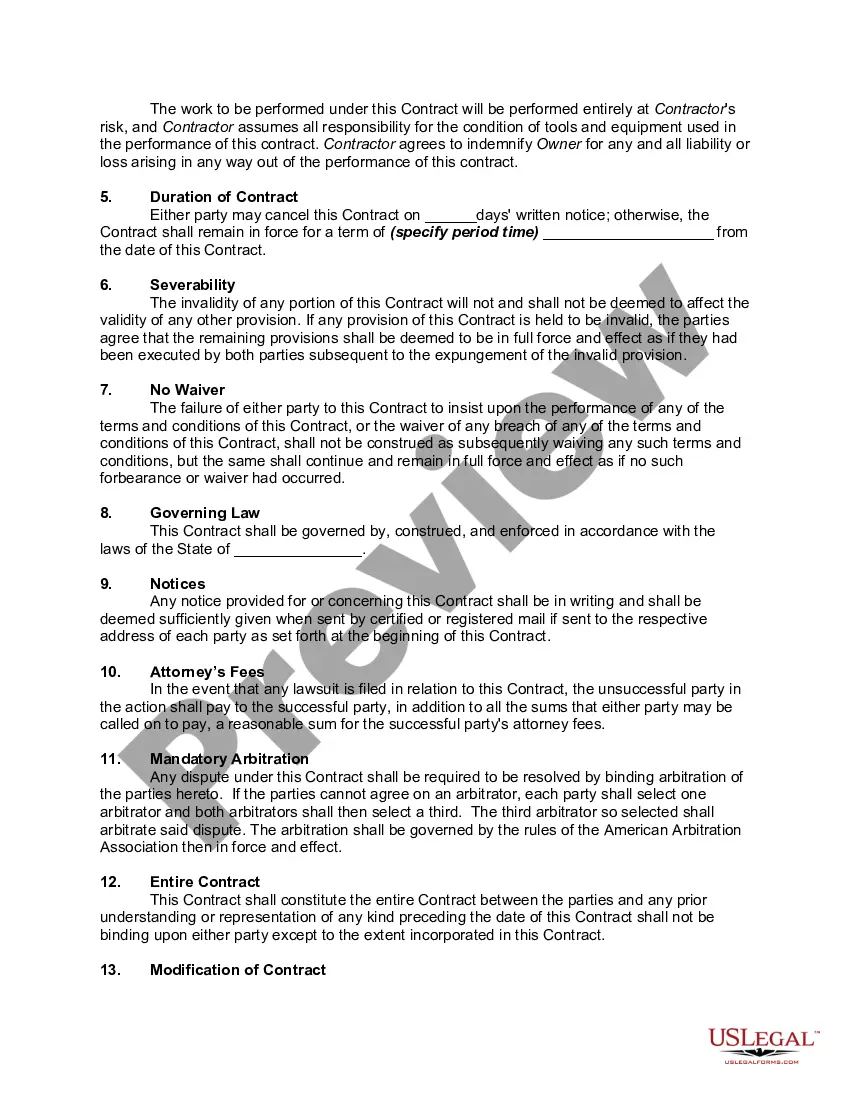

Independent Contractor Programmer With Only One Client

Description

How to fill out Contract Between Web Designer And Programmer And Web Design Company?

No longer is it necessary to squander hours hunting for legal documents to fulfill your local state regulations.

US Legal Forms has gathered all of them in one centralized location and improved their availability.

Our platform offers over 85,000 templates for various business and personal legal situations categorized by state and area of application.

Quickly and easily prepare formal documentation under federal and state regulations with our library. Experience US Legal Forms now to maintain your paperwork organized!

- All documents are expertly drafted and verified for accuracy, ensuring you receive the latest Independent Contractor Programmer With Only One Client.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by navigating to the My documents section in your profile.

- If you have not utilized our platform before, the procedure will require a few additional steps to complete.

- Here’s how new users can access the Independent Contractor Programmer With Only One Client from our library.

- Carefully examine the page content to verify it includes the example you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

Independent contractors should use their own computer, work vehicle, tools, etc. Does the worker have other customers? Contractors should be free to pursue other projects.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

Independent contractors usually offer their services to the general public, not just to one person or company.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.