Power Attorney For Property

Description

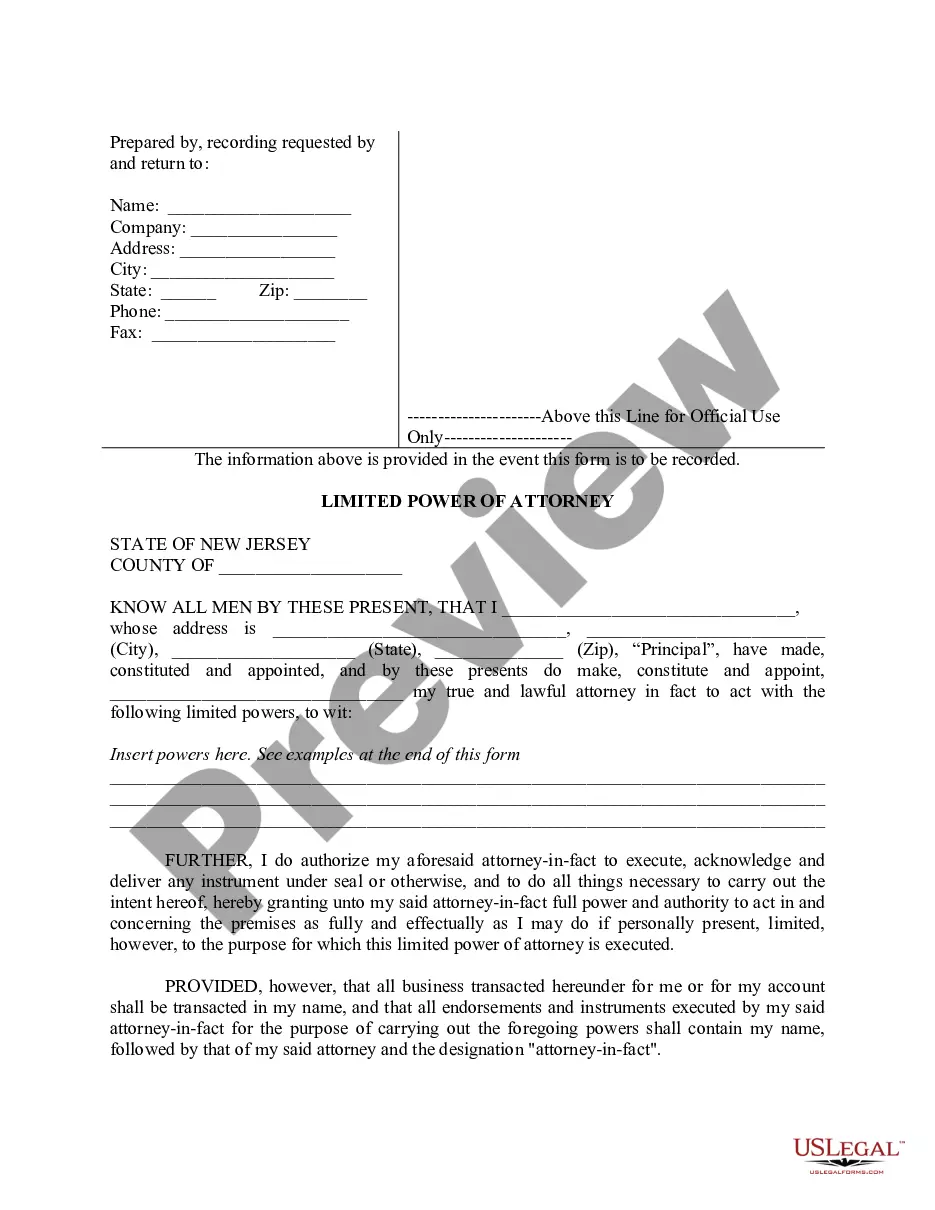

How to fill out New Jersey Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log into your US Legal Forms account if you already have one. Verify your subscription status and renew if necessary.

- If you're a first-time user, visit the US Legal Forms website and search for 'Power attorney for property'.

- Examine the available forms in Preview mode and ensure you select the template that meets your jurisdiction's requirements.

- Should you find discrepancies or require additional options, utilize the Search tab to explore other available forms.

