Codicil Will Form Without

Description

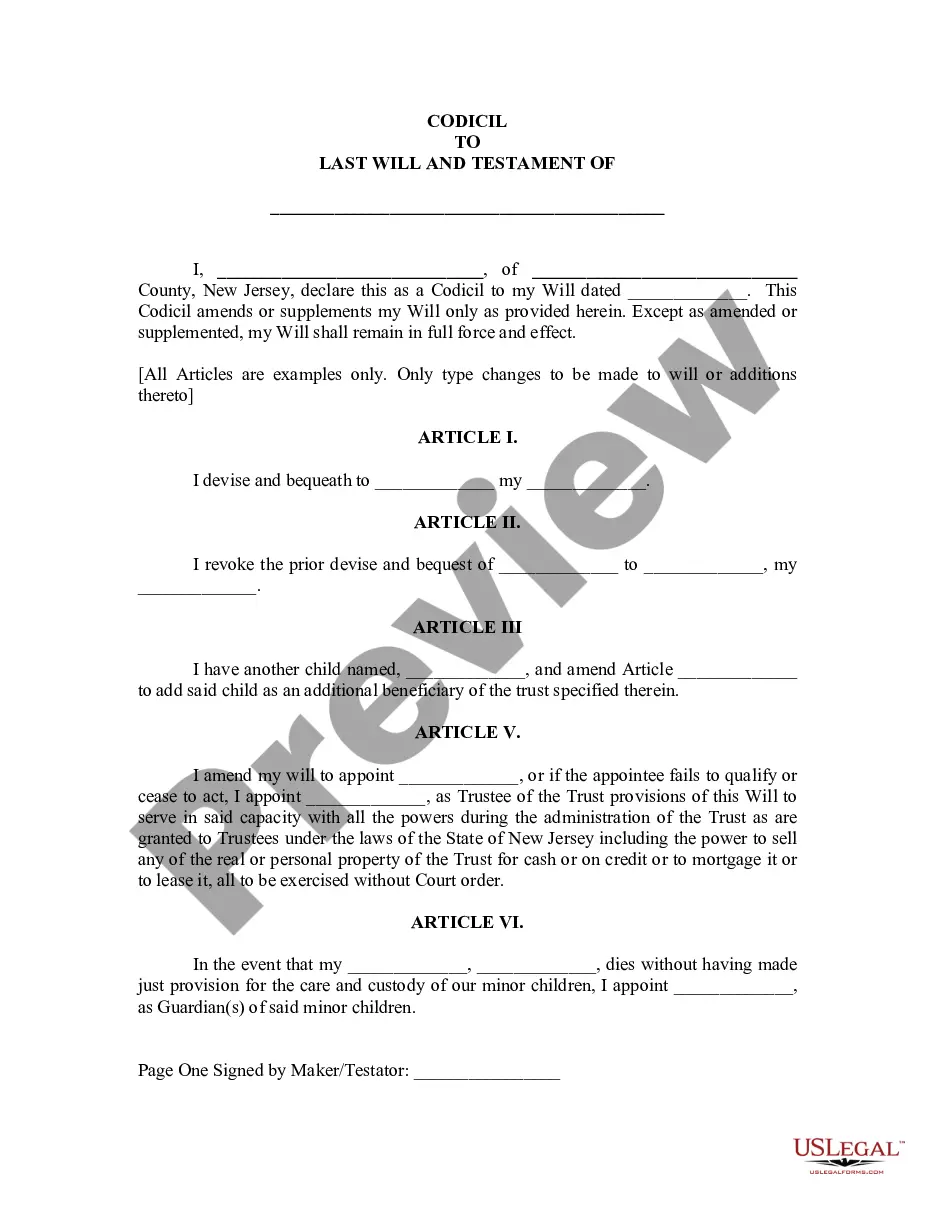

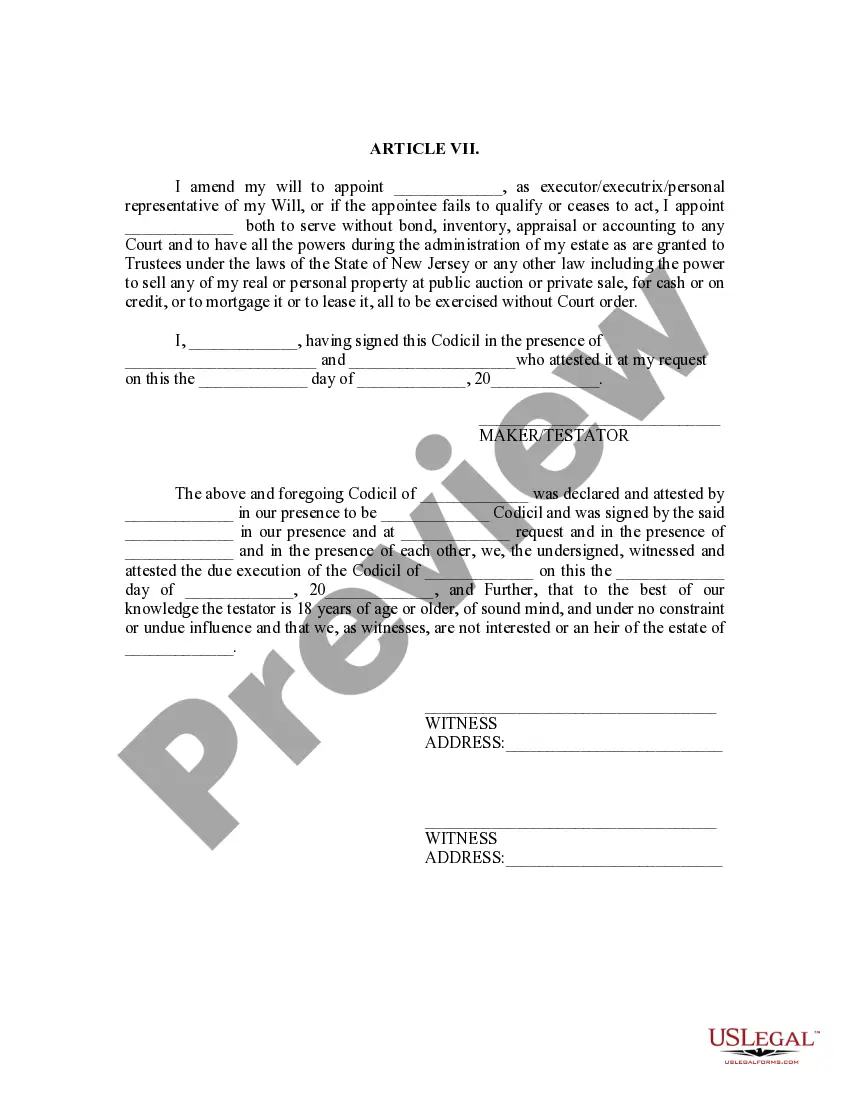

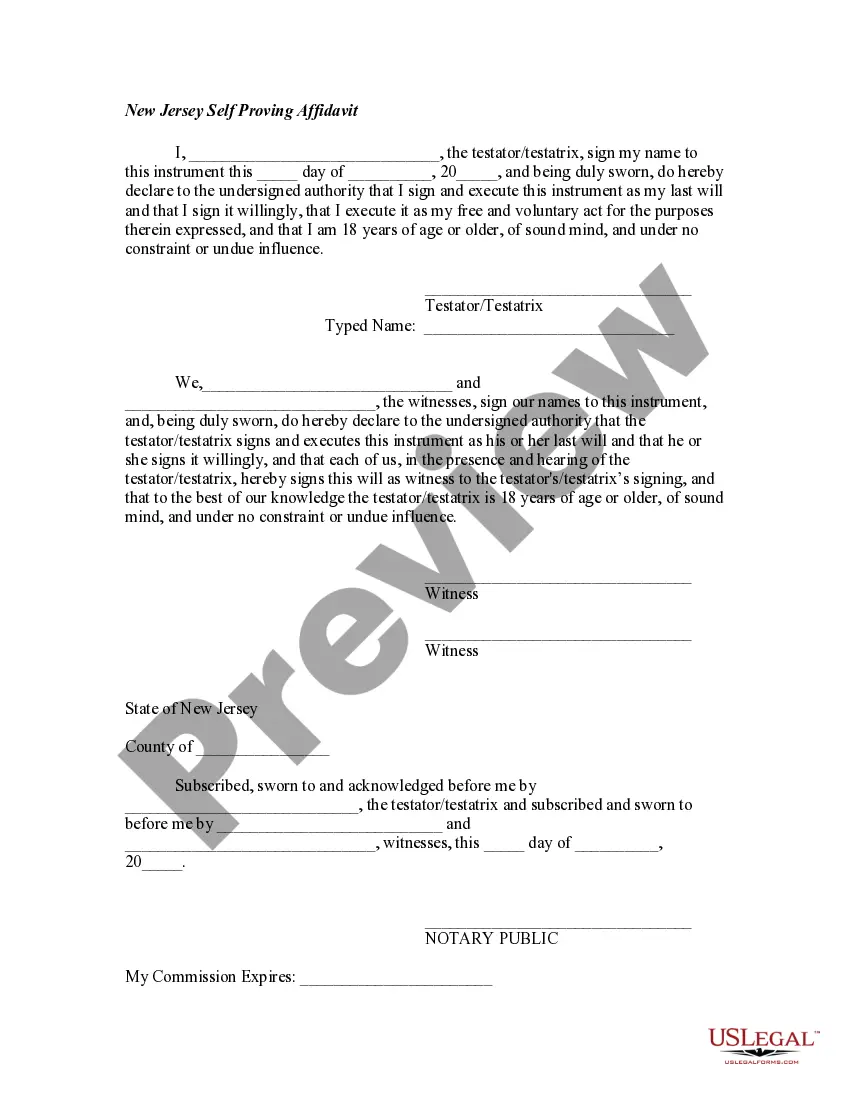

How to fill out New Jersey Codicil To Will Form For Amending Your Will - Will Changes Or Amendments?

Whether for professional intentions or for personal matters, everyone has to confront legal issues eventually in their lifetime.

Filling out legal documents requires meticulous attention, starting from selecting the correct form template.

With an extensive US Legal Forms catalog available, you don’t have to waste time searching for the correct template across the internet. Utilize the library’s straightforward navigation to locate the appropriate form for any circumstance.

- Find the template you require by utilizing the search function or catalog navigation.

- Examine the form’s description to verify it corresponds to your situation, state, and area.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Codicil Will Form Without template you need.

