Fiduciary Deed Nh For Rent

Description

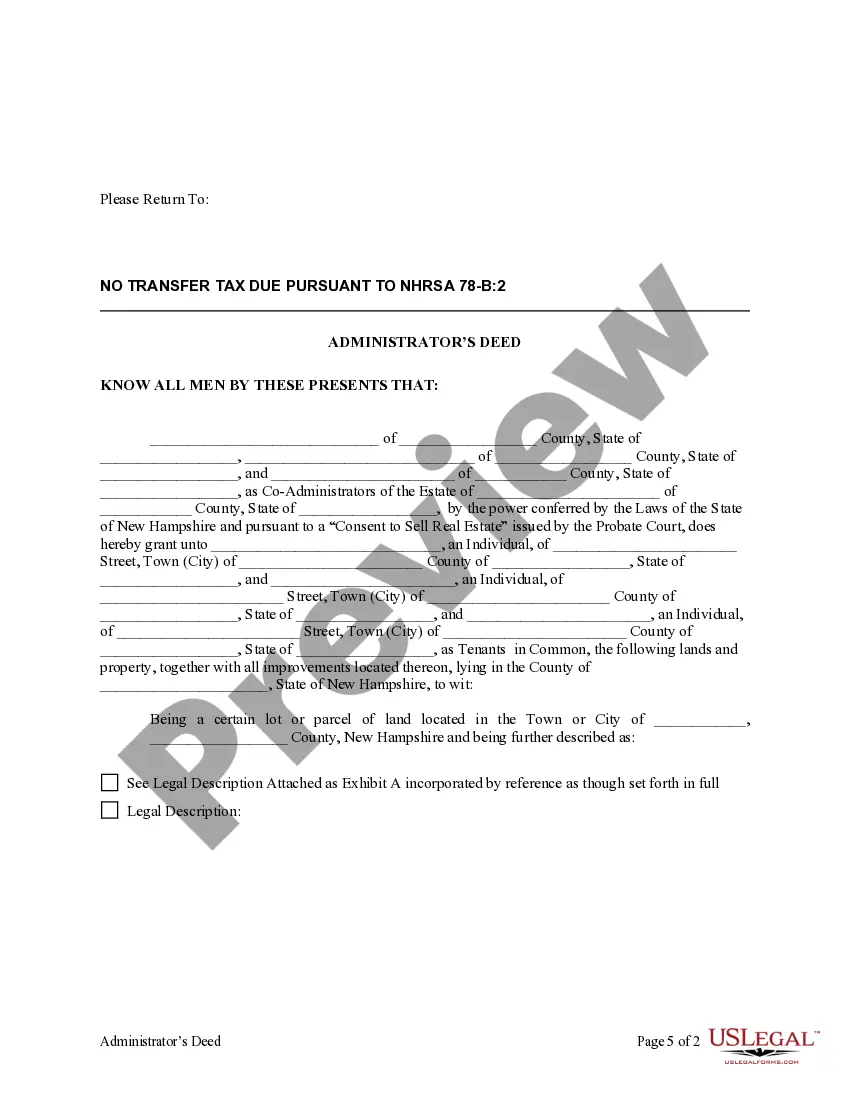

How to fill out New Hampshire Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Legal administration can be challenging, even for seasoned professionals.

When searching for a Fiduciary Deed Nh For Rent and lacking the time to dedicate to finding the accurate and current version, the processes might be overwhelming.

Tap into a resource library of articles, guides, and handbooks pertinent to your situation and requirements.

Save time and effort searching for the documents you need, and use US Legal Forms’ sophisticated search and Preview function to find and obtain Fiduciary Deed Nh For Rent.

Leverage the US Legal Forms online library, supported by 25 years of experience and reliability. Simplify your daily document management into a straightforward and user-friendly process today.

- If you possess a subscription, Log In to your US Legal Forms account, find the form, and obtain it.

- Check your My documents section to view the documents you have previously downloaded and organize your files as desired.

- If it’s your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- After downloading the form you need, verify this is the right document by previewing it and reviewing its description.

- Make sure the template is recognized in your state or county.

