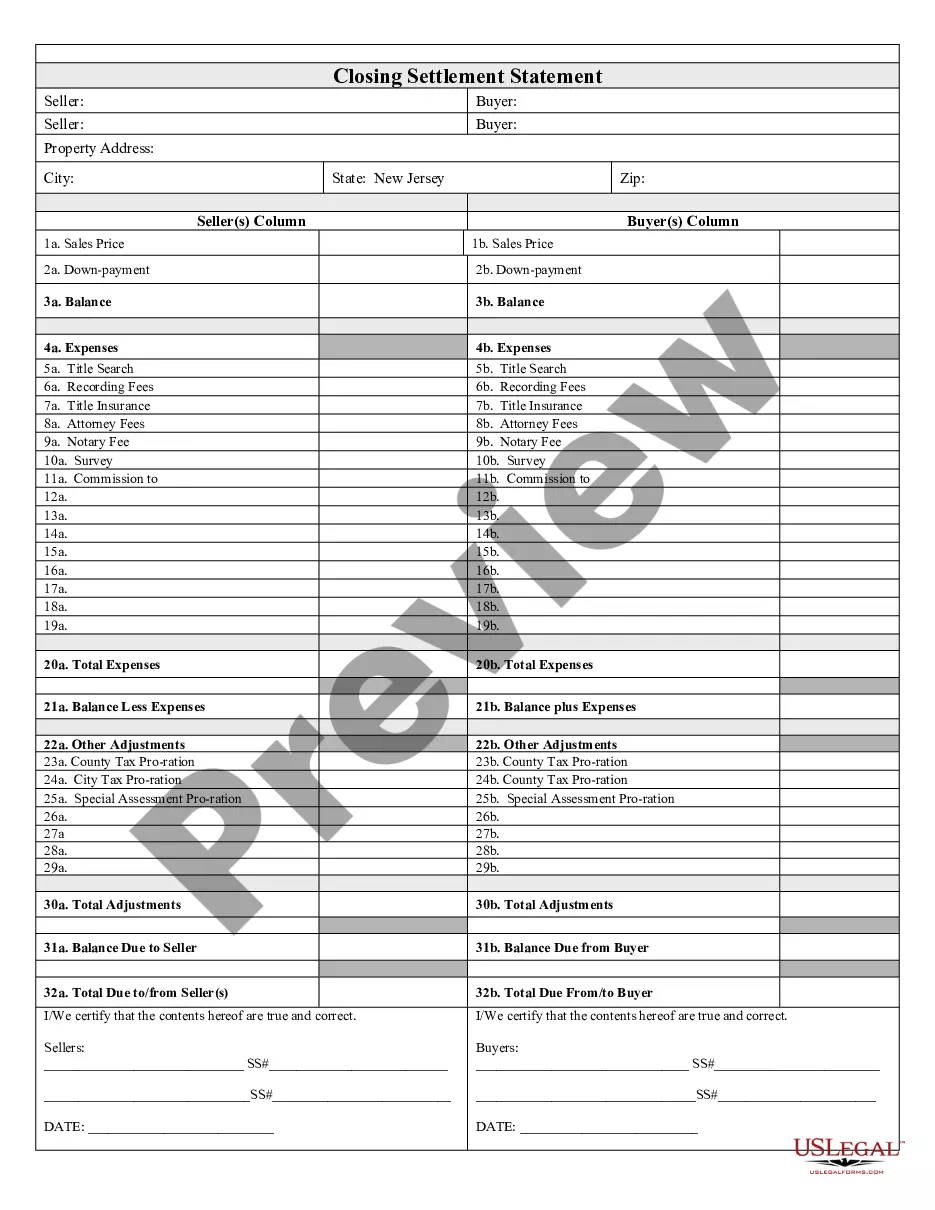

Closing Statement Form For A Business

Description

How to fill out New Jersey Closing Statement?

- If you're already a US Legal Forms user, log in to your account.

- Check your subscription status to ensure it's active. If not, renew it as per your payment plan.

- Search for the closing statement form template you need and confirm it meets your local jurisdiction requirements.

- If necessary, use the search function to locate other relevant forms.

- Select the 'Buy Now' option and choose your preferred subscription plan.

- Complete your registration if you're a new user to access the library.

- Make your purchase by entering your payment details or using PayPal.

- Finally, download the form and save it to your device, accessible anytime through the 'My Forms' section.

By following these steps, you will successfully obtain a closing statement form tailored to your needs. US Legal Forms not only provides a vast selection but also ensures that you receive support from premium experts for any forms you need.

Start creating your business's closing statement today with US Legal Forms and make your legal processes simpler.

