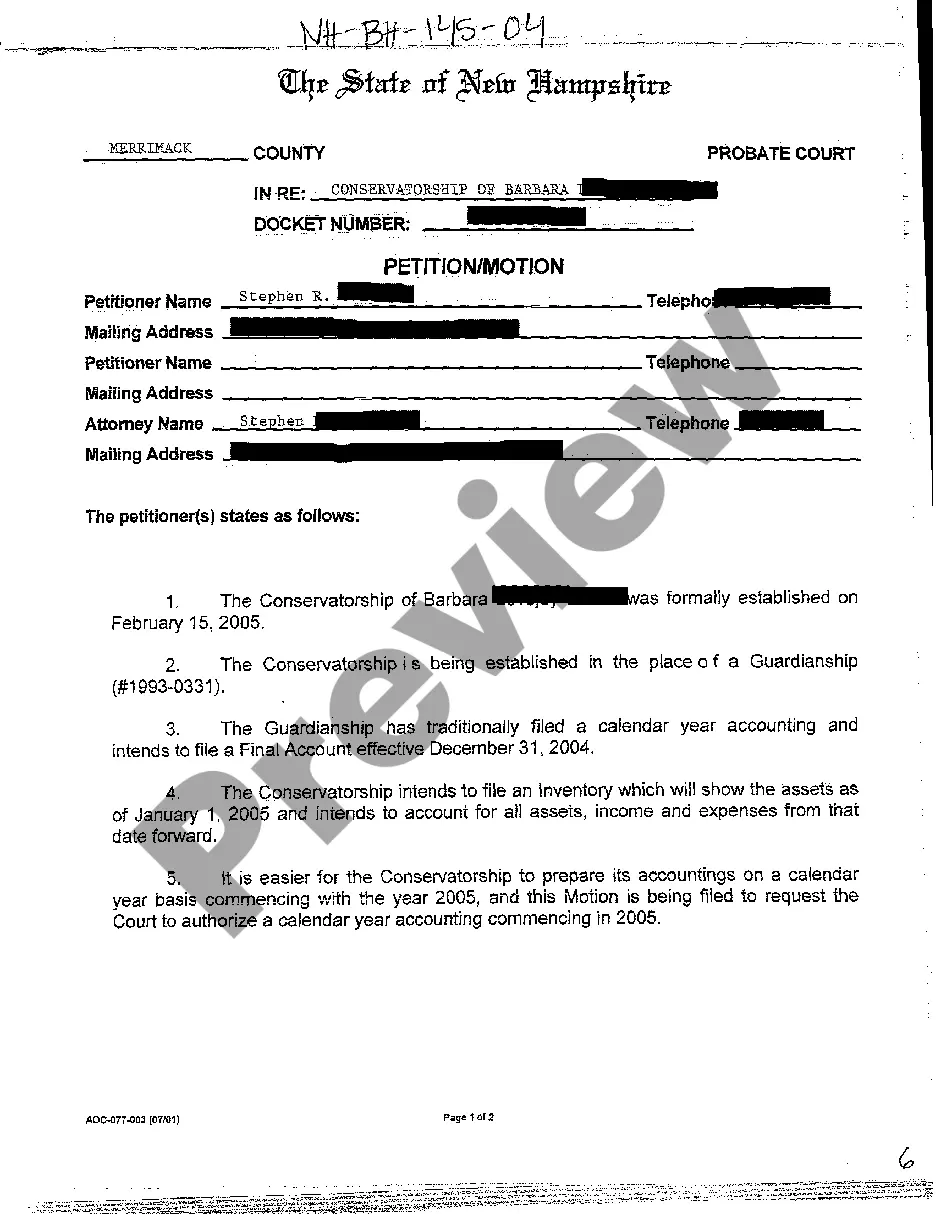

Petition To Compel Accounting Form

Description

How to fill out New Hampshire Petition Motion For Conservator Ship To File Annual Accountings?

Individuals frequently link legal documentation with a notion of complexity that only an expert can handle.

In some respects, this holds true, as creating a Petition To Compel Accounting Form requires a comprehensive grasp of topic guidelines, including state and local laws.

Nonetheless, with US Legal Forms, the process has become more straightforward: a collection of ready-made legal documents for various personal and business scenarios tailored to state legislation is now compiled in a unified online directory and is accessible to everyone.

All templates in our catalog can be reused: once purchased, they remain stored in your account. You can access them anytime through the My documents section. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and purpose, making the search for a Petition To Compel Accounting Form or any other specific template quick and easy.

- Previously registered users with an active subscription must sign in to their account and select Download to retrieve the form.

- New users on the platform will need to set up an account and subscribe before being able to save any documents.

- Here is a step-by-step guide to acquiring the Petition To Compel Accounting Form.

