Lien Release Form Nevada Withholding Tax

Description

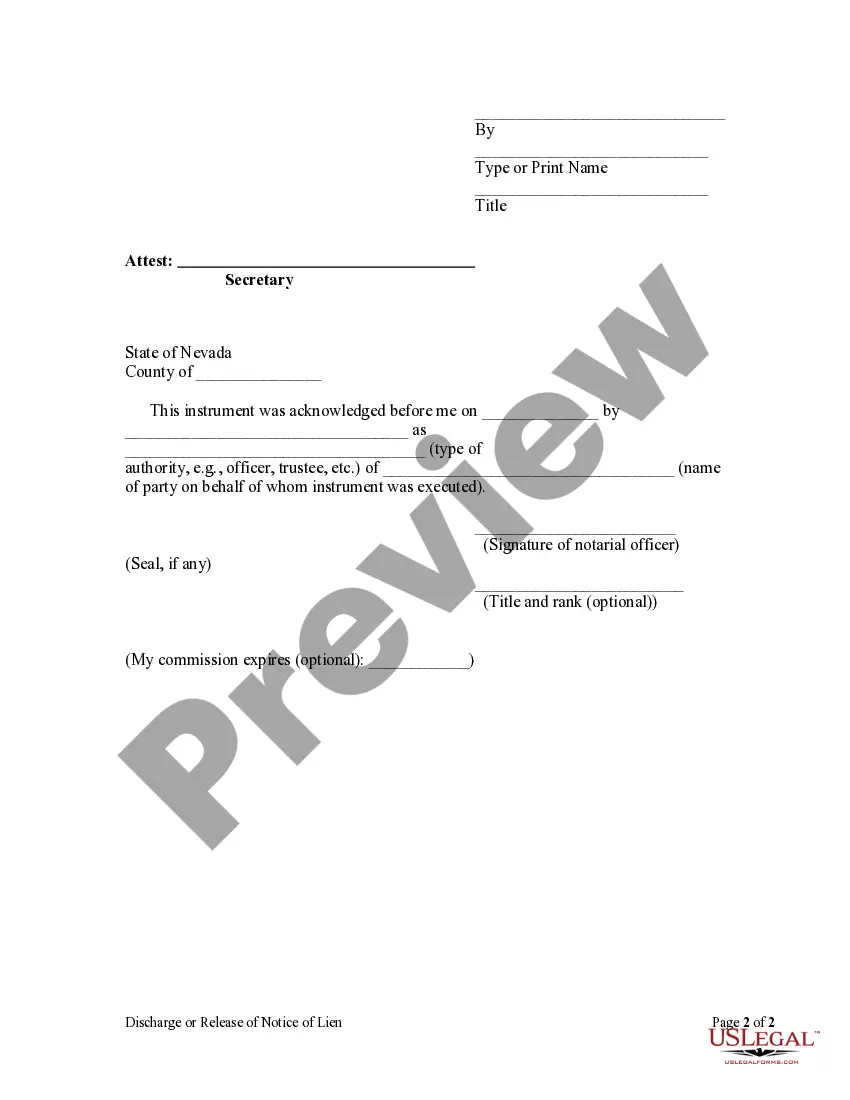

How to fill out Nevada Discharge Or Release Of Lien - Corporation?

Utilizing legal templates that comply with federal and state regulations is essential, and the internet provides numerous alternatives to select from.

However, what is the benefit of spending time hunting for the appropriate Lien Release Form Nevada Withholding Tax example online when the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by lawyers for any corporate and personal circumstance. They are easy to navigate, with all documents categorized by state and intended use.

All templates you find on US Legal Forms can be reused. To re-download and complete previously purchased forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Our experts keep up with legal updates, so you can be confident that your form will be current and compliant when obtaining a Lien Release Form Nevada Withholding Tax from our site.

- Acquiring a Lien Release Form Nevada Withholding Tax is quick and easy for both existing and new users.

- If you already have an account with an active subscription, Log In and download the required document sample in the desired format.

- If you are new to our platform, follow the steps below.

- Review the template using the Preview option or through the text description to ensure it meets your requirements.

Form popularity

FAQ

The Arkansas Consumer Complaint Form is an online service provided by the Arkansas Attorney General's office that allows consumers to file complaints regarding various issues, such as deceptive business practices, scams, and fraud.

mail your complaint to: complaints.OLTC@arkansas.gov. Mail a Letter: Complaints Unit, Office of Long Term Care, P.O. Box 8059, Slot S407, Little Rock, AR 722038059.

* You may request a complaint form be sent to you by calling our toll free number at 888-432-9257 and selecting option #3. Please leave your name and address and indicate whether your complaint is against a telemarketer, automobile dealer, or other type of business.

Formal complaints must be filed in writing with the Secretary of the Commission. Before bringing a formal complaint to the APSC, you must give your utility a chance to resolve the problem. The law requires that you make a ?good faith? effort to do so. A utility has 20 days to file a response to a formal complaint.

He or she serves as legal representation for state agencies and officers, provides official opinions on legal issues and represents the state in criminal appeals. The attorney general also represents Arkansas Medicaid in cases of fraud and neglect and pursues violations of consumer protection law.

Those laws are premised on two basic requirements: companies cannot agree to limit competition in ways that hurt consumers, and a single company cannot monopolize or try to monopolize an industry through unfair practices. File a consumer complaint online, email consumer@ArkansasAG.gov or call 800-482-8982.

The Attorney General serves as Arkansas?Aos lawyer, chief law enforcement officer and chief consumer advocate.

Formal complaints must be filed in writing with the Secretary of the Commission. Before bringing a formal complaint to the APSC, you must give your utility a chance to resolve the problem. The law requires that you make a ?good faith? effort to do so. A utility has 20 days to file a response to a formal complaint.