Nj Disclaimer Of Inheritance Form For Tax Purposes

Description

How to fill out New Jersey Disclaimer Of Right To Inherit Or Inheritance?

Locating a reliable source for obtaining the most up-to-date and suitable legal templates is a significant portion of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it's essential to obtain samples of Nj Disclaimer Of Inheritance Form For Tax Purposes only from reputable sources, such as US Legal Forms. An incorrect template can squander your time and delay your situation.

Eliminate the hassle associated with your legal documents. Explore the vast collection at US Legal Forms to find legal templates, verify their suitability for your situation, and download them instantly.

- Utilize the catalog navigation or search function to locate your template.

- Examine the document's details to determine if it meets the standards of your state and locality.

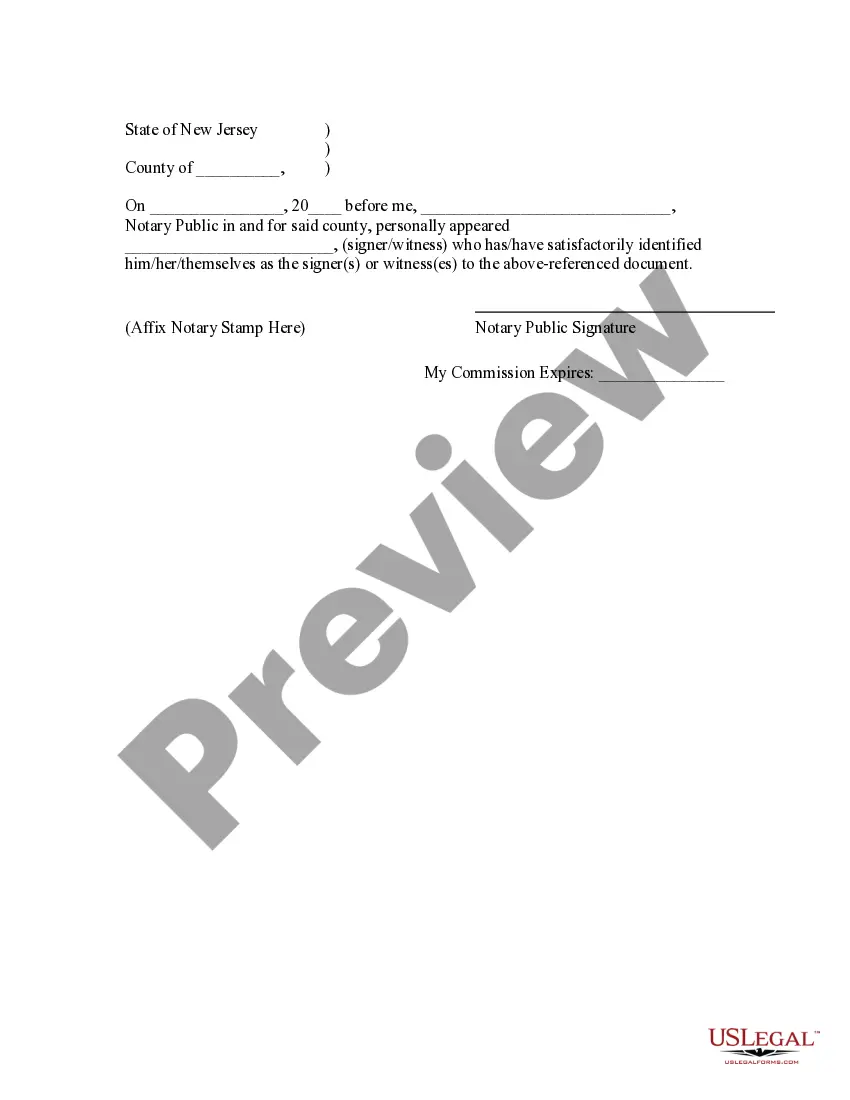

- Check the form preview, if available, to ensure the template is what you seek.

- Return to the search to find the appropriate document if the Nj Disclaimer Of Inheritance Form For Tax Purposes does not satisfy your requirements.

- Once you are confident in the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing option that caters to your needs.

- Proceed with the registration to complete your purchase.

- Conclude your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Nj Disclaimer Of Inheritance Form For Tax Purposes.

- Once you have the document on your device, you can modify it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Yes, you must file an inheritance tax return in New Jersey if the estate exceeds a certain value. This return includes all applicable assets and determines any taxes owed to the state. Notably, incorporating the NJ disclaimer of inheritance form for tax purposes can positively impact the overall tax obligations of the estate. Consulting with a legal expert ensures proper submission and compliance with New Jersey’s inheritance laws.

Yes, New Jersey typically requires an inheritance tax waiver form when transferring property or assets to heirs. This form acts as a proof that all taxes have been settled before the transfer can occur. For more efficient handling, utilizing the NJ disclaimer of inheritance form for tax purposes can simplify the process, ensuring compliance with tax obligations. It is essential to understand this requirement to avoid unnecessary delays in asset distribution.

To avoid New Jersey inheritance tax, beneficiaries should explore exemptions and deductions available under state law. Additionally, using the NJ disclaimer of inheritance form for tax purposes can help redirect assets to other beneficiaries, thus minimizing taxable inheritance. Working with a tax professional can provide guidance tailored to individual situations and financial circumstances. Proper estate planning plays a crucial role in minimizing tax liabilities.

To obtain a New Jersey inheritance tax waiver, you need to file the appropriate forms with the Division of Taxation. This process usually involves submitting the Nj disclaimer of inheritance form for tax purposes along with other required documents. You must comply with state laws regarding the timing of submissions and tax obligations. Seeking assistance from tax professionals can expedite your application.

There are several key rules for disclaiming an inheritance in New Jersey. You must file your disclaimer within nine months of the person’s passing and cannot have benefited from the inheritance in any way. The Nj disclaimer of inheritance form for tax purposes must be executed in writing to be valid. It is advisable to consult with legal professionals to navigate these rules effectively.

Proof of inheritance typically comes in the form of a will or a court-issued order of probate. These documents confirm your right to receive assets from a deceased person. Additionally, you may require the Nj disclaimer of inheritance form for tax purposes if you choose to refuse the inheritance. Always keep comprehensive records to support your claims.

Writing a disclaimer letter involves clearly stating your intent to refuse the inheritance. Start by identifying yourself and providing details about the decedent and the inheritance. Use the Nj disclaimer of inheritance form for tax purposes to ensure you cover all necessary points and submit your letter within the legal timeframe. Professional guidance can help create an effective document.

A qualified disclaimer must meet specific criteria set by the IRS and New Jersey law. It must be irrevocable and unqualified, meaning you cannot accept any part of the inheritance. The Nj disclaimer of inheritance form for tax purposes should clearly state your intention to disclaim and be filed within the appropriate timeframe. Consulting a legal expert can help you ensure your disclaimer meets all required qualifications.

Yes, when you inherit property or assets, you might receive a tax form for inheritance. New Jersey has a specific inheritance tax that applies in certain situations, and you may need the Nj disclaimer of inheritance form for tax purposes to address how the inheritance impacts your financial obligations. Always check with a tax advisor to understand your responsibilities and ensure compliance.

To disclaim an inheritance in New Jersey, you must submit a formal disclaimer in writing. Use the Nj disclaimer of inheritance form for tax purposes to ensure you meet all state requirements. The form should be filed within nine months of the date of death, and you must not have accepted any benefit from the inheritance. Consulting with an attorney can provide clarity on the process.