Recorded By

Description

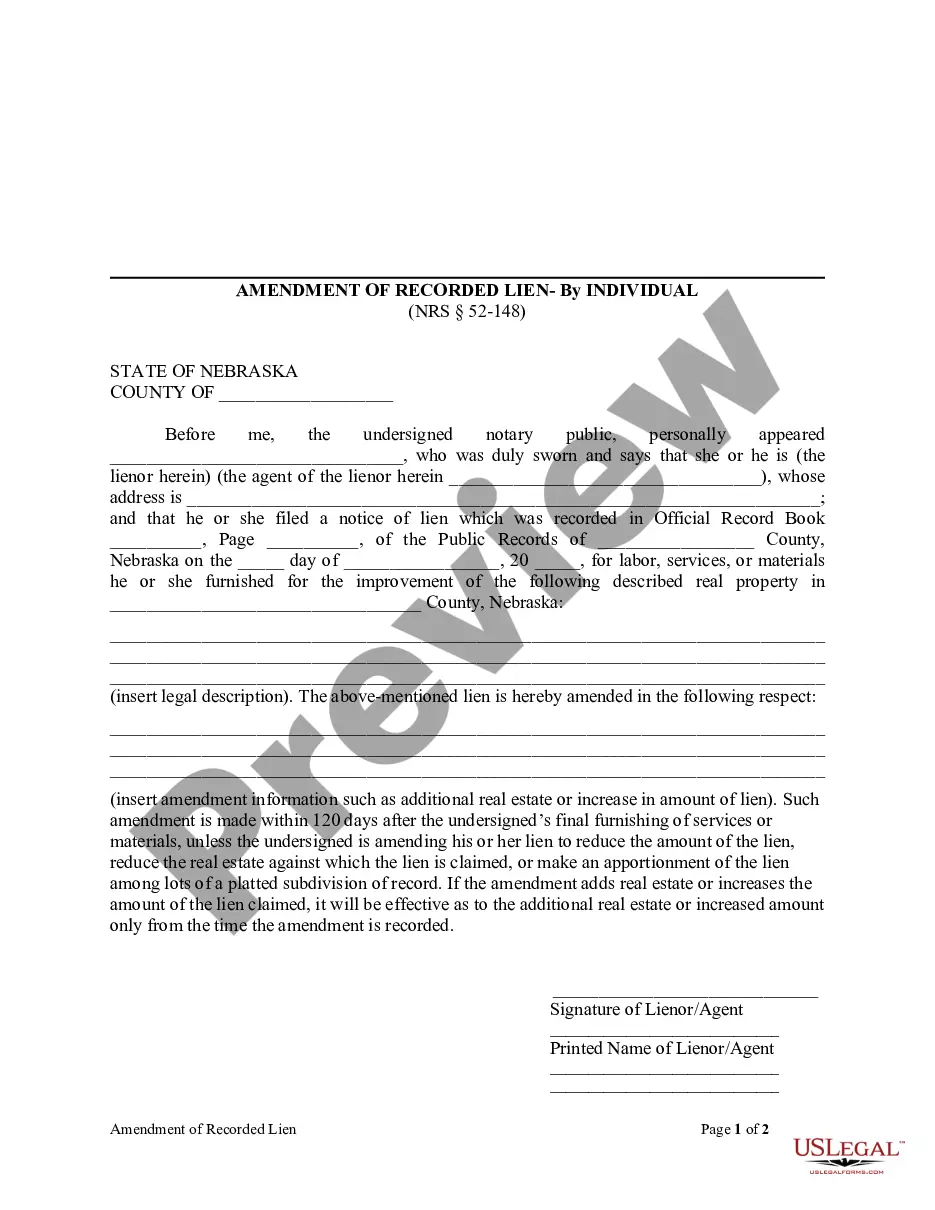

How to fill out Nebraska Amendment Of Recorded Lien - Individual?

- If you're a returning user, log in to your account and ensure your subscription is active. Locate the desired form and download it by clicking the Download button.

- For first-time users, start by checking the Preview mode for the form description to ensure you select the correct document for your jurisdiction.

- Use the Search tab if you need to find a different template. This will help you locate the most appropriate form for your needs.

- Once you've found the right document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the resources.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- After payment, download your document and save it on your device. You can access it anytime through the My Forms section in your profile.

Using US Legal Forms not only saves you time but also provides peace of mind with its vast collection of over 85,000 legal forms. All forms are editable and fillable, ensuring that you can customize them to fit your specific needs.

Start simplifying your legal document needs today—explore US Legal Forms and empower yourself with the right tools for success!

Form popularity

FAQ

To fill out a quit claim deed form, begin by identifying the current owner (grantor) and the new owner (grantee). Provide a clear description of the property involved. Make sure to also include the date and the signatures of both parties. If you need assistance with this, consider using US Legal Forms, which provides templates and guidance for a smooth process.

Maryland requires that certain information be recorded on a deed, including the names of both the grantor and grantee, a legal description of the property, and the current owner’s signature. It is crucial to ensure that this information is accurate prior to sending it for recording by the appropriate local office. Always consult legal documents to ensure full compliance.

To transfer ownership of property in Maryland, you must complete a deed that reflects the change. This deed should be filled out accurately and signed by the current owner. After this step, you must have the deed recorded by the local court or land records office to formalize the transfer. Utilizing resources like US Legal Forms can streamline this process.

In Maryland, a deed must contain the names of the grantor and grantee, an accurate description of the property, and the signature of the grantor. Furthermore, the deed must be acknowledged by a notary public to ensure it is recorded by the relevant land records office. It is advisable to check local regulations to ensure compliance.

To create a deed, you must include essential details such as the names of the parties involved, a clear description of the property, and the purpose of the deed, such as a transfer of ownership. Additionally, you should indicate how you want the deed recorded by local authorities to ensure it is legally acknowledged. Using the US Legal Forms platform can simplify this process by providing accurate forms.

If your name is not recorded by the deed, you may have limited rights to the property. Typically, the deed serves as the official record of ownership. However, you could claim an interest in the property through other legal means, such as demonstrating a verbal agreement or contributing to related expenses. Consulting a legal professional can help clarify your options.

Finding the owner of a specific property is straightforward. Start by visiting the NYC Department of Finance's online portal, where you can search for property information using the address. If you want comprehensive reports or legal documents that confirm ownership, consider using USLegalForms, which specializes in streamlined access to recorded property information.

To find out who owns a property in NYC, you can use the city's online property database. This resource allows you to search for properties by address or block and lot number, revealing ownership details recorded by the city's officials. Additionally, using services like USLegalForms can simplify this process, providing accurate records and facilitating access to the necessary documents.

When a document is recorded by the appropriate government office, it becomes part of the public record. This process provides legal proof of ownership or interest in a property, making it enforceable against third parties. Recorded documents can include deeds, mortgages, and liens, and they ensure transparency in property transactions.

Yes, property records in New York City are public and can be accessed by anyone. These records are typically maintained by the NYC Department of Finance and can show information such as property ownership and transaction history. If you wish to understand how a property has been recorded by previous owners, you can easily obtain these documents through official city resources.