New Jersey Corporation And Business Entity Database

Description

How to fill out New Jersey Business Incorporation Package To Incorporate Corporation?

Navigating through the red tape of formal documents and templates can be challenging, especially if one does not engage in that professionally.

Even selecting the appropriate template for a New Jersey Corporation and Business Entity Database will be labor-intensive, as it must be valid and accurate to the final detail.

However, you will need to invest considerably less time picking a suitable template from a source you can trust.

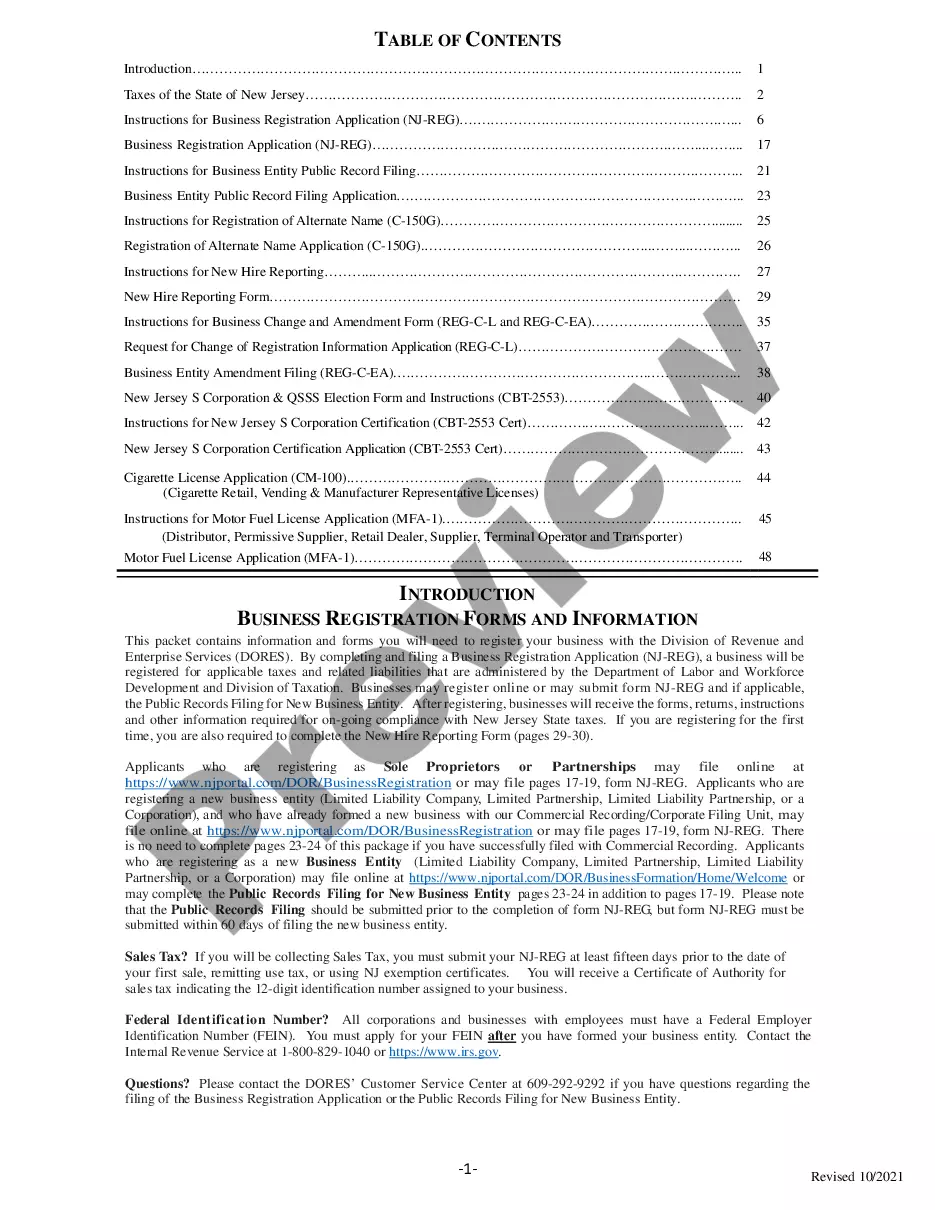

Obtain the correct form in a few straightforward steps: Enter the title of the document in the search box. Select the appropriate New Jersey Corporation and Business Entity Database from the results list. Review the outline of the sample or open its preview. If the template fulfills your criteria, click Buy Now. Proceed to select your subscription plan. Use your email to create a password for registering an account with US Legal Forms. Choose a payment method via credit card or PayPal. Save the template file on your device in your preferred format. US Legal Forms can save you time and trouble determining if the form you found online meets your needs. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the right forms online.

- US Legal Forms is a singular location where one can discover the latest examples of documents, get guidance on their use, and download these examples to complete them.

- This is a repository with over 85K forms relevant to various sectors.

- When seeking a New Jersey Corporation and Business Entity Database, you will not need to doubt its authenticity as all forms are validated.

- Creating an account on US Legal Forms will ensure you have all the necessary samples within your reach.