- Click the Buy Now button next to your chosen document and select a subscription plan that works for you.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Download the completed template to your device, and access it anytime from the My Forms section in your profile.

By following these straightforward steps, you can easily create and manage your power attorney for property documents. US Legal Forms not only provides a robust collection of legal forms but also ensures helpful support from premium experts, making the process seamless.

Don't hesitate—start securing your legal documents today with US Legal Forms for a hassle-free experience!

Form popularity

FAQ

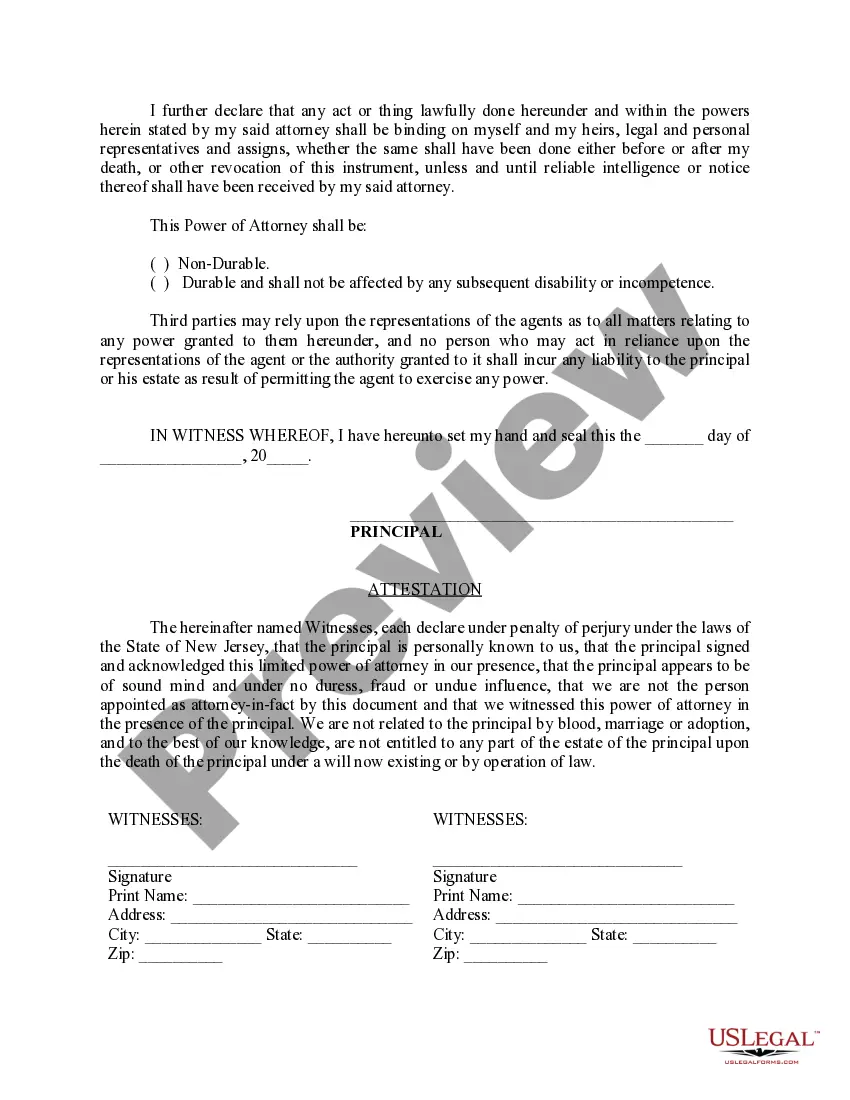

You can obtain a power of attorney without a lawyer by using templates and resources available online. Services like US Legal Forms provide user-friendly documents specifically designed for various states, including options for a power attorney for property. By following the guidelines provided, you can effectively create the necessary documentation on your own, ensuring your property affairs are managed as you desire without incurring legal fees.

