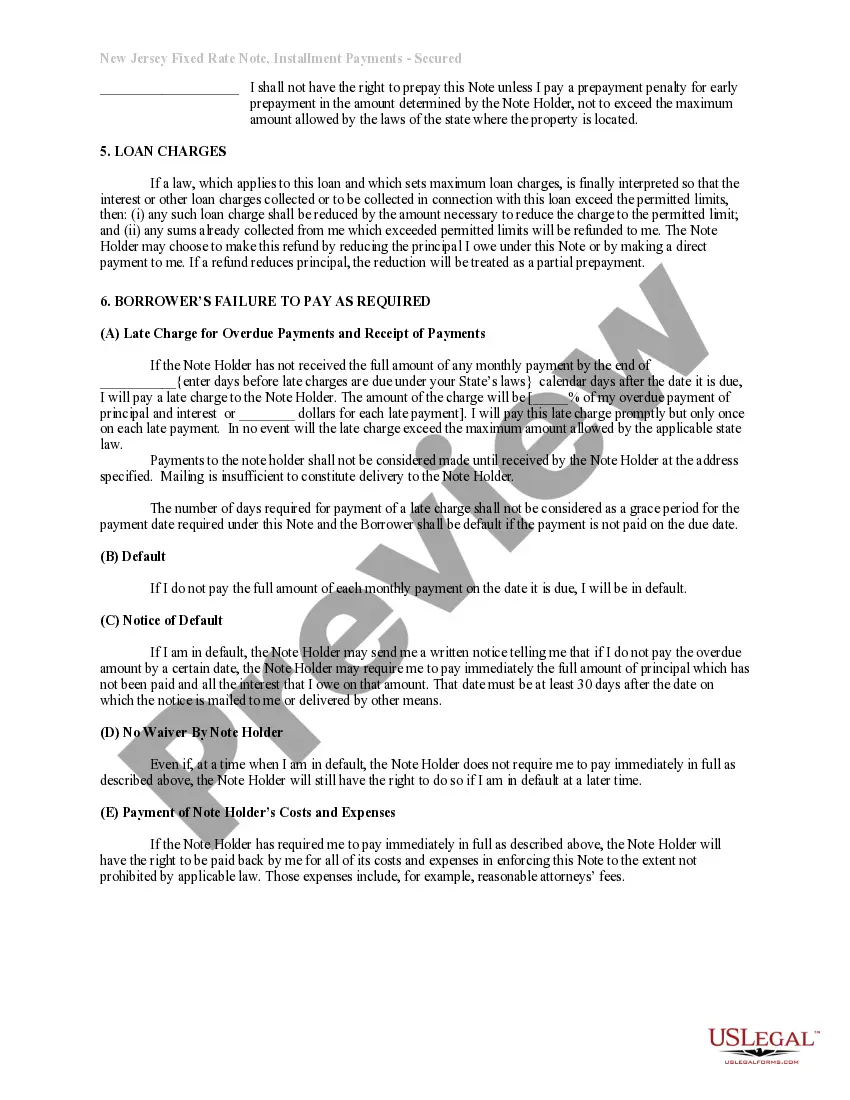

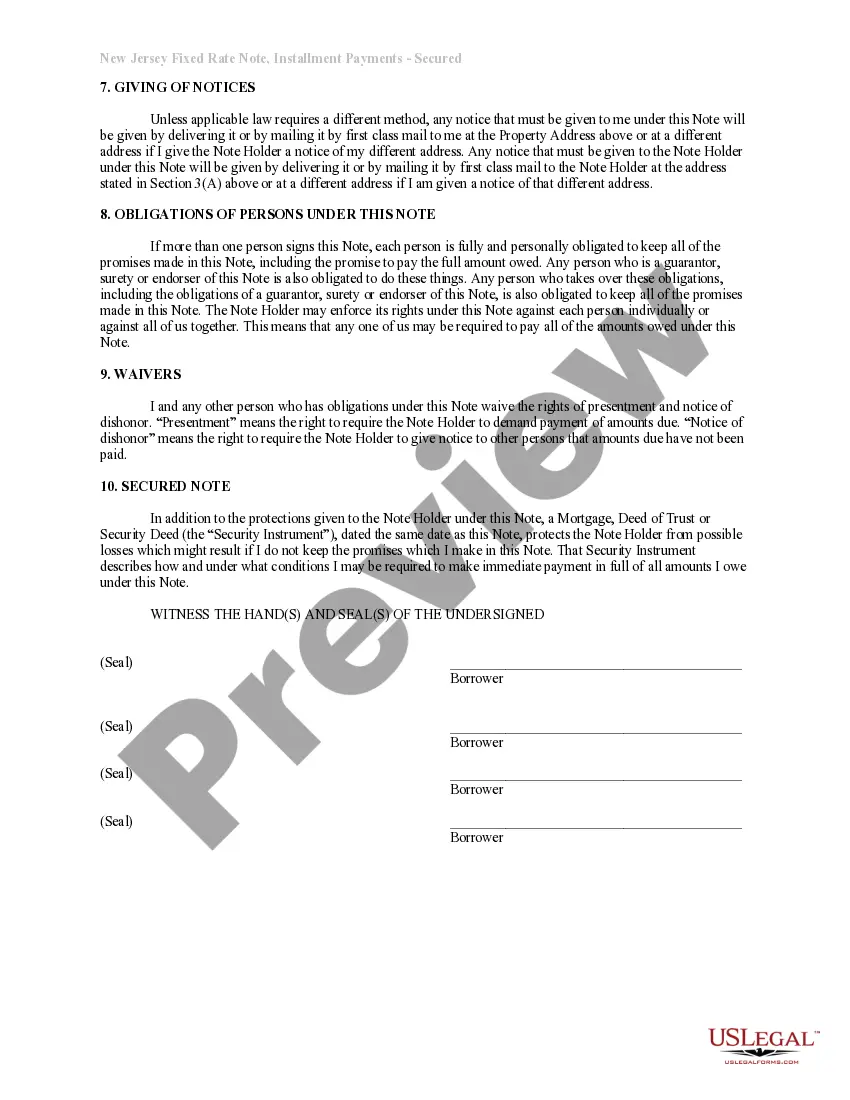

Fixed Promissory Note With Payment Schedule

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Individuals often link legal documentation with something intricate that solely a specialist can manage.

In some respect, it's accurate, as crafting Fixed Promissory Note With Payment Schedule necessitates considerable knowledge in subject specifics, including state and county laws.

However, with US Legal Forms, matters have become more straightforward: ready-to-use legal templates for any life and business scenario tailored to state regulations are compiled in a single online directory and are now accessible to everyone.

Print your document or import it into an online editor for a quicker fill-out. All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them anytime needed via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current templates categorized by state and area of application, so searching for Fixed Promissory Note With Payment Schedule or any other specific form only requires minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users to the service will need to create an account and subscribe before they can save any documents.

- Here is the step-by-step guide on how to obtain the Fixed Promissory Note With Payment Schedule.

- Examine the page content thoroughly to confirm it meets your requirements.

- Review the form description or verify it using the Preview option.

- Find another template using the Search field in the header if the previous one doesn't match your needs.

- Click Buy Now once you identify the appropriate Fixed Promissory Note With Payment Schedule.

- Select a subscription plan that fits your needs and financial plan.

- Establish an account or Log In to proceed to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

If the loan is for a period of months, divide the number of months by 12 to determine the time multiplier. For example, for a nine-month promissory note, divide 9 by 12 (the number of months in a year) to equal 0.75. Multiply 750 by 0.75 to equal 562.50.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the maker or issuer) promises in writing to pay a determinate sum of money to the other (the payee), either at a fixed or determinable future time or