Power Attorney For Irs

Description

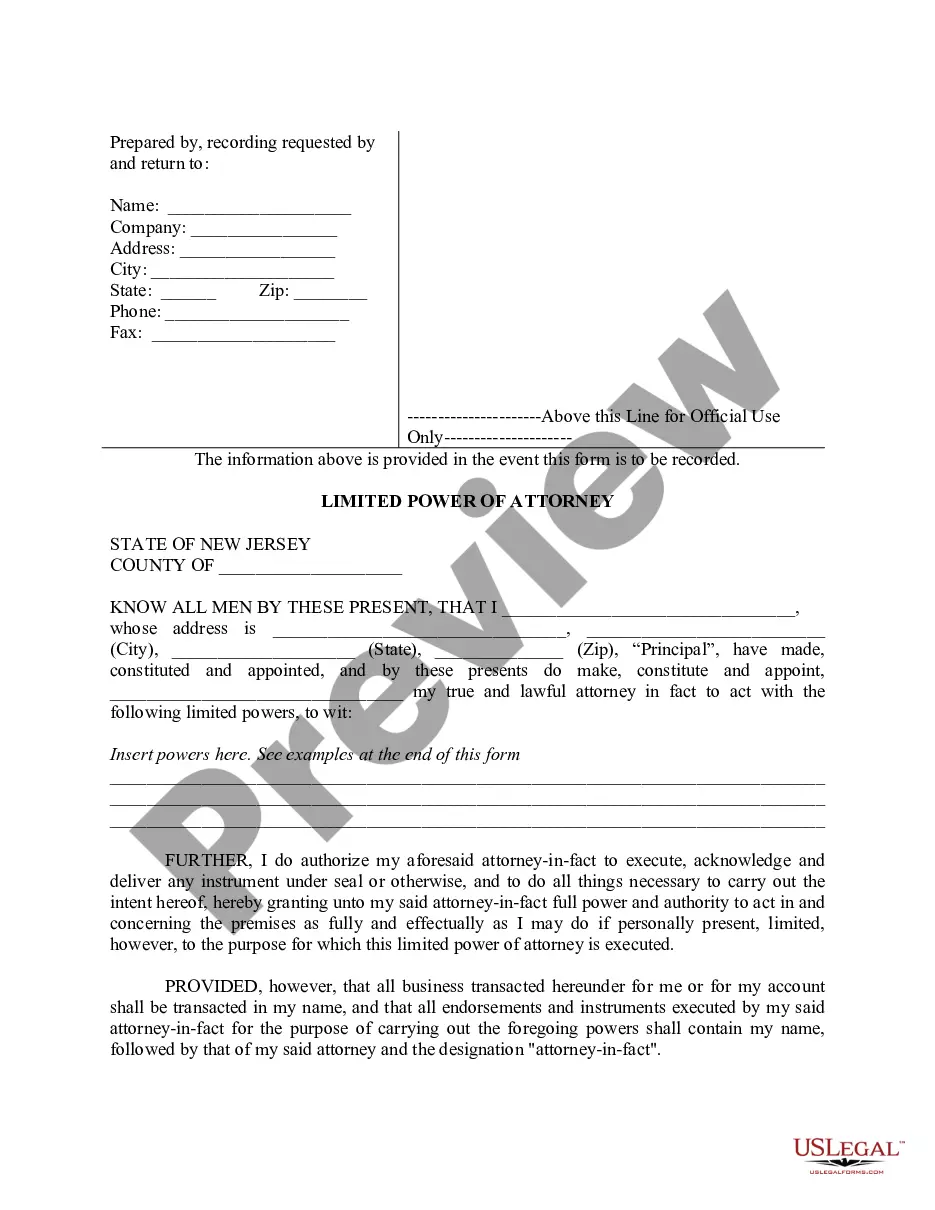

How to fill out New Jersey Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Access your US Legal Forms account by logging in. If you haven't used the service before, register first to create an account.

- Explore the form library to find the Power of Attorney that fits your requirements. Utilize the Preview mode to confirm the document meets your local jurisdiction standards.

- If you need a different form, use the Search feature to find the correct template that suits your needs.

- Proceed to purchase the document by clicking on the Buy Now button. Select a suitable subscription plan to gain full access.

- Complete your payment through your credit card or PayPal account to confirm your subscription.

- Download the completed form and save it on your device for easy access. You can also find it later in the My Forms section of your profile.

In conclusion, securing a Power of Attorney for the IRS is simple with US Legal Forms' extensive library and expert support. Leverage their services to ensure that your legal documents are accurately filled and legally sound.

Ready to get started? Visit US Legal Forms today and empower yourself with the right legal tools!

Form popularity

FAQ

As mentioned earlier, the processing time for a power of attorney by the IRS generally ranges from 4 to 6 weeks. Factors affecting this include the IRS's current workload and any additional documentation required. Following up with the IRS can help you stay informed about your power of attorney's status.

Yes, you can fax your power of attorney for the IRS, but there are restrictions based on the type of tax matters involved. Make sure to confirm the fax number and any fax-related guidelines found on the IRS website. Using a verified method ensures that your documents are received securely and promptly.

You can submit your power of attorney for IRS by mailing the completed Form 2848 to the address specified in the form instructions. Additionally, you may submit it electronically if you choose to use specific software or services that facilitate this process. Using trusted platforms like US Legal Forms can streamline the submission process for you.

Yes, the IRS allows for electronic signatures on power of attorney forms, provided they meet specific requirements. Ensure that the electronic process complies with IRS guidelines for validating the identity of the signer. This makes it easier for you to manage your tax affairs without physically mailing documents.

Typically, it takes the IRS about 4 to 6 weeks to process a power of attorney for the IRS. However, this timeframe can vary depending on the IRS's workload and the accuracy of the submitted documents. To minimize delays, it is crucial to ensure all information is accurate and complete when submitting your power of attorney.

To file a tax return with a power of attorney for the IRS, you must first complete Form 2848, which grants authority to the designated individual. Once the form is signed, the agent can prepare and submit your tax return on your behalf. It is essential to ensure that your power of attorney is valid and up to date to avoid any issues with the IRS.

To obtain a power attorney for IRS, you will need to fill out IRS Form 2848 accurately. This form grants the designated individual the authority to act on your behalf regarding tax matters. After completing the form, submit it directly to the IRS, ensuring it includes all necessary details. Using resources like US Legal Forms can simplify this process and ensure your paperwork meets all IRS requirements.

An IRS attorney represents clients in matters related to tax law, including negotiations and disputes with the IRS. They provide valuable services such as tax planning, audit defense, and assistance in navigating complex tax situations. By hiring an IRS attorney, you gain expert guidance tailored to meet your specific needs. Their involvement can significantly improve your chances of a favorable outcome with the IRS.

No, an IRS power attorney for IRS does not require notarization. The IRS accepts Form 2848 without a notary stamp, provided that it is signed by you and the person you are granting authority to. It is essential, however, to ensure that the form is completed correctly and submitted on time to avoid any issues. Review the IRS guidelines to confirm that all required information is included.

Choosing a tax attorney over a CPA can provide unique benefits, particularly in legal matters. A tax attorney specializes in tax laws and can represent you before the IRS in disputes, while a CPA focuses more on accounting and tax preparation. If you face complex tax issues or audits, a tax attorney can offer tailored advice and representation, ensuring your rights are protected. This gives you peace of mind when dealing with the IRS.