Assignment Of Trust Interest

Description

Form popularity

FAQ

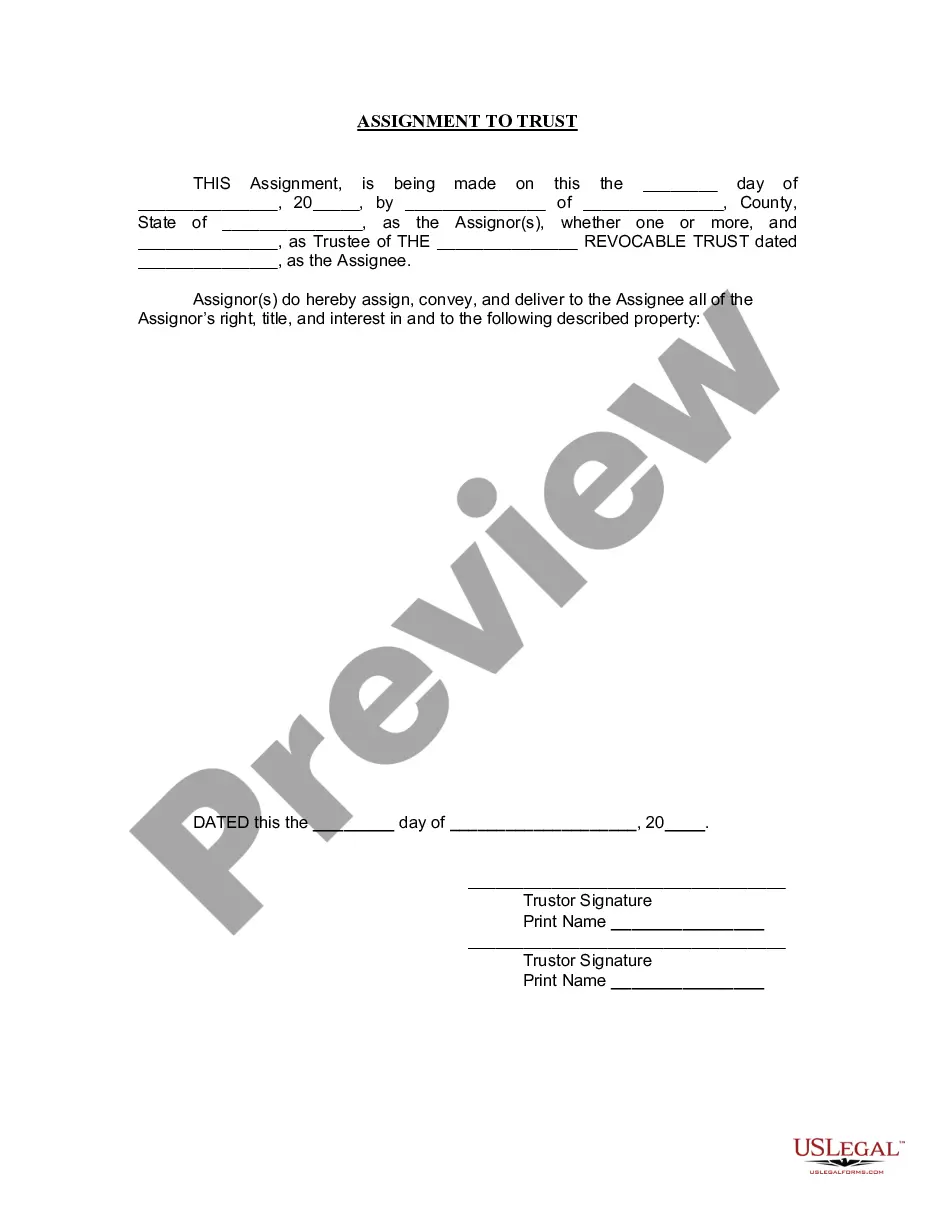

An assignment of trust interest is a formal process where an individual transfers their rights or benefits associated with a trust to another party. This can include financial benefits or rights to property held within the trust. It is important to document this process properly to ensure legal validity and to protect all parties involved. For a seamless experience, uslegalforms offers resources to navigate assignments effectively.

Assignable interest refers to a legal right where a person can transfer their share or benefits in a trust to someone else. This means that the original interest holder can designate another individual to receive the benefits of the trust. Properly handling this assignment is essential for maintaining clarity in ownership and responsibilities. If you need assistance, consider using uslegalforms to ensure compliance.

An assignment of trust interest is not inherently a gift, though it can be structured that way. This process involves transferring your interest in a trust to another party. If compensation is involved, it doesn't qualify as a gift. Understanding whether you are gifting or selling the assignment is crucial for tax and legal implications.

Transferring interest from an LLC to a trust involves a process known as the assignment of trust interest. First, you need to create a trust document that clearly outlines the trust's terms and the beneficiaries. Next, you will execute an assignment form to legally transfer your LLC interest to the trust. It's important to work with legal professionals or a reliable platform like US Legal Forms to ensure the assignment of trust interest is valid and compliant with state laws.

The assignment of interest in a deed of trust is the legal process of transferring beneficial ownership rights from one party to another. This action ensures that the new owner has the right to receive benefits from the property involved in the deed. This concept can be quite intricate, so seeking professional advice is essential. UsLegalForms has resources to guide you through these legal complexities.

Absolutely, a trust account can earn interest, enhancing the value of the assets over time. The amount of interest depends on the type of account and the financial institution involved. Understanding the assignment of trust interest can help maximize these returns and align with your financial goals. Platforms like UsLegalForms can provide information on managing such accounts effectively.

Yes, it is possible to buy someone's interest in a trust, but the process can be complex. The seller must agree to the terms of the sale, and the assignment of trust interest must comply with the trust document. It’s advisable to seek legal counsel to handle these transactions correctly. UsLegalForms can assist you in understanding the legal framework involved.

An assignment of membership interest to a trust involves transferring ownership rights in a membership entity, such as an LLC, to the trust. This process helps beneficiaries gain access to assets held within that membership. It ensures that the benefits of the membership are properly enjoyed by the trust's beneficiaries. For precise templates and guidance, check out UsLegalForms.

Typically, the beneficiaries named in the trust receive interest on the trust account. The trustee is responsible for managing the distributions according to the trust's terms. To avoid confusion regarding who receives what, clear documentation of the assignment of trust interest is essential. Again, platforms like UsLegalForms offer templates to clarify these matters.

Yes, it is possible to assign your interest in a trust, but specific procedures must be followed. This type of assignment allows beneficiaries to transfer their benefits to another party. However, you should consult legal professionals to ensure the assignment of trust interest adheres to applicable laws. Utilizing services like UsLegalForms can help streamline this process.