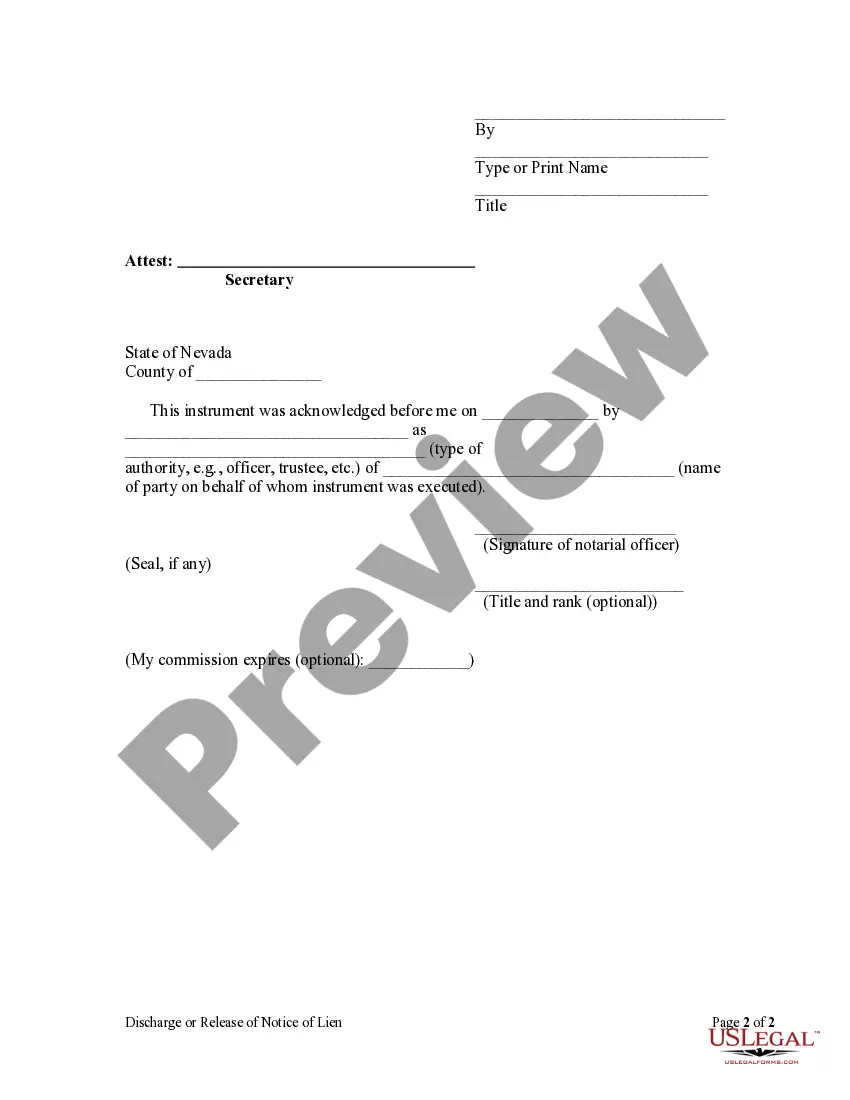

Nevada Lien Release Form

Description

How to fill out Nevada Discharge Or Release Of Lien - Corporation?

Bureaucracy demands exactness and correctness.

If you do not regularly manage the completion of documents such as the Nevada Lien Release Form, it might lead to some misunderstanding.

Choosing the right sample from the beginning will guarantee that your document submission proceeds smoothly and avoid any troubles of re-sending a document or repeating the same task from the start.

If you are not a registered user, locating the necessary sample would require a few extra steps: Find the template using the search field. Confirm the Nevada Lien Release Form you’ve found is valid for your state or region. Review the preview or read the description that contains details on the use of the template. If the result meets your criteria, click the Buy Now button. Select the appropriate choice among the available pricing options. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal account. Download the document in your preferred format. Locating the correct and updated samples for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your paperwork tasks.

- You can always retrieve the appropriate sample for your documentation from US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85,000 templates for various sectors.

- You can locate the latest and most relevant version of the Nevada Lien Release Form by simply searching on the site.

- Find, store, and download templates in your account or refer to the description to ensure you have the correct one on hand.

- With an account at US Legal Forms, you can obtain, store in one location, and navigate the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your document history is preserved.

- Browse the form descriptions and download the ones you need anytime.

Form popularity

FAQ

Yes, Nevada is one of the 12 states that provide statutory lien waiver forms that must be used to effectively waive lien rights in Nevada.

Lien must be filed within 90 days of last providing labor or materials, or completion of work (whichever is later). In Nevada, an action to enforce a mechanics lien must be initiated within 6 months from lien's filing. This deadline may not be extended, and failure to meet the deadline renders the lien unenforceable.

Unless a lien claimant has a direct contract with a Nevada project's owner (NRS 108.245(5)), a lien claimant is required to serve a project's owner with a Notice of Right to Lien within 31 days after first supplying labor, materials, equipment or services for the project. NRS 108.245(1).

Attaching a judgment lien is relatively straightforward since you already hold a court judgment against the debtor. Simply fill out the statutory lien form and file it with the county recorder in any Nevada county where the debtor has property. When the home is sold or foreclosed, you should receive your money.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.