New Jersey Estate Without Power

Description

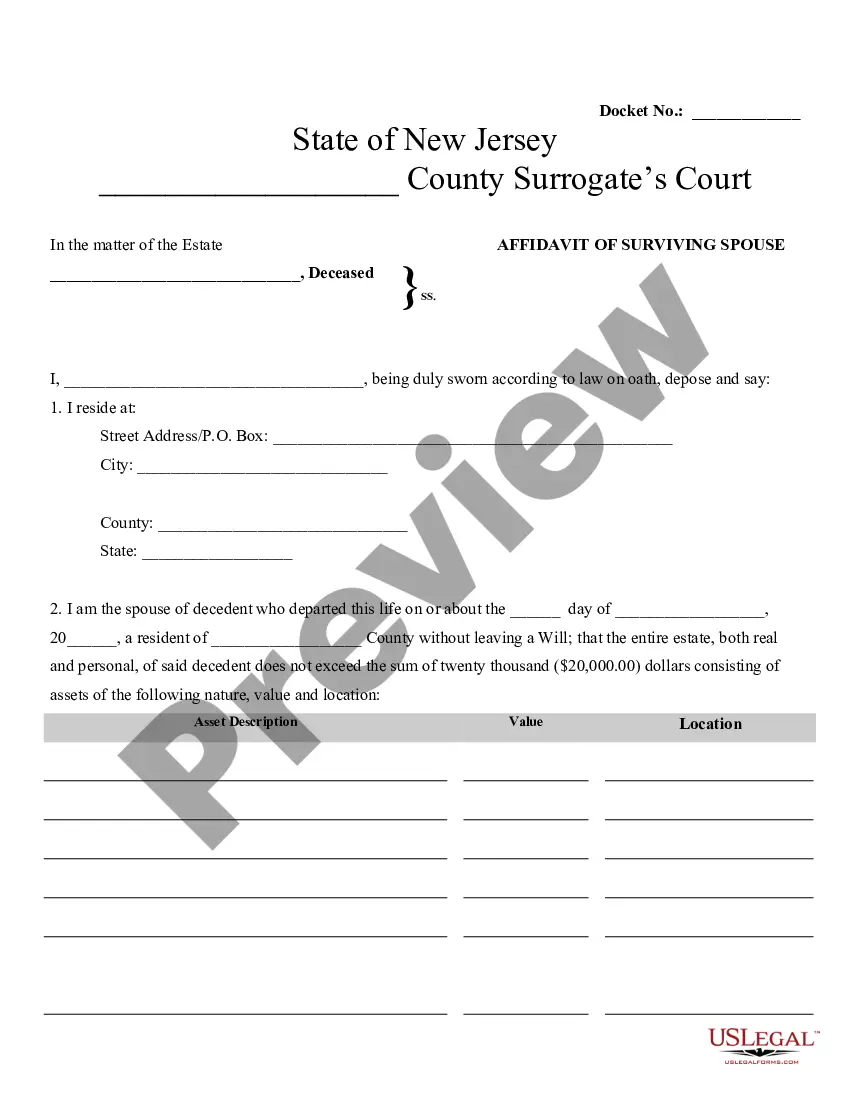

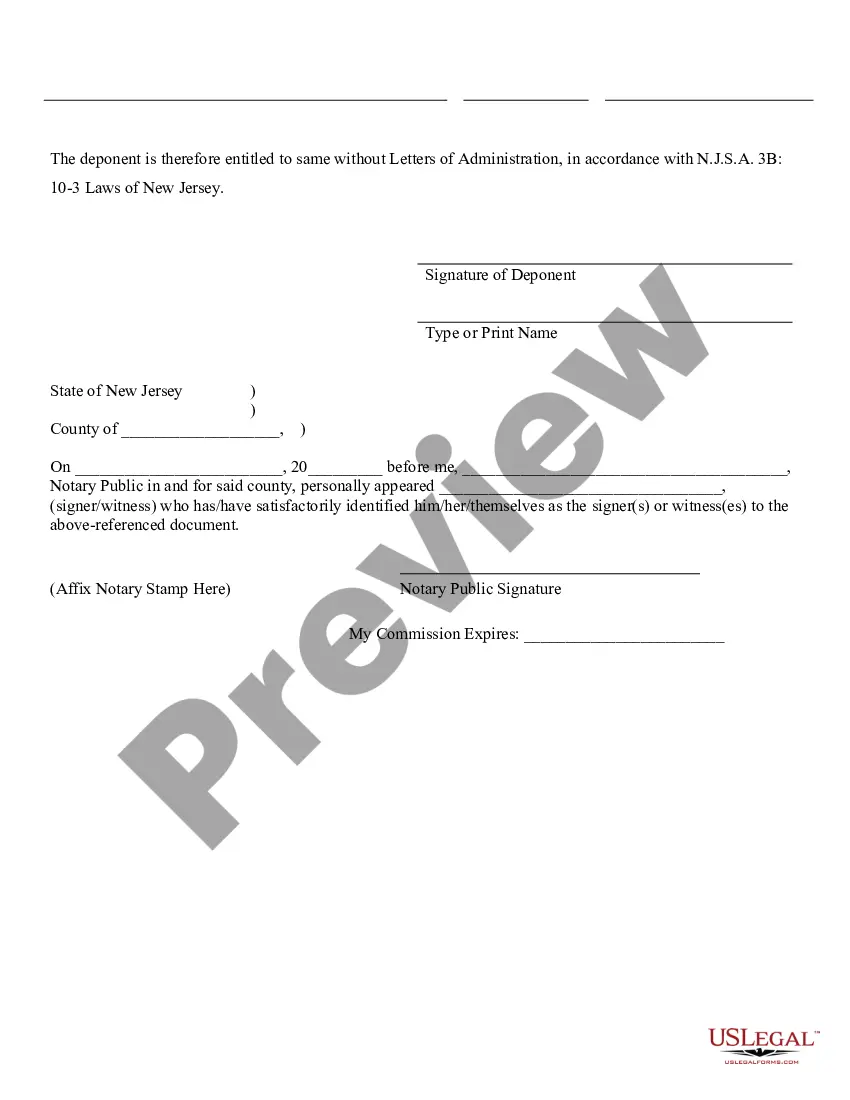

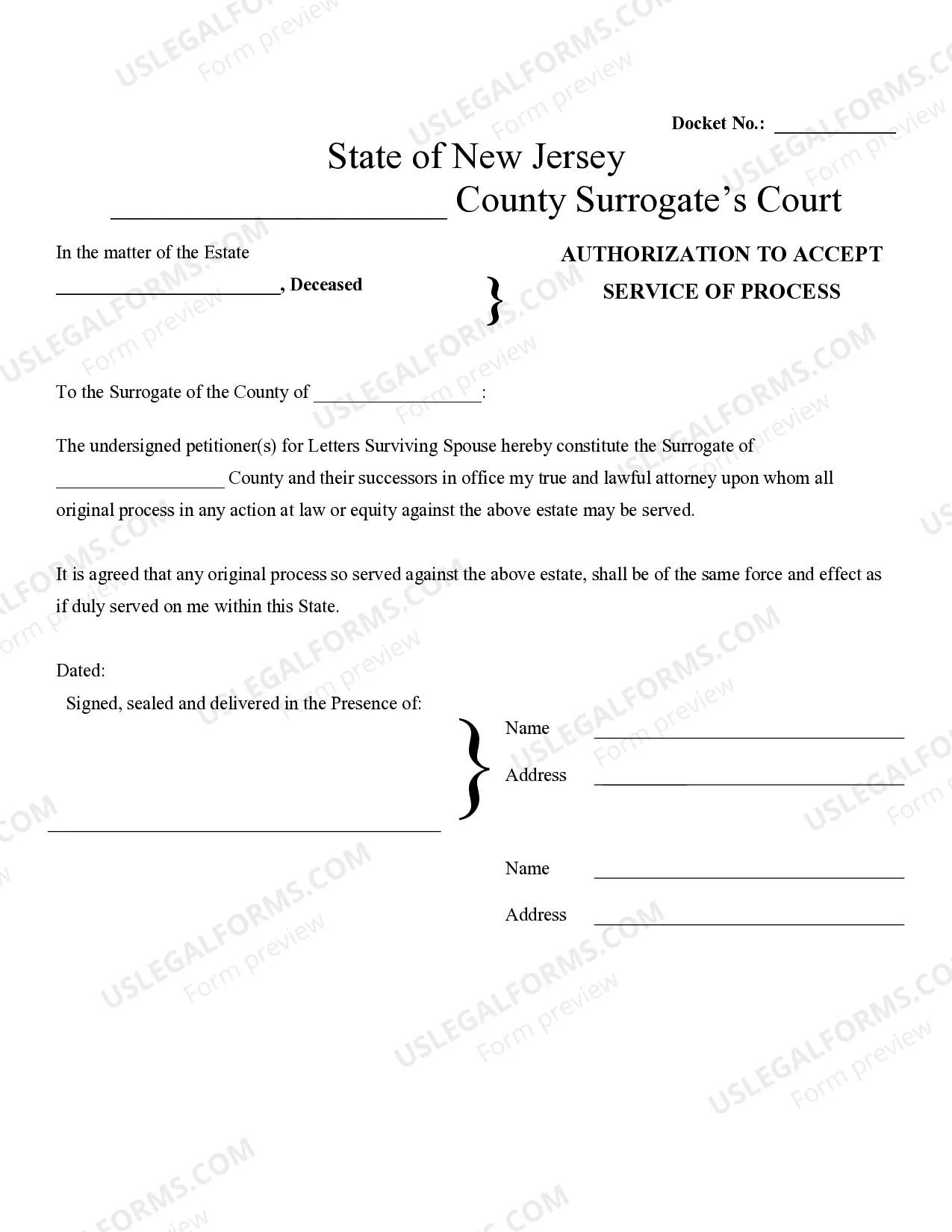

How to fill out New Jersey Small Estate Affidavit For Estates Under 20,000?

When you must complete New Jersey Estate Without Power that adheres to your local state's laws, various options may be available. There’s no necessity to review every form to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a trustworthy source that can assist you in obtaining a reusable and current template on any subject. US Legal Forms possesses the most extensive online catalog with a collection of over 85k ready-to-use documents for business and personal legal situations. All templates are confirmed to adhere to each state's laws.

Therefore, when downloading New Jersey Estate Without Power from our site, you can be assured that you possess a legitimate and current document.

Select the most fitting subscription plan, Log In to your account, or set one up. Make a payment for a subscription (PayPal and credit card methods are available). Download