- Store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by simply clicking Log In on the library site.

- If you do not yet have an account, you can always re-search for the template you require.

Form popularity

FAQ

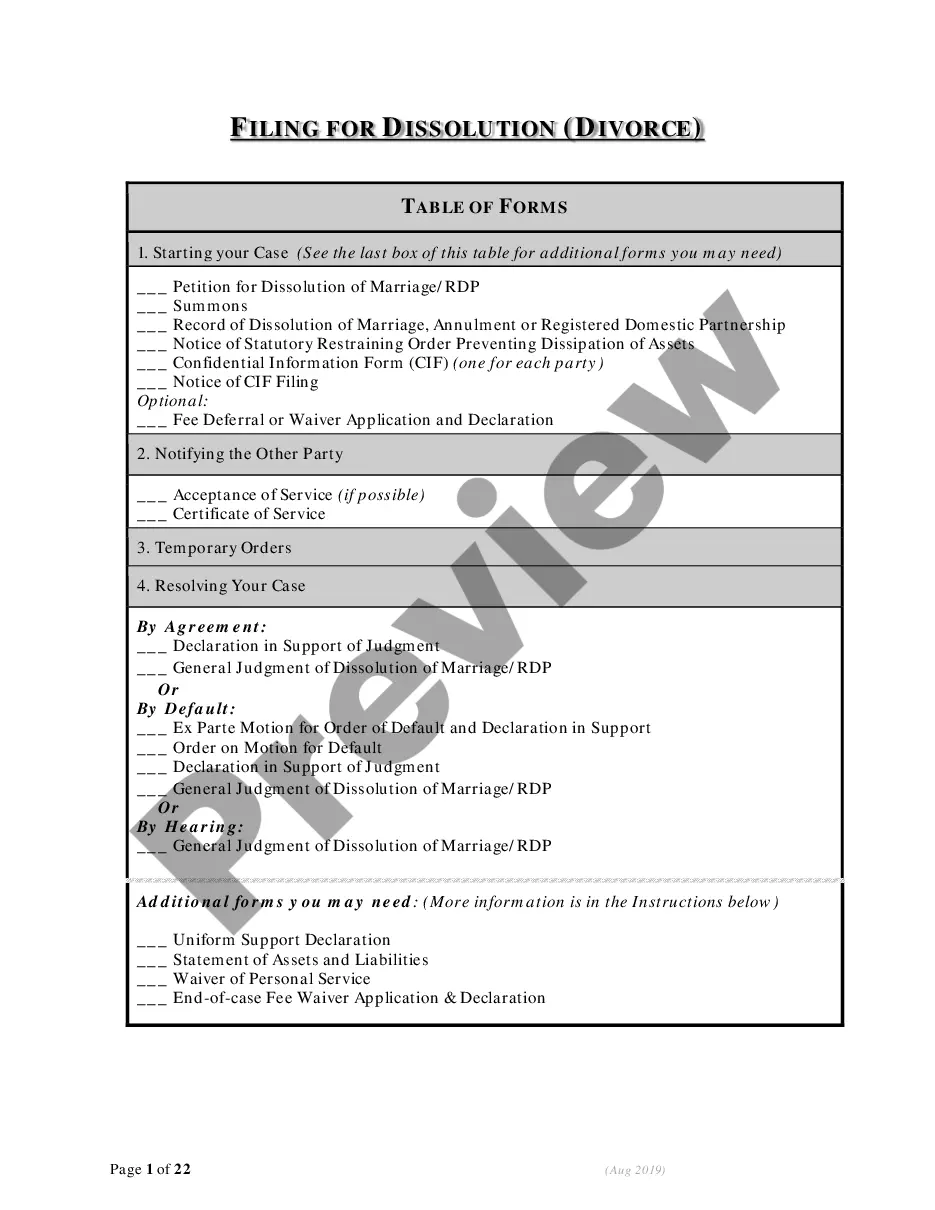

You can find out if a business is still active in NJ by searching the New Jersey Division of Revenue's online database. Enter the business name or other identifying information to get updated status details. The New Jersey corporation and business entity database provides the most accurate and reliable information.

To check if a business is active in New Jersey, visit the New Jersey Division of Revenue's website. Utilize their online search tool to look up the business using its name or entity number. The New Jersey corporation and business entity database will confirm its active status.

Yes, even online businesses must register in New Jersey. You need to follow state regulations to operate legally. By using the New Jersey corporation and business entity database, you can complete the registration process smoothly and efficiently.

Yes, New Jersey requires certain businesses to obtain a business license. The specific licensing requirements depend on your business type and location. For guidance, check the New Jersey corporation and business entity database or consult with uslegalforms to ensure compliance.

A business entity ID in New Jersey is a unique identifier assigned to your registered business. This ID helps you manage your business records and is crucial for legal and tax purposes. You can easily find this ID in the New Jersey corporation and business entity database.

To find your NJ business entity number, visit the New Jersey Division of Revenue and Enterprise Services website. You can search by your business name or other identifying details. Once you locate your business, the New Jersey corporation and business entity database will provide your entity number.

