New Jersey Trust Without An Attorney

Description

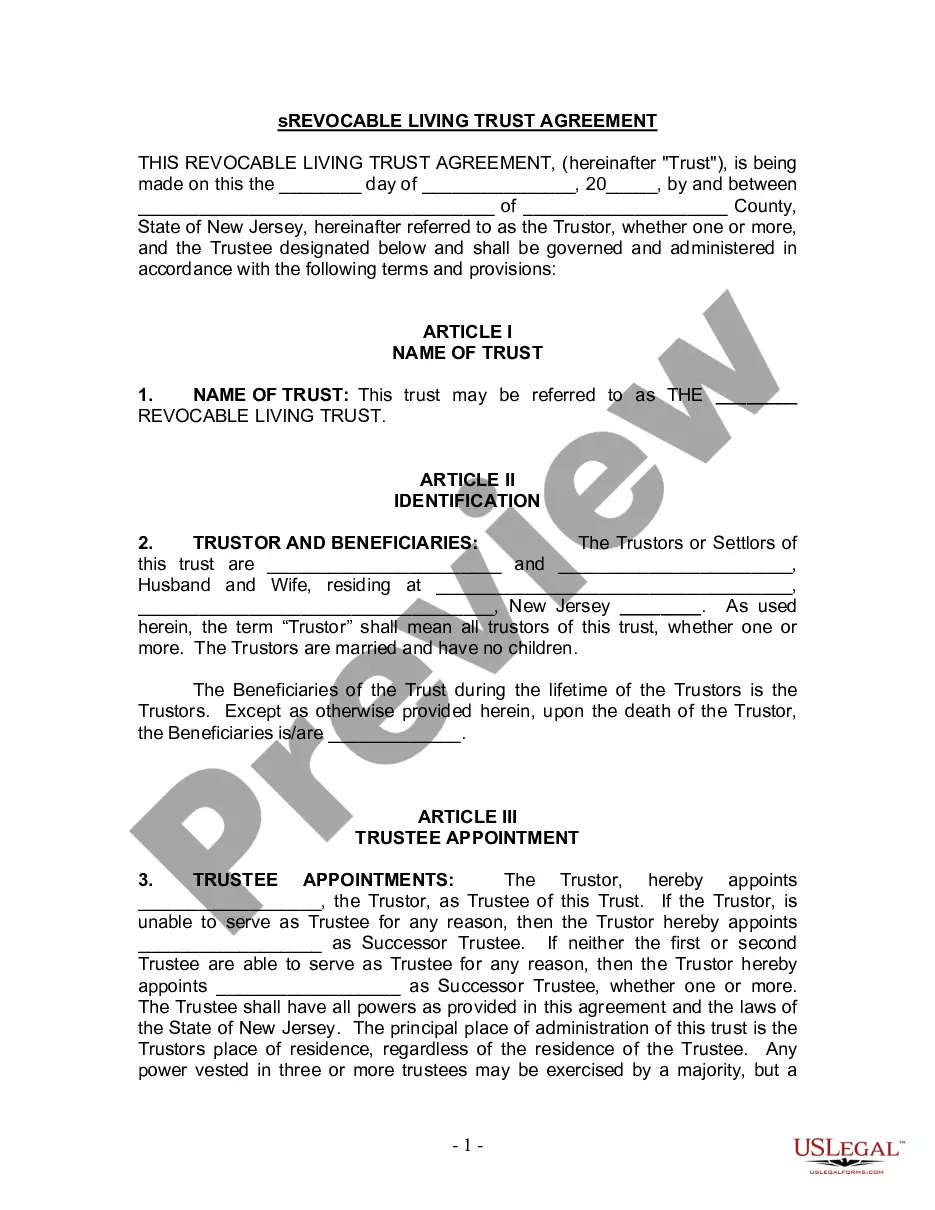

How to fill out New Jersey Living Trust For Husband And Wife With No Children?

Legal management can be mind-boggling, even for the most skilled specialists. When you are looking for a New Jersey Trust Without An Attorney and don’t get the time to devote trying to find the correct and updated version, the procedures could be demanding. A robust online form library might be a gamechanger for everyone who wants to take care of these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you may have, from individual to enterprise documents, in one spot.

- Employ advanced resources to complete and manage your New Jersey Trust Without An Attorney

- Gain access to a useful resource base of articles, instructions and handbooks and resources relevant to your situation and needs

Help save time and effort trying to find the documents you will need, and employ US Legal Forms’ advanced search and Preview feature to locate New Jersey Trust Without An Attorney and get it. If you have a subscription, log in in your US Legal Forms profile, look for the form, and get it. Review your My Forms tab to see the documents you previously saved as well as manage your folders as you can see fit.

Should it be your first time with US Legal Forms, make an account and get unrestricted usage of all advantages of the platform. Here are the steps to consider after getting the form you need:

- Verify this is the proper form by previewing it and reading its information.

- Ensure that the sample is acknowledged in your state or county.

- Select Buy Now once you are all set.

- Choose a monthly subscription plan.

- Pick the formatting you need, and Download, complete, sign, print out and send your papers.

Benefit from the US Legal Forms online library, supported with 25 years of experience and stability. Enhance your everyday papers managing into a easy and easy-to-use process today.

Form popularity

FAQ

Many estate planning attorneys will suggest that an individual have both a will and a living trust in New Jersey. It's important to discuss your particular needs with an estate planning attorney in New Jersey to understand how either document will fulfill them.

To create a living trust in New Jersey, the trust document is signed by the trust-maker in front of a notary public, and then ownership of assets must be transferred into the name of the trust to make it effective.

How much does a Trust cost in New Jersey? In New Jersey, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

Under New Jersey law, trusts must be created through a written document. While having witnesses and notarizing the trust document technically aren't required, these measures can help safeguard against claims that the document isn't valid. The grantor must also have legal capacity to create the trust.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.