Form popularity

FAQ

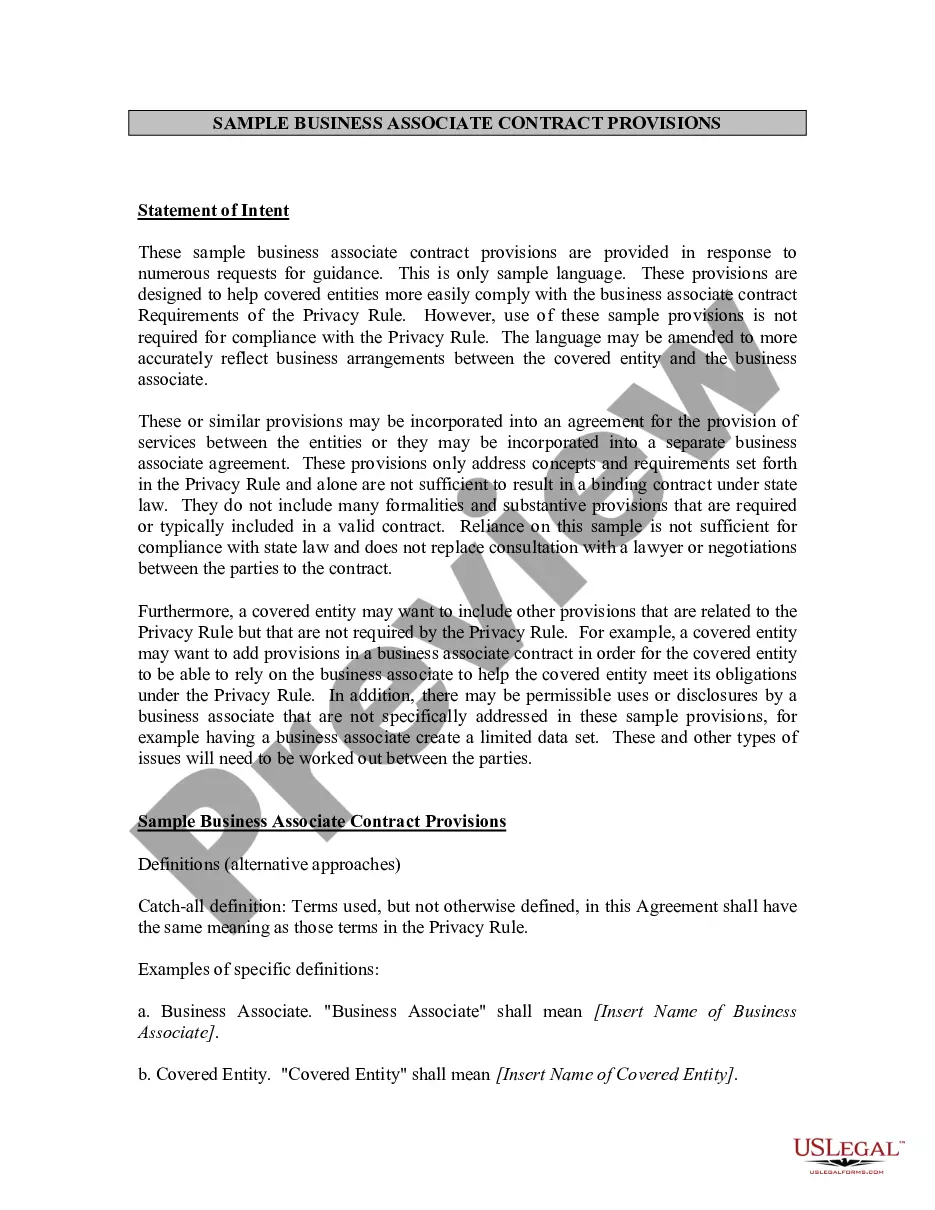

When you sell your business, the EIN typically remains with the business entity rather than transferring to the new owner. This means that the new owner must apply for a new EIN to continue operations under a separate entity. To ensure all transitions are smooth, consider completing a closing statement form for a business to finalize your obligations before the sale. This method helps clarify the status of your business and protects both parties involved.

Yes, you can dissolve your LLC while retaining your EIN, but this decision should be based on specific circumstances. Keeping the EIN can simplify the process if you plan to start another business in the future. However, filing a closing statement form for a business is still advisable to ensure all tax filings are correct and to avoid future complications. Always review your options with a legal or tax expert to determine the best course of action.

Filing a final Form 941 is a critical step if you close your business and have payroll tax responsibilities. You'll need to indicate that this is your final return and ensure all employee wages and taxes are reported correctly. Completing a closing statement form for a business can streamline this process by preparing the necessary details and helping you fulfill your obligations. If you're unsure, professional assistance can offer clarity.

Failing to cancel your EIN can lead to ongoing tax obligations, even after your business has ceased operations. The IRS may continue sending tax-related notifications and can complicate matters if you're trying to reopen a business later. It's wise to submit a closing statement form for a business to provide clarity on your situation. This process helps prevent any unwarranted financial or legal issues.

When you close your business, it's important to know whether to cancel your EIN. Generally, you do not need to cancel your EIN if you close your business and properly file your final tax returns. However, you should include your EIN when you submit a closing statement form for a business to ensure all records are correctly managed. Consult with a tax professional for tailored advice.

