Trust Account With Fidelity

Description

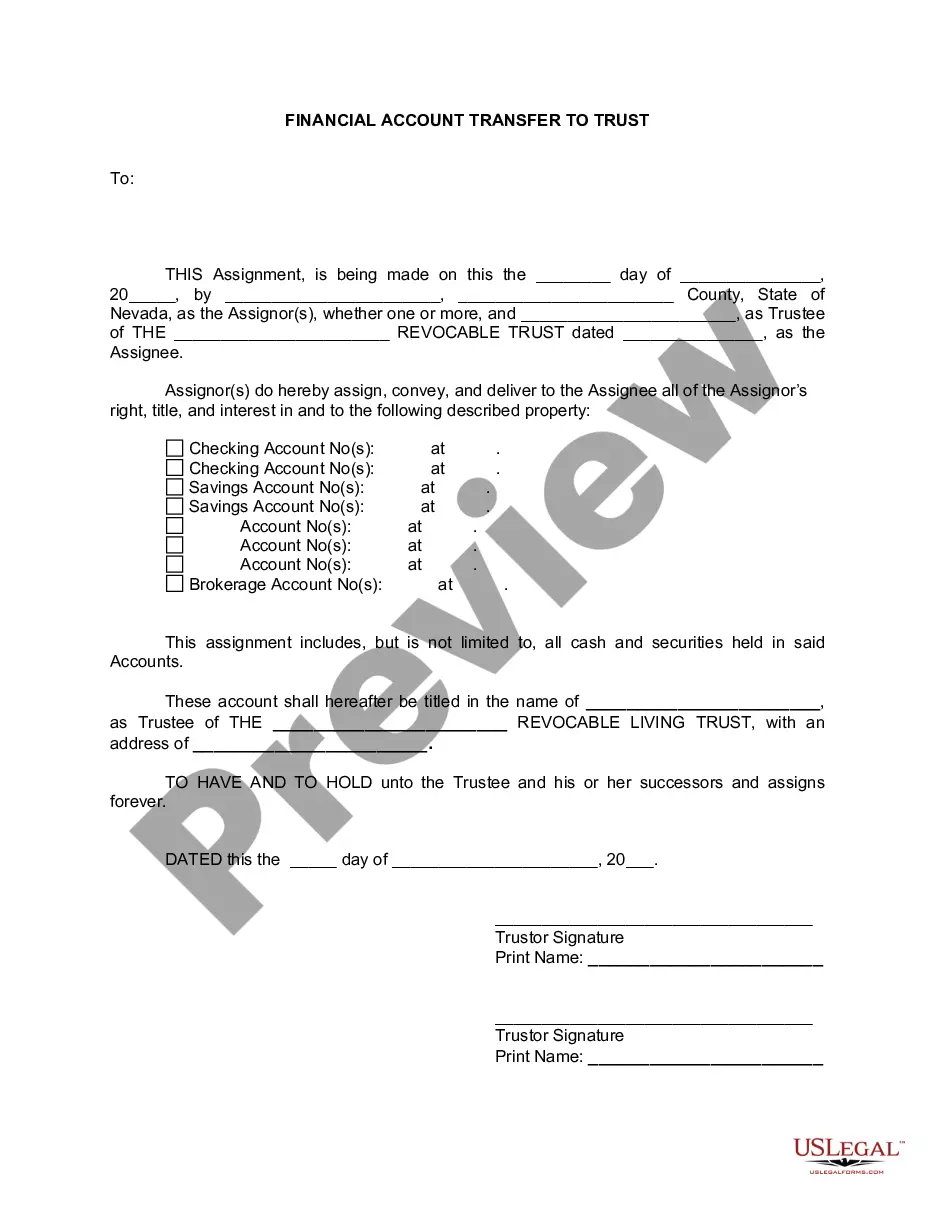

How to fill out Nevada Financial Account Transfer To Living Trust?

- Begin by logging into your existing US Legal Forms account. Ensure your subscription is active to access the required document templates.

- If you are new to the service, browse the extensive library of over 85,000 legal forms. Preview the description to confirm it meets your jurisdiction's requirements.

- Use the search functionality if you need a different template. This will help you find the exact form necessary for your trust account.

- Select the form that fits your needs and click the 'Buy Now' button. Choose your preferred subscription plan during the purchase process.

- Fill in your payment information, choosing either credit card or PayPal to complete your subscription.

- Download your form once the transaction is successful and save it on your device. Access it anytime from the 'My Forms' section in your profile.

US Legal Forms offers a vast collection of legal documents that empower users to create legally sound agreements quickly. With a focus on user experience, their platform allows easy access to professionals for guidance, ensuring that all your legal documentation is accurate and effective.

Ready to set up your trust account with Fidelity? Start your journey today with US Legal Forms and ensure all your legal needs are met effortlessly!

Form popularity

FAQ

Selecting the best bank for opening a trust account with fidelity requires looking at various factors such as fees, services, and customer support. Consider banks that are known for their trust services, as they will likely provide the guidance you need. Additionally, evaluate the bank's performance in wealth management and their ability to cater to your unique financial goals. Platforms like US Legal Forms can help streamline the process of finding the right bank by providing essential resources and guidance.

While you can explore many banks for a trust account with fidelity, not all banks provide these accounts. Some banking institutions lack the infrastructure or expertise to manage trust accounts effectively. Thus, it's crucial to choose a bank that specifically offers trust services to ensure the best management and protection of your assets. Always check the bank's credentials and service offerings.

The best bank for a trust account with fidelity varies based on the services you require. Some banks specialize in wealth management and provide extensive resources for trust accounts. It's essential to look for banks that offer transparency, low fees, and robust fiduciary services. Evaluating customer testimonials can also guide you toward a bank that aligns with your needs.

Choosing the right place to open a trust account with fidelity often depends on your specific needs. Many individuals find credit unions, local banks, and financial institutions offer personalized service. Additionally, consider banks that have a strong reputation for trust management. It's always a good idea to research and compare various offerings to find the option that best fits your situation.

Fidelity offers a variety of trust types to cater to diverse financial needs. Common options include revocable trusts, irrevocable trusts, and charitable trusts. Each trust account with Fidelity provides unique benefits, helping you achieve specific goals while safeguarding your assets. With the right guidance, you can choose a trust that best fits your financial plans.

You can open a trust account at Fidelity, and the process is straightforward. Fidelity provides the necessary support to guide you through setting up your trust account with fidelity. Once established, you will have access to a range of investment resources and tools. This ensures your trust is managed effectively and aligns with your financial objectives.

Yes, Fidelity offers trust accounts designed to help you manage and protect your assets. A trust account with Fidelity allows for flexible investment options and expert guidance. You can easily set up a trust account tailored to your specific needs. This service helps ensure that your financial legacy is secure for future generations.

A family trust offers protection and management of assets but can have disadvantages too. One notable downside is the potential for family disputes regarding asset distribution or management. Clear communication and defined terms can mitigate these issues, and resources like USLegalForms can provide templates to ensure clarity and prevent conflicts.

One of the biggest mistakes parents make when setting up a trust fund is failing to update it regularly. Life changes such as marriage, divorce, or the birth of new family members can impact your trust's effectiveness. It's crucial to review and edit the trust as necessary, and platforms like USLegalForms can help in managing these updates.

Deciding whether your parents should put their assets in a trust depends on their financial situation and goals. A trust can protect assets and simplify the transition of wealth, but it may not be necessary for everyone. Discussing options with a financial advisor is beneficial, and you may find tools like USLegalForms helpful to facilitate this discussion.