Nevada Surety Bond Requirements

Description

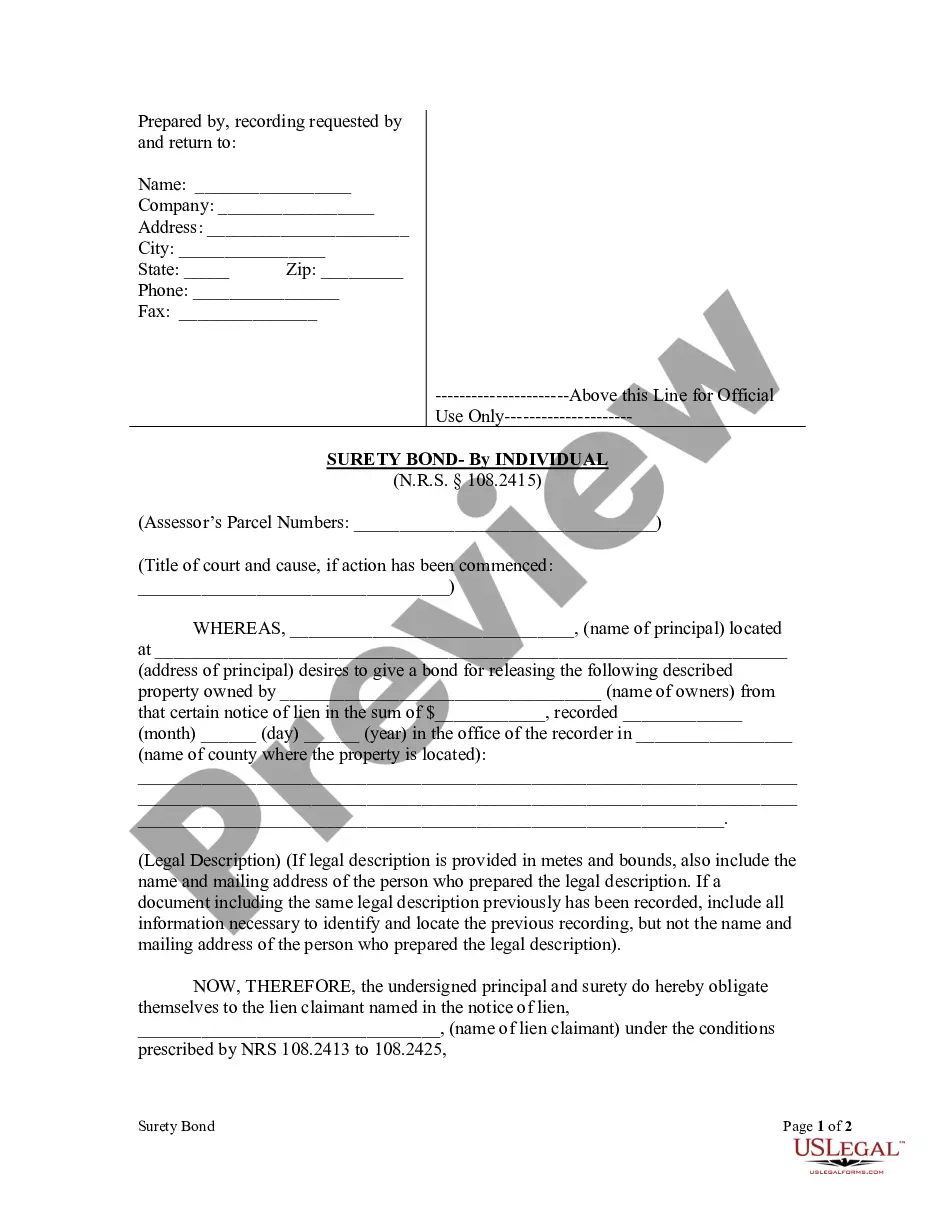

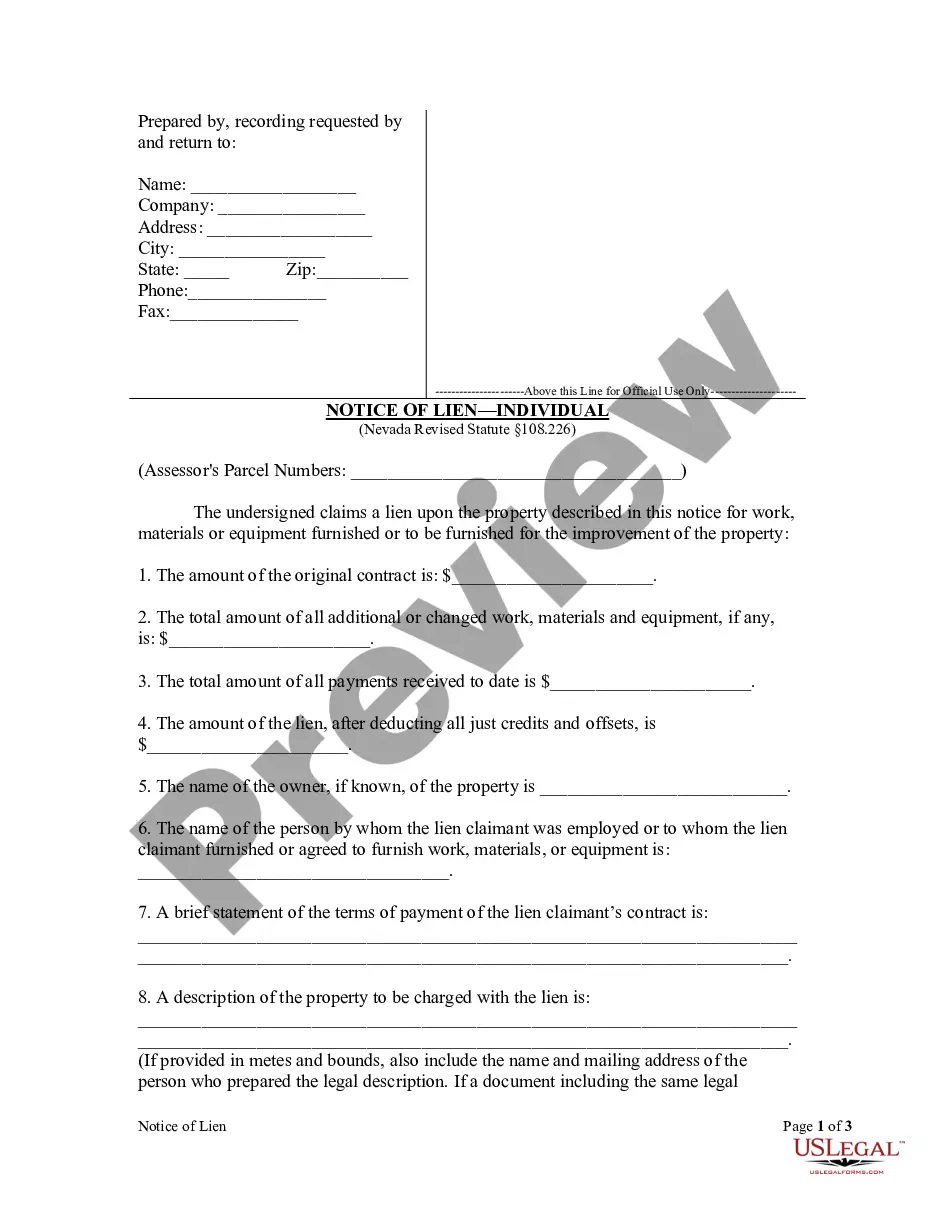

How to fill out Nevada Surety Bond Form - Individual?

Creating legal documents from scratch can frequently be intimidating.

Certain cases may require extensive research and a significant financial outlay.

If you’re looking for a simpler and more budget-friendly method of preparing Nevada Surety Bond Requirements or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

But before proceeding directly to downloading the Nevada Surety Bond Requirements, adhere to these recommendations: Review the form preview and descriptions to confirm that you have found the correct form. Verify that the template you select aligns with the regulations and statutes of your state and county. Choose the most suitable subscription option to acquire the Nevada Surety Bond Requirements. Download the form, then complete, certify, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form execution a simple and efficient process!

- With just a few clicks, you can quickly access templates specific to your state and county, carefully prepared by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services to effortlessly find and download the Nevada Surety Bond Requirements.

- If you’re already familiar with our website and have previously created an account with us, simply Log In to your account, locate the form and download it immediately or re-download it whenever you wish in the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to register and explore the library.