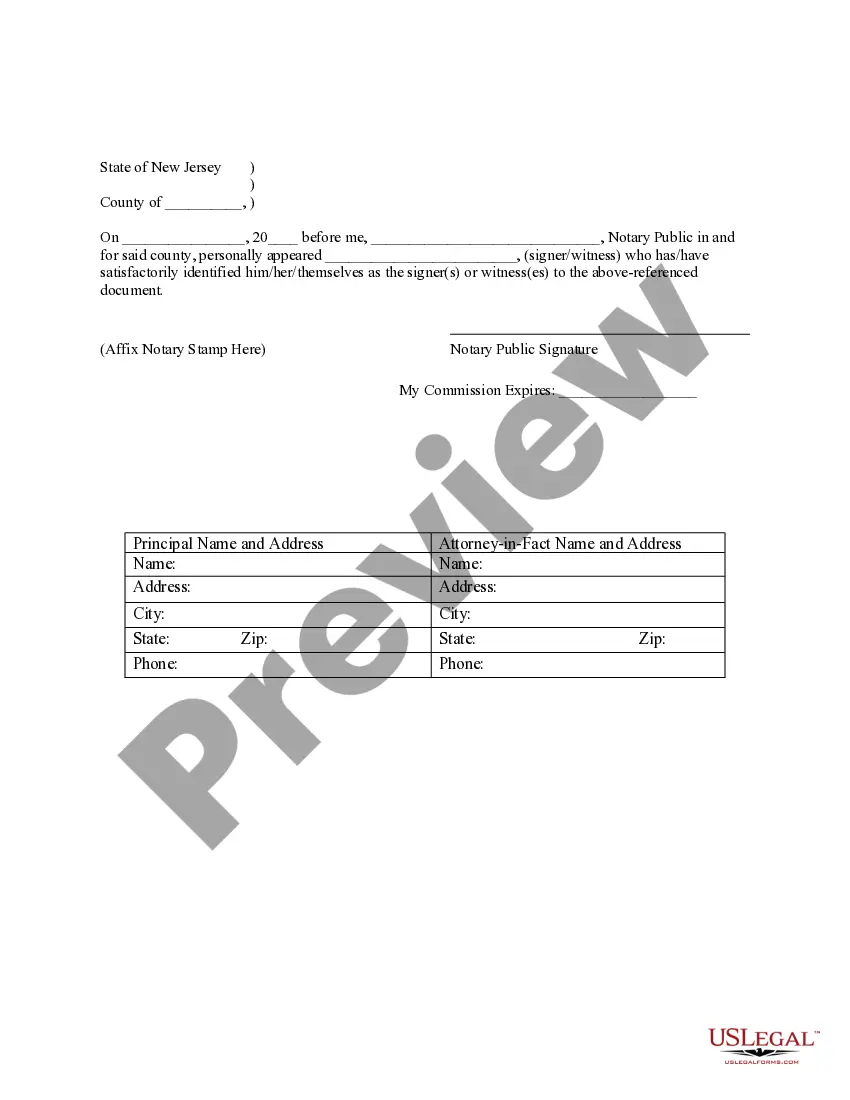

In Pennsylvania, to establish a power of attorney for property, you must sign a document that grants authority to another person. This document needs to be signed in front of a notary public, and it must clearly outline the powers being given. Additionally, it is prudent to communicate your wishes with the appointed individual. Utilizing platforms like US Legal Forms can help you ensure everything is in order, making the process easier.

The best person for power of attorney is someone who knows you well and understands your financial goals and preferences. Many people choose a family member or close friend who can act in your best interest. It is also crucial that this person is responsible and reliable, as they will manage your property matters. By selecting the right individual, you empower them to handle your affairs when you are unable to do so.

In North Carolina, you do not necessarily need a lawyer to create a power of attorney. However, consulting with a legal professional can clarify the process and ensure your documents meet all state requirements. Utilizing resources from US Legal Forms simplifies the task by offering templates and guidance, enabling you to draft a power attorney for property confidently. This can help you avoid potential pitfalls and enhance the legal validity of your document.

The best person to give power of attorney is someone you trust completely. Typically, this person is a family member, close friend, or a trusted advisor. It is important that this individual understands your wishes regarding your property and financial matters. Establishing a power attorney for property allows you to ensure your interests are protected when you cannot manage them yourself.

