Titulo De Carro Nj Withholding

Description

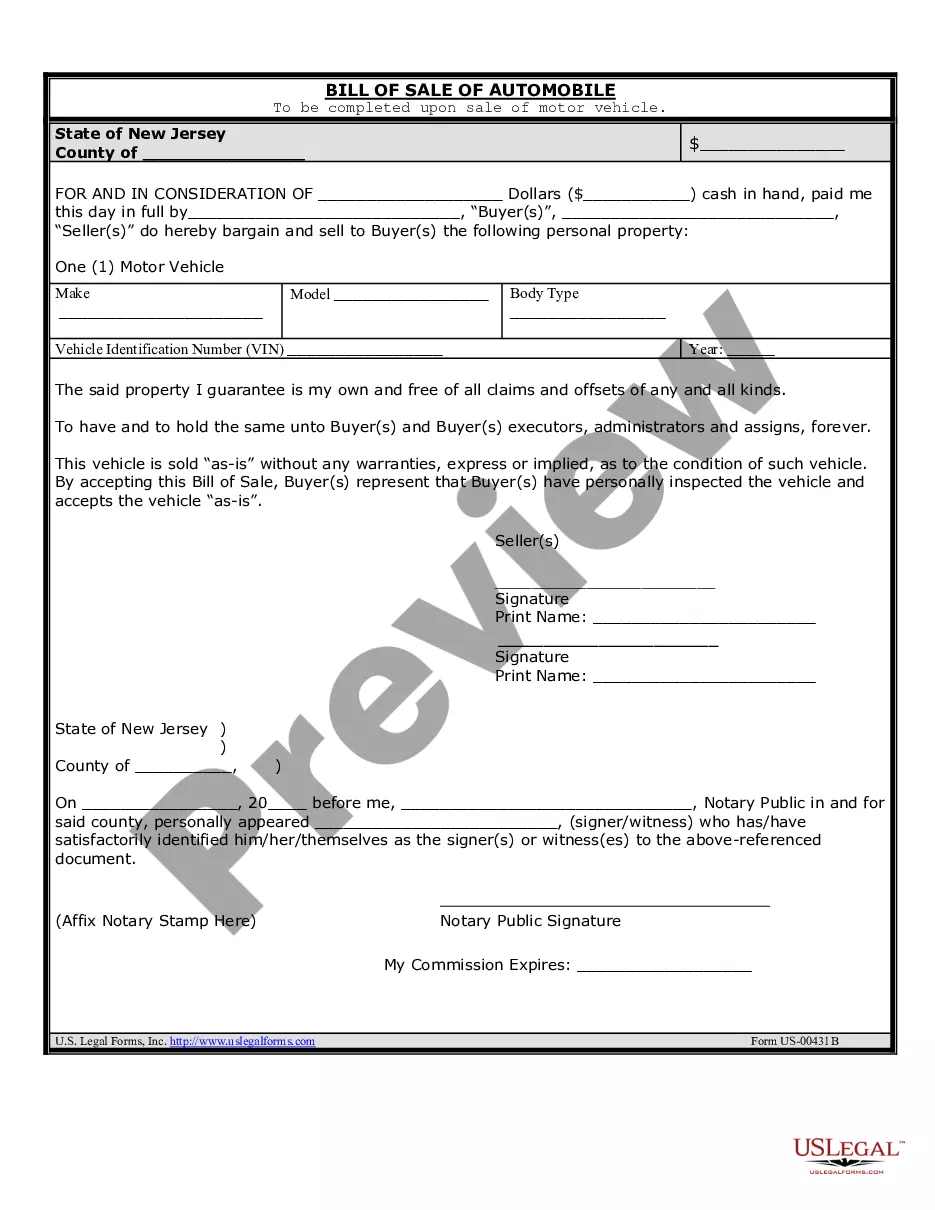

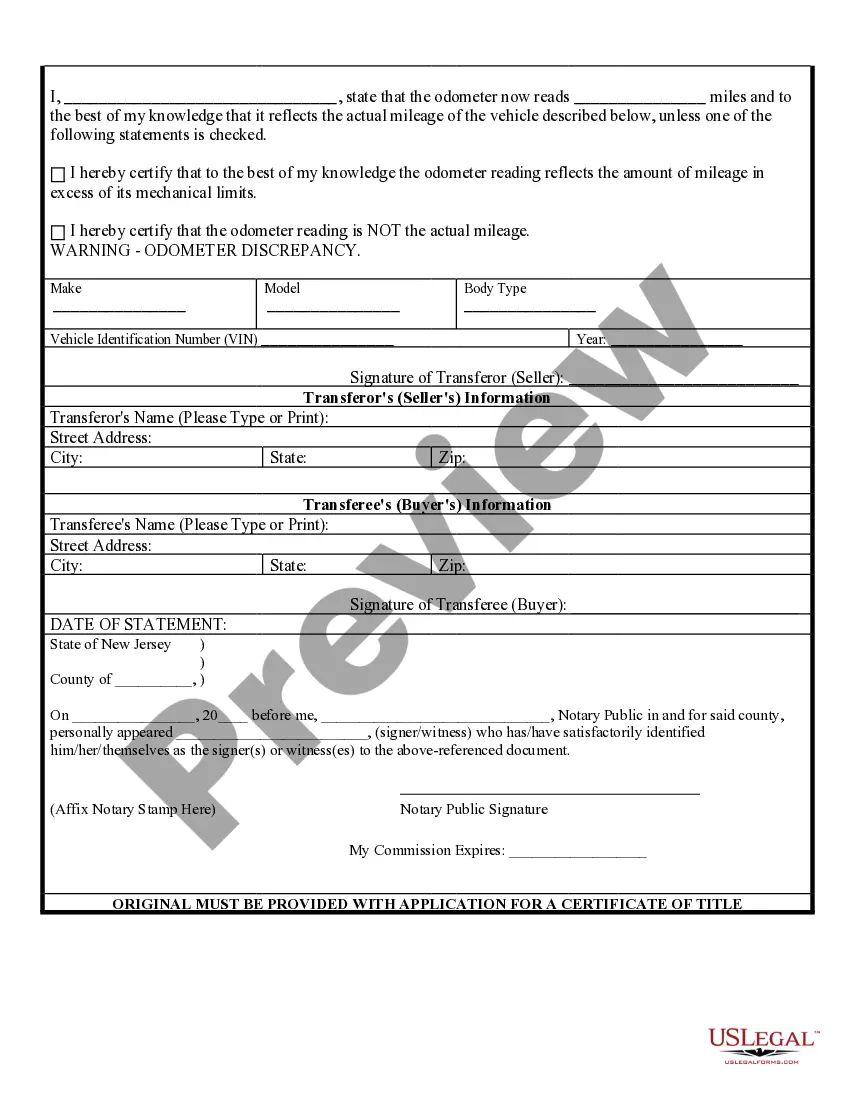

How to fill out New Jersey Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Dealing with legal papers and procedures can be a time-consuming addition to your day. Titulo De Carro Nj Withholding and forms like it typically require you to search for them and understand how you can complete them effectively. Therefore, if you are taking care of economic, legal, or individual matters, using a extensive and hassle-free web catalogue of forms on hand will greatly assist.

US Legal Forms is the number one web platform of legal templates, boasting over 85,000 state-specific forms and a variety of tools to help you complete your papers effortlessly. Check out the catalogue of pertinent papers open to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Shield your papers management operations using a top-notch service that lets you make any form within minutes without additional or hidden cost. Just log in to the profile, find Titulo De Carro Nj Withholding and acquire it straight away from the My Forms tab. You may also access formerly downloaded forms.

Would it be your first time using US Legal Forms? Register and set up a free account in a few minutes and you will gain access to the form catalogue and Titulo De Carro Nj Withholding. Then, follow the steps below to complete your form:

- Be sure you have the correct form by using the Preview feature and reading the form description.

- Choose Buy Now as soon as ready, and select the subscription plan that suits you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise helping consumers control their legal papers. Get the form you need right now and enhance any process without having to break a sweat.

Form popularity

FAQ

New Jersey doesn't have a gift tax.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

?Gift taxes would not need to be paid until the exclusion of $12.92 million is exceeded,? she said. ?If the fair market vehicle of your car is $22,000, you may need to file the gift tax return for the additional $5,000. In essence, selling the car for $1, given its value, would also be considered a gift.?

Sign in the buyer's section on the reverse side of the title and insert their driver's license or Entity Identification Number (EIN-formerly Corpcode). Visit a motor vehicle agency to transfer the title, complete the Vehicle Registration Application (Form BA-49) if applicable, and receive the license plates.

The ?supplemental titling fee? is a one-time fee imposed at the time a new vehicle is first titled in the State of New Jersey, in the amount of 0.4% of the sales price or the lease price, as determined in ance with the rules set forth below.