Fixed Promissory Note With Chattel Mortgage

Description

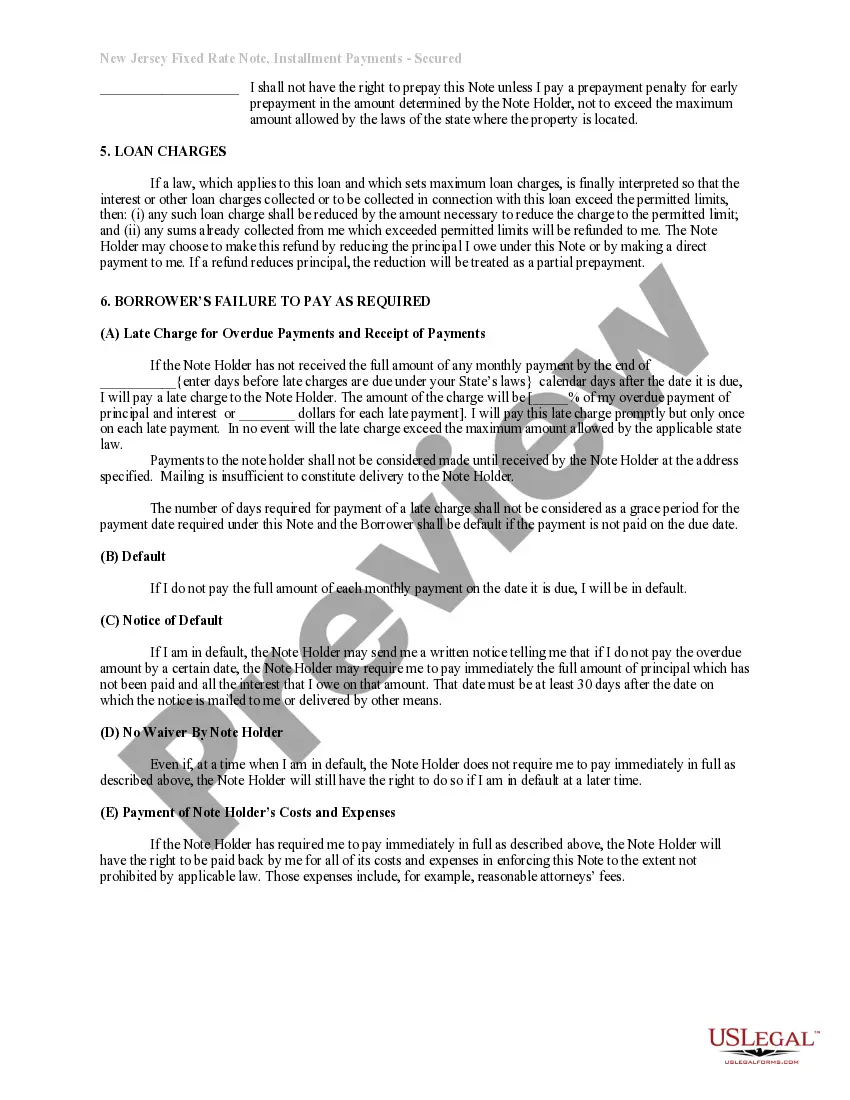

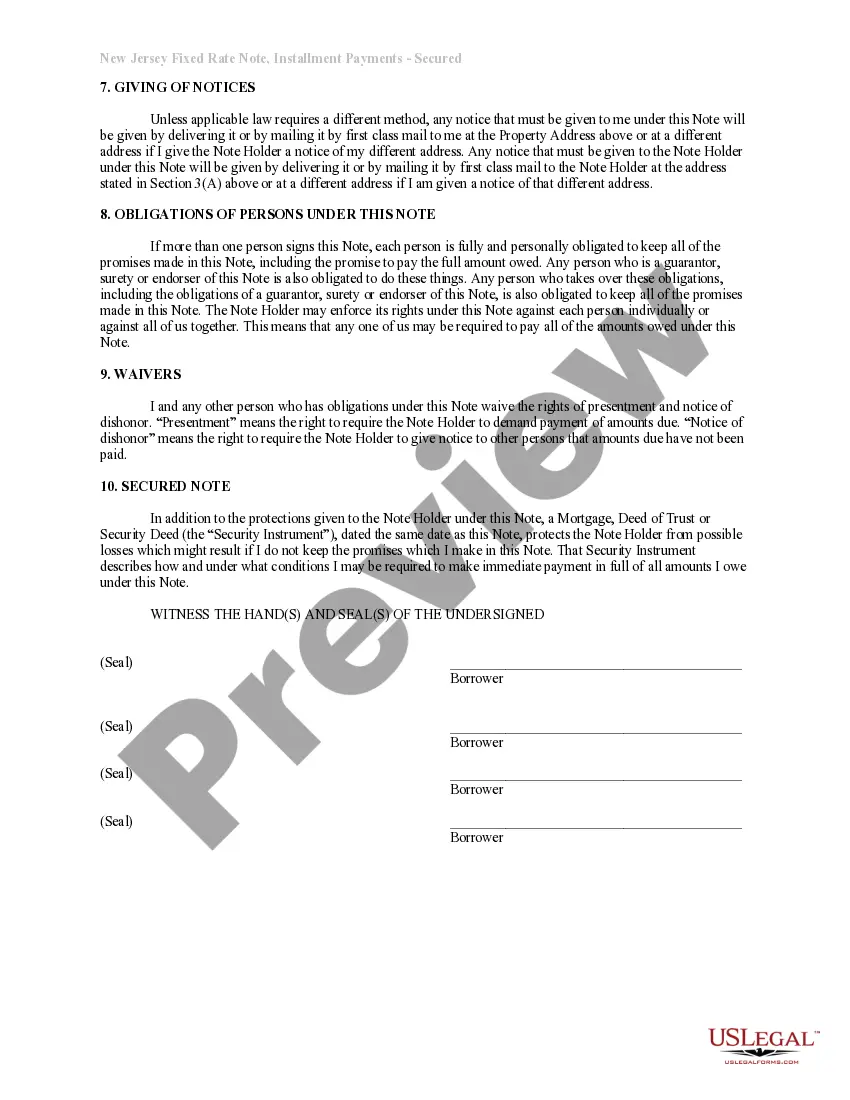

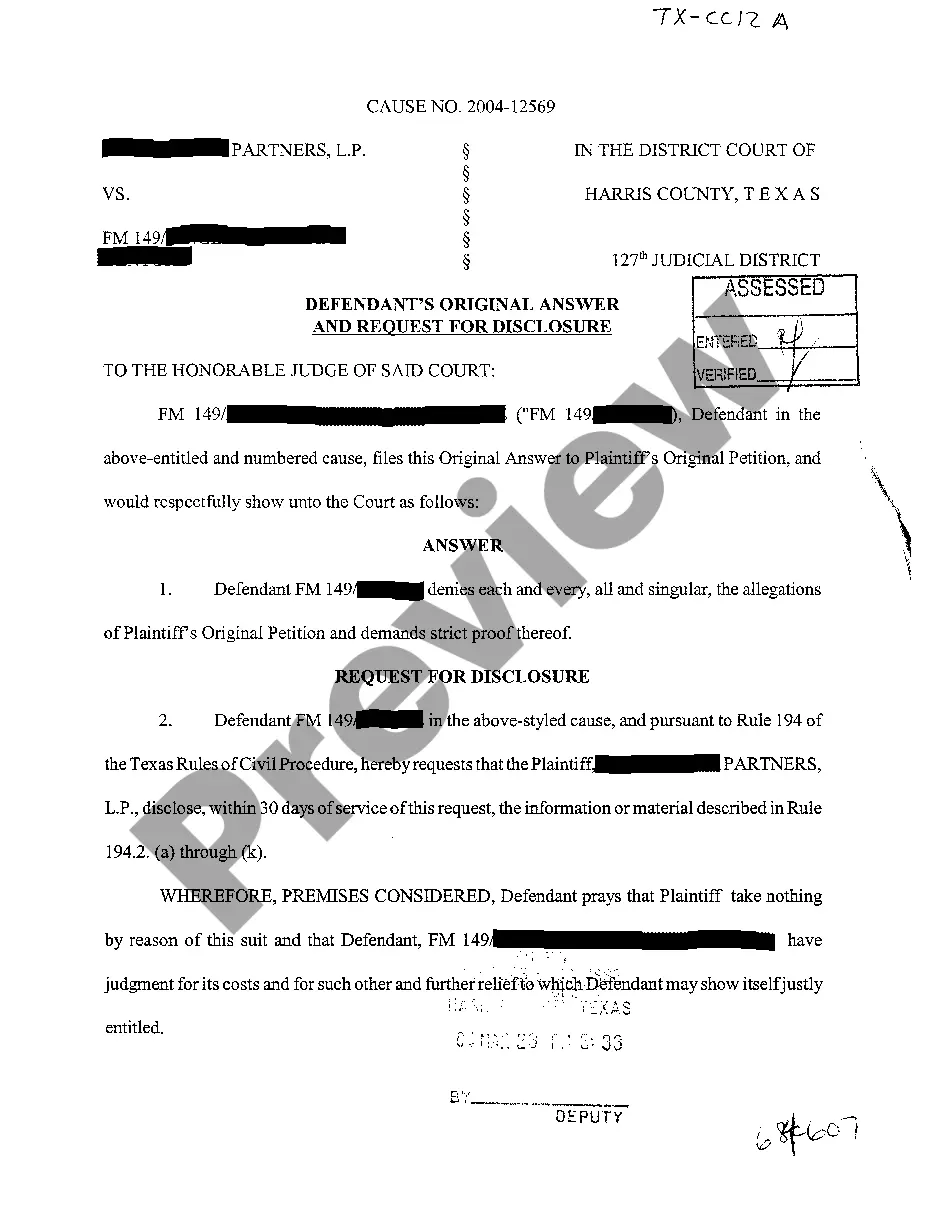

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

There's no longer a need to spend hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in a single location and made their access more straightforward.

Our platform offers over 85k templates for various business and personal legal situations categorized by state and area of application.

Preparing official documents under federal and state regulations is quick and easy with our library. Experience US Legal Forms now to maintain your documentation in order!

- All forms are professionally prepared and validated for authenticity, ensuring you receive a current Fixed Promissory Note With Chattel Mortgage.

- If you are acquainted with our service and possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever needed by accessing the My documents tab in your profile.

- If you've never used our service earlier, the process will require a few additional steps to finish.

- Here's how new users can locate the Fixed Promissory Note With Chattel Mortgage in our collection.

- Review the page content thoroughly to confirm it includes the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Chattel Mortgage DefinitionA chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle. The movable property, called chattel, also acts as collateral for the loan.

The bookkeeping behind the Chattel Mortgage purchase:Deposit Paid (Current Asset) no tax code.Motor Vehicles at Cost (Non-Current Asset) apply capital expense including GST tax code.Chattel Mortgage (Motor Vehicle) (Non-Current Liability) no tax code.Chattel Mortgage Interest Charges (Expense) no tax code.More items...?

A chattel mortgage allows the buyer to use the equipment while the lender retains an ownership interest. The lender can recover the equipment and sell it to pay off the loan balance if the buyer defaults. Chattel mortgages are used to purchase new and used equipment.

Debit asset/car by the amount cost of the car. Credit cash by the amount of down payment and notes payable-car loan by the amount of any borrowed money for the car. If no money is borrowed, then credit cash for the entire cost of the car. In the example, debit asset/car by $20,000.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.