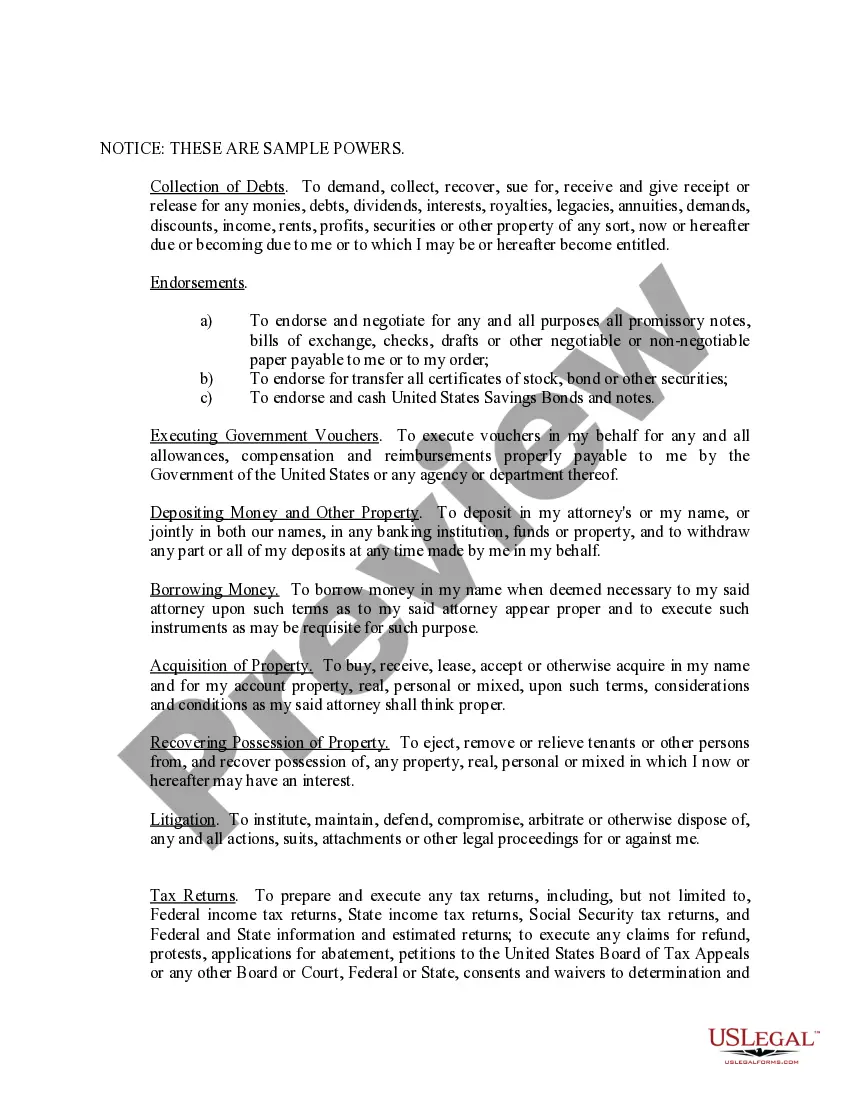

First, a legal power of attorney cannot make decisions concerning the principal's own healthcare if they have previously outlined their medical preferences. Second, it cannot create or modify a will, as this is a task reserved for the principal. Lastly, a power of attorney cannot make decisions that require the principal's presence, like performing certain legal actions that can't be delegated. It's vital to know these restrictions when you draft or accept a power attorney for property.

A power of attorney cannot make decisions that violate the principal's wishes or best interests. For instance, you cannot change a will or make decisions regarding medical treatment if the principal has explicitly stated their preferences. Additionally, you cannot use the authority for personal gain or selfish motives. Understanding the limits of a power attorney for property is crucial for both the agent and the principal.

One downside of being a power of attorney is the significant responsibility it entails. You must manage someone else's financial and legal affairs, which can be overwhelming at times. If you make a mistake or act against the individual's wishes, you could face legal repercussions. It's essential to fully understand the weight of this role before taking it on.

In South Carolina, a power of attorney can typically be overridden by the principal, as long as they are still mentally competent. Additionally, a court may revoke the power of attorney if it finds that it can no longer serve the principal's best interests. Understanding these nuances is crucial when managing power of attorney for property.

In South Carolina, the rules regarding power of attorney for property mandate that the document must be signed voluntarily and cannot be a product of coercion. The powers granted must be explicit, and the agent must act in the principal’s best interests. It’s advisable to consult resources like uslegalforms for templates and guidance to ensure compliance.