Decree Of Distribution Formal Probate

Description

Form popularity

FAQ

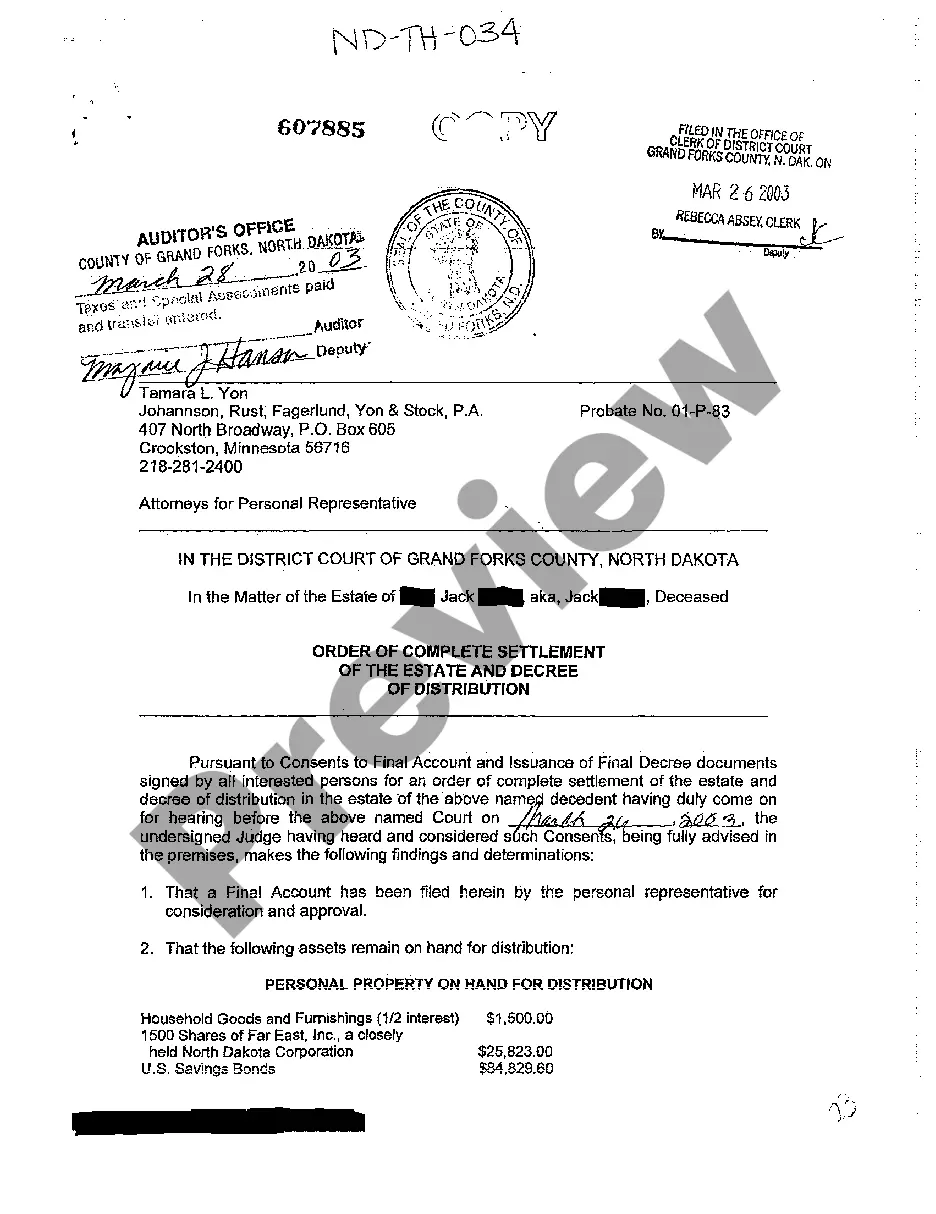

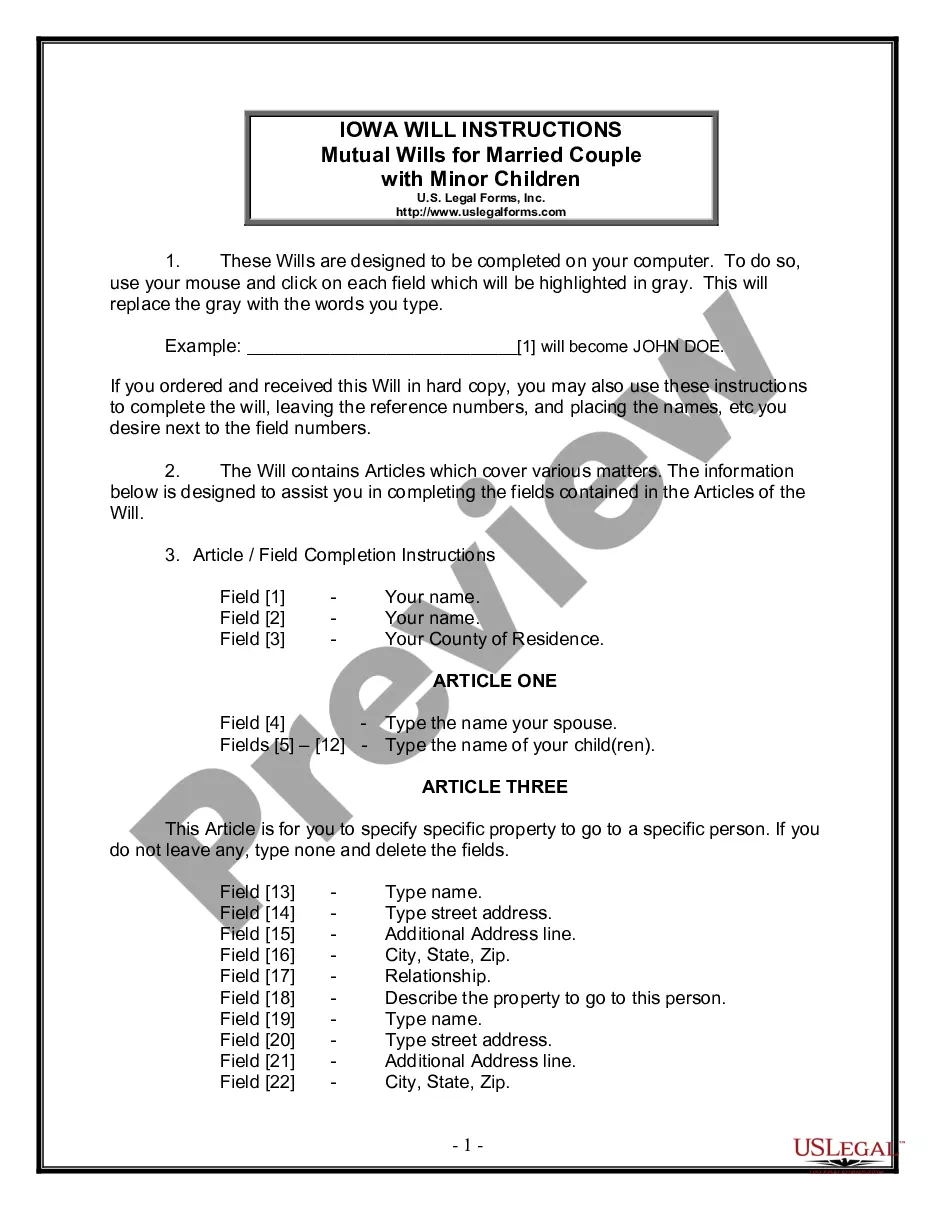

Distributions from an estate typically occur after settling debts and taxes associated with the estate. The Decree of distribution formal probate acts as a formal guideline for how assets are shared among beneficiaries. Each heir receives their designated share as outlined in the will or according to state laws. With uslegalforms, you can access essential resources to ensure your distributions comply with legal standards.

Selling items from an estate requires understanding the value of each item and the market demand. You might consider a public auction or online sales platforms for broader reach. Also, having a Decree of distribution formal probate can clarify the ownership of items you wish to sell. The uslegalforms platform can assist you in generating the necessary legal documents to facilitate smooth transactions.

