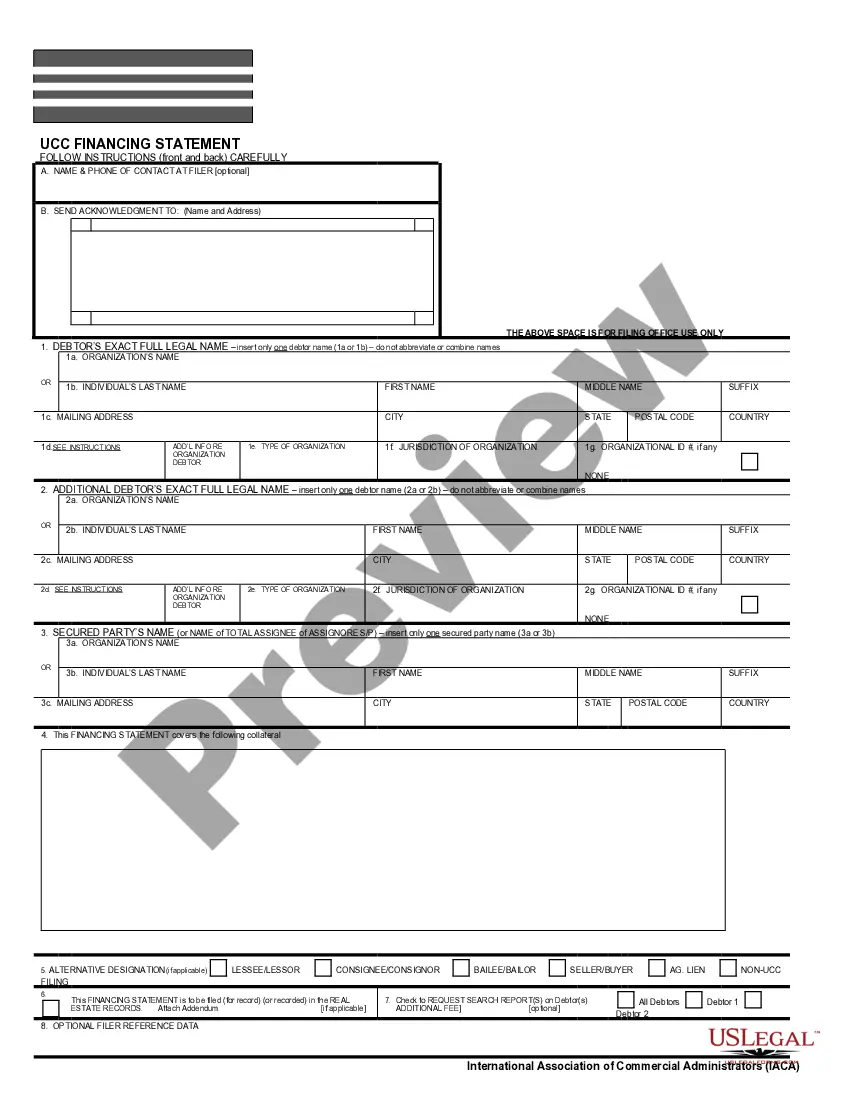

Ucc 3 Termination Form Nj For Llc

Description

How to fill out New Jersey UCC3 Financing Statement Amendment?

The Ucc 3 Termination Document Nj For Llc displayed on this page is a reusable legal template crafted by qualified attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, corporations, and lawyers with more than 85,000 authenticated, state-specific templates for any business and personal circumstance. It’s the quickest, easiest, and most reliable method to acquire the documents you require, as the service ensures the highest level of data protection and anti-malware safeguards.

Choose the desired format for your Ucc 3 Termination Document Nj For Llc (PDF, Word, RTF) and save the file on your device. Fill out and sign the document. Print the template for manual completion. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature. Re-download your documents whenever needed. Access the My documents tab in your profile to retrieve any previously purchased forms. Subscribe to US Legal Forms to have authenticated legal templates for all of life’s situations available at your fingertips.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or read the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now when you have found the template you require.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Acquire the fillable template.

Form popularity

FAQ

The Debtor must send an authenticated demand to the secured party. the demand must be sent to the name and address of the secured party found on the financing statement. the secured party has 20 days to either terminate the filing or send a termination statement to the debtor for the debtor to file.

1. Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

To add, edit or delete a debtor, secured party and/or collateral, you can file an Amendment online. Go to the UCC Home Page at .njportal.com/UCC and select the link "Amendment (UCC-3)". Enter the filing number to pull up the information and then you can make a change to the debtor, secured party and/or collateral.