- Choose Buy Now when you are ready.

- Pick a subscription package.

- Select the file format you prefer and Download, finish, eSign, print, and send your documents.

- Access local or county-specific legal and business documents.

- US Legal Forms satisfies any needs you might have, from personal to business paperwork, all in one location.

- Utilize advanced tools to execute and oversee your Fiduciary Deed Nh For Rent.

Form popularity

FAQ

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

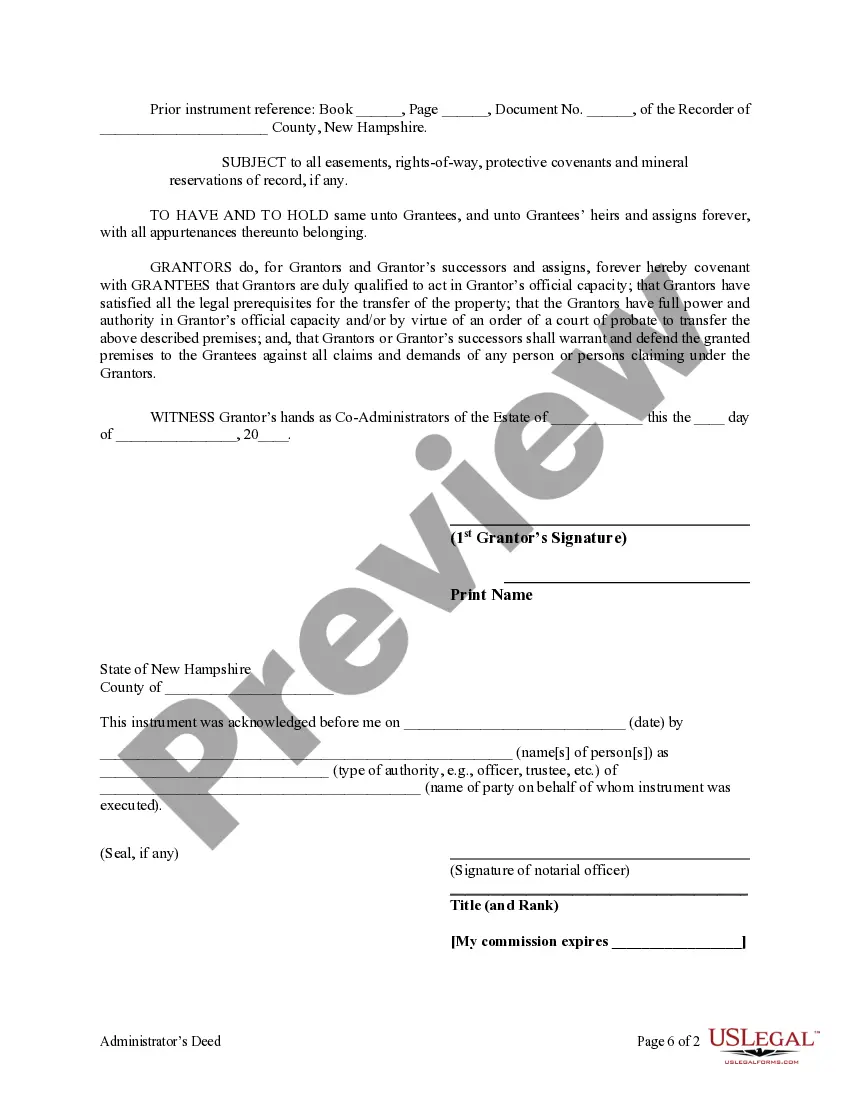

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.

A person or entity may transfer ownership of a property in New Hampshire through an executed deed. The deed must be signed in front of a notary, commissioner, or justice to be valid and must be recorded in the register's office. The deed will not be valid for a sale or transfer if not recorded.

Unlike other states, New Hampshire does not allow real estate to be transferred via a TOD deed. However, real estate can be transferred upon death using other mechanisms such as a will, a living trust or joint ownership with rights of survivorship.

The only way to change, add or remove a name on a deed is to have a new deed drawn up. Once a document is recorded, it can not be changed. To show any change in ownership of property, you need to have a new deed drawn up.