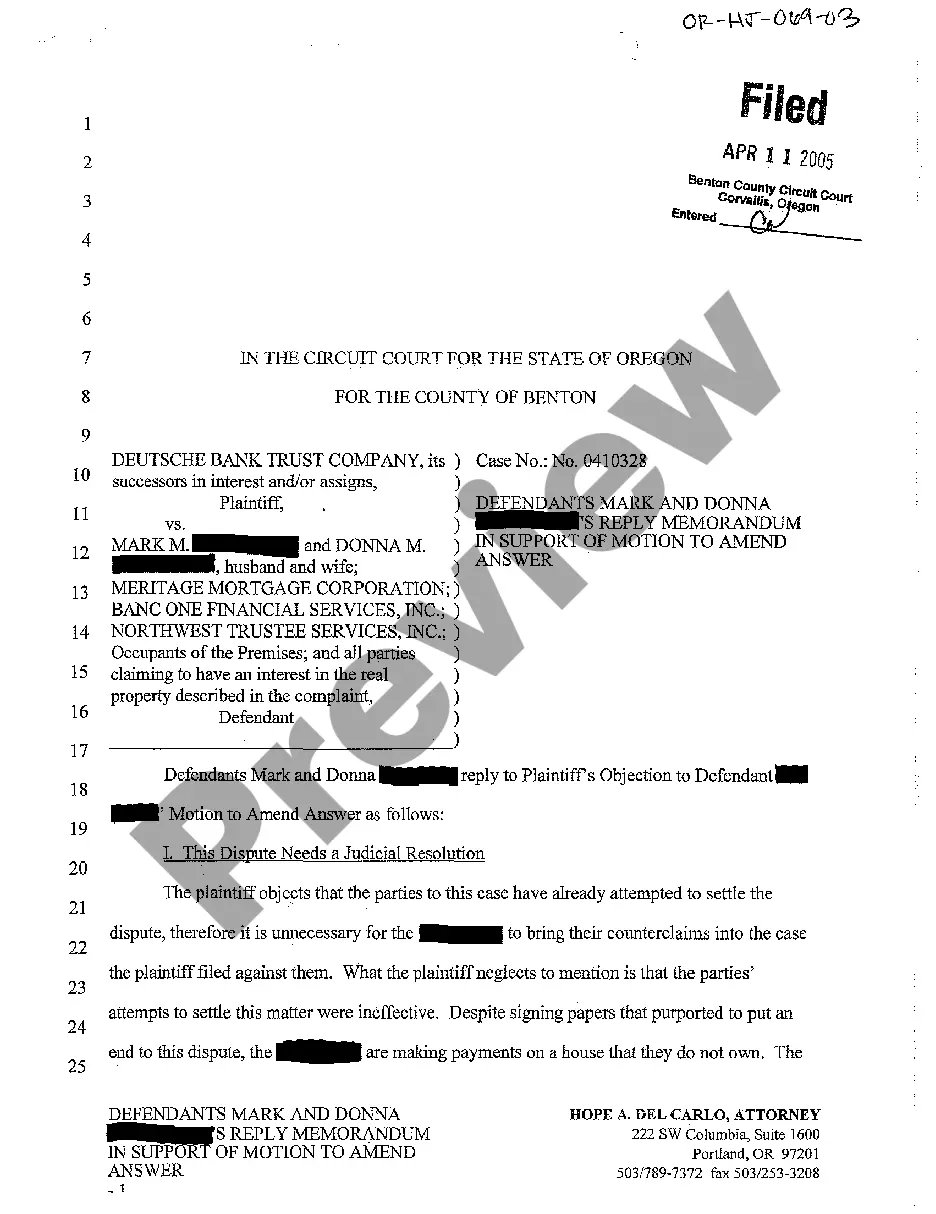

The best way to distribute estate assets involves thorough planning and clear documentation. A Decree of distribution formal probate outlines how assets will be allocated, providing a structured approach to minimize confusion or disputes among heirs. Transparent communication with all parties involved can foster goodwill, ensuring everyone understands their share. Utilizing legal services from uslegalforms can help simplify this process and provide essential guidance.

Dividing items in an estate begins with identifying all assets, which include property, bank accounts, and personal belongings. You can use a Decree of distribution formal probate to legally allocate these assets among heirs and beneficiaries. It is important to keep an open line of communication with family members to avoid conflicts during this process. Using tools and services from uslegalforms can streamline creating necessary documents, ensuring a fair division.

Informal probate in Minnesota generally takes less time than formal probate, often completing within a few months. The timeline can vary based on the complexity of the estate and whether issues arise that require additional court involvement. Ultimately, acquiring a timely Decree of Distribution formal probate allows beneficiaries to receive their inheritances more efficiently.

The distribution of the estate refers to how assets are allocated among beneficiaries after someone has passed away. This process may require a Decree of Distribution formal probate to ensure that all legal requirements are met and that the distribution is conducted fairly. Understanding this distribution helps you navigate the complexities of estate management effectively.

Certain assets are exempt from probate in Minnesota, including life insurance proceeds, joint tenancy properties, and retirement accounts with designated beneficiaries. These exempt assets pass directly to heirs without needing a Decree of Distribution formal probate. This exclusion can simplify the estate settlement process and provide quicker access to funds for beneficiaries.

In MN, formal probate requires a more structured procedure, often involving hearings and attorney representation. Informal probate is typically quicker and allows for more direct management of the estate by the executor. Ultimately, the process you choose determines how you will obtain the Decree of Distribution formal probate to distribute the estate’s assets.

Formal probate involves court supervision and is usually necessary for larger estates or contested cases. In contrast, informal probate is simpler and requires less court oversight, typically used for straightforward cases where the Decree of Distribution formal probate can be issued without complications. Understanding these differences helps you choose the right path for estate management.

Not all estates in Minnesota undergo the probate process. If an estate's value is below a certain threshold or if it contains only exempt assets, it may avoid probate. However, when formal probate is necessary, the court issues a Decree of Distribution formal probate, which outlines how the estate's assets will be divided among heirs.