New Jersey Attorney Nj Form Nj-1065 Instructions 2021

Description

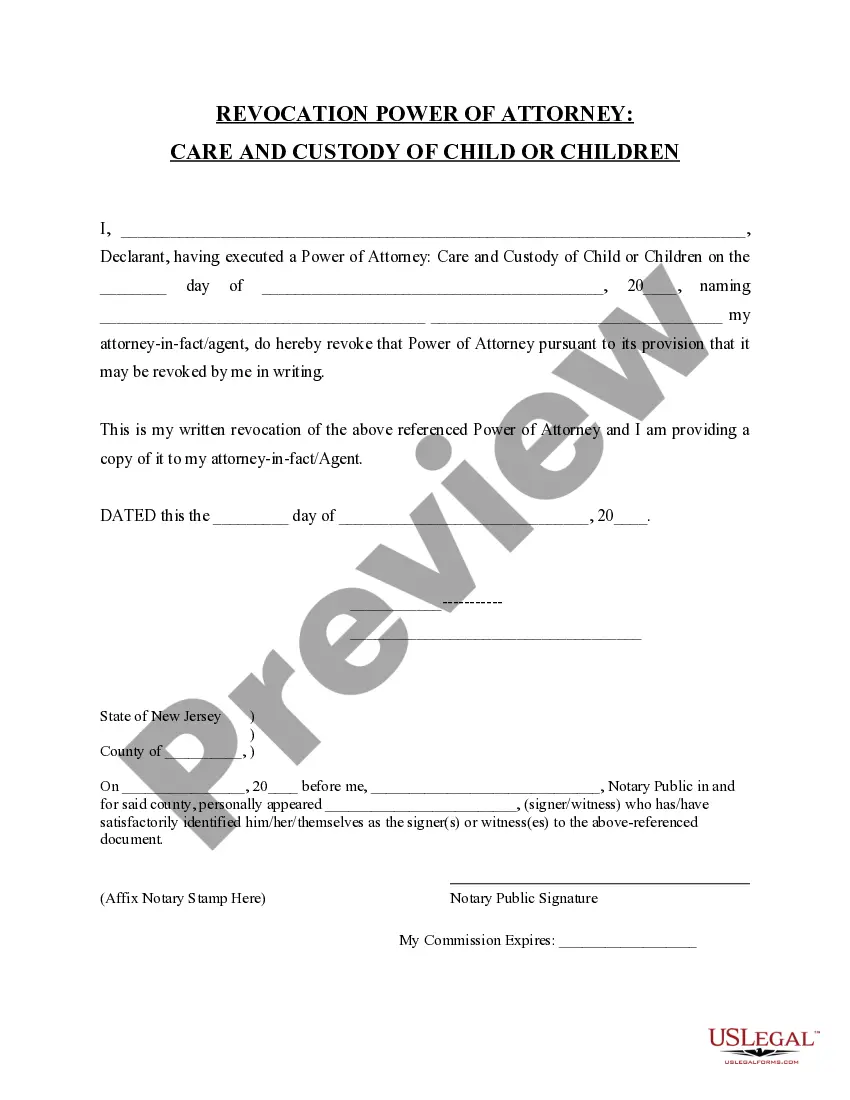

How to fill out New Jersey Revocation Of Power Of Attorney For Care Of Child Or Children?

Obtaining legal templates that meet the federal and local laws is a matter of necessity, and the internet offers many options to choose from. But what’s the point in wasting time searching for the appropriate New Jersey Attorney Nj Form Nj-1065 Instructions 2021 sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are simple to browse with all files grouped by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your form is up to date and compliant when getting a New Jersey Attorney Nj Form Nj-1065 Instructions 2021 from our website.

Obtaining a New Jersey Attorney Nj Form Nj-1065 Instructions 2021 is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview option or via the text outline to make certain it fits your needs.

- Browse for another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your New Jersey Attorney Nj Form Nj-1065 Instructions 2021 and download it.

All documents you locate through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

How do I e-file the NJ-CBT-1065 return, extension or estimated payments? Close the tax return. Open the EF Center HomeBase view. Find the client and look for the line that shows NJ CBT as the return type (or NJ CBT Pmt for estimated tax payments). Highlight the line that you need to e-file.

Form 1065 instructions Profit and loss statement. Balance sheet. Deductible expenses and total gross receipts. Basic information about the partnership and the partners. Cost of goods sold (if your business sells physical goods). W-2 and W-3 forms. Form 114. Form 720.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).

For New Jersey Gross Income Tax purposes, every partnership or limited liability company (LLC 1065) that has income from sources in the State of New Jersey, or has a New Jersey resident partner, must file the New Jersey Partnership Return, Form NJ-1065; Form NJ-1065 is no longer solely an information return.