LLCs in New Jersey must file tax returns annually, reporting income and expenses using either a corporate or personal tax return, depending on the tax structure you choose. It's important to keep good financial records to meet your tax obligations accurately. Consulting the New Jersey corporation and business entity database can help you stay compliant, ensuring you have all necessary filings done on time.

Yes, New Jersey requires LLCs to file an Annual Report each year. This report is critical for keeping your business in good standing and is included in the New Jersey corporation and business entity database. Failing to file your Annual Report can lead to penalties and potential dissolution of your LLC, so be sure to keep this requirement in mind as you plan your business activities.

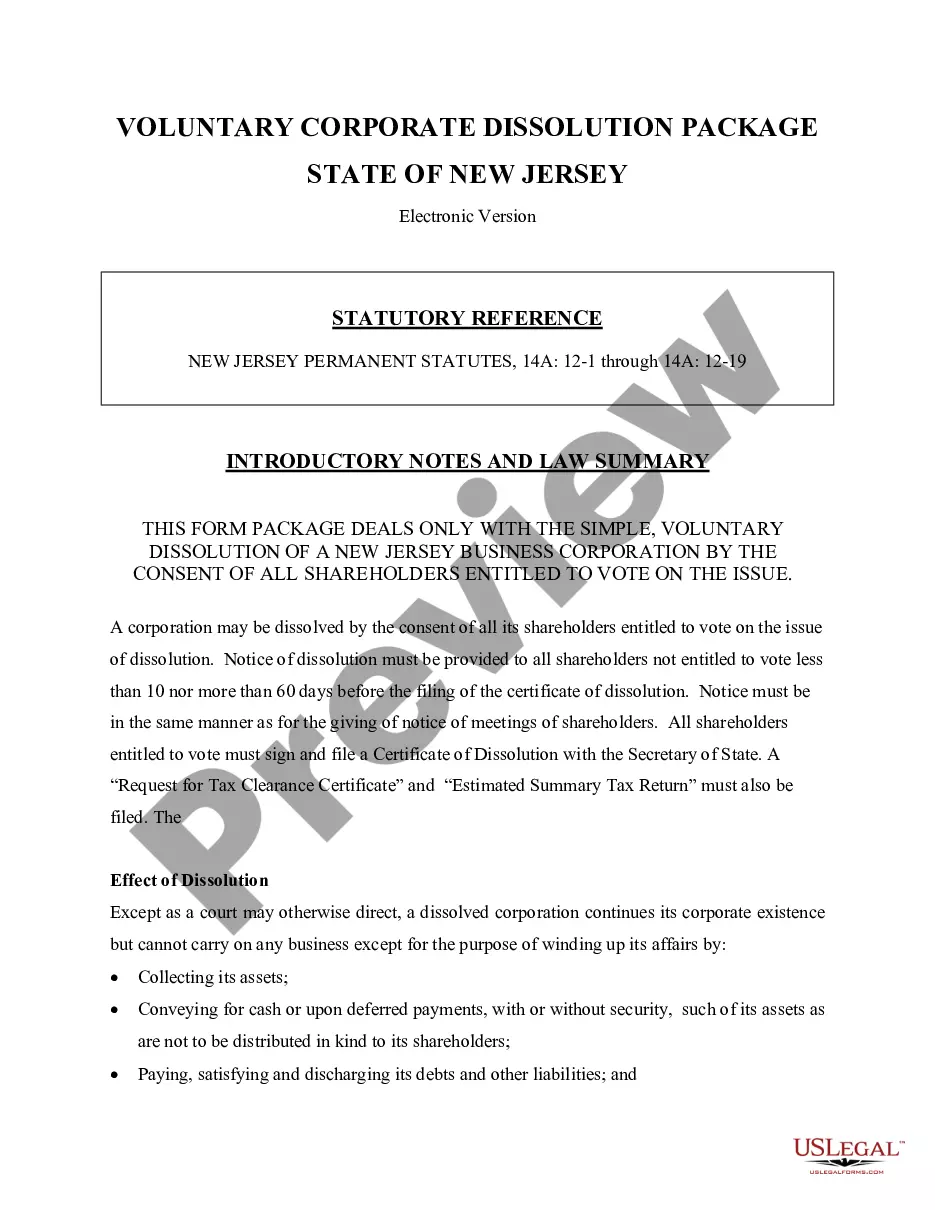

Setting up an S Corporation in New Jersey involves several steps, including forming a corporation and then electing S Corporation status with the IRS. You start by filing your Certificate of Incorporation with the New Jersey Division of Revenue, after which you can file Form 2553 with the IRS. Completing these steps ensures your business is properly registered in the New Jersey corporation and business entity database, allowing you to enjoy the tax benefits of operating as an S Corp.

A New Jersey business entity status report provides vital information about your business's current standing in the state. This report indicates if your entity is active, inactive, or dissolved, and is an important part of maintaining good standing in the New Jersey corporation and business entity database. You can obtain this report online, making it easy to stay informed about your business status.