the sample in your preferred file format (PDF or DOCX). Print the document or complete it electronically using an online editor. Obtaining accurately drafted formal documents becomes effortless with US Legal Forms. Additionally, Premium users can enjoy the robust integrated tools for online PDF editing and signing. Give it a try today!

- Acquiring the necessary sample from our platform is quite simple.

- If you already hold an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Afterward, you can access the My documents section in your profile and retain access to the New Jersey Estate Without Power at any time.

- If it’s your initial encounter with our website, kindly follow the instructions below.

- Browse the suggested page and verify it for alignment with your needs.

- Utilize the Preview mode to review the form description if available.

- Search for another template using the Search bar in the header if necessary.

- Click Buy Now once you identify the appropriate New Jersey Estate Without Power.

Form popularity

FAQ

If there are no surviving children or parents then the surviving spouse gets 100% of the decedent's estate. A child or children receive one-half of the probate estate balance divided equally, by representation.

A removed or discharged fiduciary must deliver to his or her successor all assets as of the date of discharge generally and then he or she must prepare, file and settle his/her accounts within 60 days after entry of judgement or within such time as the court may direct.

You just need to obtain the death certificate, and existing ownership deed to the court. If your spouse had mentioned a certain division of the property in his will, then the property shall be distributed accordingly by the testator. However a sale deed will have to be executed to make it legally valid.

If there are no surviving children or parents then the surviving spouse gets 100% of the decedent's estate. A child or children receive one-half of the probate estate balance divided equally, by representation.

Beneficiaries have the right to be informed As a beneficiary, you are entitled to have an accounting from the executor, also known as a personal representative or fiduciary.