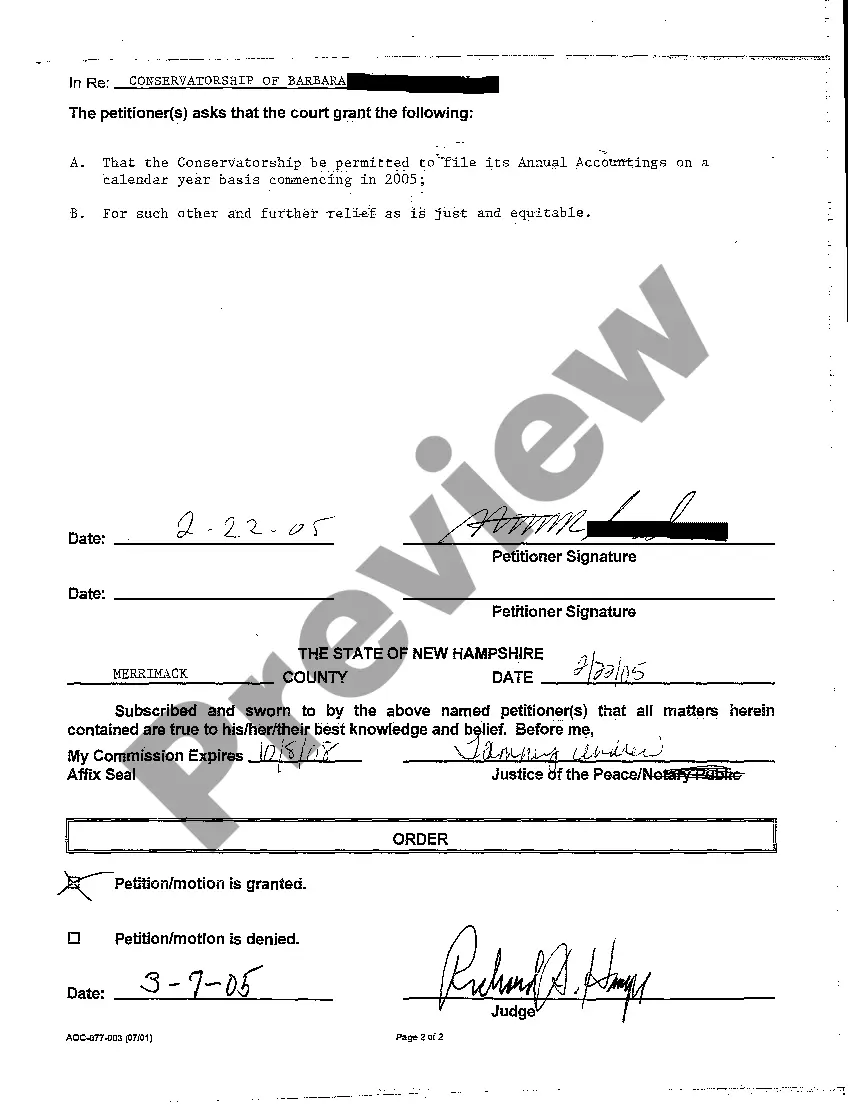

- Examine the page content thoroughly to confirm it meets your requirements.

- Review the form summary or check its details with the Preview option.

- If the previous option does not meet your expectations, look for another template using the Search field located in the header.

- Click Buy Now when you locate the appropriate Petition To Compel Accounting Form.

- Select the subscription package that aligns with your needs and financial plan.

- Create an account or Log In to advance to the payment section.

- Complete your subscription payment through PayPal or a credit card.

- Choose the file format you desire and select Download.

- Print your document or use an online editor for quicker completion.

Form popularity

FAQ

Compel accounting is a legal action taken to force an individual or organization to provide a complete and truthful account of financial matters. When you file a Petition to compel accounting form, you initiate a request to the court for appropriate action against the party that has failed to provide necessary financial information. This process aims to uncover hidden financial details, promoting fairness and accountability among involved parties. It can be a critical tool in resolving conflicts surrounding finances.

Demanding an accounting refers to the process of requesting a detailed report of financial transactions and balances. This request is often formalized through a Petition to compel accounting form. By submitting this petition, you seek transparency and clarity regarding finances, which can help ensure that all parties involved understand their financial status and responsibilities. This step is essential for resolving disputes and establishing trust.

A petition to compel accounting is a legal document that requests the court to require an executor or trustee to provide a full account of their financial management. This petition is crucial for beneficiaries who suspect mismanagement or simply want to verify the financial status of the estate. You can easily obtain a petition to compel accounting form through platforms like uslegalforms, making the process straightforward.

If a trustee fails to provide necessary accounting, legal action may be necessary to enforce compliance. Beneficiaries can file a petition to compel accounting to prompt the trustee to disclose their financial records. This action can help protect your rights and interests within the estate.

A 17200 petition for instructions is a legal request made to the court by a trustee or executor seeking guidance on specific issues related to estate management. This petition can clarify the roles and responsibilities of the fiduciary. Beneficiaries should know that utilizing the petition to compel accounting form may complement such petitions.

Compelling an accounting from a reluctant trustee requires a clear approach. You may first request a voluntary accounting, but if that fails, you can file a petition to compel accounting. This form serves as a legal means to enforce transparency and holds the trustee accountable for their financial actions.

Yes, in New York, an executor is required to provide accounting to beneficiaries. This obligation ensures that all parties understand how the estate's assets are being handled. If you encounter difficulties in obtaining this information, a petition to compel accounting form can be a powerful tool to ensure compliance.

A petition accounting is a formal request submitted to the court. This request typically demands a detailed report of financial transactions from individuals managing an estate, such as executors or trustees. The petition to compel accounting form is essential for beneficiaries seeking transparency and accountability regarding estate finances.

Typically, a trustee is required to provide an accounting annually, but specific timelines may vary based on state laws and the trust agreement. If the trustee fails to meet this timeline, beneficiaries can take action by filing a Petition to compel accounting form. This form allows you to request the court's assistance in obtaining the necessary financial information. Staying informed about these timelines can help you assert your rights effectively.

A trustee has a legal duty to provide regular accounting to beneficiaries, ensuring they are informed about the trust's financial activities. This responsibility includes documenting income, expenses, and distributions made from the trust. When a trustee does not fulfill this obligation, beneficiaries can use a Petition to compel accounting form to enforce compliance. Understanding these duties can empower you to protect your interests as a beneficiary.