- Acquire the template if it satisfies your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the applicable pricing option.

- Fill out the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you desire and download the Codicil Will Form Without.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

Assuming that no one is contesting the will or challenging the appointment of the executor, and assuming all of the decedent's next of kin (called distributees) can be found and will sign a waiver of process and consent to probate, you can expect to pay $3,000 - $3,500 in legal fees to have the will admitted to probate ...

Estate attorneys recommend updating your will each time you experience a major life event. It's a good rule of thumb to review your will every four to five years, even if you don't think anything is different. This helps ensure your family stays protected and your final wishes are respected.

A codicil to a will is a way to modify your will without preparing a whole new one. A codicil is a written document that describes precisely how to change your will. For example, a codicil might be used to name a different executor or to bequeath a specific item to someone who wasn't included in your original will.

A probate attorney is not required under New York law, but legal assistance can save time and effort by ensuring that paperwork is completed properly and everyone with an interest in the estate receives the required notifications.

From Caring.com and AARP: 24% of 18- to 34-year-olds have a will. 27% of 25- to 54-year-olds have a will. 45% of people over the age of 55 have a will.

Knowing what you need to do to update your Will (and when to do it) is important. Whether you just had one major life event, or if you haven't revisited your Will in many years and a number of things have changed, keeping your Will up-to-date is an essential part of protecting your family after you're gone.

Keep your will and beneficiaries updated So remember to review and update documents related to those accounts every few years or after a marriage, divorce, death of a loved one, or birth or adoption of a child. If you neglect to do so, your 401(k) could end up in the hands of an ex-spouse.