? US Legal Forms is the solution! It boasts the most comprehensive assortment of legal forms for any requirement.

Every template is properly crafted and verified for adherence to federal and local regulations. They are categorized by region and state of application, making it effortless to find the one you need.

US Legal Forms is an excellent resource for anyone who needs to handle legal documentation. Premium users can benefit even more as they may complete and validate previously saved documents electronically at any time using the built-in PDF editing tool. Give it a chance today!

- Experienced users of the site only need to Log In to the platform, verify if their subscription is active, and click the Download button adjacent to the Home Buyer Checklist For Closing to acquire it.

- Once saved, the template remains accessible for future reference within the My documents section of your account.

- If you do not yet possess an account with us, here are the steps you need to follow to create one.

- Form compliance verification. Before you obtain any document, you must ascertain that it meets your usage needs and complies with your state or county's regulations. Examine the form description and utilize the Preview if available.

Form popularity

FAQ

At closing, you will sign several key documents, including the mortgage agreement and the deed of trust. Additionally, the settlement statement details all transaction costs. Familiarizing yourself with these documents by referencing a home buyer checklist for closing can help you feel more confident and prepared for this final step towards homeownership.

Yes, you typically need to bring a cashier's check to the closing. It's important to confirm the exact amount required for closing costs, as this can vary. Including this step in your home buyer checklist for closing ensures you have the right funds in the proper format, which reduces last-minute stress during the closing process.

To ensure a smooth experience, a buyer should bring several essential items to closing. Your home buyer checklist for closing should include a valid photo ID, proof of homeowner's insurance, and any necessary paperwork from your lender. Don't forget your cashier's check or any funds needed for closing costs; having everything organized will help streamline the process.

The check required for house closing usually covers closing costs and must match the amount specified in your closing disclosure. It's wise to verify amounts in your home buyer checklist for closing to avoid discrepancies. A certified or cashier's check is generally preferred, but obtaining the latest payment guidelines from your closings agent is always a good idea.

Typically, you will need to provide payment for closing costs, which may involve writing a check. Your home buyer checklist for closing should detail any specific amounts and acceptable payment methods. However, some buyers opt for electronic transfers, so confirm your payment options with your closing agent beforehand.

Yes, bringing a cashier's check is often necessary for closing costs, as many lenders require this for secure payment. It's crucial to check your home buyer checklist for closing to find out the specific amount you need. In some cases, wire transfers may also be an option, so consult with your closing agent for the best method to use.

Closing requires various pieces of paperwork, including the closing disclosure and mortgage documents. Depending on your situation, you might also need tax documents and proof of homeowner’s insurance. Following a comprehensive home buyer checklist for closing can help you gather all required paperwork to avoid potential delays.

When drafting a closing checklist, begin by outlining all necessary documents and tasks you need to complete prior to the closing. Include items such as your mortgage agreement, proof of insurance, and your budget for closing costs. Utilize resources like US Legal Forms to access templates that can guide you through creating your checklist effectively. A comprehensive home buyer checklist for closing can minimize last-minute surprises.

The 3-day rule for closing refers to a mandatory waiting period that gives borrowers time to review the Closing Disclosure. After receiving this document, you have three days to understand the terms and costs before you can close the sale. This rule is designed to protect buyers and give them peace of mind. Always take the time to review your home buyer checklist for closing during this period.

On closing day, be ready with several important items. Bring your identification, any paperwork related to your mortgage, and your home buyer checklist for closing to ensure you do not forget any essential documents. It's also useful to have funds ready for any closing costs. Being well-prepared can alleviate stress and make the process go smoothly.