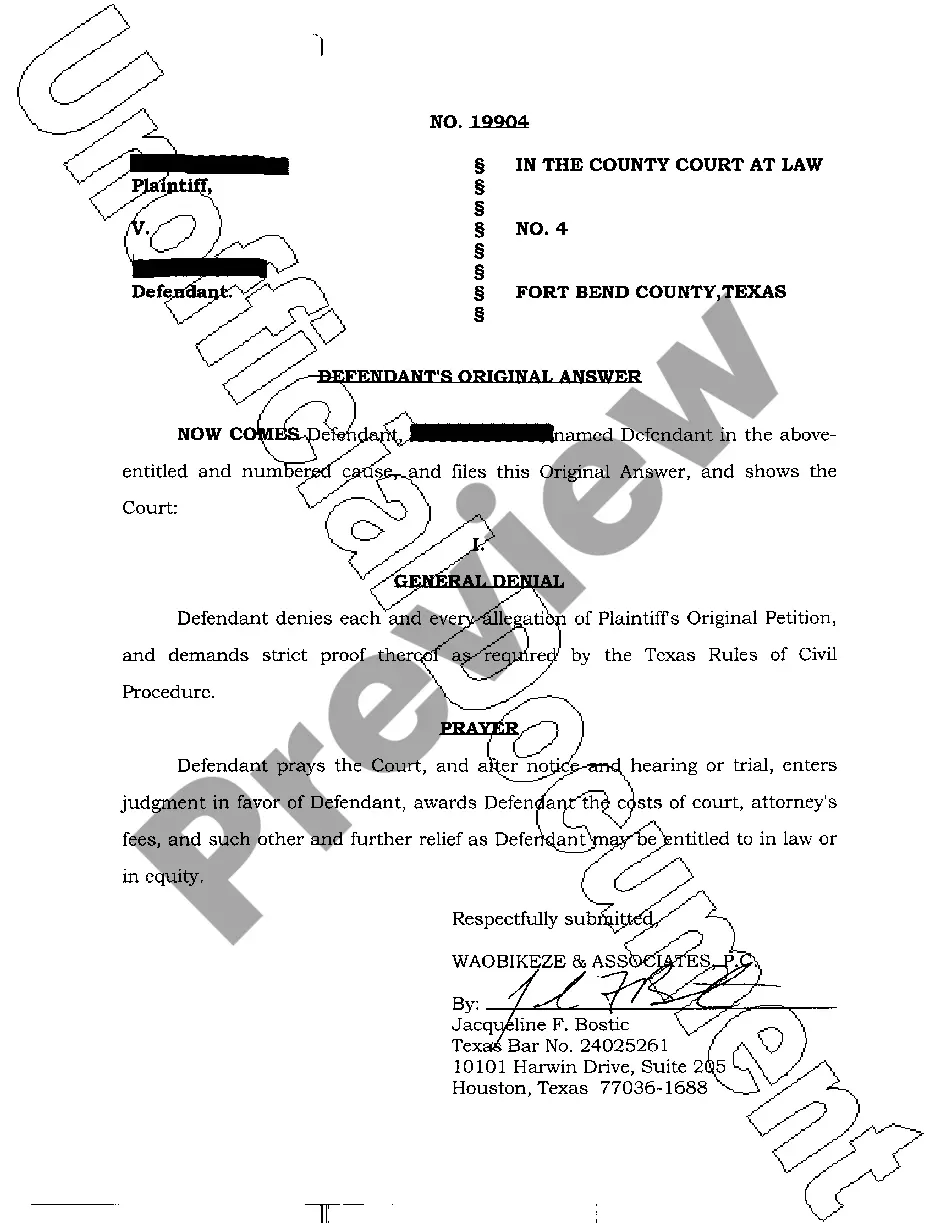

Closing the sale in business refers to the culmination of negotiations where the buyer and seller agree to transfer ownership. This step involves finalizing all agreements, contracts, and payments necessary for the transaction. A properly executed closing statement form for a business serves as a critical tool in documenting this moment, providing security for both parties.

The closing of a business sale refers to the final step in the transaction where ownership is officially transferred. This process includes signing documents and settling financial accounts related to the sale. A well-prepared closing statement form for a business is essential as it consolidates all terms and agreements to ensure both parties are aligned.

To write a business closing statement, begin by listing all final financial transactions and obligations. Clearly document any distributions to partners or shareholders, and include relevant dates and signatures for approval. Utilizing a closing statement form for a business can streamline this process and provide a structured format for capturing all critical elements.

When communicating about your business closing, it’s essential to express gratitude to your customers and employees. Clearly outline the reasons for the closure and emphasize any important next steps, such as final sales or transition plans. Using a closing statement form for a business can help articulate this message formally and ensure that all necessary information is included.

A closing statement of sale is a detailed document that outlines the final terms of a business transaction. This form summarizes the financial aspects of the sale, including costs and any distributions to shareholders. When completing your closing statement form for a business, ensure all financial details are transparent and accurate to facilitate a smooth transaction.