Form popularity

FAQ

Yes, a surety bond in the amount of $10,000 is available in Nevada, and it serves various purposes, depending on your industry. Some businesses or professionals may require this specific bond amount to meet state regulations. To ensure that you are compliant with the Nevada surety bond requirements, it is essential to research your specific industry standards thoroughly. Uslegalforms can assist you in understanding the necessary steps for securing your bond effectively.

Contact a surety bonding company authorized to do business in Nevada for information on cost and how to obtain a surety bond. The surety bond may be issued for an individual performing document preparation services in Nevada, or may be issued to a business entity performing document preparation services in Nevada.

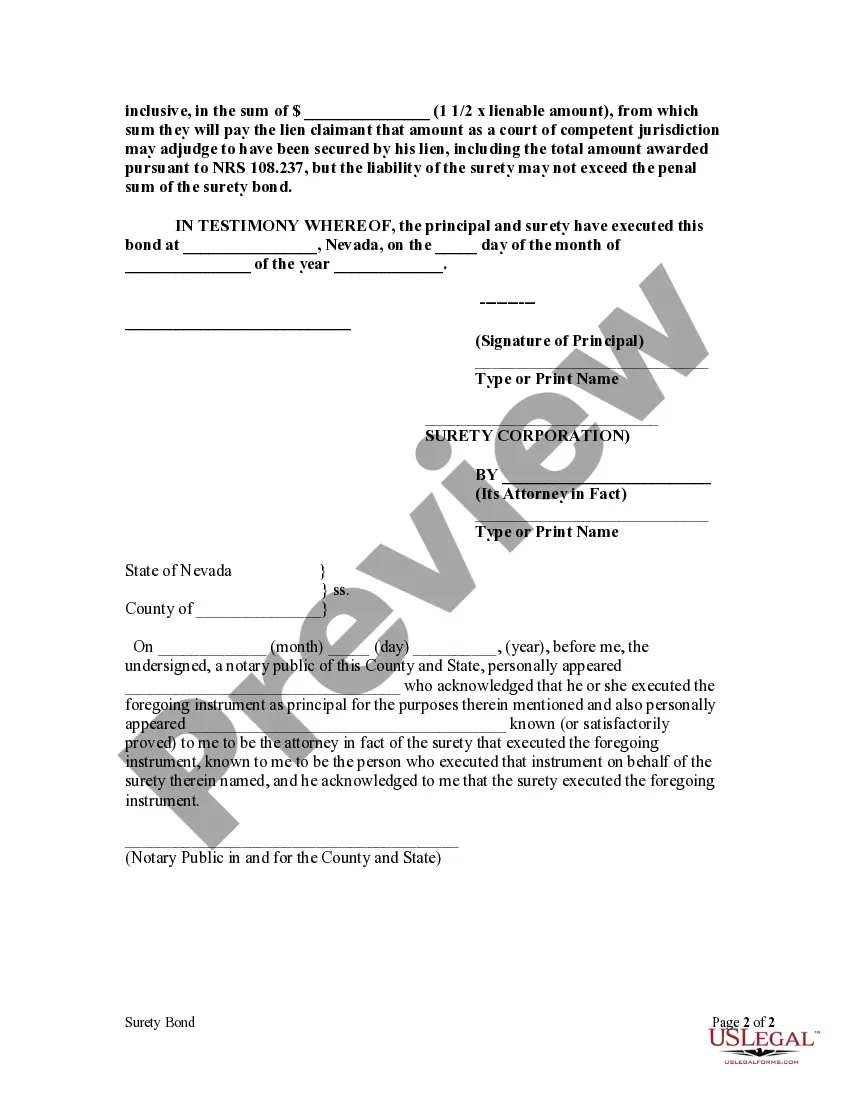

A Surety Agreement Defined They differ from an insurance contract in that an insurance contract includes two entities (insurance provider and policyholder), whereas a surety bond involves three parties: the Principal, the Obligee and the Surety.

Nevada law requires all notaries to have a $10,000 notary surety bond for the duration of their commission. The Nevada notary bond protects the people of Nevada from any mistakes you might make while performing your notarial duties.

Bond Requirement: Each applicant for a General Agent for Bail license must file a $50,000 Surety License Bond, naming the People of the State of Nevada as obligee, and must also provide a Power of Attorney. These must remain in force while licensed as a General Agent for Bail.

If the defendant cannot pay the bail amount, a bail bond can be purchased for 15% of the amount of the bail from a licensed bail agent. The bail agent may require collateral to secure the bond amount.